The financial technology (fintech) industry has been rapidly transforming the way we manage, invest, and transact in the digital era. With innovative solutions ranging from mobile payment platforms to blockchain-based financial services, fintech has revolutionized traditional financial processes, bringing convenience and efficiency to consumers and businesses alike.

However, amid the dazzling potential of fintech lies a complex landscape riddled with fintech industry challenges and risks that demand careful attention and strategic planning.

In this article, we’ll discuss the most critical fintech challenges and risks in software development for 2025 and explore the ways they can be resolved.

Table of content:

- FinTech Industry Market Overview

- FinTech Risks and Challenges

- Key Solutions for Risks and Challenges in Fintech Development

- Wrapping Up

FinTech Industry Market Overview

According to the market outlook of Expert Market Research, the global fintech market was valued at over $135.90 billion in 2021 and is expected to increase to over $266.9 billion by 2027 at a CAGR of 11.9% over the forecasted period.

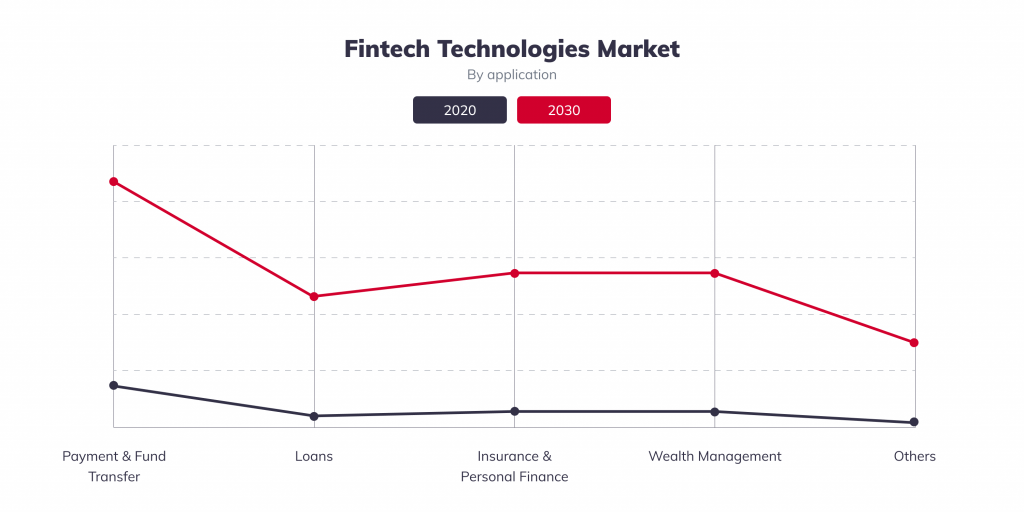

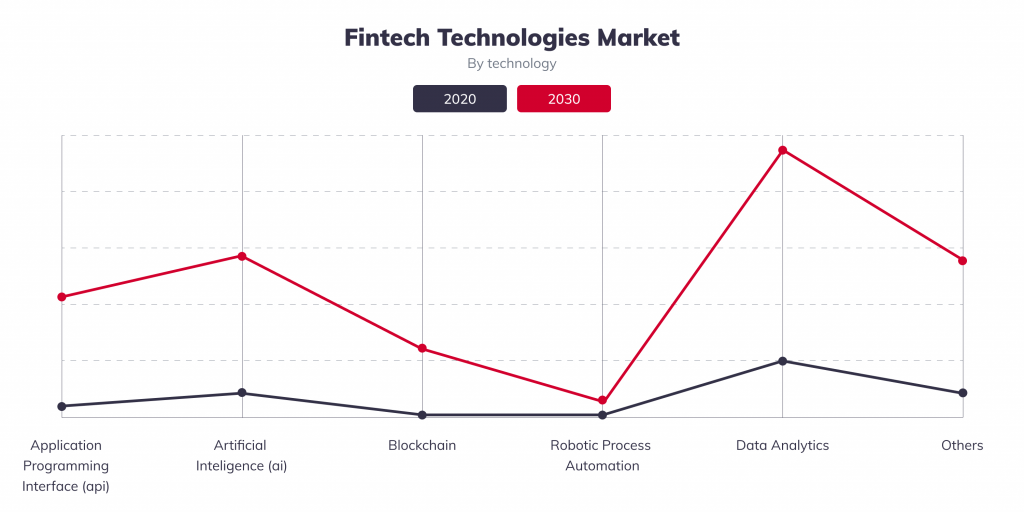

To get a better understanding of the current state of the fintech market and its potential areas of evolution, let’s review some of the key industry trends for 2025-2030. An excellent analysis has been provided in a comprehensive fintech research study by Allied Market Research. Based on this, the fintech market has been segmented on the basis of deployment mode, applications and technologies types, end-users and region.

As for critical market technologies, data analytics remains the most essential segment for the upcoming decade. However, the fintech market also expects to evolve in artificial intelligence, application programming interface development and blockchain solutions.

By 2030, the highest market share in the fintech industry will be generated by the banking segment. However, analytics also admittedly will show some notable investments from the insurance and security fields.

All these factors are actively guiding the development of fintech startups, as well as the overall market evolution.

FinTech Risks and Challenges

At present, there are plenty of risks and challenges of fintech associated with software development, each of which can significantly affect startups’ efficiency and their ROIs, and even hit the performance and development of their financial and banking business.

Below we’ve reviewed some of the biggest fintech threads that will remain relevant in the upcoming years.

Systems Vulnerabilities

