DeFi aggregators are one of the most recent groundbreaking developments in decentralized finance. According to statistics, more and more users are using aggregators for trading. Having experience in developing similar software products, we decided to share with you tips on how to create a DeFi aggregator.

Table of contents:

- What is a DeFi aggregator

- Benefits of DeFi aggregators

- DeFi aggregator development process

- Must-have DeFi aggregator features

- Other features

- IdeaSoft experience

What is a DeFi aggregator?

DeFi aggregators are one of the most promising types of DeFi projects. According to Messari, approximately 20% of total trading on non-custodial Ethereum exchanges is done using DeFi aggregators. And data from Dune Analytics shows that the number of new aggregator users, daily transactions, and volumes has increased dramatically since the beginning of the year. So, what are DeFi aggregators, and why are they so popular? Let’s figure it out!

Decentralized finance is an ecosystem of various financial instruments based on public blockchains. Unlike centralized finance, DeFi provides more privacy to users while remaining accessible to anyone. Due to openness and transparency, DeFi applications can easily integrate and interact with each other. However, in practice, it turns out that these applications are fragmented and it is quite difficult for users to keep an eye on the DeFi market. That’s when DeFi aggregators came into play.

A DeFi aggregator is a platform that gathers information from various DeFi protocols and integrates them into a single interface, allowing traders to make smarter decisions. Besides, aggregators perform other functions such as connecting liquidity pools, reducing transaction costs, depositing funds into DeFi pools, and more. Users can find an aggregator that suits their needs and get more value from interacting with DeFi.

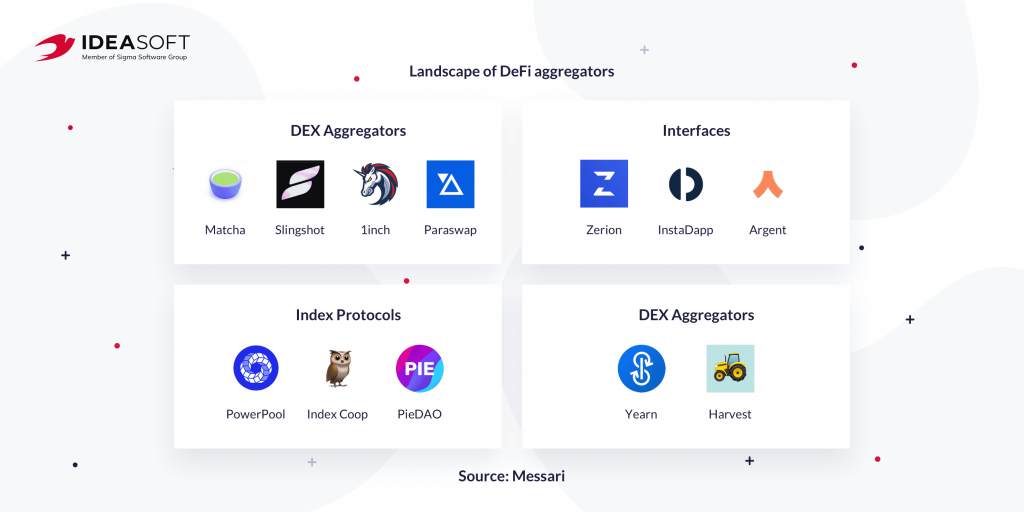

Here are some examples of DeFi aggregators on the market.

- 1inch and DEX.ag enable users to exchange crypto assets at the most favorable rate.

- InstaDApp allows users to receive loans in DAI, without verification of identity, age, or credit history.

- PlasmaFinance aggregates using decentralized oracle data across major protocols in the sector, allowing users to interact directly with these protocols from a single interface and transfer liquidity between different pools.

You can find many other DeFi aggregators as their number is constantly growing.

Benefits of DeFi aggregators

If you want to know how to create a DeFi aggregator, first you need to study all the benefits of these platforms in order to implement them in your project. DeFi aggregators are useful for both DeFi users and DeFi companies. They regulate user interactions with exchanges, decentralized applications, investment platforms, etc. Aggregators combine multiple protocols into an easily manageable single interface, dramatically improving the user experience. Now users don’t need to open multiple tabs to monitor data from different apps. They are all accessible from a single aggregator interface. This makes it easier for users to choose the most profitable options on the market, minimizing gas fees.

