DeFi lending/borrowing solutions along with decentralized exchanges are now among the top 5 projects with maximum locked-in value (in USD), according to DeFi Pulse. In this article, we’ll tell you about DeFi lending and borrowing platform development using the best blockchain development practices.

Table of contents:

- How does DeFi lending work

- DeFi lending vs CeFi lending

- DeFi lending platform features

3.1 Flash Loans

3.2 Rate Switching

3.3 Fiat Gateway

3.4 Margin Trading

3.5 Investment Rewards

3.6 Recapitalization - The process of developing a DeFi lending platform

- How we can help

How does DeFi lending work

Financial services have undergone significant changes in recent years. The use of blockchain technology lets us create a completely new market aiming to solve the problems of traditional systems. And at the forefront of innovative solutions is DeFi, offering us a new perspective on financial management. Lending/borrowing platforms have become one of the most popular types of DeFi projects due to the clear benefits for users over their centralized counterparts. And before we go to these advantages, let’s figure out how DeFi lending works.

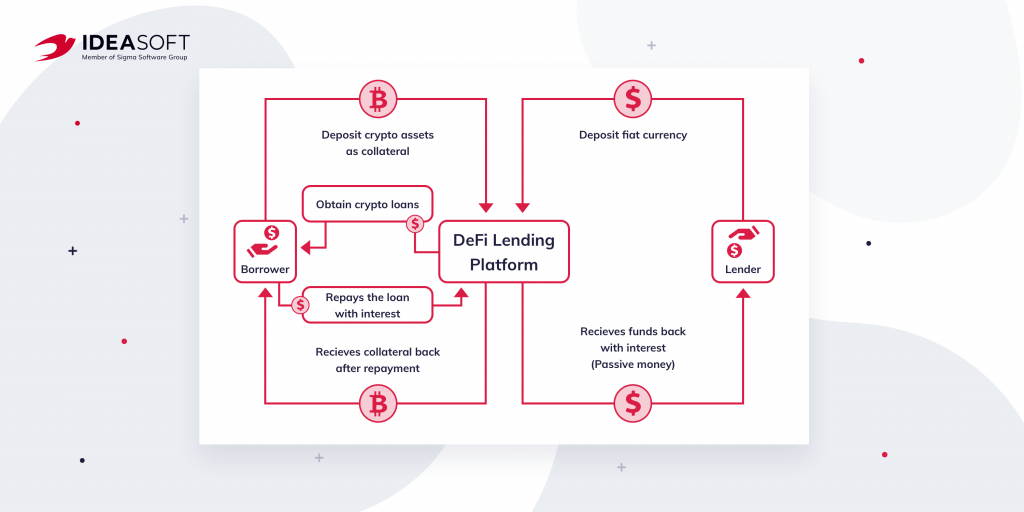

The development of decentralized lending and borrowing platforms allow users to lend and borrow crypto assets. Unlike traditional systems where a platform gives a loan to a borrower, DeFi provides peer-to-peer lending between network participants, eliminating the need for third-party involvement. The lending protocol allows lenders to earn interest. Plus, DeFi lending platforms often provide an opportunity for long-term investors to earn higher interest rates. Therefore, both borrowers and lenders benefit from this model.

One of the main advantages of DeFi is that anyone can become a lender and earn interest. Also, any user can become a borrower by signing up for a platform and connecting a crypto wallet. So this is how it works.

Loans are disbursed through self-regulatory smart contracts without any intermediaries. Borrowers pay a different interest rate for borrowing cryptocurrencies. And the interest that borrowers pay generates the interest that lenders receive. To start the process of obtaining a loan, a user deposits crypto assets as collateral. For example, if the user needs to borrow one bitcoin, he can deposit the price of one bitcoin in DAI, etc.

Now that you know how DeFi lending works, we can move on to the benefits of DeFi lending platforms. Among the main benefits of DeFi loans are the following:

- Improved borrowing speed. With DeFi, you can get a loan very quickly, thanks to automated processes using smart contracts. All you need to do is connect your wallet to a DeFi platform and request a loan. Without intermediaries and any identifications, transactions go through almost instantly.

- No intermediaries. Self-executing smart contracts allow lenders and borrowers to establish agreements directly. The absence of intermediaries in the form of banks and other financial institutions speeds up the process of issuing loans and allows borrowers to borrow funds at lower interest rates and lenders to receive higher returns.

- Permissionless. DeFi is an open and transparent ecosystem that anyone with a crypto wallet can join. Regardless of geographic location and credit history, you can act as a borrower or lender by meeting the basic requirements of a platform.

