Digital banking is not new, but an actual trend in recent years in the financial sector. Juniper Research predicts that the total number of online and mobile banking users will exceed 3.6 billion by 2024. Who is surprised by this? I think no one. Thus, the development of digital banking is on the rise. However, creating a high-quality banking application requires good expertise and the right technology. So, in this article, we will help you choose the best tech stack for a digital banking app.

Table of contents:

- How to choose a tech stack for your banking app

- Most popular technologies for Fintech

2.1 Front-end tech stack

2.2 Back-end tech stack

2.3 Databases

2.4 Innovative technologies - How we can help

How to choose a tech stack for your banking app

Before we go directly to technology, it is important to understand the principles of choosing a tech stack for a project. Basically, there is no one-size-fits-all kit.

A tech stack is a set of tools (programming languages, frameworks, libraries, etc.) used to build a software product.

Different projects have different tech stacks based on the requirements and specifics of the industry. Let’s take a look at the main factors affecting the selection of a technology stack for a banking app.

Project complexity

It is no secret that the more features you want to implement in your banking app, the more technology will be required for this. Also, if you need integrations with other platforms, this complicates the project, and you can hardly get by with a couple of technologies. To do everything right, developers need to estimate the scope of work and a list of necessary product features. Detailed and well-defined project requirements are the key to a well-chosen tech stack.

Speed of development

The speed of development of a fintech app affects not only how quickly your product gets to market but also the cost of development. It’s obvious that the longer the process takes, the more it will cost you. If you have tight deadlines, then you should choose technologies that provide ready-made solutions and simplify the development process. For example, your development team might be using Kotlin rather than Java for building an Android application. Or you can create an MVP of your product with core functionality and add other features later. It’s up to you. All your business goals influence the choice of the best tech stack for a digital banking app.

Budget

The budget for banking product development, be it mobile banking app, web app, or full-fledged neo-bank, is also an important criterion when choosing a technology. You can find both paid and free frameworks and libraries to implement the intended functionality. All you have to do is decide if you are willing to invest in paid tools that can provide a more flexible solution or increased security. A competent development team will try to find for you the best ratio of open source and paid technologies to achieve your goals.

Security

When it comes to developing fintech applications, security comes to the fore. There are many security features for mobile apps, but you should choose the most effective for your type of product. One of the main ways of protecting the system is the use of secure frameworks and libraries. The technology stack you choose should improve the reliability of the product, so avoid technologies with fraud and threat vulnerabilities. Also, the introduction of advanced technologies such as AI and blockchain can be a significant advantage, providing a high level of security in the storage of data and the execution of transactions.

Integrations

Integrations are one of the key factors in determining the best tech stack for a digital banking app. If you need to integrate third-party APIs, developers must ensure that all platforms are compatible. For this, a technology stack audit is conducted and all platform connectivity options are identified. Be sure to tell your development team what integrations your app needs so that technical specialists can take this into account when choosing technologies and creating a product architecture.

Product architecture

Any software product consists of several components. At the stage of building an app architecture, a development team decides how these elements will interact with each other. For example, in a microservice architecture, an application consists of several related services. Each service can be developed separately using its own set of technologies best suited to it. This makes it much easier to test and maintain your app. However, you may find a different architecture that best fits your needs. It all depends on the requirements of the project and the list of required functions. The architecture you choose determines the potential pool of technologies for your project.

There are almost always several options for how to implement the same features. However, by choosing the set of technologies that best suits your business needs, you can improve the reliability of your app, avoid unnecessary vulnerabilities, and improve performance, security, as well as enhance the user experience.

Most popular technologies for Fintech

Now that you know what factors influence the choice of a technology stack, it’s time to move on to the most popular technologies used in Fintech. Security and performance play a crucial role in the development of fintech applications. Therefore, technologies for banking and payment solutions must address these two main challenges. To put together the best tech stack for a digital banking app, you should start with the basic back-end, front-end, and database tools.

Front-end tech stack

The front end is a client-side, this is the part of an app with which users interact directly. Typically front-end developers use a combination of HTML, CSS, and JavaScript. HTML allows you to structure page elements (paragraphs, headings, etc.). CSS is used to style the look and feel of a document created using HTML. And JavaScript allows you to add dynamics (animations, interactive forms, etc.) to the user interface. However, the set of front-end technologies is not limited to these tools.

