Building a decentralized exchange is often a tech-driven sprint – many teams pour all their energy into coding and launching, only to treat the economic design of their token as an afterthought. This oversight can be fatal. History shows that even a great DeFi product can falter if decentralized exchange tokenomics are poorly designed.

For example, the “DeFi Summer” boom of rapid liquidity mining proved unsustainable, as mercenary yield farmers would quickly hop to the next high-APR protocol, leaving the old one “farmed and dumped” into ruin. On the flip side, projects like Aave and Uniswap took a product-first approach with sustainable tokenomics, allowing them to retain users and stay market leaders. The lesson? DEX development benefits aren’t enough – you need a resilient decentralized exchange tokenomics underpinning them.

That’s where IdeaSoft comes in. We’re not just blockchain developers. We partner with DeFi startups to build sustainable decentralized exchange tokenomics from day one. Our team has seen firsthand that token design can make or break a DEX launch.

In this article, we’ll explore four focus areas that every founder and product manager should consider:

- Staking incentives.

- Governance structures.

- Liquidity mechanisms.

- Real-world token models that tie token value to actual usage.

By the end, you’ll see how thoughtful tokenomics can supercharge user engagement and investor confidence.

Launch your DEX with battle-tested tokenomics

Talk to our Web3 experts!

Table of contents:

- DEX Tokenomics: Definition and Value

- Comparing DEX Tokenomics Models

- Risks and Pitfalls of Bad Tokenomics Design

- Best Practices for Constructing Sustainable DEX Tokenomics

- Tokenomics Designs That Scale With Your Protocol – Ideasoft Solution

- Conclusion

DEX Tokenomics: Definition and Value

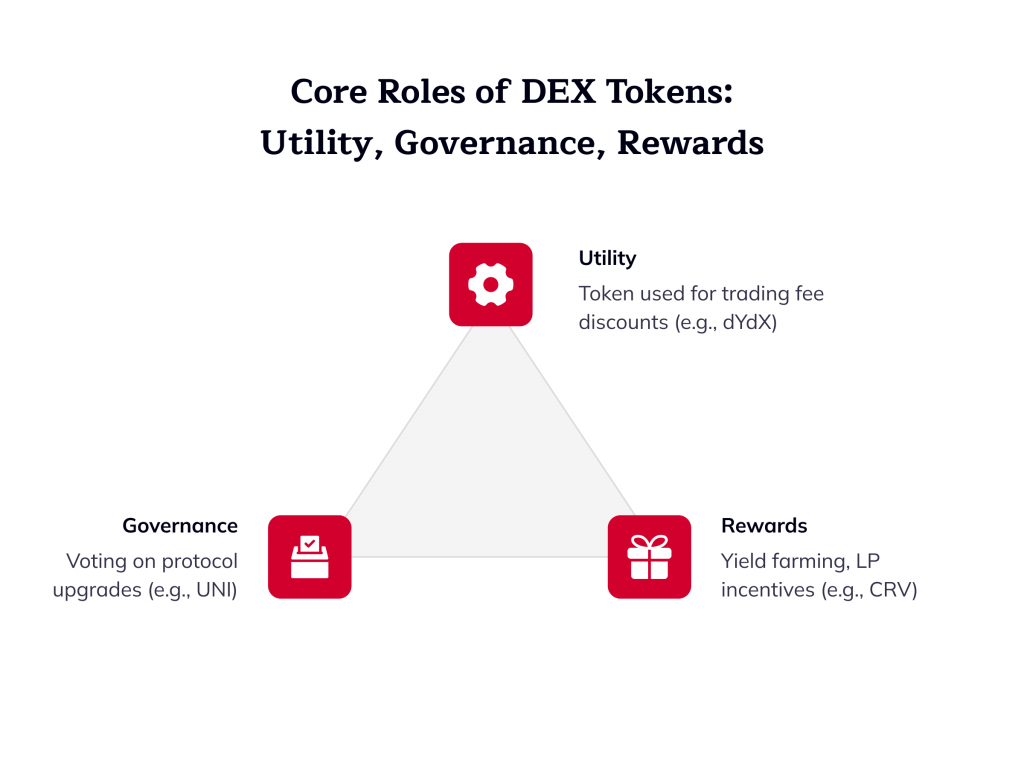

What is the process of tokenomics in the case of a DEX? Tokenomics means the economic design of the native token on a platform – how it is minted, moved, and consumed within a DEX’s ecosystem. Tokenomics for a decentralized exchange establishes the function of the token in the utility (use), decision (governance), and incentivization (reward) mechanics of a platform.

