Blockchain has all the chances to become an essential technology in fintech, and hundreds of successful projects keep on proving that. So far, its extensive adoption has already proven to enhance security, transparency, efficiency, and trust in financial transactions, revolutionizing the way finance operates.

According to Contrive Datum Insights, the current market value of blockchain in fintech has exceeded $2.012 billion as of April 2023. By 2030, it is expected to reach $183.56 billion, growing at a CAGR of 75.80% during the forecast period. Such heavy investments are caused by the emerging blockchain-powered solutions in this domain. So far, thousands of start-ups, tech development companies, and traditional finance institutions already started building successful blockchain integration projects. And, of course, so can you!

To help you maximize the performance of your fintech solution, IdeaSoft and Sigma experts created a comprehensive guide on integrating blockchain technology into the applications for the finance and banking industry. Here, we’ll discuss the key benefits of blockchain integration with the popular use cases that prove its efficiency. Additionally, you’ll explore the best practices for integrating blockchain solutions for fintech business.

Table of Content:

- Key Benefits of Blockchain Integration in Fintech

- Successful Use Cases of Blockchain Integration in Finance

- How to Integrate Blockchain Into Your Business: IdeaSoft & Sigma guidance

- Summary

Key Benefits of Blockchain Integration in Fintech

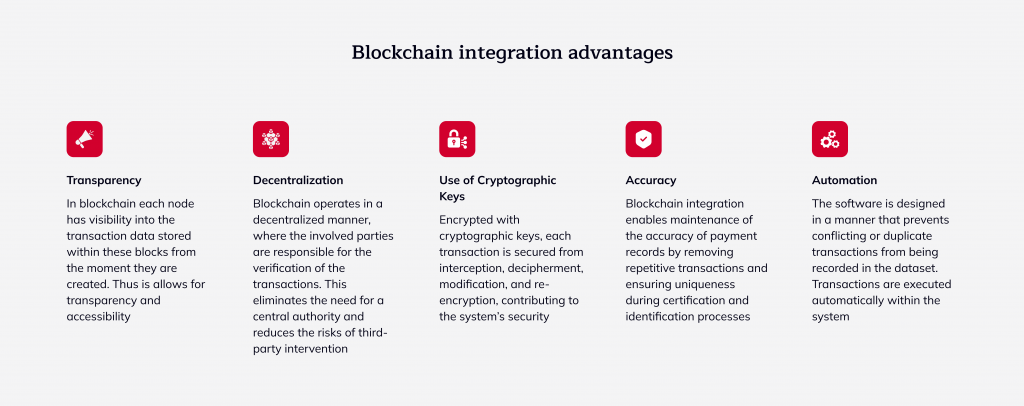

Before integrating blockchain technology into any fintech product, it’s important to ensure it’s actually worth it. So, let’s first review the key advantages of merging blockchain and fintech from the business development standpoint, which the top blockchain experts from IdeaSoft and Sigma Software have summarized.

Enhanced Security

Blockchain integration allows for improving system security through innovative cryptographic techniques and decentralized network solutions. As a result, businesses can reduce the risks of data tampering, fraud, and unauthorized access to financial transactions.

Improved Transparency

With the integration of blockchain applications in finance, all completed transactions become traceable from the genesis block, with the payment details being public to all authorized participants in real-time. This reduces disputes and improves trust among stakeholders, yet can enhance the credibility and trust in the FinTech industry as a whole.

Greater Automation & Efficiency

The application of blockchain also streamlines numerous financial and banking processes through task automation. In particular, this is achieved through paperwork reduction, improved transaction time, direct interactions between participants, and other optimizations to enhance operational efficiency.

Accelerated Transaction Management

The decentralized nature of blockchain in financial services can greatly benefit in terms of management and processing. Removing intermediaries and enabling direct peer-to-peer interactions helps to streamline the transaction process, reduce delays and improve the overall system performance and efficiency.

Additionally, automated smart contracts enhance transaction management by optimizing and enforcing the terms of agreements, resulting in faster and more accurate transaction processing.

Data Integrity

The immutable and tamper-proof features of blockchain make it an ideal solution for sensitive data storage and management. In particular, blockchain integration provides the add-on security layer for client data, transaction records, regulatory compliance documents, and other critical information, ensuring its accuracy and trustworthiness while maintaining data privacy and consent.

Risk Mitigation

By providing transparent and auditable transaction records, integrating blockchain technology into your business can significantly mitigate risks associated with fraud, money laundering, and unauthorized activities, thus enhancing regulatory compliance of your fintech solution.