To speed up the development process, engineers usually use frameworks. Basically, a framework is a development environment, a set of pre-built solutions that helps you create an effective application architecture. Each programming language supports specific frameworks. Among the most popular frameworks for web development are Angular, React, Vue.js. For mobile development are used React Native, Xamarin, Ionic, Flutter, Mobile Angular UI, and others. Each tool has its own strengths and limitations and can be used to develop different types of apps. For instance, to create cross-platform applications, developers usually use React Native, Flutter, or Ionic.

Native mobile apps are built for a specific platform (Android or iOS), so they have a number of native frameworks and libraries. For example, to develop an Android app, you can use Kotlin or Java programming languages, as well as the Android UI or Jetpack Compose frameworks to build the user interface. Again, it all depends on the requirements of your project.

Back-end tech stack

The server-side of your app or back-end is responsible for the logic of work, storage, and processing of data. For the development of the back-end part, various programming languages are used, among the most popular in the fintech sphere are Java, Kotlin, Python, C ++, C#, and Ruby. Check out the list of the most popular programming languages in 2021 here.

Java

As one of the most widely used programming languages in the world, Java has left its mark on the fintech industry as well. For example, it is the preferred technology for banks because it provides a high level of security and efficient processing of large amounts of data. Java is quite a versatile language, so it becomes a great solution for a wide variety of fintech projects, including commercial software, Android apps, big data apps, or IoT devices. Java is a proven technology that can be a great option for your project.

| Benefits | Drawbacks |

| Java is platform-independent. It’s highly secure. Java is cheap to maintain. Java programs are stable and robust. It provides improved performance and efficiency of the system | Java is memory-consuming. Java code is usually verbose and complex. It doesn’t provide a native look and feel on a desktop, but is perfect for mobile apps. |

Kotlin

The verbosity of Java code causes a lot of discussion among developers, so Kotlin is increasingly becoming the main alternative to this programming language. Kotlin is a more modern and simpler technology that contains the best Java features and solves its main shortcomings. With Kotlin, you can create both web apps and mobile apps for Android. It is a great solution for mobile banking applications.

| Benefits | Drawbacks |

| Kotlin provides cleaner code. It has more advanced features than Java. Kotlin is a highly secure programming language. It’s compatible with Java code. | Lack of ready-made solutions and Kotlin specialists, since the language is quite new. |

Python

Python is one of the most preferred programming languages in the fintech industry. It is actively used by asset management firms, banks, and fintech startups. The fact is that Python addresses many banking challenges including data efficiency, compliance, and predictive analytics. In addition, this programming language supports many Fintech-focused libraries designed to achieve different business goals in an easier and faster way.

| Benefits | Drawbacks |

| Python is a simple and versatile programming language. It reduces software development costs and time to market. Supports many libraries created for fintech. Provides high productivity of applications. | It’s quite weak for mobile computing. It has some design restrictions. Python is memory-consuming. |

C++ and C#

C++ is widely used for analytical solutions and applications requiring fast and efficient computing. Most often this is the #1 choice for projects in which data processing speed is a priority. The disadvantages of this technology are its complexity and low level of security.

In turn, C# is a younger programming language, which is more secure and dynamic. Taking the best of C and C++, it allows developers to create almost bug-free apps. However, C# is very dependent on the .Net platform, which is not convenient for all projects.

Ruby

Ruby is a scalable and robust programming language. In the fintech industry, you will find examples of the use of Ruby in the development of digital payment systems, analytical platforms, and digital wallets. However, it should be noted that this technology also provides slow processing and requires a lot of memory.

Databases

Choosing databases is also a crucial step in building the best tech stack for your digital banking app. The more users will work with your app, the greater the load on the system is. A database must handle these workloads and provide fast and efficient processing of user queries. Whatever action your users ask for balance check, transaction history, or something else, the system must execute them safely and at high speed. That’s what databases are made for.

Databases for fintech projects must be reliable, which is why banks and other financial organizations prefer proven solutions. Among the most popular databases used in the financial area are the following:

| Database | Benefits | Limitations |

| PostgreSQL | -Has excellent analytical capabilities -Fast processing of large amounts of data -Great programming language support | -Comparatively low reading speed .-Comparatively slow performance |

| MySQL | -High performance -Cross-platform database -Highly secure since it has complex encryption algorithms | -It’s hard to scale -Decreased performance with large-sized data |

| MongoDB | -Highly scalable -Provides fast query response -Flexible | -Memory-consuming -Transactions using MongoDB are complex |

| Oracle | -High performance and portability capacities -Multiple database support -Provides great security features | -It’s complex -High price |

In addition to front-end, back-end technologies, and databases, the tech stack of a project can also include servers, hosting platforms, APIs, and other technologies necessary for the coordinated work of all elements of your application.

