Mobile banking app development has been one of the most popular areas in fintech in recent years. Banks, being a fairly traditional industry, have finally realized the need and benefits of digitalization. The rise of neobanks, Covid-19, which irrevocably changed user behavior, the development of mobile technologies – all this led to an increase in the use of mobile banking and payment apps. According to Juniper Research, the total number of online and mobile banking users will reach 3.6 billion by 2024. Therefore, we decided to put together a complete guide to building a mobile banking app. Hope you find this insightful.

Table of contents:

- Mobile banking market overview

- How to build a mobile banking app: features

- Tech stack for banking app development

- The process of banking app development

- What to look for when building a banking app

5.1 Security

5.2 Compliance - Banking app development cost

- Where to find mobile banking app developers

Mobile banking market overview

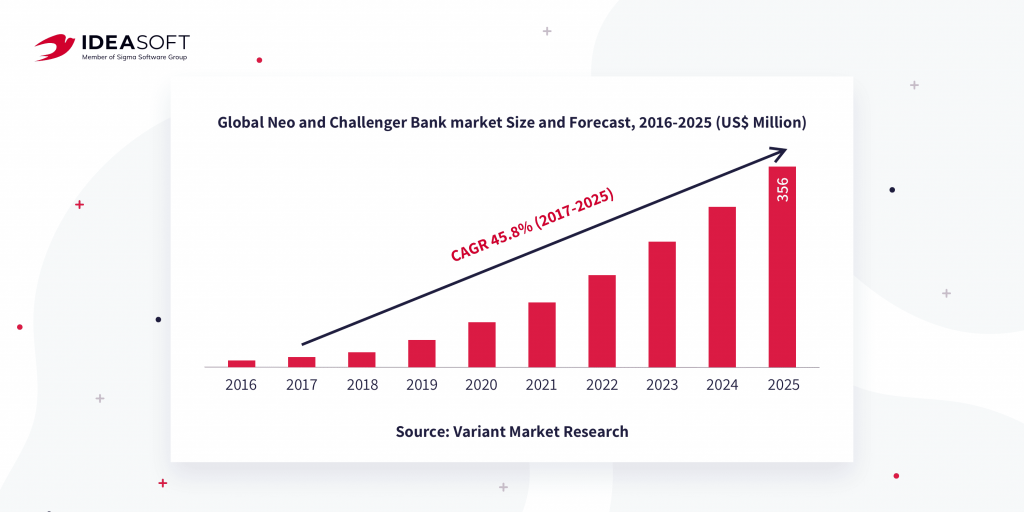

The financial sector, like any other industry, is forced to adapt to market changes. The popularity of mobile banking has been growing from year to year, and Covid-19 has further strengthened this trend. According to ResearchAndMarkets forecasts, the mobile banking market is expected to reach $1,824.7 million by 2026. Does this surprise anyone? The answer is definitely no. Mobile banking allows customers to complete transactions using their smartphones or tablets. There is no need to leave our houses, stand in lines, waste time on the way to bank branches. A couple of years ago, this looked like an advantage. With the lockdowns associated with Covid-19, mobile banking is a must.

A study by The American Bankers Association (ABA) found that 39% of bank customers use apps on phones or other mobile devices as their main option for managing their bank account, while branch banking fell to 10%. With the spread of Covid-19, many banks have been forced to close their branches and switch to serving customers through digital channels. In this regard, the number of banks without physical branches, which are called neobanks or digital-only banks, has also increased. According to data from Airnow, as of May 2020, the six app-only digital banks included in these statistics had a combined total of over 30 million iOS and Android app downloads. Therefore, if you decide to create a neobank now is the right time to do so.

In addition to Covid-19, the rise in popularity of digital banking is also influenced by the growing demand for self-service and personalization, the increase in the number of smartphone users worldwide, as well as technological developments in the field of mobile banking (chatbots, real-time customer service, etc.).

