As a startup founder or product manager, you’ve likely heard buzz about “digital ledgers” and token economies without clear answers on blockchain ROI or actual blockchain investment benefits. The big question: Is investing in blockchain worth the effort and cost? Let’s address blockchain investment benefits head-on.

At its core, blockchain can streamline operations, cut out middlemen, and even unlock new revenue streams. The key is a strategic approach focused on business pain points (not just crypto gimmicks). If done right, a blockchain project can pay for itself by reducing costs and boosting customer engagement or revenue.

Highlights:

- Blockchain can streamline operations, cut costs, and open new revenue streams.

- ROI from blockchain includes operational efficiency, transparency, new funding models, and market expansion.

- Smart applications like tokenization, smart contracts, and NFTs can drive measurable startup growth.

- N-Finity, Securitize, Biteeu, and BridgeTower achieved tangible ROI with blockchain solutions.

- Key blockchain ROI metrics include cost savings, revenue growth, user acquisition, and risk reduction.

IdeaSoft’s experience bears this out – as a leading blockchain development firm with 8+ years in the market and over 250 successful projects delivered, we’ve seen startups achieve measurable ROI through Web3. For example, IdeaSoft helped build N-Finity, an NFT marketplace that tackled a major market gap by allowing NFTs to be used as collateral (thereby protecting part of the owner’s invested value).

Throughout this article, we’ll show how startups can achieve blockchain ROI by investing in blockchain strategically. If you’re wondering whether Web3 is worth it, read on.

Curious how blockchain can transform your startup?

Reach out — we’re here to help you!

Table of contents:

- Understanding Blockchain’s Business Value

- Startup-Friendly Use Cases with ROI Potential

- Measuring ROI on Blockchain Projects — Metrics That Matter

- Startups Already Thriving with Web3: Case Studies

- Conclusion

Understanding Blockchain’s Business Value

Before jumping into use cases, let’s define what ROI (Return on Investment) means in the context of blockchain. It’s not necessarily short-term profit. Blockchain business ROI can also involve cost savings, efficiency improvements, risk mitigation, and strategic positioning. In other words, a blockchain project may not inflate your top line in month one, but it may cut your operating expenses or create new possibilities that pay off down the line.

Measure blockchain ROI on two dimensions: financial returns (revenue, cost savings) and strategic returns (competitive advantage, market share, user trust). Most investing in Web3 2025 plans emphasize that cost savings and process improvement will largely drive early blockchain value.

Core Benefits for Startups

Which business problems can blockchain solve?

Here are some basic blockchain investment benefits for startups:

- Cost savings through efficiency. By removing intermediaries and automating processes through smart contracts, blockchain has the potential to simplify and reduce the cost of transactions. For example, even incumbents use it to minimize record-keeping and reconciliation effort. McKinsey highlighted that duplicative processes like KYC (Know Your Customer) checks can cost banks up to $500M a year each. An industry-wide shared blockchain-based KYC system could require only one verification per customer and save hundreds of millions while increasing transparency. Startups can achieve the same efficiencies at smaller scale (e.g., automating supply chain payments or eliminating paper contracts).

- Transparency & trust. Blockchain’s distributed ledger is transparent to authorized parties and tamper-evident. This can reduce fraud and errors – a big ROI consideration for industries involving intermediaries or non-transparent processes. More transparency means less loss to fraud and more trust with users and partners. For a startup, being able to prove every transaction to customers or regulators can be an incredible competitive differentiator (e.g., food supply chain traceability or fair trade verification on blockchain). It’s ROI in the form of brand trust and risk reduction.

- New fundraising models. This includes ICOs (Initial Coin Offerings), STOs (Security Token Offerings), and tokenized crowdfunding. These models enable startups to raise funds from a global pool of investors by selling digital assets or tokens. Even regulated platforms such as Securitize have cropped up to help offer compliant security token sales. IdeaSoft built a security token issuance platform for Securitize, showing their real-world experience with this new financing technique. The payoff here is access to capital that might be hard to come by through traditional VC or IPO routes, and an inbuilt community of token holders from day one.

- Greater market reach. Startups can reach new users and markets that are keen on decentralization. For example, integrating crypto payments can attract global customers who want to pay using digital currencies. NFT-ing your product can create a new revenue stream of digital collectibles. These strategic benefits are realized as ROI in the form of new revenue streams and customer acquisition that might otherwise be impossible.

