P2P payment apps are powerful tools for transferring funds between people nowadays. We can pay for purchases and services without leaving our homes just using our smartphones. Merchants can receive payment directly to a card or account by integrating a payment app into their websites. More importantly, you can choose which application to use or create a custom peer-to-peer payment app.

According to eMarketer, the value of P2P mobile transactions will reach $612.23 billion by 2023, so this market continues to evolve, and if your business idea is related to P2P payments, you have a good chance of success. To help you, we have compiled a P2P payment app tutorial in which you will find answers to questions on how to build a powerful and legally compliant peer-to-peer payment app.

If you are wondering how to make a peer to peer payment app, we have compiled a P2P payment app development guide in which you will find answers to questions on building a powerful and legally compliant payment processing app.

Table of contents:

- What is a P2P payment app and how does it work

- Advantages of peer-to-peer payment apps

- Must-have features for a peer-to-peer payment app

- Steps to build a P2P payment app

4.1 Choose P2P app type

4.2 Draw up a list of features for your app

4.3 Choose the right technology

4.4 Provide sufficient security of your app

4.5 Regulatory compliance

4.6 Create an effective design

4.7 Find a software development team

4.8 Test your app - How to monetize a payment gateway app

- Where to start developing a P2P payment app

What is a P2P payment app and how does it work?

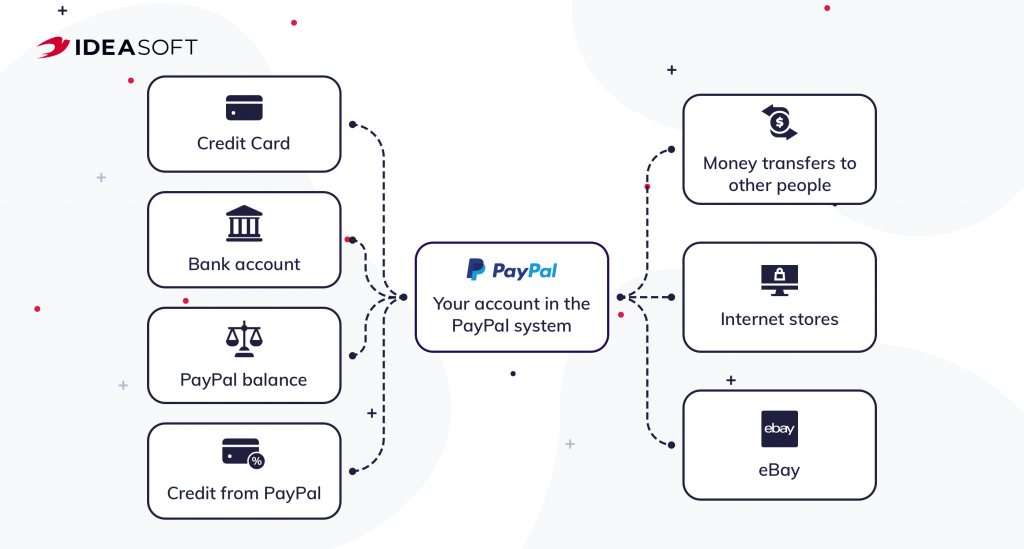

First, let’s figure out what are peer-to-peer payments from the technical part. Peer-to-peer transactions are electronic money transfers that are made directly from one account to another using a payment application. Probably everyone has used PayPal at least once, one of the first and the most popular P2P payment apps. So how does it work?

You create and link your account to your credit card or bank account. Further, using another person’s email address, phone number, or account, you can send him or her money. Usually, the legitimacy of a transaction is verified using passwords or additional data about a sender and a recipient. P2P systems allow transferring funds between banking card owners without resorting to intermediaries, which means you save on commissions. These apps are often free, but small fees may apply depending on the source of your funds. To make payments, users need an app available via a smartphone or computer and Internet access. No cash confusion or bank lines. Everything is extremely simple.