How to build a mobile banking app: features

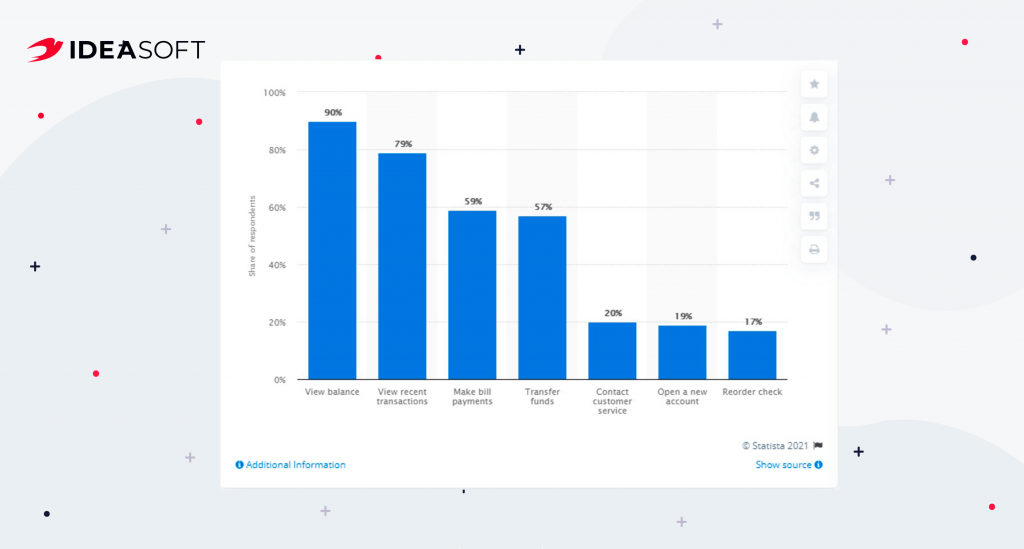

The functionality of a banking app is its core. Before moving on to compiling a list of features for your banking, study the needs of your target audience. For example, according to research by Statista, the top 3 most common reasons why customers use a mobile banking app in the United States in 2019 were viewing an account balance, viewing recent transactions, and making bill payments. So this is where you should start. Let’s take a look at the basic and advanced features of mobile banking applications.

Basic features:

- Sign up/Sign in. A secure and fast authorization process is essential for any banking application. We recommend using multi-factor authentication and biometrics to make the process secure. Also, keep in mind that the registration flow may differ depending on your bank type. For example, if a user already has an account with your bank, he or she just needs to download the app and use his/her phone number to sign up. If you create a neobank and provide digital-only services, you need to follow the KYC (know your customer) and ask the user to upload documents confirming his/her identity.

- Account management. The user account should be flexible and functional enough. Provide users with card management, viewing account balance and transaction history, setting payment limits. Also, additional personalization would be a plus. For example, it can be a personal financial advisor or the ability to customize the look of the interface for a specific user, leaving only the necessary features.

- Payments and transactions. Of course, first of all, the transfer of funds must be secure, so don’t miss the part of the article on securing a digital banking app. Be sure to use SMS, biometrics, or password confirmation of the transaction to eliminate the possibility of payments made by mistake. Next, don’t forget about payment templates, which will greatly simplify the payment process for your users.

- Bill payments. Bills online payment is what the majority of users are looking for when downloading a mobile banking application. Provide users with the ability to set monthly/weekly payment reminders to make recurring payments. This is a great feature that your customers will love.

- Push notifications. Push notifications will benefit both you and the app users. This is a great way to communicate with your customers and keep them engaged. So you can offer promotions, share the news, and the like. However, to be honest, an excessive number or irrelevant content of notifications can annoy users. Think about how you can make these messages useful and not disturbing.

- Customer support. Sometimes users may need assistance while interacting with your app. Make sure your clients can easily contact a bank representative and get the necessary customer support. There are many options for how you can do this. It can be a chatbot, live chat, quick call button, FAQ section, etc.

Advanced features:

- Trading/Investing. With innovative fintech solutions, you no longer need to have a lot of money to become an investor or trader, which is why these activities become more and more popular every year. By allowing users to invest with your app, you open up additional opportunities for them and improve the user experience.

- Branches and ATM Map. This feature is not relevant for neobanks, but if you have branches and ATMs, be sure to give users the ability to quickly find them on the map.

- Currency converter. The currency converter can be a real advantage of your banking application. While some banks simply display exchange rates, you can go a step further and allow users to exchange currency directly on the app.

- QR-code payments. QR code payments are gaining popularity, especially in the context of the Covid-19 pandemic, when contactless payments are the most reasonable solution. According to Statista, in 2020, 27.5% of respondents in the United States and the UK had used a QR code as a payment method.

