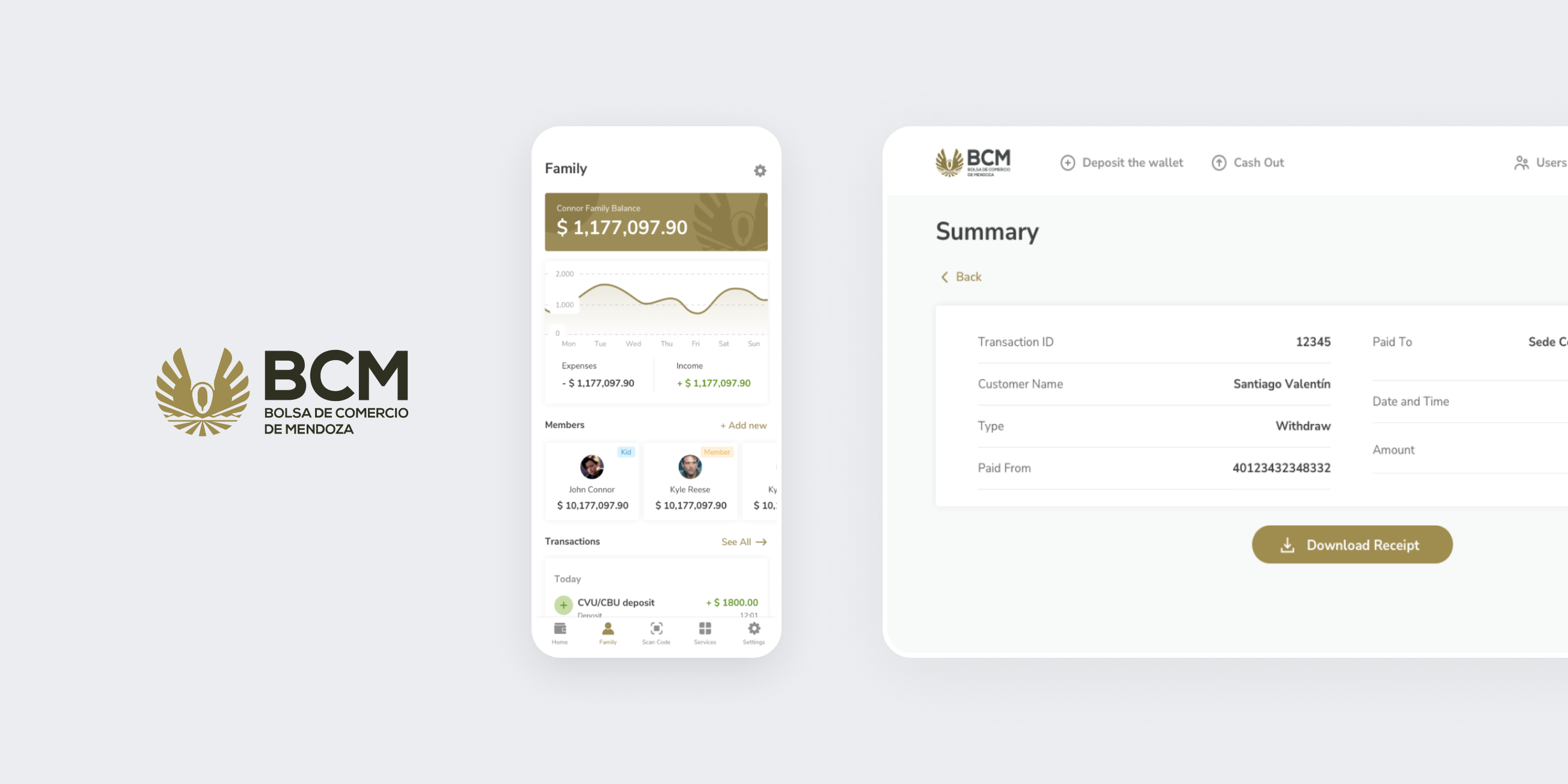

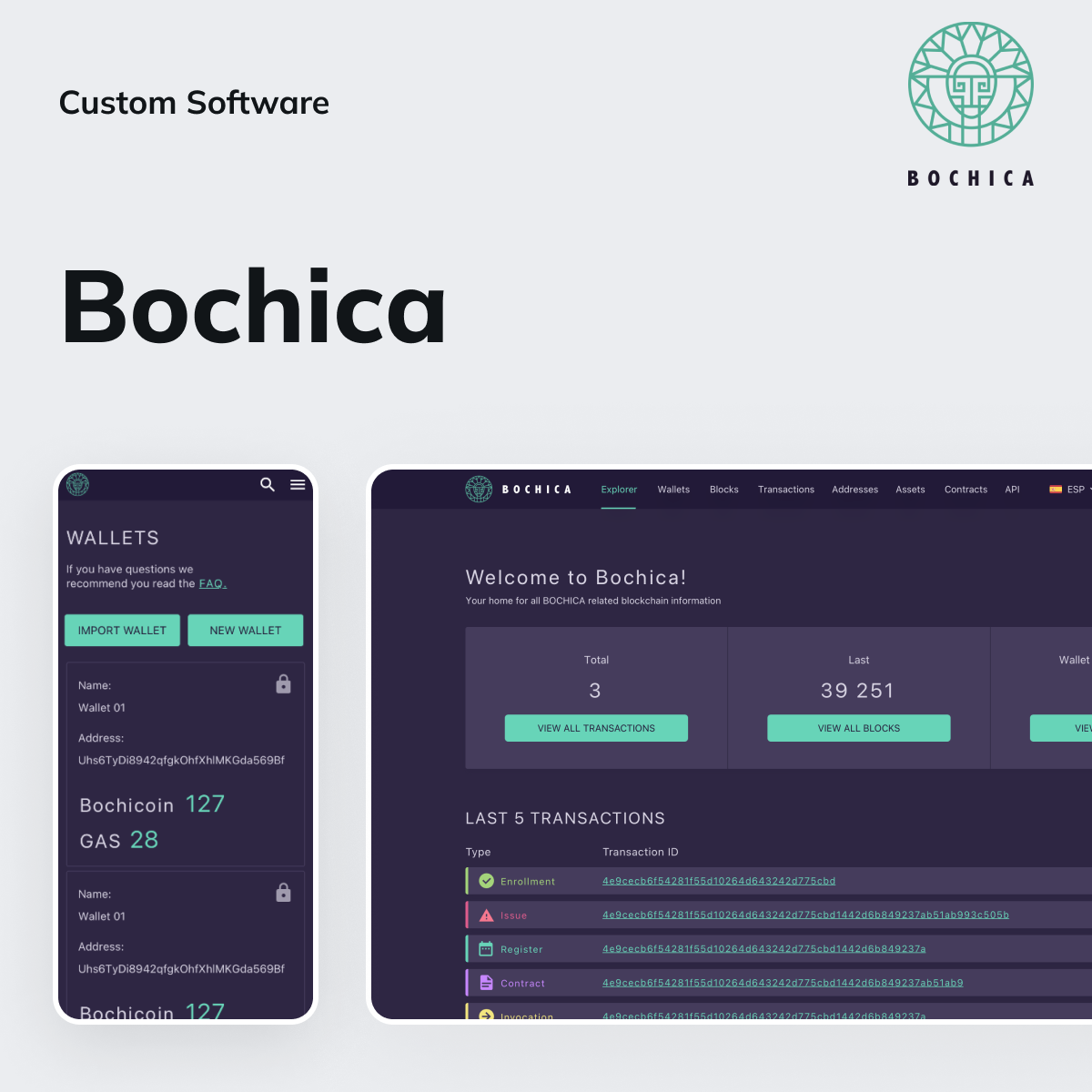

The primary objective of the IdeaSoft team was to create a robust neobank software architecture and subsequently develop and implement it.

In the project overview, our team identified two main challenges faced by the Bolsa de Comercio de Mendoza. The first challenge was the heavy reliance on manual operations, which required significant staff involvement and required numerous iterations.

