Security Token Offerings (STOs) emerged after the 2018 ICO bubble burst. Then, the cryptocurrency market lost over $700 billion in valuation. The decline prompted regulatory bodies to adopt a more stringent approach, seeking secure token legislation. In response to this regulatory shift, entrepreneurs and investors have turned their attention to STOs, attracted by their classification as crypto tokens that successfully pass the “Howey Test”.

STOs require reliable security token issuance platforms for successful asset tokenization. We at IdeaSoft have practical experience in security token issuance platform software development – Securitize. It is a platform that enables the compliant trading of private securities on public blockchains and multiple exchanges.

We have been working with Securitize for several years. We have fully developed it along with their unique Digital Securities Protocol (DS Protocol). Now, this STIP is our reliable and renowned partner. Our article will discuss how to develop a security token issuance platform based on our experience working on the Securitize platform.

Looking for a reliable provider to build a fully compliant STO platform?

Let us help you with the project scope, and correctly draw up the requirements for your project

Table of Contents:

- What is the Security Token Issuance Platform (STIP)?

- Key Features of an STIP

- Developing Your Own Security Token Issuance Platform

- Benefits of Security Token Issuance Platform Development

- Securitize – Our Best Case Study on STO Platform Development

- Summary

What is the Security Token Issuance Platform (STIP)?

Security Token Issuance Platform (STIP) is a digital infrastructure that facilitates issuing and managing security tokens on a blockchain. What are security tokens? Security tokens represent ownership or investment in real-world assets. STIPs enable the conversion of these traditional assets into digital tokens, thereby leveraging the benefits of blockchain technology.

After the BTC ETF approval, there has been a great demand for security token issuance platforms. STIPs unlock liquidity, reduce transaction costs, and increase accessibility to a wider range of investors. The types of assets that can be tokenized include:

- Real estate

- Equity and stocks

- Debt instruments

- Commodities

- Venture capital and private equity

- Art and collectibles

People often confuse the difference between utility and security tokens. In short, security tokens offer a regulated and compliant avenue for investment, while utility tokens provide a means for accessing specific services or functionalities within a Blockchain network. You dive deeper into this topic in another of our articles about the difference between utility token vs. security token.

Key Features of an STIP

Our CTO, Herman Stohniiev, highlights the following benefits of STO platform development:

- Tokenization tools. Robust tokenization tools enable the seamless conversion of real-world assets into digital tokens, allowing for fractional ownership, divisibility, and efficient transfer on the blockchain.

- Compliance automation. Integration with KYC and AML processes ensures that the issuance and trading of security tokens comply with the relevant legal frameworks.

- Smart contract creation. The platform must support the creation and deployment of smart contracts. These self-executing contracts encode the rules and terms of the security tokens. This way functions such as dividend distribution, voting rights, and other contractual obligations are automated.

- Investor management tools. A toolset for comprehensive investor management includes features for onboarding, verification, and communication with investors. The platform facilitates a secure and transparent process for issuing and managing security tokens to various investors.

- Secondary market integration. This feature allows for trading security tokens after the initial issuance, providing liquidity to investors. Secondary market integration enhances the attractiveness of security tokens as tradable assets.

If you need assistance in security token trading platform development, our team that has experience with Securitize projects can help you a lot.

Developing Your Own Security Token Issuance Platform

Developing a security token issuance platform involves seven basic strategic steps. Below is a detailed guide on how to develop your STIP:

- Define target audience and asset type. Consider whether your target audience caters to retail investors, institutional investors, or a specific industry. Also, determine the types of assets you intend to tokenize. It should be based on market demand and regulatory considerations.

- Choose the registration country. It is necessary to choose the right country of registration for your STIP initially. For this purpose, you need to examine the country’s legal framework. If you want to build STIP for the USA market, you must ensure that the chosen country of registration allows that. We at IdeaSoft specialize in such issues and can select a variant that will consider all the legal nuances for you.

Here is what our CTO, Herman Stohniiev, says about the importance of compliance with legal requirements.

We have a demonstrative example in our portfolio regarding compliance with legal requirements. When we worked on Securitize, our team had 10-12 engineers. At the same time, we had a team of 20-25 lawyers from a specialized New York law firm who monitored and helped to describe the prodject documentation and the legal part. Except that, they also worked on the legalization of all processes.