Also, users of decentralized exchanges often face problems due to high slippage when orders are executed at a price that is less favorable than expected. Aggregators help solve this issue. For example, PlasmaFinance aggregates data from different protocols and allows users to see available prices in real-time and swap the best DEXs. 1inch went even further by aggregating liquidity from different DEXs so that whenever a trader swaps, the protocol generates the best cryptocurrency prices from all DEXs to which it’s connected automatically.

Aggregators also help services to find their customers. This is one of the best ways to introduce a new project and increase its liquidity. Basically, aggregators take advantage of one of the main DeFi benefits – interoperability to create a single, competitive marketplace accessible to a wide range of users. Therefore, when developing a DeFi aggregator, you should lay in your product opportunities for both traders and companies.

Leveraging our crypto exchange development services can help you solve these challenges by building a high-performance backend and secure integration layer tailored for real-time liquidity aggregation.

DeFi aggregator development process

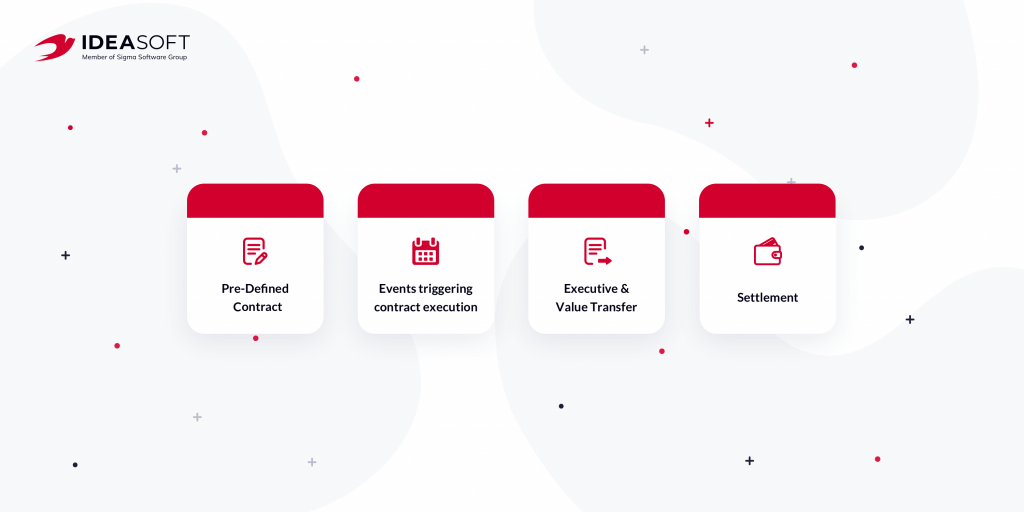

DeFi aggregators work on the basis of smart contracts, like other DeFi products. Smart contracts are a great way to regulate the relationship between users and platforms in an automated way. However, I think you know that they can be vulnerable if created without considering the best security practices. Therefore, first of all, to build your DeFi aggregator, you need to enlist the support of an experienced blockchain development team that knows all the features of working with smart contracts.

Platform security is critical to building trust with your future users. Over the past year, we have heard the news from everywhere about hacker attacks on DeFi services, most of which became possible due to errors in smart contracts. Never neglect security if you want to launch a successful DeFi project.

DeFi aggregator development process consists of several stages:

Discovery phase

This step is necessary for a detailed study of the goals and requirements of the project in order to create a product that meets the needs and expectations of end-users. During the discovery phase, a customer and a development team together determine the scope of work, budget, and deadlines, developing a detailed plan for how to create a DeFi aggregator. We advise you not to skip this step, as the discovery phase helps to optimize costs and reduce project risks.

UX/UI part

DeFi aggregators emerged with the motto of improving user experience by providing a single interface for working with different protocols. However, it is not enough to integrate several protocols into one product to live up to this statement. You really need to create an interface that makes it easier for users to interact with DeFi and unleash all the benefits of an aggregator. So there is no point to lay down functionality that in fact turns out to be complicated and confusing. This is where you need an experienced UX/UI design team to help you implement features into a user-friendly interface that your users will love.