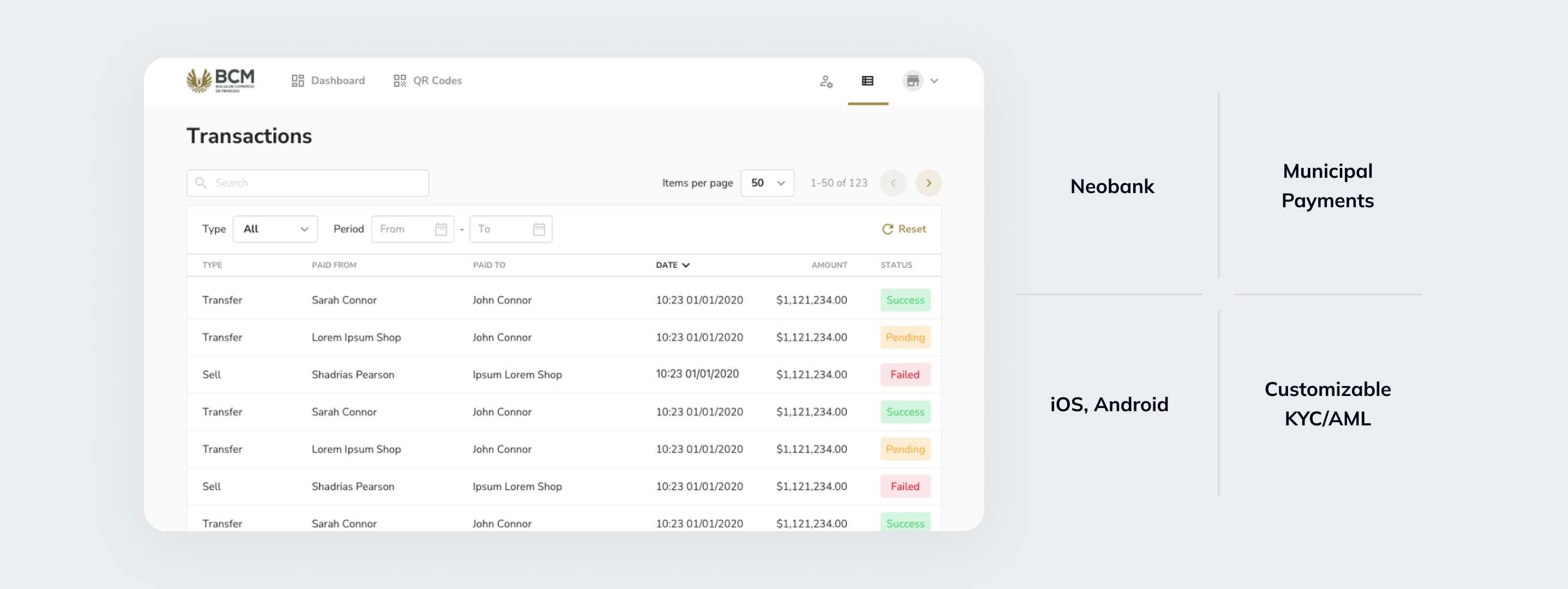

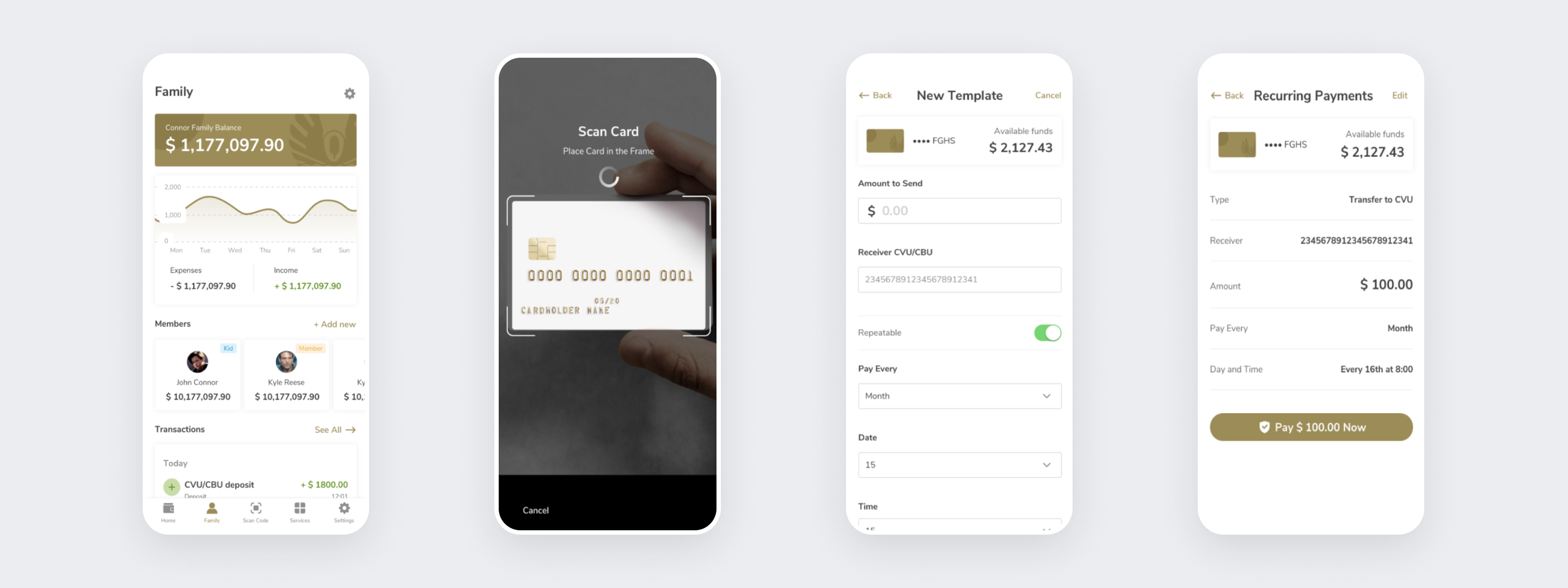

The second challenge was the predominance of cash transactions, which accounted for a substantial portion of payments. This reliance on cash payments negatively affected liquidity and transparency within the organization. Additionally, the manual handling of cash transactions further increased operational costs. Several core features were implemented to address these challenges as part of the project. These features included integrating municipal payments (such as taxes, utilities, and insurance) into the system. A mobile application was developed for both iOS and Android platforms, enabling convenient access to banking services.