- Spending tracking. This feature will be helpful for your users as it gives them more control over their budget. Provide users with the ability to set limits on purchases, show analytics of expenses by category, plan future expenses, and they will interact with your application more often.

Innovative features

Now you know the main basic and advanced features of online banking apps, but they may not be enough to provide an exceptional user experience. Innovations open up many new opportunities that will help you get more customers and increase your profit. Especially such features are loved by millennials, who are the #1 target audience for any bank. So what innovative banking features are there and what to choose for your mobile banking app development?

You’ve probably heard about the shake-to-pay option when you just need to shake your phone and find someone who does the same nearby to activate the P2P payment function. Thus, users don’t need to dictate or enter the recipient’s card number, it is enough to establish contact between smartphones. Voice payments are also popular. Royal Bank of Canada and Barclays have already become the early adopters of this technology.

Blockchain and AI can be other innovative solutions for your banking. Artificial intelligence is capable of improving security and predicting user behavior to offer better services. Blockchain is a reliable way to securely store user data. Plus, having cryptocurrency support can be a great advantage as well. Don’t limit your product to standard features if you want to bypass the competition and draw attention to your app. Remember that Covid-19 has strengthened digitalization processes and created conditions for the further development of the fintech industry. And innovation is the main weapon of fintech.

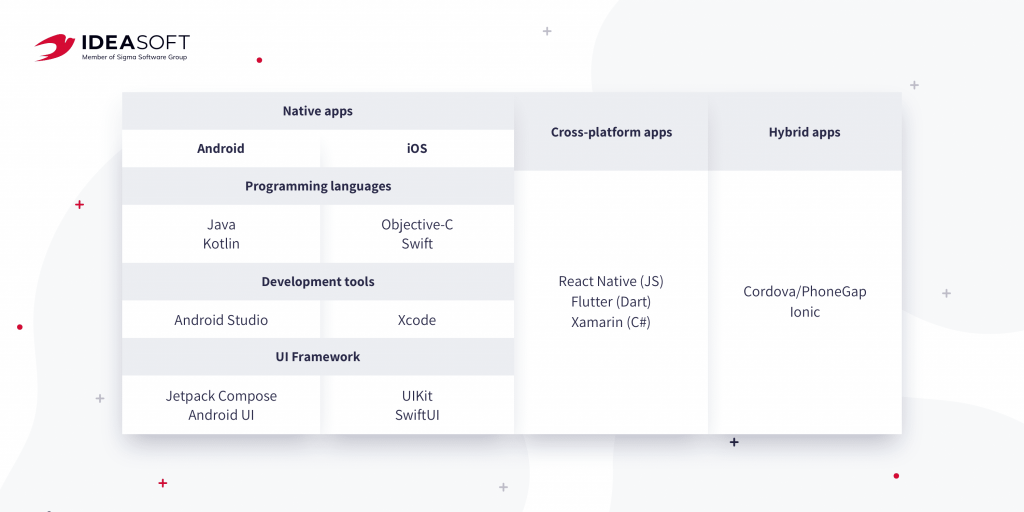

Tech stack for banking app development

A properly selected tech stack for a mobile banking application affects its security and performance. First of all, it is important to keep in mind that highly secure frameworks and libraries should be chosen for creating fintech products to build a reliable and stable system and avoid potential vulnerabilities. The choice of programming language and specific frameworks depends on many factors, including the following:

- The size and complexity of your project. The more features and integrations your app has, the more likely you will need to use more different technologies during the development process.

- Development speed. Deadlines also affect the choice of the technology stack. If you want to speed time to market, then you need technologies to speed up the development process. For example, this is one of the signals to choose Kotlin over Java when building a mobile banking app for Android.

- Integrations. Does your digital banking need integrating with third-party APIs? The choice of the stack also depends on the answer to this question, since all chosen technologies must be well compatible.

- Scalability. You need to make sure that the selected technologies provide enough flexibility to your system in case you want to make changes quickly or in the face of an increased number of users.

- Mobile application type. Each type of mobile app, whether native, cross-platform, or hybrid, has its own technology stack. Therefore, first of all, you need to decide on what platforms you want your application to work on.

Technical specialists can help you make the final decision on the tech stack for your project after reviewing all the requirements. To ensure excellent user experience and performance of your banking application, we recommend using native programming languages - Swift for iOS, and Java or Kotlin for Android. Also, it is better to avoid a lot of open-source code and solutions, as the augmented closed functionality will make your product more secure and competitive.