Herman Stohniiev, CTO at IdeaSoft

- Choose the right blockchain technology. Choose a blockchain protocol that aligns with your project goals and offers the necessary features for security tokens. It can be Ethereum, Binance Smart Chain, and Polygon, etc. Also, pay attention to the token standard (ERC-20, ERC-1400, ST-20, etc).

- Develop the platform core. This step includes implementing tools for converting traditional assets into digital tokens, developing and deploying smart contracts, and designing UI and UX.

- Integrate with necessary services. In this step, you must integrate KYC and AML processes to ensure compliance with regulatory requirements. This step may also involve partnering with established custodians.

- Implement security measures. This step includes regular security audits during the security token offering platform development and implementing end-to-end encryption, multi-signature wallets, and firewalls with DDoS protection.

- Test and refine the platform. Conducting thorough functional testing of the platform to ensure all features work as intended is a must. You can engage third-party security auditors to comprehensively audit the smart contracts and overall platform security.

Developing a Security Token Issuance Platform is a complex process that requires careful planning, adherence to legal requirements, and a commitment to security and user experience. We greatly emphasize the legal requirements of the STI platform development.

Benefits of Security Token Issuance Platform Development

From our previous experience with Securitize and great involvement in the market of securities, we can highlight the following 5 benefits of the security token issuance platform:

- Facilitating retail investment flow. STIPs allow retail investors to engage with assets beyond public stock exchanges. This democratization of finance enables retail participation in privately owned companies, including early-stage ventures. Previously accessible only to accredited investors, these asset classes can now welcome retail capital under specific regulations. This has the potential to inject trillions of dollars into private markets. STIPs empower individual investors by granting them access to previously exclusive investment opportunities.

- Unlocking global liquidity. STIPs allow for launching global Security Token Offerings (STOs), drawing investors from around the globe. STIPs broaden the sources from which companies can raise capital. It levels the playing field, dismantling the constraints associated with traditional investment networks. Additionally, by introducing security tokens to private markets, the opportunity for liquidity in equity positions arises. This way, historically long-dated private markets can be transformed into more dynamic and accessible ecosystems.

- Fractionalizing ownership. The tokenization of high-value assets, such as commercial real estate and art, paves the way for increased market participation. Traditionally, the exclusivity of these markets stemmed from high entry costs. However, thanks to STIPs, more investors can engage, enhancing market depth and activity.

- 24/7/365 secondary markets. Security tokens bring liquidity to previously illiquid ventures. This allows VC investments to trade on secondary markets. Consequently, this eliminates the need for VCs to wait for startups to go public or be acquired to realize returns. Moreover, the transition to tokenization ensures that markets operate continuously, 24/7/365.

- Programmatic compliance. Security tokens introduce programmatic compliance through the automation of control for adherence to security laws. Smart contracts embedded within STIPs enable the incorporation of case-specific compliance requirements, including KYC and AML checks. Features such as profit sharing, voting rights, and bankruptcy protection can be encoded into smart contracts, mitigating the risk of fraud and misappropriation of funds. This automated compliance framework enhances transparency and trust in security token transactions.

As you can see, your security token issuance platform development can greatly influence the overall trading market.