Innovative technologies for digital banking apps

If you want to build the truly best tech stack for a digital banking app, traditional technologies may not be enough. Increasing user expectations and high competition are forcing banks to look for new effective solutions and innovative technologies come in handy here more than ever. Among the most popular advanced solutions used by banks today are the following:

- Artificial intelligence (AI). AI is widely used by banks for digital identity solutions, predictive analytics, and security threat prevention. Also, this technology allows you to streamline business processes and improve the user experience thanks to chatbots and robots. Business Insider Intelligence predicts that the median estimated cost savings for AI banks will be $447 billion by 2023.

- Distributed ledger technology (DLT). The use of blockchain and other distributed ledger technologies has been gaining popularity in recent years. In this way, banks ensure the security of systems and give users more control over their data, as well as provide more cost-efficient transactions. If you are interested in blockchain development services, feel free to contact us.

- P2P transactions. Peer-to-peer payments and lending are the solutions that users love very much. They allow you to lower transaction fees and thus make payments cheaper and faster. The advent of P2P payment systems has become a market disruptor and has forced traditional financial institutions to also adopt this technology to meet user needs.

- Robotic Process Automation (RPA). Robotization can significantly optimize the business processes of an organization. Bankers can now prioritize tasks and devote time to more meaningful ones by assigning low-priority tasks to bots. It is worth noting that this not only enhances the user experience but also improves the bank’s productivity due to better performance and lower error rates.

- Cloud computing. With cloud computing, banks can provide 24/7 customer service. Also, this approach increases the security of data storage and processing, as well as opens up opportunities for more accurate analytics.

Find out more fintech trends of 2021 by reading our recent article.

How we can help

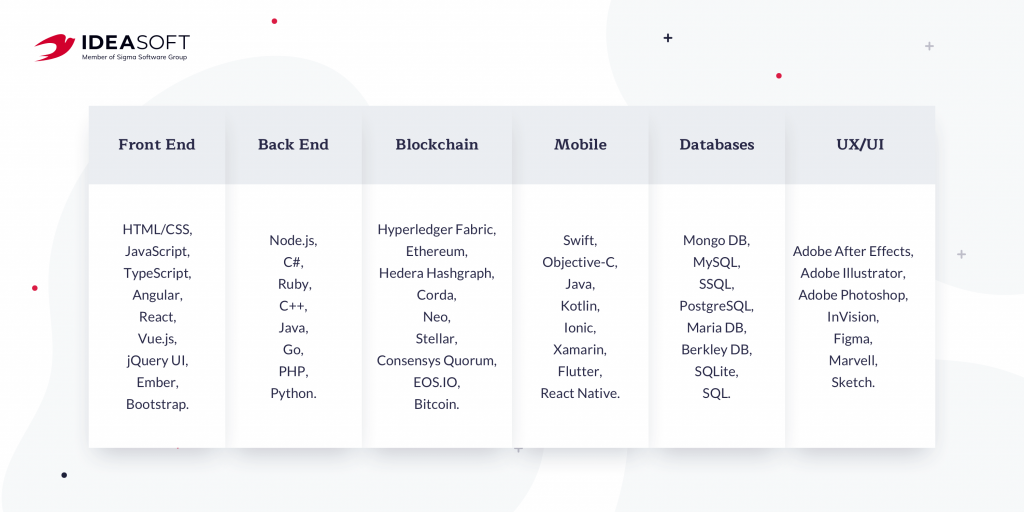

If you are choosing a technology stack for the development of a digital banking app or other fintech product, it is best to consult with technical specialists to make the right choice. IdeaSoft is a team of professionals in the field of software development with more than 5 years of history. During this time, we have implemented more than 250 projects, including those related to the fintech sector.

The IdeaSoft team consists of experienced developers, and the company’s technology stack includes more than 50 technologies. Our clients are fintech companies from all over the world. Check out the IdeaSoft portfolio to find out more about our best projects.

Feel free to contact us to discuss the technical details of your project. We’ll be happy to help you choose the best tech stack for a digital banking app.