Apart from core DEX features, most DEX tokens serve one or more of these fundamental roles:

- Utility. The token may be used on the platform for a certain purpose, i.e., to cover trading fees, get discounts for trading, or gain access to premium features. For example, the token of the dYdX exchange provides traders with discounts on trading fees if they hold the token.

- Governance. The token gives holders voting rights to determine the future of the DEX. Fee rates, new listings, or protocol upgrades can be voted upon by the community. Uniswap’s UNI token, for instance, is primarily a governance token giving holders the ability to vote on protocol changes (e.g., fee mechanism or new functionalities)

- Rewards. The token is used to reward contributors to the DEX, such as liquidity providers or engaged traders. It rewards early engagement and sustained participation. Curve’s CRV token is the archetype. It is given as a reward for yield farming to liquidity providers, who can then lock CRV as veCRV to increase their rewards and participate in governance

Here is a table that compares them side by side.

| Token Function | Impact on DEX | Example |

| Utility Token (used for fees, access, etc.) | Drives platform usage by giving holders benefits or discounts. Encourages users to use the DEX more because they save money or gain convenience. | dYdX’s DYDX – offers trading fee discounts to users who hold or stake it, incentivizing higher trading volumes. |

| Governance Token (voting power) | Decentralizes control and aligns the platform with its community. Holders become invested in the DEX’s success since they can influence key decisions. | Uniswap’s UNI – purely a governance token granting voting rights on protocol upgrades and fee parameters. No direct fee dividends (at least initially), so its value is tied to community confidence and future potential. |

| Rewards Token (incentives & yield) | Bootstraps liquidity and user engagement by rewarding participation. Can create loyal users if rewards are meaningful, but must be managed to avoid inflation. | Curve’s CRV – issued to liquidity providers as a reward. Users who lock CRV for veCRV gain boosted pool rewards and fee revenue. |

Comparing DEX Tokenomics Models

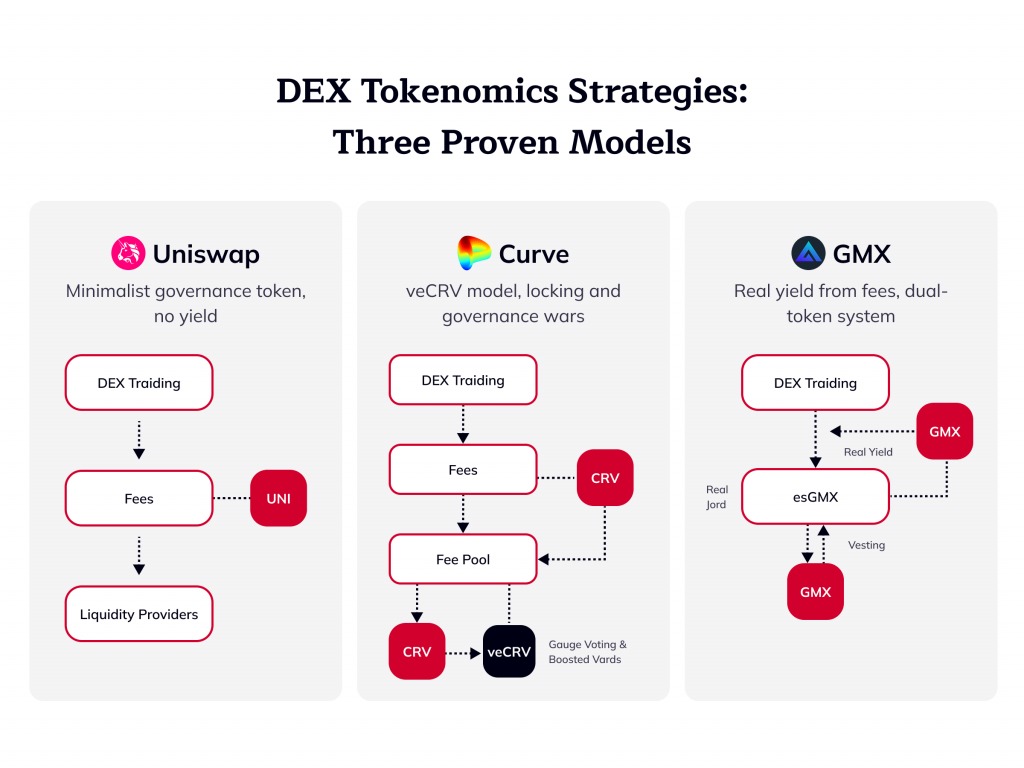

Not all DEXs are in the same tokenomics business. Let’s compare three of the leading DEX token models – Uniswap, Curve, and GMX. Comparing them, we can see how decentralized finance tokenomics design affects liquidity, governance, and market positioning.