The financial and banking industry is closely tied to sensitive and private data, so software security will remain one of the primary areas of focus for 2020-2030. Currently, more and more international regulators focus on system vulnerability problems in fintech industry and the rising number of security breaches, hacking attacks and third-party penetrations only confirms its importance in the fintech world.

For instance, just in Q1 of 2022, the NVD database published 8,051 vulnerabilities, which is about 25% higher compared to the same period in 2021. Moreover, according to Edgescan’s 2022 Vulnerability Statistics Report, the vulnerability risk of every 10th Internet-facing web application is considered a high or critical risk, and nearly 46% of apps today report notable vulnerability issues.

Digital Identities

A rising implementation of smartphones and contactless payments has uncovered the challenges of digital identity in the fintech technologies market. Currently, the key features to keep in mind for digital IDs in the financial and banking industry include:

- Verified and trusted – digital identities are valuable if approved by authorities, regulators and other relevant stakeholders.

- Portable – digital IDs need to fully replicate the functionality of physical documentation across multiple services.

- Secure – digital IDs must feature extremely high security against loss, theft or corruption. Additionally, they must be encrypted to prevent compromise.

Data Ownership

Another important aspect that hits various businesses within and outside of the fintech and banking industry is the data ownership challenge. Typically, it regulates the parties who are allowed to access, create, modify, and delete different data.

In fintech software solutions, data ownership must be given by the security roles. This allows for efficient management of complex scenarios of access privileges and the level of access. As a result, this can significantly minimize the risks of third-party system breaches and potential data compromises, as well as numerous reputational and financial losses.

Ethical and Bias Concerns in AI

The use of AI-powered algorithms for financial decision-making raises ethical questions, particularly around bias and fairness. Fintech companies must develop transparent and accountable AI models, ensuring they do not inadvertently discriminate against certain demographics or perpetuate existing biases in financial services. Resistance to change or a lack of understanding of these technologies may impede their widespread adoption, delaying fintech’s full potential.

Fintech Security Concerns For Third-Party Service Integrations

Nowadays (and for upcoming years as well), APIs have become the foundation of nearly all modern applications. These enable a coherent and efficient performance of different apps, speed up the time-to-market and open up a wide range of opportunities for improving the functionality and competitiveness of a particular software.

