If you haven’t heard of asset tokenization yet, it’s time to fix it. And if you have, then you probably know that tokenization is a prerequisite for the full use of all the advantages of blockchain technology. More than a trend but not yet a universal solution. Read in this article what asset tokenization is and why you might need it.

Table of contents:

- What is an asset tokenization

- How it works

- Advantages of asset tokenization

- Challenges of asset tokenization

- Where to start asset tokenization

What is an asset tokenization

Tokenization is the conversion of the right to an asset into a digital token. In other words, asset tokenization is a digital representation of a real asset. Digitally, an asset is recorded on the blockchain as a token. A “token” is a unit designed to represent a certain value within a particular ecosystem. It looks like a unique code. The value of tokens corresponds to the value of a specific asset underlying them.

Tokenized assets are managed by smart contracts that enable the purchase and sale of digital assets. Asset tokenization is used in various industries as a method of making payments that don’t require the transfer of any confidential information and personal data, which makes it safe and transparent at the same time. You can find use cases of asset tokenization in finance, real estate, healthcare, sports, and other industries.

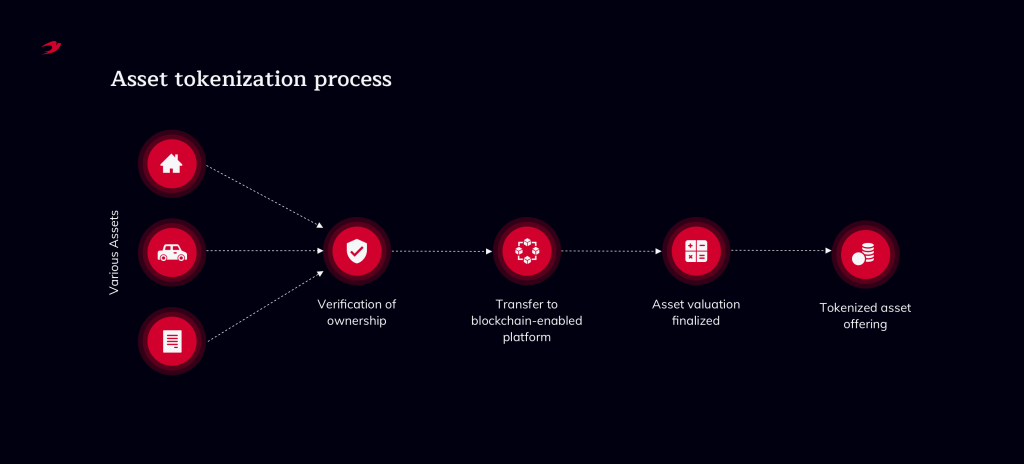

How it works

Let’s imagine you have a real estate worth $500,000, turning them into 500,000 tokens will allow you to sell them on exchanges using smart contracts. Your tokens can be divided among several owners: someone will buy 100, someone 50, respectively, each will own a certain share of your asset. This approach increases liquidity by making it possible to divide property rights among several people at once. Through tokenization, businesses can raise capital by selling partial ownership of illiquid assets to investors who find it easier to access valuable assets digitally than if they were sold in full physical form.

The tokenization process starts with evaluating an asset. If your asset belongs to existing markets (like gold, silver) where the sale of tokenized assets is already taking place, this won’t be so difficult. If you are tokenizing an asset that hasn’t yet had an existing market, you need to contact an accounting firm to determine the value of the token.

There are several types of tokens that help you tokenize different types of assets. They were proposed by the Ethereum community. This separation lets the tokens of the same standard share some common smart contracts and store common data. The token standard consists of a set of predefined functions. Among the main common tokens are the following:

Tokens are recorded on blockchain where their regulation can be carried out using self-executing contracts called smart contracts. Smart contracts allow you to put in the system the terms of an agreement in the “if / then” format, which will be executed automatically. The blockchain provides an immutable record of data, which means once an asset purchase transaction is recorded on the blockchain, no one can remove or change your rights to the asset.