Uniswap: Less Token, More Influence

Uniswap infamously launched without a token at all in its early months, optimizing for building a fantastic AMM exchange as a first priority. When the UNI token was eventually released, it was left fairly minimalist in terms of utility – primarily it provides governance rights.

UNI holders can vote on proposals (e.g., to enable fee sharing or add new features), but UNI does not inherently provide holders with access to trading fees. There is no reward staking from Uniswap’s own fees (at least, not until any “fee switch” is activated by governance). This is a “governance-first” tokenomics framework, with minimal direct monetary incentives. How did this affect Uniswap’s performance? Here is how:

- Liquidity. While no native token rewards were initially provided, Uniswap accumulated massive liquidity through the virtue of its first-mover status and excellent product-market fit. LPs were compensated through fees paid on trades, and the reputation of the platform attracted organic LPs. When competitors like SushiSwap tried a “vampire attack” (luring Uniswap’s LPs away with higher token rewards), Uniswap responded by airdropping UNI tokens and briefly incentivizing key pools – but long-term, it did not rely on continuous liquidity mining.

- Governance. By turning UNI into a governance story (at least thus far), Uniswap provided its users with the power to steer the protocol, which amplifies the DEX’s decentralization ethos. However, it can be argued that without explicit economic incentives (like dividends or fee sharing), casual users had less motivation to hold UNI beyond speculative belief in Uniswap’s prosperity.

- Market positioning. Uniswap’s tokenomics (or absence thereof) wagered on a product-led strategy. This allowed the project to weather the rollercoaster DeFi cycles. Such novel revenue models as Uniswap’s, which offer actual fee revenue for LPs, made the ecosystem robust and sustainable.

In short, Uniswap did not need flashy token mechanics to become the gold standard DEX – its sustainable architecture and community goodwill were enough.The UNI token still reached a multibillion market cap largely on the strength of the Uniswap protocol itself, and speculation that some day or other there would be governance votes to pay UNI holders a portion of fees. In fact, even speculation that Uniswap might introduce a fee share for UNI holders has been enough to create market excitement previously.

Curve: Incentives and Governance on Steroids (the veCRV Model)

Curve Finance did the opposite: its CRV token is the cornerstone of a mature incentive and governance system known as vote-escrow, and it assists in playing a significant role in propelling Curve’s dominance in stablecoin trading. Key elements of Curve’s DEX token model:

- Permanent rewards with lock-ins. CRV is rewarded to liquidity providers as yield farming profit for almost every Curve pool, significantly attracted liquidity (who would not desire bonus yield?). Curve adds a twist to it, however, in order to build loyalty: the user can lock up their CRV for up to 4 years to accrue veCRV (vote-escrowed CRV). Locking longer results in more veCRV, which in turn provides greater rewards and trading fee dividends. In reality, a locking LP of CRV can achieve significantly more APY than an unlocking LP. This mechanism efficiently aligns incentives: short-term dumpers of CRV lose much potential profit, whereas people who trust Curve reward holders and lockers of tokens.

- Strong governance (Curve Wars). veCRV is not merely a passive lock-up token – it’s an active governance tool. veCRV holders vote on the allocation of CRV inflation across Curve’s pools (the “gauge weights”). Essentially, through voting, they decide which liquidity pools get the most rewards. This has spawned the so-called Curve Wars, where outside protocols vie to receive veCRV so that they can send more CRV rewards to pools in which they have an interest. For instance, issuers of stablecoins want higher liquidity on their coin on Curve, so they buy and lock up CRV themselves or pay veCRV holders to vote for their pool. It’s a gamified governance system where more veCRV = power = more liquidity on your asset of choice. At the peak, one protocol (Convex Finance) controlled more than 40% of all veCRV, essentially having disproportionate sway over Curve’s reward distribution.