The process of banking app development

The process of developing a mobile banking application can be divided into two large phases: the discovery phase and mobile app development. The first phase is preparatory and requires a lot of research work, but it forms the foundation for the successful technical implementation of your idea. The development phase also consists of several sub-phases. Let’s take a closer look at all the stages.

Discovery phase

The Discovery phase aims to develop a general plan of work on the project. This phase includes both parties, a development team, and a client. The discovery phase focuses on defining the scope of work, building the product architecture, identifying functional and non-functional requirements, choosing a tech stack, estimating costs, and creating a project development plan. A detailed study of the business part of the project guarantees the creation of a high-quality mobile banking app that meets the customer’s requirements as well as the needs of the end-user.

The Discovery phase begins with a general description of the project, within which you need to answer the following questions:

- Who is your product’s target audience and how can you meet their needs?

- What value does your product bring to the market?

- Who are your competitors and what makes you different?

- What features should your application have?

- Do you have a preference for a tech stack?

The answers to these questions are much more important and more complex than they may seem. According to statistics, one of the main reasons for the failure of a software product is the lack of interest in the market. Your target audience already has certain expectations when they download an app from app stores. You have to know them to fit in.

Next, we need to draw a parallel between your business goals and tech solutions for the project and form a winning mix. The main outcome of the discovery stage is the Software requirements specification (SRS). This is a document describing how your app should behave, what features it should have, what kind of load it should withstand, timelines, budget, and more. We strongly recommend not to skip the discovery phase when creating such a complex product as a digital or neobanking app. This step will help you optimize costs, reduce project risks and other failures.

Development phase

After we have a clear work plan, we can start developing a mobile app. Here I want to mention how important it is to choose a development team with experience in creating fintech projects. Only such a team can build a secure and regulatory compliant mobile banking app. Compuware research data shows that 79% of users are willing to retry an app only once or twice if it doesn’t work the first time. Therefore, you need to be confident in the quality of your product before launching it on the market. An experienced development team will be able to ensure that the app meets all the requirements and make it not only bug-free but also user-friendly.

The development phase looks like this:

UX/UI design

Fintech applications are expected to be more secure and faster than other apps. And it all starts with design. The UX/UI development process begins with researching the audience, their habits, and needs. Then a prototype is created to demonstrate the logic of work and the structure of the app. You also need to carry out tests. The world knows cases of how design can affect the perception of a product. For example, the Bank of Jordan’s mobile banking app had to make changes to the UX part after launching the project, which took 6 months to increase user loyalty.

Programming

We have already mentioned that the quality of the code and the use of safe libraries and frameworks are crucial for mobile banking app development. Poor code adds vulnerabilities to your app that affects security. The programming process consists of front-end and back-end development. The first part is responsible for the functionality of the user interface, and the second one for the logic of the application. Developers must ensure that both parts interact well for the proper work of the banking app.

Testing

You should never ignore testing. Remember the statistics? Only about 16% of users are willing to give your app second and third chances. And even more so, few people will entrust their funds to online banking containing bugs and errors. Run enough tests to make sure your application works as intended before you bring it to market.

Publishing

Both App Store and Google Play have application guidelines that must be followed during development. They relate to design, security, data collection, and the like. Application publishing processes differ from store to store. For example, AppStore has stricter rules than Google Play, and it usually takes longer to publish an app there. Make sure your development team is familiar with the guidelines and can meet them.

Support

The world of technology is an ever-changing environment. As an app creator, you need to work on improving the user experience and functionality of your banking app. Therefore, we advise you not to lose contact with your development team, which knows your project well and can quickly make the necessary changes.

What to look for when building a banking app

Security

One of the most important requirements for a fintech application is security. Users will not forgive you for losing personal data or funds, and, unfortunately, the number of hacker attacks and fraud only increases from year to year. According to Finances Online, since 2001, the monetary damage caused by cybercrime has been increasing every year and has reached approximately $4.2 billion by 2020. Protecting a banking application from security breaches and fraud is a complex and demanding task, and it is worth starting from reducing the risks. Some of the most common reasons for poor security in banking apps are:

- Vulnerable application architecture (insecure APIs).

- Lack of security features.

- Weak data storage.