Startup-Friendly Web3 Use Cases with ROI Potential

Why invest in Web3? Let’s explore some startup-friendly blockchain use cases – practical ways to apply Web3 that have shown real returns. We’ll also mention real examples (including IdeaSoft projects) to illustrate each:

Tokenized Products & Services

Tokenization is the expression of ownership or access rights in digital tokens on a blockchain. Startups are using this concept to create new product models and streams of revenue. You can create:

- Loyalty and engagement tokens. Instead of points, some companies issue tokens that customers can earn and redeem. This can drive engagement (users feel real ownership of loyalty rewards) and even become an asset on the balance sheet if tokens get market-valued. For example, a content startup can reward creators and viewers with tokens that can be spent within the platform or redeemed outside.

- Fractional ownership. Real estate, art, and even agricultural startups are tokenizing assets so that they can be fractionally owned. This opens up investment from a wider base and can release capital from illiquid assets. A startup can raise funds by tokenizing an expensive piece of intellectual property or real estate – basically crowdsourcing its assets. The investors get tokens representing a share, and the startup raises funds without traditional loans. This is one example of why to invest in Web3 – it provides new funding and liquidity channels that equate to ROI (access to capital and investor base).

- New business models through tokens. Certain startups center their entire product around a token economy (imagine play-to-earn games or finance apps that use decentralized finance). Well-designed models have the capacity to scale rapidly. Just avoid token hype – the idea being that the token must drive to actual utility or value in the product, and hence user growth or revenue (the ROI numbers that matter).

Security token offerings allow startups to issue tokenized equity or revenue shares under regulatory compliance. Securitize (upon which IdeaSoft developed the token issuance system) is a demonstration of how compliant token sales can be executed. Token issuance allows a startup to raise funds faster and from a wider pool of investors than in traditional venture rounds – that’s a simple ROI in efficiency in fundraising.

Smart Contracts for Operational Efficiency

Smart contracts are self-executing contracts where the terms of the agreement are written directly into lines of code on the blockchain. For a startup, they can automate complex workflows that otherwise take time and middleman fees:

- Automating payments & escrow. If your startup deals with multi-party transactions (marketplaces, services, etc.), smart contracts can ensure automatic payment to all if conditions are met. This eliminates the need for monitoring and can eliminate costly payment processors or escrow services (saving fees = direct cost ROI). For instance, a freelance site could use a smart contract to hold a client’s payment and pay out to the freelancer once work has been submitted and accepted, all without a bank in the middle.

- Supply chain and inventory. Smart contracts can trigger actions like re-ordering or payment at delivery receipt, making supply chain finance more effective. They also provide an immutable history of events (helpful for auditing and reducing fraud). One famous example is IBM and Maersk’s blockchain trade platform that attempted to digitize shipping documents and do away with billions of inefficiencies.

- Operational transparency. Because data on a blockchain is shareable and secure, startups that exist in partnership or B2B settings can use it to create a single source of truth. For example, a B2B SaaS can write usage statistics to a common blockchain ledger with customers, so that both will agree on billing data. This reduces conflict and enables trust, which indirectly improves ROI through reduced friction in client relationships.

NFTs and Digital Identity

NFTs are not just digital art. They’re handy for business in identity and community. Startups can use NFTs to drive user engagement and brand loyalty, and that in turn translates into revenue.

- Membership and loyalty NFTs. Instead of membership cards, companies provide NFT-based memberships. They can grant access to perks, and more importantly, they can be resold. An example is that a gaming startup could sell NFT “passes” for early access to content with a portion of the game’s success (the NFT would receive rewards).

- Digital identity verification. Tokens or NFTs can represent verifiable credentials, like a degree, certificate, or KYC verification. A startup in professional networking or certifications can use this to allow instant trust between strangers (e.g., set up “I am a certified developer” using an NFT badge). The ROI in this case is indirect but remarkable: reduced fraud and faster user onboarding since verification is blockchain-secured. Less human vetting = less cost; stable user profiles = better platform reputation.

- Asset ownership & royalties. Creators (writers, artists, musicians) can token their content and automatically get rewarded royalties from future sales through the use of NFTs. A creator platform startup could add this feature and attract top creators by promising them payment through smart contracts. Having more creators translates to a richer platform and possibly taking a cut of that action for the startup (ROI in network growth and revenue sharing).

