Payment systems around the world are undergoing changes. With the growth of digital payments and new user needs, we are all looking for more flexible and transparent software solutions. Along with open banking, another solution is a new and fast-growing payment channel called Request-to-Pay (RTP). What are its benefits, how does it work, and how you can benefit from it? You can find answers to these and other questions in this article.

Table of contents:

- What is Request To Pay and how does it work?

- Benefits of RTP

- RTP market overview and future prospects

- How to take advantage of RTP

- How IdeaSoft can help you

What is Request To Pay, and how does it work?

Before getting into the details of how Request-to-Pay can make a difference, let’s look at what RTP is and how it works.

Request-to-Pay (RTP or R2P) is a payment channel that allows payers and payees to exchange data in real-time. The term is primarily used within the UK, but the concept is also gaining widespread acceptance in other regions. For example, in Europe it is called Request 2 Pay (R2P), and in the USA, you can find Request for Payment.

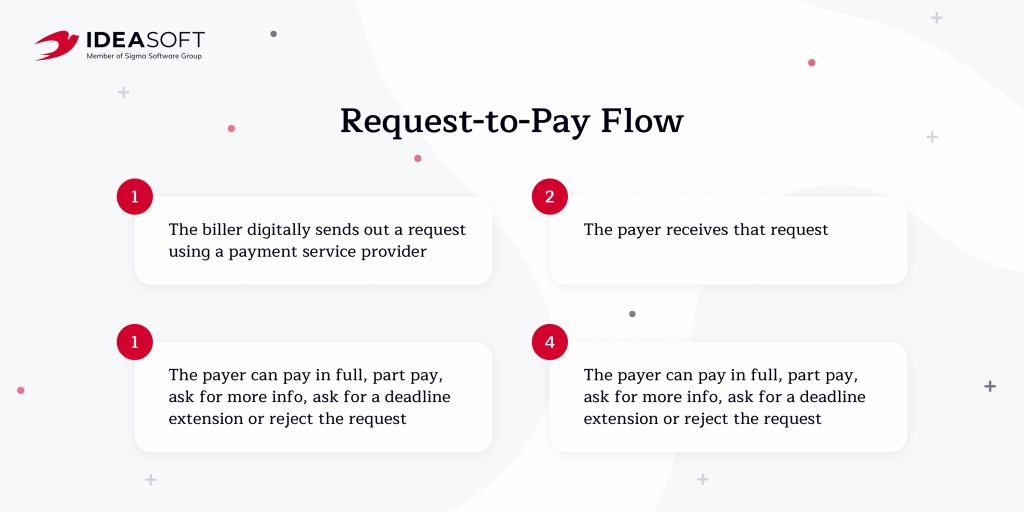

Basically, RTP is a highly secure messaging service through which a biller can initiate a digital payment request from the payer. The payer receives this request on their mobile device, usually in a banking app or a third-party fintech app, and can choose from several options: pay in full, pay only a part, ask for an extension, decline, or ask for information. If the payment is confirmed, the money is automatically transferred to the recipient’s account in real-time. Thus, all participants of the payment flow receive more flexibility and communication opportunities regarding payments.

RTP is closely related to open banking since it forms the necessary open ecosystem for the Request-to-Pay process. With Request-to-Pay, open banking billers can allow their payment service providers (PSPs) to instantly and irrevocably make and receive payments directly between their accounts and their customers’ accounts. All this empowers users with the advantages of instant payments and an open financial ecosystem.

Benefits of RTP

Regarding the benefits of Request-to-Pay, a good place to start is with the flexibility of this solution.

Today, with the flexible nature of work, most people have a situation where bill dates don’t usually match up with payday. Request-to-Pay allows you to take control of this situation and establish communication between the payer and the biller regarding the payment date. According to Answer Digital, 52% of payers would like the option of delaying a bill payment, and with RTP they get this opportunity.

RTP is not the only payment system that is flexible. Its value lies in the fact that with RTP it’s cheaper and easier for companies to offer flexible payment options to their customers than establishing custom systems from scratch.

| Payer | Payee |

| Greater control and flexibility when making payments. Avoid commissions or fees for late payments by requesting extra time. Improved financial management. | Increased loyalty from customers.Improved cash flow and debt management.Reduced collection and return costs. |

Improved security

Request-to-Pay is a highly secure payment method. To send a request, the biller doesn’t even need the payer’s payment details. The request is sent to a payer’s proxy payment address. Also, payers have full control over whether to accept or reject payment and money cannot be withdrawn from their accounts without their approval. In addition, payers use their trusted bank or payment app to accept payment requests and don’t need any third-party platforms.

Reduced costs

Request-to-Pay enables cost reduction possibilities for both the payer and the payee. The payer will be able to avoid late fees by requesting extra time and will carry out transactions directly from their account to the beneficiary’s account with lower bank fees. In turn, companies will be able to improve debt management and reduce the time and effort to track late payments by using digital invoicing. On a company scale with hundreds of customers, the savings are significant.

Faster and more convenient payments

While payments made with credit cards can take several days to process, RTP provides almost instantaneous payments. Direct real-time communication between the payer and the biller also facilitates invoice resolution. This way RTP ensures a smoother reconciliation process. Electronic invoicing and the ability to pay with a few clicks is a definite plus for all parties of the payment process.