- Liquidity & market position. Curve’s tokenomics positioned it as a liquidity behemoth. With CRV incentives, Curve always has some of the deepest stablecoin liquidity in DeFi. LPs stick around for the delicious CRV (and boosted yields through veCRV). Curve’s design also spurred the entire ecosystem (Convex, Yearn, etc.) of competing for as much CRV rewards as possible.

Curve’s model illustrates the strength (and sophistication) of high-duty tokenomics. It reveals how “carrot and stick” design may produce a positive feedback loop. The CRV case also illustrates that governance needn’t be symbolic. If your token’s governance actually dictates reward flows or fees, people will pay attention.

GMX: Real Yield and Revenue Sharing

GMX represents a newer generation of tokenomics of DEXs that focuses on “real yield,” where token owners are given actual income generated by the protocol (as opposed to further emissions of tokens). This is how GMX’s tokenomics work:

- Dual tokens – GMX and GLP. GMX has two native tokens: GMX (the governance and utility token) and GLP (an index token of liquidity providers). Users get rewarded with GLP when they provide liquidity (by contributing assets to the pool of GMX). Traders then trade against this combined liquidity. The genius is how fees are distributed: 70% of all the trading fees on the platform go to GLP holders, and 30% go to GMX stakers. So, when you stake GMX, you’re rewarded with some protocol fees (distributed in ETH/AVAX, i.e., “real” external value), and when you hold GLP, you also get compensated for fees (tacked on to GMX rewards).

- Real yield for GMX stakers. When stakers stake GMX, they receive their share of that 30% of the fees. That is usually distributed in blue-chip tokens like ETH, so stakers receive a real return. The important thing to note here is that this yield is derived from real usage (trading fees) and not inflation. GMX does have an inflationary incentive (esGMX) that vests over time, but it’s tightly controlled and meant to further encourage long-term holding.

- Liquidity & positioning. Tokenomics of GMX allowed it to become one of the top decentralized derivatives exchanges soon. Liquidity providers are willing to put assets into GLP (though they take on traders’ P/L risk) since the fee reward incentives are attractive, and GMX stakers are holding, not selling, since they get periodic ETH/AVAX payouts.

GMX shows the new tokenomics playbook for DEXs: lower inflation, real revenue-sharing, and mutual gains for both token stakers and liquidity providers. It teaches us a core principle: if you give your token real utility (fee dividends, in this case), you get long-term believers, not short-term hunters.

Looking for custom tokenomics modeling?

We’ll help you shape the right design!

Risks and Pitfalls of Bad Tokenomics Design

What is the main risk of a poorly designed tokenomics? When poorly done, the consequences range from a sluggish platform to an outright death spiral for your token’s price. Let’s go over some common risks and pitfalls of bad tokenomics design for top DEX aggregators.

Hyper-Inflation and Over-Emission

Printing tokens like there is no tomorrow may bring in users initially (everyone loves high APY yield farms), but if unchecked, inflation will destroy your token price and erode long-term trust. We’ve seen this in many DeFi 1.0 projects – e.g., the dYdX token had a high initial emission to traders and LPs, which, combined with minimal near-term use case, led to high inflation and sell pressure.

Another blow-up token was Iron Finance’s TITAN, which dropped from around $65 to nearly $0 in one day – partly due to a reflexive token minting mechanism that spiraled out of control. It is clear – tokenomics affect crypto.

Misaligned Incentives (Mercenary Capital)

If your DEX token economics incentivize short-term behavior but not long-term behavior, your users might be gaming the system and ghosting on you afterwards. For instance, most liquidity mining incentives have been riddled with “farm-and-dump” cycles where users join purely to earn and dump tokens, TVL, and token price plummets once rewards dry up.

Misalignment is also possible when the token promotes behaviors that aren’t actually in the best interests of the platform’s well-being. Suppose a token rewards volume traded – it could incentivize wash trading unless designed carefully.

Rigid or Centralized Governance

Poorly constructed tokenomics for governance can lead to voter disinterest (nobody votes because there’s no value or it’s too complex) or, alternatively, governance capture by a select group of whales. When all or most of your tokens are controlled by one player (or cartel), they can essentially control the direction of the platform, negating the whole point of decentralization.