IdeaSoft developed an NFT marketplace for N-Finity on the NEAR blockchain that solves a very significant issue: NFT non-collateralization. N-Finity by enabling NFT owners to collateralize (i.e., use their NFTs as collateral for borrowing or insurance), ensures users will be able to recover some part of their value invested. This feature takes away one of the largest fears (losing everything if the NFT market collapses) and makes the platform more actively traded.

For N-Finity, the Web3 return on investment is self-evident – more users and trades, through confidence in users.

Measuring ROI on Blockchain Projects — Metrics That Matter

You can’t manage what you don’t measure. To ensure your blockchain project is delivering value, you need to monitor the correct ROI measures. They will vary based on the project, but let’s break some of the typical blockchain ROI metrics.

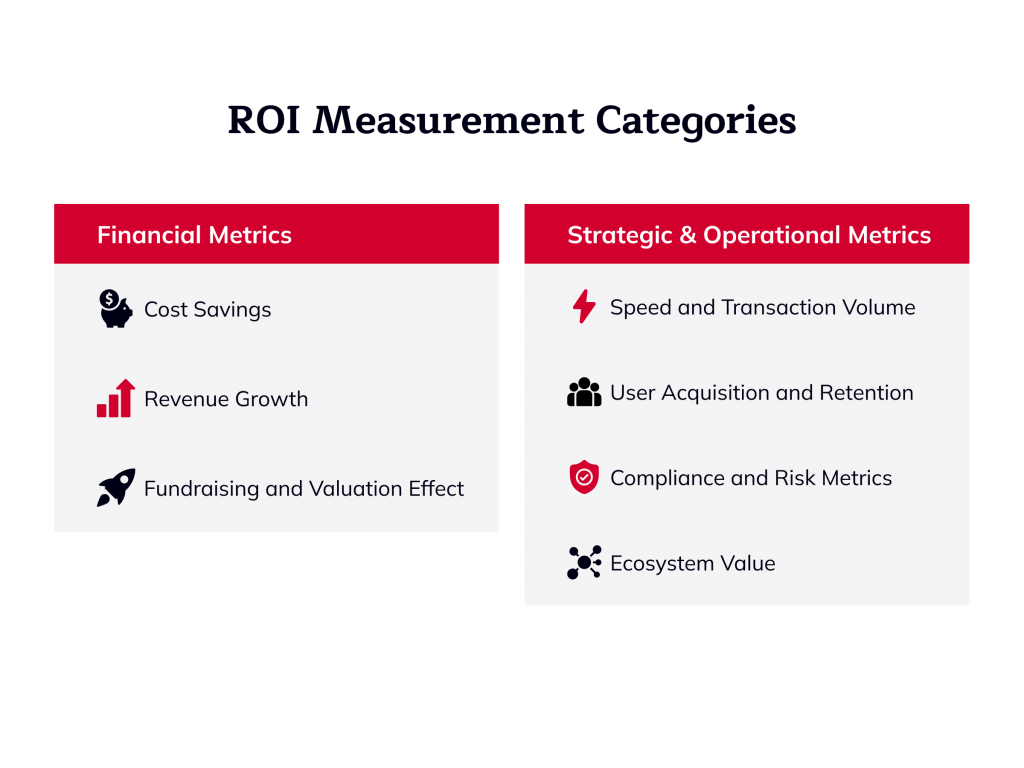

Financial measures:

- Cost savings. This is often the easiest short-term ROI to measure. Track the reduction in operating costs after deploying blockchain. For instance, if the process previously needed 3 full-time employees and now it is managed by a smart contract, what are the yearly salary savings? Or if employing a blockchain reduced your fee on transactions by 50%, determine that dollar savings over time. Think back to the KYC example: a shared blockchain utility could save each bank up to $500M annually. A startup may not hit that number, but saving $50K in fees is a huge victory for a small firm.

- Revenue growth. If your blockchain project generates new revenue streams (e.g., token sales, transaction fees, or premium features), monitor those closely. How much revenue can you attribute directly to the blockchain feature? For instance, if you launch an NFT series, track the first-sale revenue and any royalties on subsequent sales. Or if you launch crypto payment options, track the increase in sales from crypto-paying customers. These numbers prove firsthand ROI in the form of new money coming in as a result of Web3.

- Fundraising and valuation effect. Startups can consider funds raised via token offerings as a type of ROI (the cost being time invested creating the token and regulation compliance). If your blockchain pivot allowed you to raise another $1M on your last funding round, that’s a tangible benefit.