- Transparency. DeFi has the highest level of transparency that maintains user trust. Built on public blockchains, DeFi lending platforms allow any user to review the smart contract code and see how the system works.

- More control over crypto assets. It is no secret that some centralized platforms can lose user funds due to system errors or hacker attacks. With DeFi, users are the custodians of their funds, which gives them more control over their assets and personal data.

So as you can see, DeFi lending gives users more freedom and profit in managing their crypto assets. The inclusion of P2P transactions allows you to reduce costs and speed up the process of issuing loans. In addition, the members of the network remain anonymous.

DeFi lending vs CeFi lending

Decentralized finance emerged as an alternative to centralized finance or CeFi. The main difference between DeFi and CeFi is the lack of central authorities in decentralized platforms. Let’s take a closer look at the other differences between CeFi and DeFi lending to find out the cons and pros of both mechanisms.

| Criteria | CeFi lending | DeFi lending |

| Access | Determined by a platform | Permissionless |

| KYC requirements | Required | No need for KYC |

| Funds Custody | Platform | User |

| Control | Centralized authorities | Not controlled by centralized authorities |

| Loan disbursement speed | Lower | Faster |

| Platform examples | BlockFi, Nexo, Celsius | Compound, Maker, Aave |

As shown, DeFi lending is very different from CeFi. Firstly, when using a DeFi platform, no one can forbid you to become a member of the network and take a loan if you have provided the necessary collateral. While in centralized platforms, the moderator can approve or decline a loan request. Secondly, an important advantage of DeFi is that users themselves act as custodians of their assets, which removes responsibility from the platform and increases the level of user confidence.

DeFi lending platform features

If you decide to build your own DeFi lending and borrowing platform, start with must-have features. DeFi lending services have similar functionality to regular lending platforms, but they also have unique features associated with the decentralized nature of the product.

First of all, in order to start using a DeFi platform, users must connect their crypto wallets. Therefore, you need to make a list of wallets that your platform should support. For example, Compound allows users to sign up with Metamask, Ledger, Wallet Connect, Coinbase Wallet, and Aave platform provides more options. Decide which integrations you need.

After connecting a wallet, the user can start using the core functionality of the platform. Let’s take a closer look at the main features of DeFi lending apps.

Flash Loans

Flash loans are a type of uncollateralized lending that has gained popularity thanks to the rise of DeFi lending platforms like Aave and dYdX. Thanks to this feature, users have the ability to borrow without providing collateral, but this loan has a limited duration and is automatically canceled if the user cannot repay it. Regulation takes place using smart contracts that don’t allow the transfer of funds if the conditions laid down in them haven’t been met. So the borrower must pay off the loan before the transaction is completed. Otherwise, the smart contract will cancel it.

Flash loans are a fairly innovative and debatable concept, but users have already appreciated their benefits. The possibility of getting a loan almost instantly at the right time is very convenient for traders who can make money on price discrepancies on different exchanges, etc. In any case, this feature can be a great advantage for your DeFi lending platform too.

Rate Switching

Crypto asset markets are very volatile, so users of your platform will appreciate the rate-switching feature. Rate switching allows borrowers to switch between stable and variable interest rates and thus protect themselves from sudden market movements. This feature helps to achieve certain stability of the rates when borrowing. Rate switching is one of the key features of Aave, so we advise you to consider implementing it in your platform.

Fiat Gateway

The DeFi world can seem complicated for beginners, so you need to make sure your lending platform is easy to use and meets the needs of your customers. Fiat gateway is one of the features that will help you with this. Why confuse users and force them to use third-party tools to buy a cryptocurrency when you can implement this feature inside your platform? Fiat gateway will enable your users to buy digital assets with fiat currencies using the interface of your app, thereby improving the user experience. It also simplifies the onboarding process for users.

Margin Trading

Margin trading is a useful feature for traders that involves trading with borrowed money. This helps to increase potential profit in low-volatility markets or in the short term. By borrowing money, a trader increases his capital and leverages his positions, although he assumes certain risks. For example, dYdX allows you to use up to 5x leverage, and you use your own funds as a guarantee. If you decide to implement this feature in your lending platform, think carefully about the mechanism that will need to be written in the protocol.

Investment Rewards

In addition to features for borrowers, you should also think about features for lenders. In order to motivate them to provide funds for borrowing on your platform, you need to offer a reasonable investment reward. For lenders, this is an opportunity to receive passive income from crypto assets, and for you, the process of attracting and retaining lenders. Develop your own reward strategies for lenders to encourage them to make long-term investments.