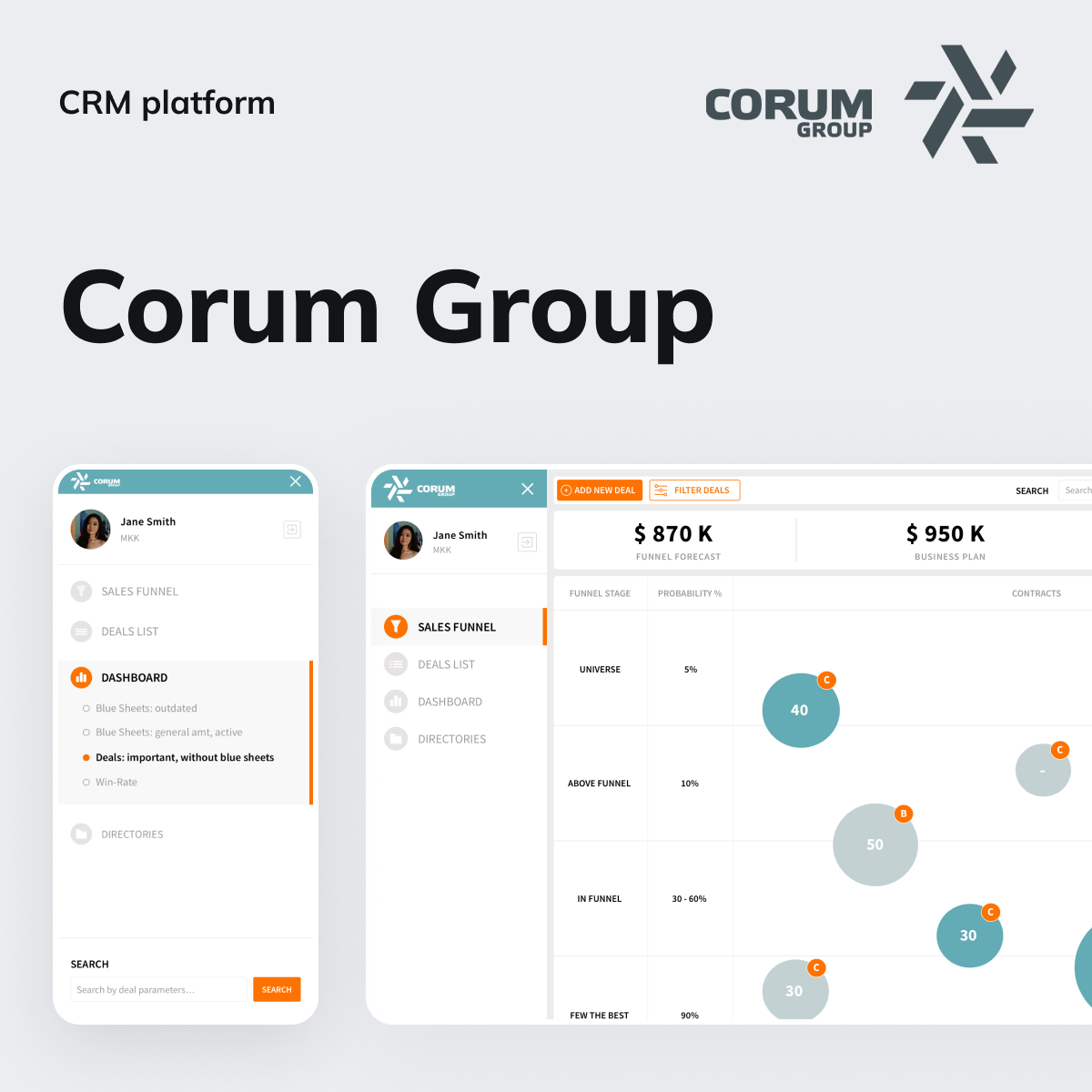

User management functionalities were also introduced, allowing for efficient administration and oversight. The system provided different levels of user roles, including admins and super admins, with corresponding access and privileges. The CRM features focused on effectively managing users and employees, ensuring streamlined operations and enhanced customer service.