However, the most critical risk for the implementation of third-party services for the fintech industry is their security concerns. According to BlueVoyant’s research, in 2021 over 93% of companies suffered a cybersecurity breach due to significant weaknesses in their supply chain/third-party vendors.

Additionally, having analyzed the API-related incident data, the researchers of Marsh McLennan Global Cyber Risk Analytics Center have discovered that the lack of security in APIs may cause $12 billion to $23 billion (US) and from $41 billion to $75 billion globally in average annual API-related cyber loss.

In terms of the financial and banking technologies industry, the insufficient security of third-party service integrations in fintech app risks the digital security of any company’s operations and data.

Thinking of implementing your own fintech app?

Let us help you correctly draw up the requirements for your project!

Cloud Migration

When analyzing critical fintech challenges, it’s also worth mentioning the risks of cloud computing adoption for banks and financial institutions. Though experts claim increased efficiency and reduced costs, not all firms can successfully and safely integrate cloud solutions into their systems.

For instance, Forbes analytics highlight that adoption is not the issue. Instead, the key point is to find the most efficient and effective cloud solution which can replace the old on-premise systems and applications, and maybe even add to the company’s competitiveness after migration to the cloud.

Additionally, there are some common stereotypes about FinTech cloud migration, which make companies uncertain about its adoption:

- Cost Estimation. Regardless of the industry, cloud migration costs are often underestimated, which results in notable cost overruns. A team of Dutch university professors has accessed the cloud migration cost of 10 “international corporate banks” and uncovered that 5 out of 10 banks experienced cost overruns (versus the expected estimates) in at least five categories. That included dependency management, third-party services, re-architecting, legislation and departmental support.

- Data Management and Security. Data confidentiality and its protection implies properly aligning permissions, encryption and secure storage to restrict readability and comply with local regulations.

- Integrity. Cloud solutions for fintech should feature the appropriate permissions for restricting data modifications or deletion.

- Data Confidentiality. Since financial and banking institutions work with tons of sensitive and personal data, it’s essential to continually work on improving its protection to restrict its readability and user access, as well as to prevent the violation of existing regulations.

Though there are various aspects to consider in fintech cloud migration, its potential advantages can surely improve the performance and competitiveness of thousands of industry-related businesses.

Malware Attacks

During the 2015-2020 period, finance and insurance was the most targeted industry by cybercriminals. Moreover, research by IBM X-Force shows that in 2021 nearly 70% of the attacks on financial industry firms targeted banks, which means the risks for related companies to be attacked are extremely high and require exceptional attention.

The BCG report also uncovered that financial firms are 300 times more likely to fall victim to cyberattacks compared to other organizations, which is no wonder. In the case of a successful attack on a financial and banking institution, criminals can gain much more profit.

From a business owner’s perspective, the importance of keeping your company secure from ransomware attacks is one of the critical problems in fintech that cannot be overestimated. When infected by malware, a company can experience operational and reputational damage. At the same time, a cyberattack will inevitably lead to significant financial losses, which in some cases may result in bankruptcy.

Key Solutions for Risks and Challenges in Fintech Development

Having explored the major challenges related to fintech software development, the common question of any business owner is how to successfully reduce the risks of being affected and quickly recover if any of these issues emerge.

Let’s review the advanced solutions for fintech software development that are widely incorporated in the financial and banking industry today.

Adopt a Secure-by-Design Mindset

Previously, we’ve listed a bunch of risks and challenges in fintech software development, most of which were related to the system’s security concerns. For this reason, one of the first items to introduce into fintech development is the implementation of a secure-by-design mindset.

This implies investing significant resources in building a robust cyberattack defense infrastructure to reduce the penetration risks and decrease the costs for infrastructure recovery. Additionally, a secure-by-design mindset will allow for the creation of an ecosystem that encompasses the right skill sets and capabilities to enhance security, not only on a corporate level but even for the security of the state. For instance, this practice has been already implemented in Singapore, the US and the UK and some European countries.

