The global crypto wallet market size was estimated at $8.42 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 24.8% from 2023 to 2030. Still, security breaches, regulatory shifts, and rapid tech evolution leave CEOs and CTOs questioning—how to future-proof their wallets?

At IdeaSoft, we specialize in Web3 crypto wallet development. We offer secure, scalable, and innovative crypto wallet solutions. Our expertise ensures that your custom crypto wallet stays ahead. As a specialized crypto wallet development company, we’re ready to help you build next‑generation wallets with cross‑chain support, social recovery, and modular DeFi integration.

Highlights:

- The market for crypto wallets is booming, but security concerns remain a key focus for development.

- Cross-chain compatibility and DeFi integration are essential for wallet scalability.

- A user-centric design is crucial for adoption across both novice and experienced crypto users.

In this article, we’ll explore the trends shaping the future of crypto wallets, how to tackle challenges, and why IdeaSoft is the ideal partner for crypto DeFi wallet development.

Future-proof your crypto wallet with us!

Discuss your wallet project with our blockchain experts

Table of contents:

- Current Challenges in Crypto Wallet Development

- Key Trends Shaping the Future of Crypto Wallet Development

- Innovations to Expect in Next-Generation Wallets

- IdeaSoft Case Study: Non-Custodial Dollet Wallet

- How Companies Can Remain Ahead of Crypto Wallet Development

- Conclusion

Current Challenges in Crypto Wallet Development

Crypto wallet development is about preventing security threats, performance issues, and changing regulations. For FinTech innovators and blockchain startups, these are the challenges that can cause product delays and expose users to financial loss. That’s why many companies turn to specialized fintech software development services to ensure compliance, security, and seamless performance from day one. Let’s break down the top challenges and how to resolve them.

Security Threats: Preventing the Next Ronin-Scale Hack

The Ronin hack worth $600M proved that big platforms are also not immune to exploits. Vulnerabilities in the wallet—via private key misuse, phishing or smart contract exploits—remain top of mind.

Preventative measures:

- Implement Multi-Party Computation (MPC) to escape single points of failure.

- Use AI-fueled threat detection to alert on suspicious behavior in real-time.

- Use hardware security modules (HSMs) for encryption at the institution level.

Scalability Struggles: Handling Surging Transaction Volumes

Crypto bull runs expose wallet weaknesses. High traffic can cause slow transaction processing, failed swaps, and frustrated users. How to mitigate:

- Layer 2 solutions (e.g., zk-rollups, Optimistic rollups) reduce congestion.

- Asynchronous transaction processing improves load management.

- Auto-scaling infrastructure provides wallets to handle peak loads promptly.

In our blog, you can find more insights about crypto wallet development.

Integration Bottlenecks: DeFi, NFTs & Multi-Chain Complexity

A modern wallet must handle DeFi lending, NFT marketplaces, and multi-chain interoperability. But each blockchain follows its own protocol, so it’s not a straightforward integration. How to minimize:

- Use cross-chain bridges and universal smart contracts to make interoperability easier.

- Use a modular architecture to add features without rebuilding the wallet.

- Assure SDK compatibility to enable dApp support across several ecosystems.

Ready to Build Your Secure & Scalable Wallet?

Launch wallet development with IdeaSoft!

User Adoption: Balancing the Right Security & Simplicity

Too much security friction (too complicated seed phrases, too long authentication process) scares off users. Too little security = exploits. Discovering the balance is crucial. How to reduce:

- Use biometric authentication to allow for fast, secure entry.

- Use social recovery mechanisms instead of seed phrases.

- Optimize gas fee management to prevent surprise transaction fees.

If you have a FinTech project and are thinking about blockchain integration, read our blockchain in FinTech development guide.

Uncertainty of Compliance: Navigating Global Regulations

Regulations for crypto evolve minute by minute, and non-compliance can lead to legal roadblocks or platform shutdowns. How to decrease:

- Implement adaptive KYC/AML layers that respond to jurisdictional requirements.

- Use on-chain analytics tools to monitor suspicious activity.

- Stay ahead with real-time regulatory feeds integrated into compliance modules.

At IdeaSoft, we build custom crypto wallets that will mature with the market. You might need institutional security, DeFi integrations, or solutions ready for compliance—we ensure your wallet is built to last. Explore our custom blockchain development services!