By mid-2022, Convex Finance had accumulated so much of Curve’s governance power (veCRV) that it pretty much controlled Curve’s reward allocations. Even though Convex was a good citizen of Curve’s network, it illustrates how easy it is for token-based governance to concentrate. In addition, an inflexible governing structure that cannot change (e.g., unnecessarily high quorum requirements that cannot be met, or no ability to handle emergencies) can leave a project grounded when rapid alterations are required.

Not sure if your tokenomics works long-term?

Request an expert audit!

Best Practices for Constructing Sustainable DEX Tokenomics

Top DEX solutions are different and require a different approach. Nevertheless, the battle-tested best practices listed below will guide you towards a sustainable structure:

- Align your rewards with long-term staying power. Structure your incentives so that users are encouraged to stick around. Rather than just a one-time airdrop or high first-week APY, consider mechanisms like time-weighted rewards (the longer you provide liquidity or stake, the greater your rewards) or loyalty bonuses.

- Use vesting and lock-ups wisely. It’s rarely a good idea to let large token grants (whether to the team, investors, or even those receiving liquidity mining) hit the market without some vesting period. Team and early supporters’ vesting schedules show that your insiders are long-term – it prevents an early dump that will shatter community trust. Similarly, if you are liquidity mining, you can vest for those rewards or provide a bonus to users who will lock their tokens. We’ve seen that with Curve (lock up rewards for boost) and even more recent AMMs that offer more attractive rewards to “locked” LP tokens.

- Implement smart governance. For example, use quadratic voting or capped voting power to avoid whale dominance, set up community proposal frameworks, and keep the process user-friendly (maybe integrate voting UIs directly into your DEX app). Importantly, let your community govern real things. If all decisions are still effectively made by the core team, governance token holders will lose interest. Give them say over fees, new listings, or treasury use – whatever is safe and sensible to decentralize.

- Avoid ridiculously complex emissions or rules. If complex mechanics (like algorithmic rebasing or dynamic supply) need to be used, make sure to thoroughly test and simulate how these impact market interaction. Far too often, projects add complexity in the hope that somehow it’ll stabilize price or induce users, but actually, it just backfires. Most investors and users like straightforward tokenomics (e.g., fixed supply or predictable emissions) over something they need to learn a PhD to understand.

Let’s turn your tokenomics into a growth engine!