Sergej Kunz, a co-founder of one of the most popular DEX aggregators 1inch, admitted in an interview with TheDefiant that he considers UX to be a weak part of his product that needs improvement, and one of the reasons why users prefer centralized exchanges. So, learn from other people’s experiences and take care of the UX/UI design of your aggregator at the stage of its development. This will save you money in the future.

Smart contracts protocol development

In DeFi applications, most of the back-end part is embedded in smart contracts. We have already talked about how important it is to choose an experienced development team to create reliable smart contracts. At this stage, developers will create and launch all the necessary algorithms for the operation of your platform, as well as implement the necessary integrations with other DeFi protocols. If you want to build a trading ecosystem end-to-end, working with a seasoned defi exchange development company ensures you get robust architecture, deep liquidity integrations, and top-grade security.

You need to put in your protocol a certain logic of work that allows you to achieve the goals of the project. For example, 1inch has a unique algorithm that allows users to exchange crypto assets at the most favorable rate. This is possible thanks to splitting orders and the selection of the best rates on different DEX platforms. Also, you should think about the necessary features for monetizing your aggregator. Usually, DeFi aggregators earn commissions from users or partners. Develop your own strategy that organically fits into the functionality of the product.

Front-end development

Front-end is also a very important part of the DeFi aggregator development process, as this is the part that users interact with directly. Front-end developers not only make sure that all interface elements are correctly positioned, but also fulfill their functions, helping users to effectively interact with the platform. Choosing the right frameworks and libraries helps to create powerful and reliable applications.

Testing

Testing is crucial for the DeFi product development. Tests allow you to make sure that all platform features work as intended and also help you identify and prevent system vulnerabilities. When it comes to smart contracts, you simply cannot ignore testing and audits. According to The Block Research, in 2020 there were 15 hacks of DeFi platforms amounting to $120 million funds being stolen. Timely testing and bug fixes reduce future risks of attacks.

Once you are sure that your DeFi aggregator is ready to launch, you should start collecting feedback, introducing new features, and improving the system to remain competitive in the market. Working with an experienced development team, you will go through all the steps of developing a DeFi aggregator easily and get a reliable and secure software product.

Must-have DeFi aggregator features

When looking for an answer to the question of how to create a DeFi aggregator, you cannot ignore the selection of features for your platform. Having studied the functionality of the most popular DeFi aggregators, we have compiled a list of core features that you should think about first.

- Sign up. To get started with a DeFi aggregator, a user usually needs to connect his wallet, which he uses for storing and transferring crypto assets. You need to create a list of wallets that your platform should support and implement this integration.

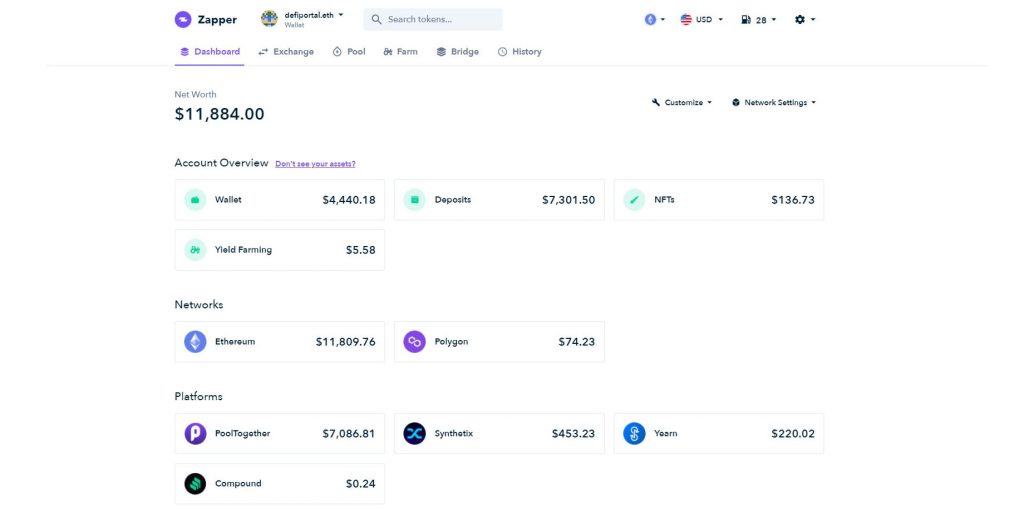

- Dashboard. The main task of any DeFi aggregator is to connect different protocols in a seamless interface. Therefore, a dashboard is one of the main features that will be helpful to your users. For example, Zapper aggregator is well known for its dashboard, which allows users to instantly assess the value of their portfolios. Zapper categorizes assets into various categories such as wallet, income positions, liquidity provision, and borrowing. This allows you to structure information and navigate faster. Think about how you want to present data to your users.