Typically, such apps allow you to transfer money between users of different banks, which makes transactions convenient. Payment processing times can vary from a few minutes to several hours depending on the payment type. P2P systems have a wide range of applications. You can pay for services using such apps, buy online things, send and receive borrowing requests, make cross-border payments, and more.

Advantages of peer-to-peer payment apps

P2P payment apps are widely used not only by individuals but also by businesses. That is why the idea of creating a payment app so often attracts startups and established businesses.

For example, it is much easier for merchants to receive payment for goods directly to their cards, so they integrate payment apps into their online stores. Moreover, by creating a payment app on the blockchain, you can conduct direct transactions in cryptocurrency. Here are some more benefits of peer-to-peer payment apps.

| Advantages for individuals | Advantages for business |

| + You don’t need to withdraw cash to pay + You can easily track your finances in your app + Many applications support automatic conversion between different currencies + You can pay from anywhere in the world with an Internet connection + You save on fees due to no need for intermediaries | + You will ensure affordable cross-border transactions and be able to reach a larger pool of customers + No intermediaries to charge expensive services + You can monetize your app and earn extra money on it + You can receive instant payment for your services directly to your card or account + You will increase the level of trust and user engagement |

Best practices to build a P2P payment app

Building a peer-to-peer (P2P) payment app requires careful planning and attention to detail. Here are some best practices to consider for your P2P payment app development:

- User-friendly Interface: design a clean and intuitive user interface that is easy to navigate. Ensure a seamless and hassle-free user experience during the payment process.

- Security and privacy: implement robust security measures, such as end-to-end encryption and secure authentication protocols, to protect user data and transactions. Ensure that your app complies with relevant data protection regulations and standards, like GDPR or CCPA. In addition, regularly update the app, fix security vulnerabilities, and protect against emerging threats.

- Multiple payment options: create a payment app that supports a wide range of payment methods, such as credit/debit cards, bank transfers, and digital wallets, to cater to users’ preferences.

- Seamless integration: provide seamless integration with other platforms, such as social media accounts or e-commerce websites, to facilitate easy payments and enhance user convenience.

- Customer support: build a payment processing app that offers reliable customer support channels, such as live chat or email, to assist users with their queries or concerns. To enhance responsiveness, provide a clear and accessible FAQ section to address common questions.

By following these best practices, you can create a robust and user-friendly P2P solution that meets the needs of your target audience while ensuring security and convenience in their transactions.

Must-have features for a peer-to-peer payment app

When creating a custom P2P payment app, you have many options regarding functionality and capabilities. It’s up to you. However, there are some must-have features that users expect by default when downloading a payment app. Therefore, when making a list of features for your future product, include the following first.

Digital wallet. A digital wallet is the main feature of any payment application. With the help of a wallet, a user stores his electronic currency and makes payments. Usually, digital wallets are integrated with payment card tokenization services from VISA and Mastercard and with external systems/services to have wide functionality. Creating a digital wallet is a separate issue that should be given special attention before starting your payment application development.

Send and request money. The user should be able to send the desired amount of money and request money from another user.

Send bills/invoices. For the convenience of a user, your app should have a function for generating a transaction invoice/bill that can be received by both a sender and a recipient.

Currency conversion. Automatic currency conversion is a great feature that makes P2P payment apps so popular, so you shouldn’t give it up. By implementing this function, you will allow your users to make cross-border transactions, pay for services and goods using your application while traveling, and not think about converting. The best way to implement this feature is to synchronize your payment app with the bank’s exchange rate at the time of the transaction.

Unique one-time passwords or IDs. Security is crucial for payment apps. To avoid unwanted or accidental transactions and fraud, a user must confirm the unique ID and OTP (one-time-password). If you want to provide an even higher level of security, you can configure the need to enter an OTP every time a user logs in.

Transfer to a bank account. Users may need to transfer money from card to card and from card to bank account. Give them that opportunity.

History of previous transactions. The transaction history will enable your users to keep track of their spending and money transfers. Try to keep the information as long as possible. Also, the function of generating statements, downloading, and printing transaction history will be a great solution.