Along with that, there are some other benefits of implementing blockchain solutions for fintech as a whole:

Successful Use Cases of Blockchain Integration in Finance

Before you start planning blockchain integration for your fintech business, let’s discuss the potential of this technology in the fintech niche. Below are some of the latest apps featuring different fintech types which have really benefitted from embedding the relevant blockchain solutions:

- Compliant trading of tokens on public blockchains and multiple exchanges – Securitize Insurance Platform. Leveraging the blockchain-based Digital Securities Protocol (DS Protocol) has enabled effective and secure cross-border transactions at a reasonable cost.

- Free-fee blockchain-based online marketplace – Openbazaar startup. The company built the decentralized concept of eCommerce with a similar structure to the eBay platform, enhancing transaction processing with blockchain payment technologies.

- P2P money transfers through blockchain technology – Abra. This blockchain banking company has come up with a simple application offering a decentralized payment solution for cost-efficient micro-payment services.

- Blockchain-powered digital cryptocurrency wallet – BitPay. By integrating blockchain, BitPay has built a secure and transparent payment solution that enables users to send their cryptocurrency assets (like Bitcoin, Ether, or Ripple) from their computer or mobile device directly to a payment address, where they can be later deposited to the bank account or cryptocurrency wallet.

Along with that, IdeaSoft and Sigma Software have extensive expertise in other blockchain niches. Feel free to review our Blockchain-based projects portfolio or contact our experts to discuss the best practices for launching a fintech app and building a blockchain-based solution for your business!

How to Integrate blockchain solutions for fintech business: Best Practices from IdeaSoft & Sigma Software

At IdeaSoft, we continually improve our experience and knowledge across different domains, all this to deliver the best solutions for every client. In blockchain and fintech development, our specialists closely cooperate with Sigma Software to improve the expertise, strengthen the skills and integrate the most efficient tactics in each project. Our developer teams actively participate in joint workshops and share experience in building innovative software products for any business and industry.

Based on our recent research for the fintech industry, we’ve summarized the major recommendations on how to integrate blockchain into a business successfully.

#1 Identify the Relevant Use Case

To stay ahead of the competition among fintech companies, planning the use-case-driven project first is important. Additionally, make sure to focus not only on your business goals and needs but also on your client’s pains and market trends as well.

We recommend doing comprehensive research on the niche-related projects on the market, identifying their strong and weak points to build a competitive and functional blockchain solution for the fintech industry.

#2 Explore the Most Effective Blockchain Solutions

A common mistake of applying blockchain in financial services is to fall for the hype, putting it virtually everywhere randomly. However, making data-driven decisions about blockchain integrations tailored to your business and its clients makes more sense. While some projects can benefit from private networks, others may need a fully decentralized solution.

For any fintech company, our developers from IdeaSoft and Sigma help to choose an effective and profitable blockchain integration strategy, ensuring it fully aligns with your business goals and client needs.

#3 Analyze Data Leakage Issues

The fintech industry operates with tons of sensitive data and information, which is the choicest piece for hackers and fraudsters. For this reason, fintech companies must prioritize the security of each document, ensuring it’s always safeguarded and can’t be compromised. At the same time, when entrusting blockchain integration to software development vendors, you need to ensure the selected company shares your values.

For instance, reliable blockchain integration companies, such as IdeaSoft or Sigma Software, always sign the NDA contract to keep the shared information confidential. Additionally, such companies continually work on improving the system’s security and adopt the latest solutions to prevent any third-party breaches or data leakage issues.

#4 Hire Dedicated Blockchain Developers

In-app blockchain integration requires deep expertise, experience, and dedication to develop an efficient and profitable solution. So, to identify and integrate the best blockchain for financial services, engaging the corresponding tech stack and skill set is of the essence.

To get the top expertise for your fintech project, consider hiring the top developers from reputable blockchain integration companies like IdesSoft and Sigma Software. This will help you develop a competitive and efficient solution that fully aligns with your business goals and client needs.

Summary

Since more and more blockchain startups are emerging in fintech, it’s getting harder to build a competitive product that fully aligns with the current trends and market needs. However, with the right development expertise and technical know-how, this technology can significantly enhance your business performance while keeping your fintech products functional, secure, and relevant to your clients. Combining blockchain with tailored mobile development solutions can further expand the reach and usability of your fintech offering.

Having explored the best practices of blockchain integration for fintech, it’s now time to start implementing it into your business! Contact our specialists at IdeaSoft and Sigma Software to explore how you can make the most of the top blockchain solutions today!