Key Trends Shaping the Future of Crypto Wallet Development

Here, we want to discuss 3 trends in crypto wallet app development that you should be aware of.

Security Reinvented

Security threats aren’t abating, nor are breakthroughs in wallet security. A multi-layered approach is going mainstream:

- Multi-factor authentication (MFA) and face/fingerprint biometric authentication add security without added complexity.

- AI-powered fraud detection detects suspicious transactions in real-time, preventing phishing and unauthorized access.

- Hybrid cold storage solutions combine hardware wallets with secure software environments for institutional-grade security.

DeFi Wallet Evolution

DeFi wallets are transforming from simple asset storage to full-fledged financial ecosystems:

- In-wallet lending, staking, and trading reduce reliance on third-party platforms.

- DeFi super apps integrate swaps, liquidity pools, and governance tools into a single interface, making it easy for users to interact.

- Automated yield strategies help users optimize returns without requiring much DeFi knowledge.

If you want to dive deeper into this topic, we recommend reading our crypto wallet app development guide.

Cross-Chain Transactions

The multi-chain future is already here, and wallets must adapt. Users prefer seamless interactions across blockchains without manual bridging.

- Native support for Ethereum, BNB, Solana, Layer 2 networks, and upcoming ecosystems.

- Cross-chain atomic swaps allow users to trade assets between chains without intermediaries.

- Unified transaction history provides transparency across multiple blockchains in one dashboard.

Need an Adaptable Wallet That Keeps Up With the Market?

Get Your Estimate!

Innovations to Expect in Next-Generation Wallets

Now, let’s discuss 4 innovations that will bring your crypto wallet fame.

AI-Driven Wallets

Artificial intelligence will transform crypto wallets from merely passive storage instruments to intelligent security systems. Since phishing attacks and wallet-draining scams are becoming increasingly sophisticated, AI-based fraud identification will be the key feature in such wallets. These wallets will track user habits, detect oddities, and block unauthorized transactions in real time.

Aside from security, AI will also assist in optimizing transactions. Imagine a wallet that suggests the best time to send money based on network congestion or automatically route transactions through the cheapest gas fee network. AI assistants may provide users with real-time portfolio snapshots, alerting them to trends or dangers before they make a trade.

Gas-Free Transactions

Uncertain and expensive gas fees are one of the major adoption inhibitors, especially for new users. The future of wallets is addressing this by making transactions appear seamless—users won’t be forced to handle gas payments themselves.

One is gas abstraction, where the wallet itself remits gas fees on behalf of the user. That way, users send transactions without necessarily holding native blockchain tokens to pay as fees. The alternative is sponsored transactions, where third parties or dApps pay gas as payment in return for a small service fee or as part of loyalty programs.

Layer 2 solutions like zk-rollups and optimistic rollups will also play a significant role, reducing fees while maintaining security. Users won’t even think about gas fees in a couple of years.

Wallet-as-a-Service (WaaS)

For the majority of companies entering the crypto space, it’s expensive and time-consuming to develop a safe and feature-rich wallet from scratch. Wallet-as-a-Service (WaaS) products are changing the game by providing pre-built wallet modules that can be integrated in weeks, not months.

Fintech startups, gaming platforms, and NFT marketplaces are now able to offer their own branded wallets without any burdensome blockchain development. WaaS providers offer:

- API-based solutions to enable easy integration with existing apps.

- Regulatory compliance frameworks for traversing international crypto regulation.

- Multi-chain compatibility so wallets can operate on Ethereum, BNB, Solana, and others.

We at IdeaSoft specialize in multichain crypto wallet development. Instead of reinventing the wheel, you can focus on UX while we handle security, infrastructure, and updates.

Gamification & Rewards

One of the most thrilling developments is reward-based security features. Individuals who enable multi-factor authentication (MFA) or hold funds in non-custodial wallets for extended durations can receive loyalty points or staking rewards.

Gamification is also used in social trading and accomplishments. Imagine a wallet that keeps track of how long you’ve held a certain token and rewards you with an NFT badge or leaderboard ranking in exchange. Users could get rewarded for completing security quizzes, referring friends, or voting on DeFi governance proposals.

Discuss AI-based wallets and WaaS solutions with our experts

Start Your Wallet Project!