Strategic & operational metrics:

- Speed and transaction volume. If blockchain technology makes your service faster or more scalable, quantify it. Faster service can enable more transactions (and revenue) and happy customers. Volume metrics (transactions on your system, or wallets/users active) usually indicate adoption. A surge is a sign your blockchain product is flying – an ROI on user acquisition and engagement.

- User acquisition and retention. Did your Web3 functions introduce new users or retain current users? For instance, if you launch a token that rewards activity, does retention go up versus prior to the token release? Maybe your customer acquisition cost (CAC) goes down because the prospect of receiving tokens draws organic users. These metrics (CAC, churn rate, daily active users) provide a measure of the ROI on community and network effects created by your blockchain business.

- Compliance and risk metrics. If you’re in a regulated setting, monitor gains in compliance (e.g., error rates on record-keeping, audit outcomes). If blockchain use cuts your chargeback fraud by 80% because each transaction is traceable, that is quantifiable ROI (you save money).

- Ecosystem value (network ROI). Some Web3 projects experience network effects – the more participants (users, nodes, partners), the more valuable the network. You can gauge how many partners are plugged in via your blockchain API, or asset value locked in your protocol (TVL, as they say in DeFi).

In describing blockchain business ROI to stakeholders, blend quantitative figures (dollars earned/saved) with strategic wins (competitive advantage, user growth). For instance: “Our blockchain pilot cost $100K, but it’s saving ~$50K annually in ops and enabled a new $200K revenue stream. And it made us an innovator in our space, with two partnership offers.”

That’s a great ROI story. Another suggestion: Benchmarks and Baselines. Capture the “before” state (costs, speeds, etc.) prior to deploying blockchain, so you have a baseline. It’s the only means of credibly asserting improvement. Web3 is new, after all, and having metrics to support your claims of ROI builds credibility among investors and team members alike.

Ready to unlock real ROI with blockchain?

Let’s discuss how Web3 can fuel your startup’s growth!

Startups Already Thriving with Web3: Case Studies

On occasion, the greatest way to forecast blockchain operations ROI is simply to watch who is already bringing home the bacon.

Biteeu (Crypto Exchange)

Problem. Most crypto exchanges suffer from issues of trust and security, especially new players who seek to battle with the titans.

Biteeu, a compliant crypto exchange, spent on quality blockchain infrastructure and compliance (IdeaSoft developed it). They invested in strong security (unhackable multi-signature wallets, immutable audit trails) to build user trust.

ROI. By focusing on security and transparency, Biteeu acquired institutional partners and clients that were wary of unfamiliar exchanges. The measurable ROI materialized in the shape of more trading volume as well as improved user acquisition from areas requiring compliant exchanges. Effectively, Biteeu converted blockchain’s trust feature into a market advantage, stealing away users (and fees) that generate income.

BridgeTower (Global Marketplace)

Problem. Institutional crypto trading does not come with compliance and trust (all that KYC/AML nonsense), which cuts out large participants.

BridgeTower created a solid marketplace with KYC/KYB authentication, AML filtering (with MasterCard’s technology), proof-of-reserves, and even staking and NFT functionality. Essentially, they wed the wild west of crypto markets with the strict controls of traditional finance on a blockchain platform.

ROI. By meeting strict regulatory and security demands, BridgeTower managed to onboard institutional clients who need those assurances. They most likely reduced clients’ burden of due diligence (everything is baked into the platform). BridgeTower’s own ROI comes from the capacity to command premium pricing on a compliant product. It’s a fine example of Web3 infrastructure investment, opening up a new market (institutional DeFi access) and reaping returns as one of the first movers.

IdeaSoft’s development support in introducing such advanced features enabled BridgeTower to reach the marketplace faster, capturing customers and market share ahead of its competitors.

Conclusion

To wrap up, let’s circle back to the big picture. Blockchain isn’t a magic money machine or a silver bullet – and it shouldn’t be adopted blindly. However, with a strategic approach, it can deliver an asymmetric Web3 return on investment. “Asymmetric” means your upside (in cost savings, new revenue, market positioning) can far exceed the initial investment, if you play it smart.

So ask yourself: What part of my business could be transformed or significantly improved with greater trust, transparency, or decentralization? Start there, and you might find an opportunity for employing blockchain investment benefits.

Let’s start a dialogue. If you’re exploring blockchain for your startup and want to maximize your chances of success, IdeaSoft is here to help. Sometimes a 30-minute talk can spark a game-changing idea or save you from a costly misstep.

We love brainstorming and consulting with startups on Web3 strategies!

Don’t hesitate to reach out