Push notifications. Push notifications will be useful for both you and your users. You can send notifications with new offers, promotions, or updates. And users can quickly see messages if a card has been credited, for example. However, remember that push notifications can be useful and annoying, so let users choose which notifications they want to receive on their phones.

Additional features can include:

- Chatbot. A chatbot in your P2P payment app can improve user experience. While interacting with the app, a user may have questions or problems. A chatbot will help quickly resolve issues that may arise when transferring funds, incorrect debits from the wallet, etc.

- Fingerprint security lock. To minimize the risks associated with the security of your application, you can configure the fingerprint security lock. This way, only the owner of the account can access it.

- Cryptocurrency payments. The value of cryptocurrencies is growing every day. According to Reportlinker, the cryptocurrency market is predicted to grow with a CAGR of 56.4% from 2019 to 2025. Many companies allow paying for their products and services using cryptocurrency. If you want to create a modern app that provides additional opportunities for users, think about the feature of making payments in cryptocurrency.

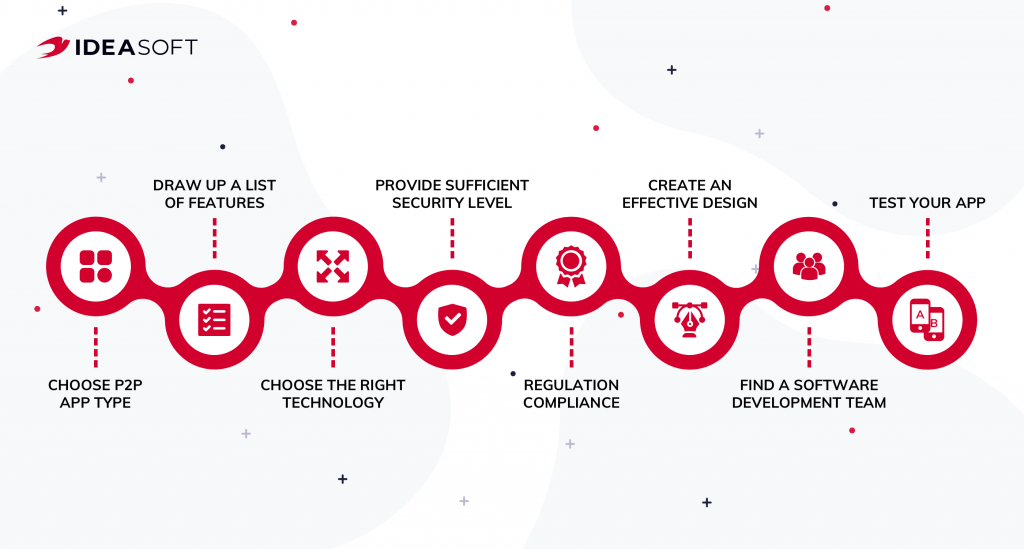

Steps to build a P2P payment app

Having dealt with the features of a P2P payment app, let’s move on to the main steps of developing your application. Before you start looking for a payment p2p app development team, you have to work on creating a concept for your project and drawing up clear requirements. So here’s what to look out for.

Choose P2P app type

There are several types of peer-to-peer payment apps. The most popular are banking and standalone solutions. Depending on your business model, you can stop at one of them, but you should be aware of all types of payment apps. So, we will give a brief description of each one.

- Bank-based solutions. Bank-based apps involve a bank as one of the parties to transactions. Many banks are developing their own P2P payment systems to make services more accessible and convenient. These apps receive money and deposit it directly to bank accounts rather than a saved foreign currency account. Sellers, in turn, must have POS terminals to accept such payments. Banking apps make transactions easier for both banks and users.

- Standalone services. These are independent providers that offer their own payment systems such as Venmo and PayPal. Such applications allow users to create a digital wallet and use it to store electronic money and make payments. Typically, these apps support MasterCard and Visa cards. You should choose this application type to build a business around it.