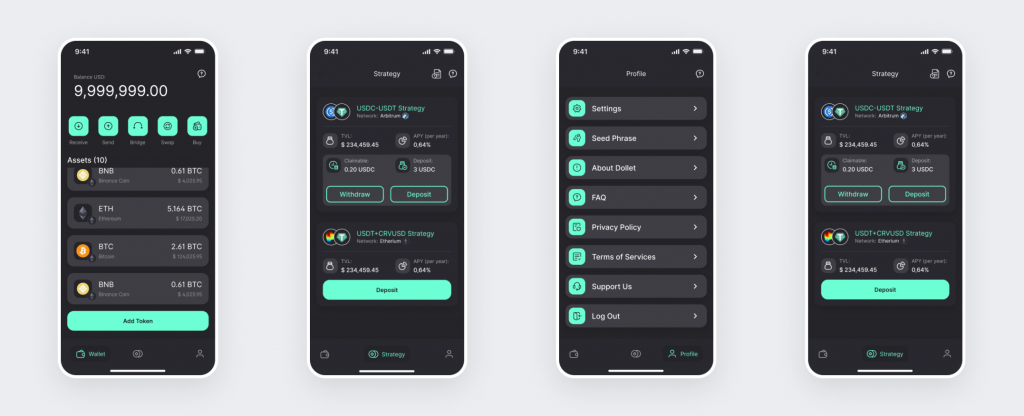

IdeaSoft Case Study: Non-Custodial Dollet Wallet

When fast-growing blockchain startup Dollet approached IdeaSoft, they needed a non-custodial wallet that not only secures users’ funds but also offers easy DeFi interaction.

Dollet was constructed on a multi-layered encryption framework to protect user data and private keys. The wallet is founded on a non-custodial architecture, with users retaining full authority over their assets without interference from a third party. Since its introduction, Dollet has had no security breaches, solidifying its reputation as a very secure crypto wallet.

In cognizance of the growing demand for seamless DeFi functionality, the wallet was designed to support:

- Direct staking and lending within the application so users can gain passive returns on their assets.

- Decentralized trading with built-in DEX functionality.

- Multi-chain capabilities, so users can interact with Ethereum, BNB Chain, and Solana.

This overlap enabled Dollet to onboard premium users who were looking for a wallet that does more than store crypto.

How Companies Can Remain Ahead of Crypto Wallet Development

Now, we want to advise you on critical points on how to develop a future-proof crypto wallet.

Collaborate with Experienced Blockchain Developers

Crypto wallet development is complex—multi-chain integrations, security threats, and compliance matters require advanced expertise. Selecting IdeaSoft—a trusted crypto wallet app development company—ensures your wallet is secure and scalable by design.

Implement Security First

A prominent example of the potentially catastrophic impact of poor security practices is the 2023 Mixin Network Hack. Mixin Network suffered a security breach wherein attackers exploited a vulnerability in the network’s smart contracts and stole around $200 million.

Any wallet needs:

- Multi-layered encryption to keep private keys secure.

- Biometric verification & MFA for access control.

- AI-based fraud detection to flag suspicious activity.

2023 Mixin Network Hack shows the risks that are related to inadequate security measures for crypto wallets. Our crypto wallet development services will save you from security threats.

Prioritize User-Centric Design

A wallet can be feature-rich, yet if it’s hard to use, people won’t adopt it. Simple onboarding, simple navigation, and modular dashboards make wallets easier to use. Discover more on how to develop a crypto wallet UI that fosters adoption.

Regulator-Friendliness

Crypto laws vary by jurisdiction, and non-compliance may result in substantial fines or business closure. Future-proof wallets need to have:

- KYC/AML software to verify user identity.

- Geo-restrictions to prevent unauthorized access.

- Automated compliance monitoring to stay one step ahead of legal changes.

Let’s discuss how to future-proof your crypto wallet with security, compliance, and user-first design.

Conclusion

The future of crypto wallet development is characterized by security, scalability, and seamless multi-chain support. Businesses that emphasize user experience, compliance, and innovation will be at the vanguard of the blockchain ecosystem. Developing a secure, feature-filled wallet requires skill, and the crypto wallet development cost depends on functionality, integrations, and security features.

Secure Your Spot in the Future of Crypto Wallets!

Let’s build your next-gen wallet together. Book Your Consultation