Book a strategy session

Tokenomics Designs That Scale With Your Protocol – Ideasoft Solution

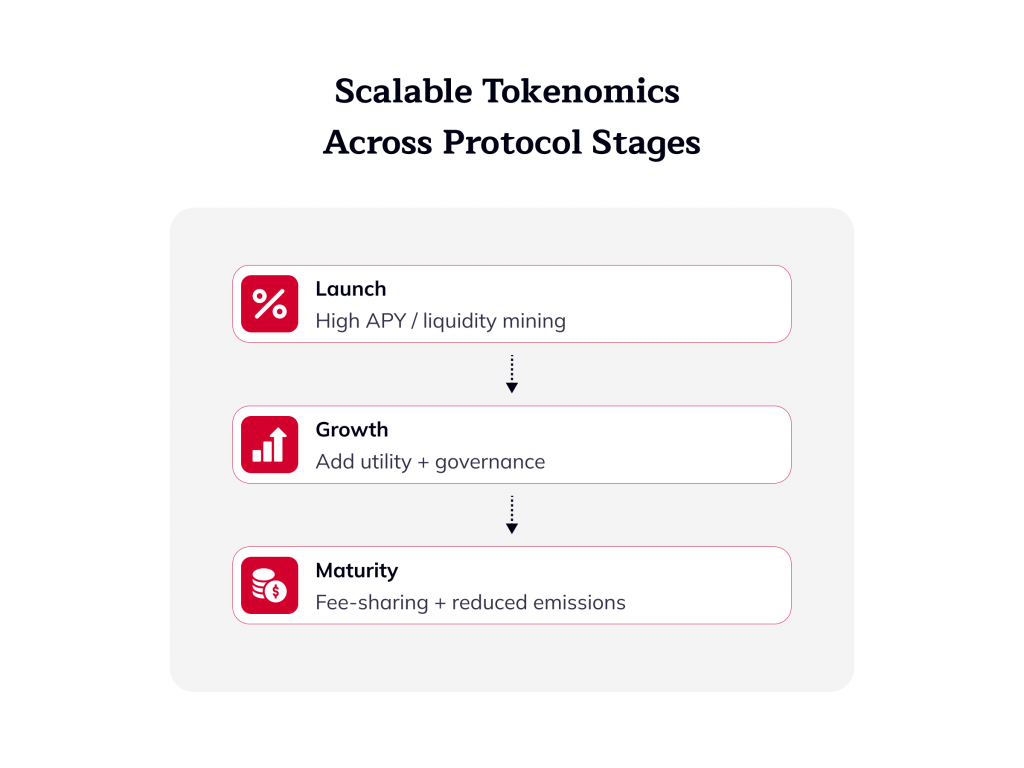

Token models that were successful at launch (when you had 100 users and cared about bootstrapping) will need to shift before you’ve hit 100k users and are generating real fees. DEX tokenomics, simply put, needs to scale with the life cycle of your protocol.

At IdeaSoft, we’ve made it our mission to help projects design tokenomics that aren’t just solid on day one, but can scale and adapt as the protocol develops. We worked on Hoper – we did overall platform development and blockchain side integration as well as tokenomics logic and community engagement system.

How do you design changing tokenomics? It starts with designing for different stages of your project:

- When you’re launching, you might emphasize incentives to attract liquidity and users (e.g. more rewards, referral bonuses).

- At the growth stage, you can introduce or boost utility for the token, such as enabling governance after a community has been established, or adding fee-sharing after revenue becomes more sizeable.

- At the mature stage, the tokenomics may switch to sustainability – i.e., reducing emissions, relying more heavily on actual protocol revenue, and focusing on decentralizing governance and value accrual to holders.

IdeaSoft’s DEX development team uses an integrated approach: technical architecture and token economy are balanced against one another so they complement each other. We can help you with:

- Tokenomics design & modeling. We work alongside you to develop various scenarios for economic situations – inflation, growth in users, token dispersal over time, etc. We achieve this with spreadsheet models and sometimes with specific simulations as well. We prefer to hard-push your tokenomics under multiple hypothetical scenarios (bull market, bear market, exponential growth, etc.). Using modeling, we might pose the type of query, “Will our liquidity bonuses be within means still in 2 years? ” or “What does the token price do if volume doubles but we maintain the same emission schedule?”.

- Economic audits. Have tokenomics but don’t know if they’re bulletproof? IdeaSoft conducts professional token economic model reviews. Whereas a smart contract audit finds code bugs, a tokenomics audit finds economic design flaws. We’ll examine things like: fairness of distribution, inflation curves, game-theoretic exploits (could someone break into your reward system?), and incentives alignment. We’ve learned from having seen many token launches go wrong – we know the usual points of failure. After an audit, you will have an actionable report with suggestions.

- Custom DEX development. Tokenomics doesn’t exist in a vacuum – it needs to be coded into your smart contracts and built into your DEX’s user interface. Our development service ensures your custom DEX features and tokenomics align. For example, if we build an advanced staking system, we will also develop the contracts and UI for it, so the user doesn’t even realize it. If your tokenomics entail cross-chain implications (maybe your DEX operates on several chains based on a single token), we handle the bridging or multi-chain deployment strategy.

Our approach to creating DEX tokenomics can be reduced to Strategy → Prototype → Implement. We start with strategy and modeling, move on to prototype the economic system (sometimes testing on testnets or closed beta with token incentives to see how users behave), and then implement fully with governance alignment and community in mind.

Is your DEX aiming to introduce novel token mechanisms? Or maybe you want to upgrade your existing token model to version 2.0 for your next growth phase? We’re here to help craft a solution that fits your protocol’s DNA.

Let’s create a token model that scales with your protocol!

Contact our Web3 team

Conclusion

As we’ve discussed, focusing on liquidity incentives, governance empowerment, aligned rewards, and scalability from the start pays huge dividends. When your investors, liquidity providers, and traders are all rowing in the same direction (since the decentralized finance tokenomics rewards them to), your DEX can achieve sustainable growth that technology alone cannot deliver.

IdeaSoft’s role in this endeavor is to be your wise partner. We possess long experience in developing DeFi protocol-scalable models. Creating a new token from scratch, analyzing and fine-tuning your existing token configuration, etc. – we keep economics and tech in sync. Our endgame is the same as yours: a thriving DEX with a token that values up as the platform expands, with your members active and engaged for the long haul.

Need help building scalable tokenomics?

Let’s talk!