- Social media platforms. Social media and messengers are also developing built-in payment features as Facebook did. This way social media users can send money to their friends without leaving the app. However, if you are not going to build your own social network, this type of P2P payment app will not be for you.

- Mobile OS systems. Here, payment options are more of a built-in feature than a full-fledged application. Examples of mobile OS payment systems are Apple Pay, Samsung Pay, and Android Pay.

Draw up a list of features for your P2P app

Next, get back to the features. You need to list the necessary features, which a development team can then estimate. Start with the basic ones and then add the features you want to see in your app. In order not to miss anything, you need to study your target audience, create a portrait of your user and the user flow, the path that users will go through interacting with your app.

Don’t try to develop all the features at once, as this may be unreasonable and too expensive. Prioritize features, focusing on core ones, you can add new features later when you are sure that they are needed.

Choose the right technology

The next step is the technology selection. The right technology will help you make a P2P payment app more functional and more interesting for users. And this is an important factor to survive the competition, right? FinTech gave us such innovations as NFC and biometrics ID, but we shouldn’t be limited to them. The financial sector continues to undergo digital transformation and new technologies are emerging. For example real-time payments (RTP), unified platforms, Artificial intelligence (AI), and blockchain. Don’t hesitate to use trending technologies and tools to create your app, because the faster, more convenient, and more profitable your product is, the more chances you have to succeed.

One of the most promising technologies listed is blockchain. According to MarketsandMarkets, the global blockchain market will reach $23.3 billion by 2023. Blockchain-based solutions are secure and they provide a high level of transparency that users can accurately assess. Thanks to a distributed storage system, information about all transactions are stored in blocks linked to each other. No block can be deleted or changed without destroying the entire system. Also, blockchain was originally created to build peer-to-peer systems without the involvement of intermediaries. Read our recent article Where to start implementing blockchain to find out more about adopting this technology.

Provide sufficient security for your payment app

We have already mentioned security, but when creating a peer-to-peer payment app it is better to think twice about it. All information about your users’ accounts and the history of their transactions must be reliably protected, as well as the process of transferring funds. According to the Cybersecurity Ventures Official Annual Cybercrime Report, the total cost for cybercrime committed globally will reach $6 trillion by 2021. I don’t think you want your users to become victims of hacker attacks. How do you ensure the proper level of security for your application?

We have already discussed the need to send a unique ID/OTP when confirming operations and logging in. This will help avoid accidental payments or fraudulent actions. Try to use all the security features built into devices, such as fingerprint scanner, face recognition, or at least activate two-factor authentication. You also need to ensure the security of your digital wallet and prevent any chances of a personal data leak. Be sure to discuss with a development team what security features you can put in your payment application.

Regulatory compliance

Regulatory compliance is as important an issue as security. Your payment app must comply with payment standards. Experts say the fintech industry lacks regulation, but different regions already have documents that need to be considered. Unfortunately, it is very difficult to think about the payment requirements of all regions and create a universal app that will meet all standards. Therefore, you should choose a target region for yourself and create a P2P payment app following its laws and recommendations.

Here are some examples of authorities with which you need to resolve legal issues by region:

| Region | Authority |

|---|---|

| China | FinTech Committee under the People’s Bank of China (PBOC) |

| Korea | FinTech Center under the Financial Services Commission (FSC) |

| Australia | Innovation Hub by the Australian Securities and Investments Commission (ASIC) |

| European Union | Directive (EU) 2015/2366 + GDPR |

| UK | Financial Conduct Authority. |

| US | Depends on the state |

Create effective design

In pursuing functionality and legitimacy, you shouldn’t forget about the design of your app. The correct structure of the user interface and an attractive look determine the convenience and user-friendliness of an app for users. Also, a memorable design will help you build great awareness and engagement. UX/UI design development consists of several stages. Let me remind you that the UI part is responsible for the look and feel of an app (colors, layouts, typography), and the UX is responsible for the process of user interaction with the interface, and his overall impression. At IdeaSoft, our design team sticks to the following workflow.