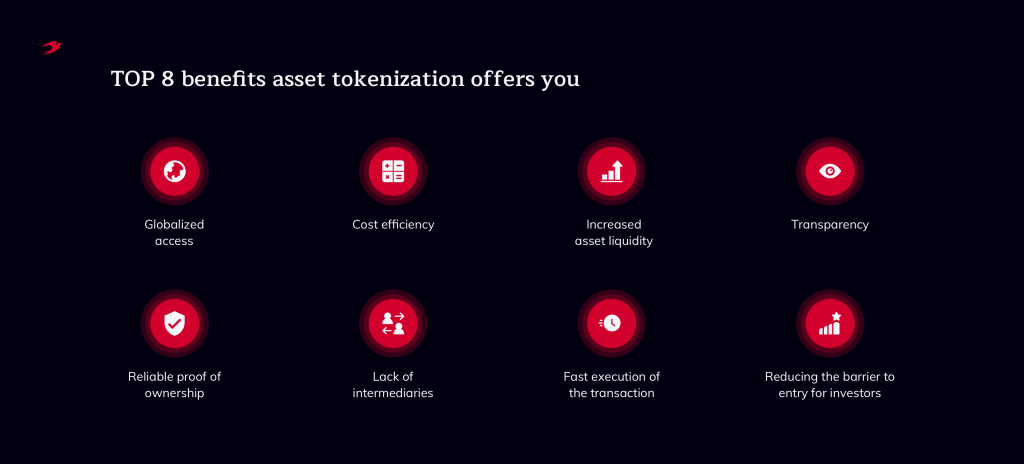

Advantages of asset tokenization

Asset tokenization has many benefits, which makes the topic so popular. Blockchain offers a new level of asset management that is faster, more reliable, and more cost-effective. Among the main advantages of tokenizing assets on the blockchain are the following:

- Globalized access. The blockchain has no geographic boundaries. Any of the network’s participants can take part in transactions, which opens up access to the new global market. Ethereum co-founder Joseph Lubin said at SXSW conferences in 2019 that thanks to the introduction of blockchain, the global economy will grow 10 times over the next 10-20 years.

- Cost efficiency. Tokenization provides a faster and smoother transfer of assets across accounts without the involvement of centralized intermediaries. Besides, within the blockchain, you get lower commissions, and in some cases, there may be no commission at all. Therefore, companies conducting transactions using tokenized assets get a more streamlined process for lower prices.

- Increased asset liquidity. As mentioned, tokenization is a great solution for asset owners with poor liquidity. All thanks to partial ownership of assets, which lets the seller complete the transaction faster with minimal spending. Analysts at the Cisco technology corporation believe that in 8 years, 10% of global GDP will be stored on the blockchain.

- Transparency. The blockchain distributed ledger system makes the technology safe and open for supervision. The parties can see any transaction, which increases the level of trust and prevents any fraudulent activity.

- Reliable proof of ownership. Blockchain is an immutable and highly traceable system. Each block of information refers to the previous one, so no transaction can simply be changed or deleted, and its path easily leaves a trace. If a transaction of buying or selling your asset was recorded on the blockchain, it will remain on the blockchain and you can always verify your ownership.

- Lack of intermediaries. When you don’t need intermediaries who take a certain time of the transaction, the process is faster and cheaper. On the blockchain, you create a contract in the form of a code, which sets the conditions for their automatic execution. Smart contracts are very reliable; they can even contain fines for non-compliance with the terms of the agreement. Such a contract cannot be deleted.

- Fast execution of the transaction. Since all transactions take place automatically when certain events occur (receiving payment – sending a token), the whole process is fast. Smart contracts, through which the movement of assets is carried out, requires a minimum of human presence.

- Reducing the barrier to entry for investors. Dividing the asset into tokens and the ability to own the asset partially opens up the market for new investors. Now you don’t need to have a lot of money to overcome the barrier to entry into the investment market, you can buy several tokens and receive deviants.

Challenges of asset tokenization

Of course, asset tokenization has not yet received widespread use because the technology is new and business is only working on cases of successful tokenization. What stops asset owners from tokenization and is it possible to somehow deal with shortcomings? First, let’s take a look at the main tokenization challenges.

- Lack of uniform standards and regulation. One of the main problems of asset tokenization is the lack of government regulation of this process in the vast majority of countries. This leads to the need for additional registration of the same operation, both ‘on-chain’ and ‘off-chain’. In fact, you are forced to involve third parties to prove the ownership of the asset or estimate its value before tokenization. Or you act according to the blockchain rules without legally confirming contracts.

- An emerging market. The market for tokenized assets has not yet formed, although experts predict its constant growth. The lack of a unified legal regulation and infrastructure makes it hard to use all the advantages of blockchain and requires building a specific model for each specific project.

Also, tokenization problems include the fact that as the barrier to entry into the investment market decreases, the quality of investors decreases too. Unlimited access to assets and the simplicity of registering and closing accounts can lead to chaos. Therefore, market participants should be responsible when looking for partners within the blockchain.

Where to start asset tokenization

As you can see asset tokenization is a progressive and promising approach to asset management that just needs additional regulation. But having experience of working with blockchain, you can easily minimize risks and optimize the advantages of technology. IdeaSoft can help you to tokenize your assets and get started with smart contracts. Entrust this task to blockchain experts and get benefits from working with blockchain technology. Let’s discuss now!