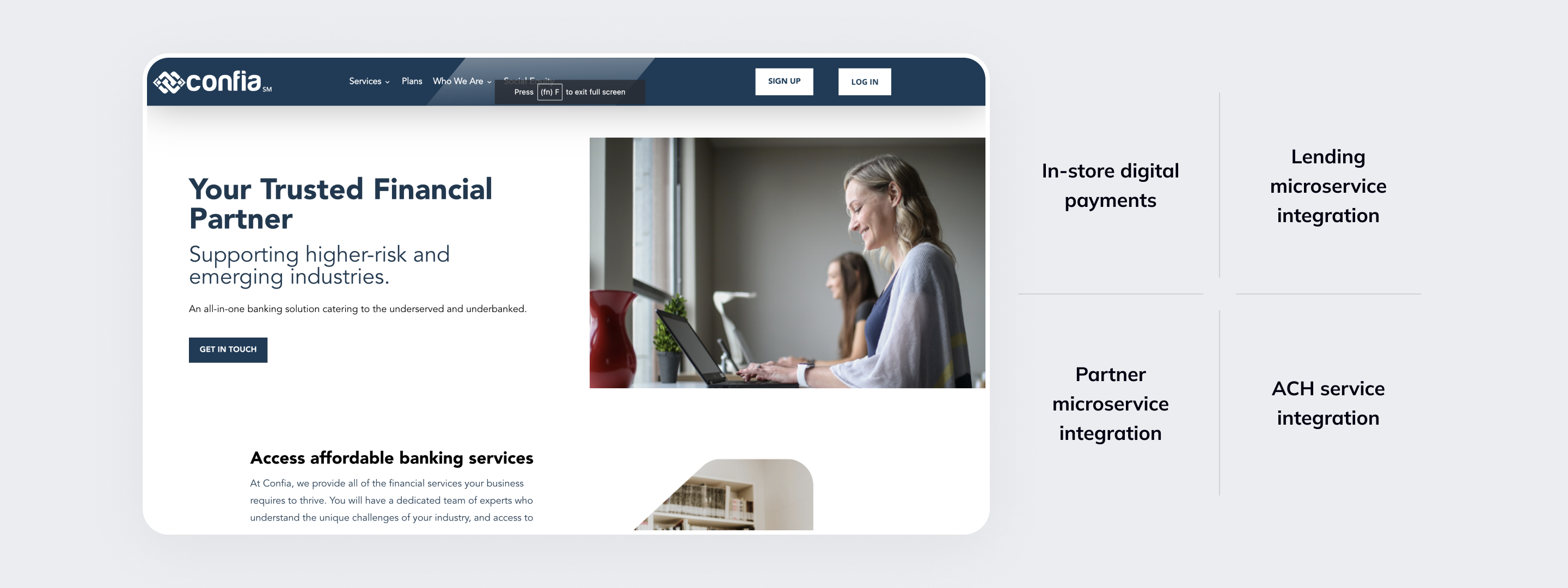

Development of Service Features for Confia Infrastucture

Confia is dedicated to being an affordable, trusted, and transparent partner that helps cannabis businesses navigate the complexities of banking. As a thought leader and a best-in-class financial technology, Confia believes that its approach to banking and transactions will unlock the power of cannabis businesses and help execute its corporate goals.

The main task for IdeaSoft tech team was to integrate new microservices for payment methods and enhance overal platform functionality.

Learn more about our Fintech Software Development Services