Recapitalization

Recapitalization helps users stabilize during market movements. For example, Maker issues MKR tokens to keep DAI stable. So if the collateral system is not sufficient to cover the value of the DAI, then MKR is created and sold in the market for additional collateral. You should also think about recapitalization strategies and implement them into your platform. All the logic of the system will be embedded in smart contracts.

Of course, this is not a complete list of features for the decentralized lending and borrowing platform. The more options you provide to users, the higher the chance of success. Follow the latest crypto trends so you don’t miss out on new ideas.

The process of developing a DeFi lending platform

In this part of the article, we will look at how to build a DeFi lending platform from a technical point of view. The DeFi app development process consists of several stages, and we advise you to enlist the support of an experienced development team to successfully complete each of them. Since decentralized finance is a fairly new direction, it can be really challenging to find developers with relevant experience. Therefore, when choosing a partner for the development of a DeFi product, pay attention to the expertise of developers, experience in creating smart contracts, and delivered projects. We also recommend reading our guide on how to start a successful DeFi project.

Discovery phase

The Discovery phase is an important part of creating a DeFi application, as it allows you to build the business logic of your project. The fact is that each project is a separate business case that requires a custom solution. And in order to do everything right from a technical point of view, developers need to build a lending platform architecture that would meet your business goals and fit the needs of end-users.

During the discovery phase, business analysts will help you identify and describe the main tasks of the project, core features, as well as create a portrait of your potential users. All these data form the basis for choosing the right technology stack and building the correct architecture of the product. According to statistics, the discovery phase helps to optimize the budget and reduce project risks, so we advise you not to skip this step.

UX/UI design

UX is often one of the weak points of DeFi applications and the reason why users still prefer centralized platforms. No matter how complex the logic of your lending app is, everything should look simple for users. Therefore, you need to work with experienced UX/UI designers that will help you assemble your requirements into a single functional and intuitive user interface.

We advise you to choose DeFi lending and borrowing platform development companies that have an in-house design department. There are several advantages here. First, designing and developing your platform within a single company will save you time and money. Secondly, in this case, a single team will work on your product, which will be able to resolve issues and work as one quickly.

DeFi lending protocol development

We have already mentioned that in order to create a blockchain-based lending platform, it is necessary to put all the logic of the platform’s operation into smart contracts. Smart contracts are self-executing contracts that are triggered automatically as soon as all the conditions laid down in them are met. Once you have decided on the requirements for the project, the mechanism for calculating interest rates, the type of credit pool, the mechanism for investing rewards, etc., all these features need to be implemented technically in the form of code.

Smart contract development requires sufficient blockchain expertise. First, contracts must be secure and free of bugs and vulnerabilities in the code; otherwise, your platform will be unreliable. Secondly, for all their security, smart contracts must remain flexible and functional so that you can easily update them if necessary. And finally, one of the main difficulties of working with smart contracts is the gas fee for their use. If the gas fee is too high, users won’t be interested in using your lending platform. Therefore, gas optimization is also one of the key tasks in the development of a DeFi product, and only truly experienced engineers can cope with it.

Testing and launching

DeFi is a transparent and open system that imposes additional security requirements. When testing your lending app, you need to make sure not only that the system is working as intended but also that it is free of vulnerabilities. And the main task here is to audit smart contracts. You shouldn’t have to transfer issues with assets locked into smart contracts and other problems. The practice of recent years has shown that DeFi protocols are one of the favorite targets of hackers. Don’t give them a chance. Remember that providing full-coverage unit tests is crucial in preventing attacks and fraud.

Our team can help you develop cross-chain DeFi platforms, enhancing security and interoperability across multiple blockchains.

How we can help

Now that you know how to build a DeFi lending platform let me tell you how we can help you. IdeaSoft offers end-to-end DeFi lending platform development services. From business analysis and design to deployment and testing, our team has all the necessary expertise to complete the tasks of your project within one company. IdeaSoft’s portfolio includes over 250 projects, most of which are related to blockchain development. Crypto exchanges, including decentralized (DEX) ones, lending/borrowing platforms, NFT marketplaces, issuance platforms, DeFi aggregators, and more. Our engineers know how to develop a DeFi product of any complexity level.

If you want to set up a DeFi lending platform that fits all security requirements and the needs of end-users, we will be happy to provide you with the best experts to meet these challenges. The IdeaSoft team has more than 140 software development professionals ready to start a new promising project. Check out our blockchain development services or contact us directly to discuss cooperation details.