- Insecure app interaction with external data sources (NFC, Bluetooth devices, servers).

- Improper security algorithms.

Also, users themselves often neglect security rules and put their accounts at risk. Therefore, your task is to provide the most secure system you can and implement the best security features. Among the main ways of protecting your banking mobile app are multi-factor authentication, device security features (fingerprint, face ID), end-to-end encryption, real-time text and email alerts, implementation of AI algorithms, and others.

Regulatory compliance

Regulatory compliance is the second crucial component of a successful bank application. First, it is another way to protect user data. Secondly, for your potential customers, the compliance of the app with the regulation is a guarantee of the reliability of your bank. However, regulation for the fintech industry is quite a challenge. It differs from state to state and it is under constant development, so as new laws and directives come out, you may need to make additional changes to the app.

So make sure you take into account the legal framework when creating the project requirements. The main provisions of the regulations in different countries relate to the protection of user data. For example, in the European Union, you must comply with the General Data Protection Regulation (GDPR) and the ePrivacy regulation designed to control the processing of personal data and protect privacy in the electronic communications sector. Plus, The New Payment Services Directive (PSD2) regulates third-party access to customer payment accounts and introduces the mandatory implementation of interfaces for access to payment service providers.

Also, you shouldn’t forget about AML (anti-money laundering), designed to combat fraud and corruption, and about KYC (know your client), which obliges you to obtain sufficiently complete information about counterparties-legal entities. In the US, each state has a number of its own laws that mobile banking must comply with. Therefore, be sure to study the legal framework of the regions with which you are going to work to implement all the necessary features during the development process.

Banking app development cost

Well, along with the question of how to build a mobile banking app, there always comes the question of how much mobile banking app development costs. As you probably guessed, it is extremely difficult to name a specific price without studying the requirements of the project. Therefore, let’s look at the main factors affecting the cost of creating a digital banking application.

- The complexity of development. An important factor here is the number of features and required integrations, connected APIs, etc.

- The complexity of UX/UI. The design for your mobile banking also affects the cost of implementing the project. The more platforms and screens your app needs to support, the more expensive the design will be.

- The number of platforms and types of mobile apps. If you decide to create native apps for iOS and Android, be prepared for the fact that you need to create 2 separate apps, which will increase the development time. But this way you’ll achieve a great user experience.

Also, the cost of developing a digital banking app largely depends on the location and type of vendor. It’s no secret that developer rates are different in different regions. This is how the average hourly rates for software development according to the YouTeam study look like, using data from their platform, PayScale, SalaryExpert, Indeed, Upwork, and TopTal.

| North America | Western Europe | Eastern Europe | Latin America | Asia | Africa |

| $46.35 | $67.20 | $32.29 | $45.71 | $25.83 | $28.00 |

Eastern Europe is a top choice for outsourcing software development for many businesses. A large pool of engineers, high-quality development, and reasonable rates have made this region home for various software, including mobile banking apps. But in addition to choosing a region, we also advise you to pay attention to the structure of the company with which you are going to work. Partnering with a company that provides full-cycle software development services, you can save time and money by solving tasks related to design, programming, and testing within one company.

Where to find mobile banking app developers

There are several ways to hire a development team for your fintech project. The first of these is freelance portals like TopTal or YouTeam. There you will find a large selection of engineers of various experience, seniority level, and tech stack. However, be careful when choosing a development team on such sites so as not to hire bad engineers. Always check developer info and experience. Plus, be prepared to pay a commission to a platform. This is also one of the disadvantages of this approach.

The second way is to find a development team for building your banking app on online business directories like Clutch, GoodFirms, Techreviwer. Having chosen the profile of the company you like, you can visit its website, study the reviews and ratings, as well as the delivered projects. Remember that working with a company rather than individual freelance specialists gives more guarantees and reduces project risks.

There is also a third way. You can hire the IdeaSoft team for mobile banking app development right here and right now. The company has been creating software solutions for various industries for over 5 years, including fintech, telecom, retail, blockchain, and others. Our experience has been backed up by over 250 successfully delivered projects over the past few years.

IdeaSoft is the creator of payment applications, exchanges, trading platforms, issuance platforms, and various banking solutions. As a part of Sigma Software Group, a Swedish IT company with Ukrainian roots, numbering over 1000 developers, we can complete all the necessary tasks related to developing your app. Feel free to contact us to discuss your project!