Increased customer loyalty

Finally, with Request-to-Pay, companies provide their customers with an additional payment option, thereby enhancing the customer experience. RTP ensures more visibility for end consumers and businesses and enables communication. It is a more customer-centric approach aimed at building trust with customers and increasing their loyalty.

RTP market overview and future prospects

As mentioned, the Request-to-Pay model is being implemented all over the world. The first country to adopt this concept was India, which has launched the Unified Payment Interface (UPI) back in 2016. In Europe, RTP appeared in 2020 with EBA Clearing’s Request-to-Pay solutions complying with the new SEPA Request-to-Pay Scheme (SRTP) created by the European Payments Council (EPC) in November 2020. Pay.UK introduced a similar service in the UK in June of the same year. Now RTP solutions are also available in the United States and other regions.

As one of the fintech trends, Request-to-Pay has different implementation models in the market. For example, you can find solutions where RTP is a separate overlay scheme leveraging standardization with a financial market infrastructure (SRTP). Also, Europe’s second Payment Services Directive (PSD2) allows the use of Request-to-Pay through an open banking framework, which is another direction for implementing RTP.

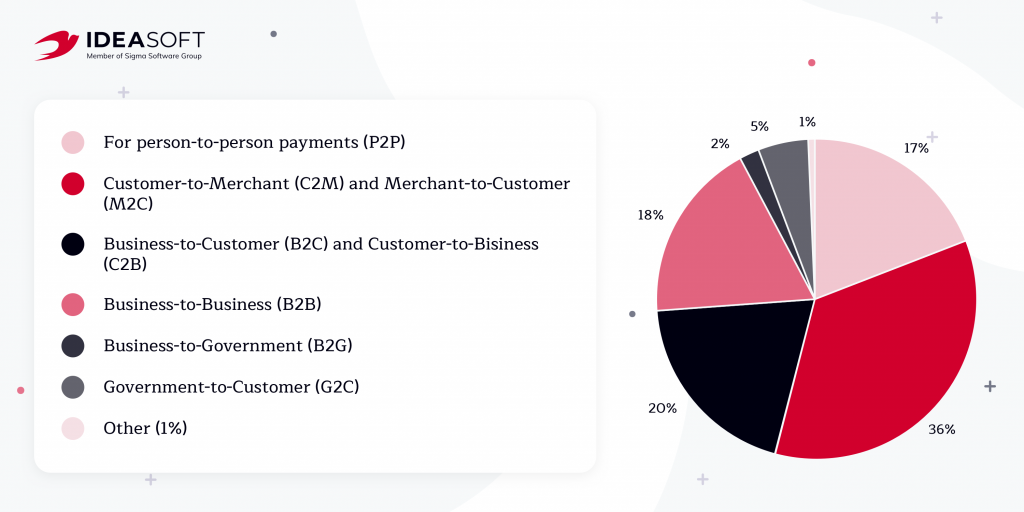

According to a survey by the European Payments Council (EPC) conducted in early 2021 among financial industry experts, 56% of respondents agreed that the RTP scheme is most useful in Customer-to-Merchant (C2M)/M2C and Business-to-Customer (B2C)/C2B situations.

The request for payment has great potential for fintech and other financial institutions to provide overlay services. For example, banks can provide lucrative microloans to clients who don’t have enough funds to pay off a payment request. Third-party financial providers may also offer data aggregation services for all pending payments associated with their linked accounts using open banking APIs. In addition, RTP allows businesses to better understand the spending habits and preferences of their customers and use this to create new services.

Request-to-Pay is another way of updating existing payments infrastructure. Recently, the financial services market has been actively developing the trend of exchanging information between various financial providers to promote market development and provide an improved user experience. RTP is one of the ways to achieve these goals, so we can expect more widespread adoption of this solution in the coming years.

How to take advantage of RTP

Request-to-Pay has appeared as a “missing piece in the instant payment puzzle”. Any business interested in streamlining the customer payment process, improving debt management, and increasing cash flow transparency will find RTP a useful solution. Banks, fintech companies, service payment providers, merchants, billers and corporations are the main target audiences for RTP solutions.

The Request-to-Pay scheme is most effective in open banking and allows solutions to be developed and maintained through a collaborative process to facilitate data exchange. Open banking provides instant payments by allowing user-authorized access to their data and accounts. In this case, a biller can send a payment request to the buyer’s mobile phone using, for example, a QR code or by adding an attachment. After the client is authenticated in the app of his or her bank, they can confirm or reject the payment.

Banks and payment providers that have implemented RTP gain a significant advantage in the market by offering their users more options for making payments and increasing their engagement.

How IdeaSoft can help you

IdeaSoft, part of Sigma Software Group, provides expert mobile app development services for financial businesses around the globe. The company’s portfolio includes successful projects in banking software, lending/borrowing protocols, financial planning tools, open banking solutions, and more. The IdeaSoft team works with a wide technology stack, including such advanced technologies as blockchain and AI/ML, which allows us to create truly innovative solutions that meet the needs of the market.

IdeaSoft has the necessary tech expertise to implement Request-to-Pay technology based on an open banking system. We will provide you with a secure and functional solution that allows you to integrate invoice management systems with payment apps, as well as ensure effective communication between payers and billers. If you are ready to upgrade your payment capabilities, feel free to contact us to discuss your project.