Protecting Sensitive User Data

This approach implies working on the security of the data storage environment, which must be accessed only by authorized users according to permission level. Also, fintech developers should constantly update the security protocols and check for potential vulnerabilities (for instance, through the pentest) to ensure data is secured 24/7.

However, one of the required measures for protecting sensitive client data in financial and banking (as well as most other industries) is data encryption. Basically, it’s the process of transforming data into an alternative format that can only be read by a person with access in a decrypted way.

Penetration Testing for Escaping Malware Attacks

At present,. pentest remains one of the most efficient practices for keeping ahead of attackers and consistently working on security improvements. An advanced team of cyber experts with notable expertise in penetration testing can efficiently examine your system for potential threats and vulnerabilities, which plays an irreplaceable role in troubleshooting security issues.

Moreover, these professionals can help not only optimize existing fintech systems but can also collaborate with QA specialists to ensure the robust performance of the particular project before its official release.

DRP/BCP Analysis in Fintech

Fintech companies should not only work on potential threats but also consider efficient and effective algorithms on how to act if a specific incident occurs. That’s where the BCP (Business Continuity Plan) comes into play. Its goal is to outline proactive measures to ensure the continual availability of business support systems and to mitigate the disruption risks as well. Typically, the BCP covers the following components:

- Emergency Response – a plan of action for responding to emergency cases, targeted on preventing a disaster or minimizing its outcomes

- Crisis Management – a set of rules to be followed when reacting to critical incidents in a timely manner, when all previous efforts have failed for some reason

- Disaster Recovery – a guide for leveraging advanced technologies and solutions to eliminate the outcomes of a particular incident based on detailed case analysis. In other words, it implies setting up a second line of defense aimed to bounce back from the worst disruptions with minimal damage.

- Business Continuity – these are steps on how to maintain critical business processes and functions after an emergency or disruption.

The end goal of the BCP is to ensure the organization is capable of responding and recovering from potential threats as efficiently and effectively as possible.

Got lost in tech details?

Let us help you figure it out, and correctly draw up the requirements for your project

Using Software Composition Analysis (SCA)

SCA is the automated process that identifies the open source software in a codebase, which basically helps companies evaluate system security, code quality and license compliance.

Fintech developers usually apply SCA to proactively identify problems and consider actions on how to successfully remediate them to avoid reputational, operational or monetary impact on a particular company.

Implement Safe & Secure Third-Party Service Integrations

Since third-party tools can provide cybercriminals with a clear and easy path to access internal company’s systems, financial and banking institutions need to only use trusted licensed software to mitigate risks. Additionally, companies can consult with cybersecurity specialists to understand the security flaws of a particular third-party partner and consider the most efficient strategies to allocate sensitive resources which will not compromise the safety and security of your fintech solution.

Involve DevSecOps for Cloud Migration

DevSecOps (development, security and operations) experts can significantly improve the performance and safety of applications by integrating the latest security practices and approaches across every stage of fintech software development. Basically, they allow software security to be transformed into a fundamental component of a production pipeline through a detailed software composition analysis.

Analyzing the potential benefits of this practice implementation, it’s no wonder that nearly 91% of financial companies have implemented or are currently working on the DevSecOps practice implementation (Sonatype).

Wrapping Up

There are many aspects to consider when developing fintech software solutions, which is why a considerable number of startups fail. Nevertheless, being aware of the potential risks and challenges in fintech development, and choosing an expertized technical provider can significantly increase the chances of launching a solid and efficient software solution that ideally works for your business’s needs and objectives.

Being a reputable fintech product development company, IdeaSoft has successfully delivered over 250 projects with outstanding products, modern systems, and emerging technologies on board, including dozens for the financial and banking sector. Do you already have a fintech project for us? Contact our team to explore development strategies for an efficient fintech solution and how your business can benefit from them today!