Find a software development team

With the preparatory stages complete, it’s time to find an experienced development team to help you bring your ideas to life. Take the time to find and select skilled developers. You can use the ratings from Clutch, GoodFirms, TopDevelopers, Techreviewer, and others. Here’s what to look for when choosing a development partner.

- Appropriate expertise: the experience and technology used by a company must meet your requirements. For example, does a company work with blockchain? Does it have experience in developing projects for FinTech?

- Successful projects: first of all, you should be interested in FinTech projects as similar to your project as possible, so you can see how the team is coping with the tasks.

- Customer reviews: read customer reviews. This will help you learn about the strengths and weaknesses of a company. Honestly, people don’t like to spend time writing reviews, so it takes some effort to motivate them. If a company doesn’t have reviews, it most likely doesn’t care about its reputation, and it’s a bad sign.

2 more quick tips. First, if you want to reduce the cost of software development, turn to outsourcing and choose companies from Eastern Europe (the best match between price and quality). Second, choose companies that provide a full development cycle, so you won’t have to look for other partners for design or support.

Test your app

At the end of the project, don’t forget to ask about the testing results, but rather test the application yourself. It is better to find bugs early and fix them than release to the market a defective product. Testing helps determine whether your app is working as intended, whether it bears the necessary load and whether it is convenient to use. Test again and again until you are satisfied with the result. Here’s a quick checklist for testing your application.

- Make sure your app installs and runs correctly.

- Ensure a user can perform typical operations.

- Check if the app works the same on different devices and OS versions.

- Check how the app behaves in case of special events (incoming calls, low battery, airplane mode, etc.).

- Test hardware connectivity – Bluetooth, WiFi, NFC, USB.

- Test the app with real users to ensure there are no bugs and get feedback.

- Decide who will support and maintain the application (dedicated team, outsourcing services).

Remember that a few clicks and swipes are enough for a user to draw a conclusion about your app and decide whether to use it further. According to Compuware, 48% of users are less likely to use an app again if they experience performance issues. Plus, users won’t forgive you for bugs in security, usability, functionality, etc. There are always alternatives. Testing can help you avoid many risks, so never underestimate this step.

How to monetize a payment gateway app

P2P payment app monetization involves implementing strategies to generate revenue from services. Here we have collected a few tips to help you monetize your online payment app:

- Transaction fees: as obvious as it is, charging a small percentage or fixed fee for each transaction processed through the payment gateway is one of the most commonly known options for revenue generation. This is a common revenue model used by payment gateways where the app earns a commission on each transaction.

- Value-added services: consider providing additional services that complement the payment gateway, such as analytics reports, fraud detection, or risk management solutions. These value-added services can be offered as add-ons for an extra fee.

- White labeling: allow businesses to customize and brand the payment gateway app with their own logo and design. Charge a licensing fee or ongoing revenue share for providing this white labeling option.

- Integrations and partnerships: collaborate with other businesses, such as e-commerce platforms or software providers, and offer seamless integrations with their systems. Generate revenue through referral fees or revenue-sharing agreements with these partners.

Remember, the specific monetization strategy will depend on your target market, the app’s unique value proposition, and the needs of your users. It is important to balance generating revenue and providing your users with a seamless and secure payment experience. The ideaSoft business team always considers all of those approaches to create the best business logic for your application.

Where to start developing a P2P payment app

Now you know how to build a payment processing app and how the development process goes. You should do a lot of analytical work and decide what features your app should have, what technologies are better to use, and what requirements your product should meet. So where do you begin?

Start by researching users and defining the functionality of your app. Your main task here is to describe your idea in detail and then discuss it with a development team, which will help improve it and implement it. Choose a skilled development team with a proven track record in developing fintech solutions. The quality of your application depends on the expertise of the software developers, so take your time to choose.

Experts predict a great future for peer-to-peer payment apps, so catch the wave. Our team is always ready to advise you on the technical implementation of your idea. Feel free to contact us. Good luck with your project!