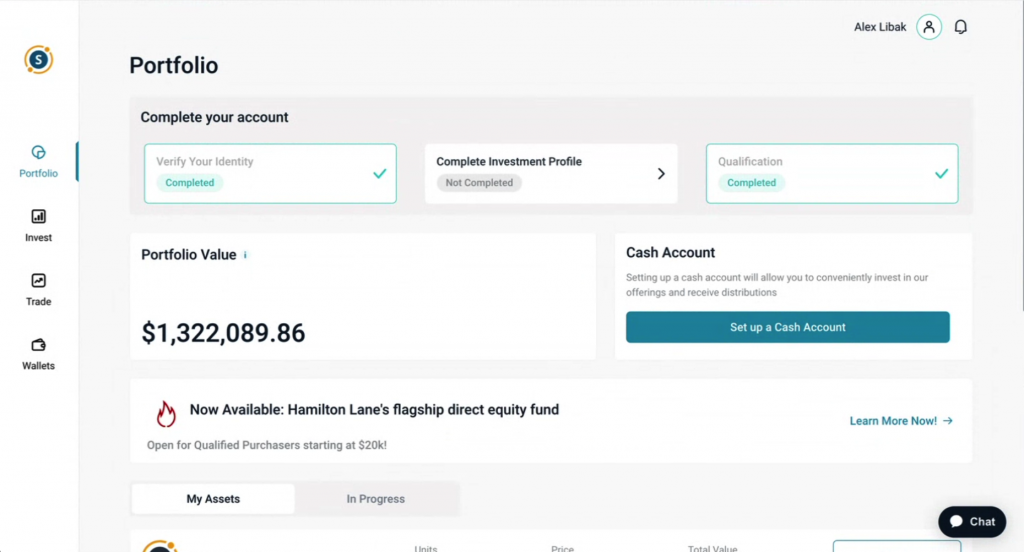

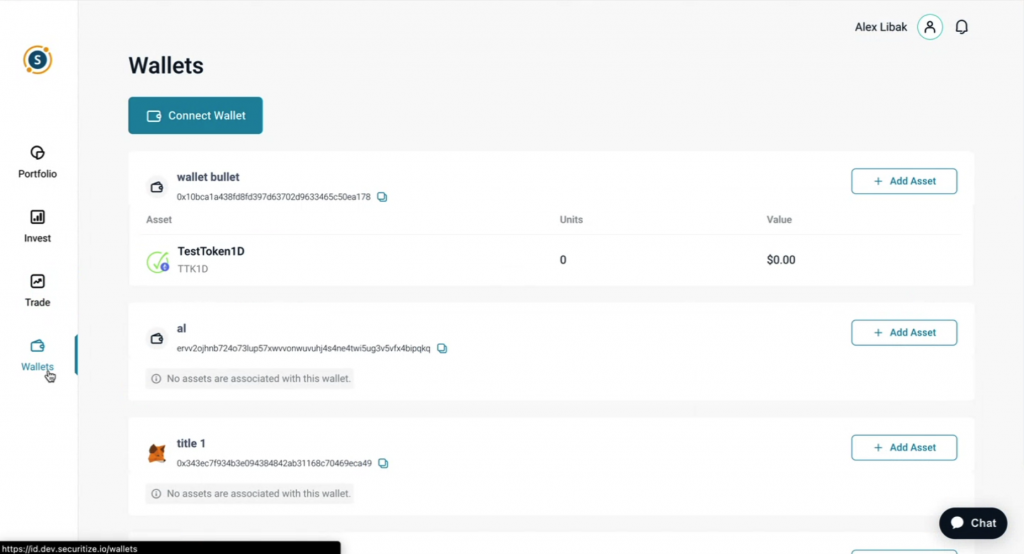

Securitize – Our Best Case Study on Security Token Issuance Platform Development

Securitize is full-stack technology solution for issuers of digital securities. Our IdeaSoft team developed a platform that enables the compliant trading of private securities on public blockchains and multiple exchanges. We implemented the following features:

- Investor onboarding

- Credit card processing

- Investor dashboard for lifecycle management

- Optional 2FA for investors

- Document signing

- KYC/AML accreditation qualification

- Fund and payout in fiat and crypto

- Multi-blockchain support

- Issuer admin console

- Real-time cap table

- Dedicated customer support

One of the most important and unique aspects that our team has developed is the Digital Securities Protocol (DS Protocol). It allows for the compliant trading of tokens on secondary marketplaces, like Alternative Trading Systems (ATS) in the U.S., and many other global securities exchanges and marketplaces.

Summary

Developing an STIP enables retail capital flow, unlocks global liquidity, fractionalizes ownership, and introduces instant settlement, 24/7/365 secondary markets, and programmatic compliance. The benefits extend beyond technology to democratize finance, provide liquidity, and redefine how assets are owned, traded, and managed in the digital era.

If you need our assistance to make a security token issuance platform, feel free to contact us today. We have much practical experience in this domain based on Securitize project development. We can help you with all your issues in building a security token issuance platform.