- Exchange tab. An exchange tab is a feature that allows users to quickly and with the greatest benefit exchange one crypto asset for another. The exchange aggregates liquidity from integrated DeFi protocols and provides the user with the best options. We have already mentioned the 1inch split algorithms for achieving the best exchange rate. Zapper has a different algorithm. It aggregates the most liquid Uniswap and Balancer markets and presents users with the best deal. Zapper also allows you to specify gas and slippage tolerance settings when creating an order. The built-in exchange is one of the main tools of the DeFi aggregator, allowing users to make profitable transactions in a few clicks.

- Liquidity pools. A liquidity pool is a collection of funds (tokens) placed in a smart contract by so-called liquidity providers. The reserves are pooled between a network of liquidity providers who supply the system with tokens and get rewarded. Different platforms provide different rates and commissions, as well as various bonus systems that attract capital to their platform. You should provide users with all the information they need about your liquidity pools.

- History and analytics. The effectiveness of trading operations largely depends on analytics. Give users the ability to track their transaction history and performance right in your application. For example, Zerion uses information from the most popular tool for most DeFi investors, EtherScan. The aggregator displays all data on a single page of transaction history in a graphical view, which eliminates the need for users to open additional tabs. And Zapper provides users with additional features to make it easier to work with data. This way you can easily find the desired transactions using filters or download the transaction history in CSV.

- Farming. After the launch of such projects as Yearn, Sushiswap, and Yam Finance in the summer of 2020, the term Yield Farming gained popularity, and aggregators are actively using this crypto trend. Yield Farming is expected to generate income from the placement of cryptocurrencies on various DeFi-platforms for crypto-lending. In this way, DeFi aggregators create favorable conditions for attracting capital to their platforms.

Other features

In addition to the basic features, many DeFi aggregators have additional functionality that improves the quality of the user experience. Also, such features allow you to differentiate yourself from competitors and take an advantageous place in the market. The main task of any DeFi aggregator is to make it easier for users to interact with various DeFi protocols, so you should continue to work on the convenience and functionality of the platform constantly.

Here is a list of some interesting features that existing platforms offer:

- Zapper invites users to try a demo without having to connect a wallet. This allows potential users to evaluate the functionality and usability of the platform before starting to fully work with it.

- Zerion provides users with a wide range of tools to customize the interface. So users can choose a theme and language. 1inch also allows platform users to customize their token portfolio and wallet token lists. Think about how you can give users more freedom to interact with the interface of your DeFi aggregator.

- DeFi Saver has a Recipe Creator feature that allows you to combine any number of actions from different DeFi protocols into one transaction. The platform also has many automation features that optimize operations.

Also, we advise you to consider the availability of your DeFi aggregator on mobile platforms. According to statistics, most users prefer to interact with applications using a smartphone. By having a mobile app you increase the potential reach and engagement of users who can track their portfolio any time they want right from their phones.

IdeaSoft experience

Now that you know how to create a DeFi aggregator, you know what expertise it takes. Let us tell you how IdeaSoft can help you develop such a DeFi platform.

IdeaSoft has been creating custom software solutions for innovative businesses around the world for over 5 years. We work with both startups and enterprises, offering solutions that best fit the requirements of each specific project. Most of the projects from the IdeaSoft portfolio are related to blockchain technology. Our team has been involved in building crypto exchange platforms, issuance platforms, NFT marketplaces, non-custodial wallets, DeFi aggregators, and more.

Our client list includes Biteeu, a fully licensed and compliant cryptocurrency exchange for the European Union; Bochica, the first Colombian blockchain; Securutize, an issuance platform that entered the list of Blockchain 50 Most Promising Companies within the Blockchain Ecosystem by CB Insights in 2020. Feel free to check out our portfolio to find out more about these projects.

If you are looking for assistance in setting up a DeFi aggregator feel free to contact us to discuss your project. We will be happy to help you!