Over the last few years, Decentralized Finance (DeFi) has grown from a niche topic into a full-fledged ecosystem. With promises of open, transparent, and permissionless financial services, DeFi has drawn the attention of developers and users, but most importantly, banks. Some might feel that traditional financial institutions perceive decentralized finance for banks as some kind of disruptive threat.

Explore how DeFi can streamline your financial processes—speak with our experts!

Let us help you figure it out, and correctly draw up project requirements for your business.

Still, an emerging perspective is that banks and DeFi could coexist or, better yet, thrive together. Going forward, one can also consider DeFi solutions encapsulated inside traditional banking frameworks, perhaps even opening new lines of financial products.

We see that the legislation for digital assets is increasingly being applied across countries and industries. The future will see a convergence between fiat and crypto, positioning DeFi as part of a new range of banking products. For example, we have already discussed how digital currencies benefit banks, and in this article want to discuss the benefits of DeFi for banks.

Table of contents:

- Potential Benefits of DeFi for Traditional Banking

- Is Cooperation Between DeFi and Traditional Banking the Key for Millennials & Gen Z?

- Steps for Traditional Banks to Embrace DeFi

- How IdeaSoft Can Support Your Bank Growth

- Future Predictions for Traditional Banking and DeFi

- Summary

Potential Benefits of DeFi for Traditional Banking

At first glance, it might seem counterintuitive for banks to embrace DeFi. After all, its core value proposition seems to be bypassing traditional financial intermediaries. However, banks have a few strong incentives to integrate DeFi solutions into their product lines. It all lies in the DeFi banking innovation.

First, consumer demand is shifting. As more and more “digital citizens” grow older and build financial muscle, demand seems sure to grow for digital-first, decentralized financial services. These consumers prize three things:

- Speed

- Transparency

- Control

As you probably guessed, all these things are at the core of DeFi. Using the products on offer with DeFi will allow banks to reach this developing demographic, too, while they continue reassuring more conservative customers with regulation and its attendant trust.

Moreover, the financial benefits of DeFi for banks can unlock additional sources of revenue. Since interest rates are currently meager, financial institutions are eyeing ways through which new revenues could be generated. Protocols under DeFi come with yields that are considered higher than savings accounts and, therefore, present an opportunity for banks to offer more attractive financial products to their customers.

There are numerous DeFi opportunities for banks here. By merging fiat and crypto within DeFi, banks can create a new class of financial products that tap into the advantages of both systems.

Is Cooperation Between DeFi and Traditional Banking the Key for Millennials & Gen Z?

At the core, millennials and Generation Z truly think about money differently than earlier generations did. In fact, what they want is flexibility, speed, and transparency. Nobody wants to go to a physical branch anymore or wait several days for a transaction to happen.

Instead, they seek out digital-first, user-friendly financial solutions. Meanwhile, cryptocurrencies and DeFi platforms align perfectly, offering 24/7 access, lower fees, and direct peer-to-peer transactions.

In fact, people often say that changes in traditional banking come at a snail’s pace. It just clings to its legacy systems that may be perceived as outdated by the younger generation. But what if it is possible to apply DeFi for financial institutions? Could it be that the combination of DeFi’s innovation with the trust and security of traditional banks finally gives us the ultimate solution? How to create a mobile banking app with DeFi banking innovation in mind?

Banks adopting decentralized finance could find in a partnership the best of both worlds for Millennials and Gen Z. It’s the place where younger generations can get tech-savvy, borderless services through a DeFi platform, with banks providing security and regulatory stability that is often missing in DeFi.

Steps for Traditional Banks to Embrace DeFi

We have a neobank development case study. Based on it and our experience in DeFi, here are 2 points banks must carefully consider.

The Regulatory Roadblocks

To apply the benefits of DeFi for banks, financial institutions must overcome several key hurdles. They revolve around:

- Regulation

- Compliance

- Trust

Historically, the financial sector has been tightly regulated. Every transaction must comply with Anti-Money Laundering (AML) rules, Know Your Customer (KYC) protocols, and a range of other regulatory frameworks designed to prevent illicit activities.

Regulation and compliance are crucial for banks to adopt DeFi. Without clear guidelines on how to integrate crypto-based financial services into the existing regulatory frameworks, banks will hesitate.

And it’s not just about having laws on paper. Banks must also fully understand the risks and mechanisms of DeFi, particularly when it comes to AML compliance in the world of crypto. As crypto assets are more “fluid” and, in some cases, anonymous, they present a significant challenge. DeFi platforms often operate without intermediaries, which can make tracking and reporting suspicious transactions a tricky proposition for traditional financial institutions.

Integrating DeFi mechanics can enhance your enterprise’s financial operations

Explore how DeFi can streamline your financial processes—speak with our experts

Nevertheless, the legislative environment is slowly catching up. Several countries, including the U.S. and those in the European Union (MiCA), are beginning to draft clearer rules around digital assets and decentralized finance. This momentum is essential for banks to feel comfortable entering the DeFi space.

As regulations tighten and become more precise, we’ll likely see more banks exploring partnerships with DeFi platforms or developing in-house DeFi solutions. DeFi for financial institutions is just a new source of innovative ideas.

The Role of User Experience (UX)

While regulatory compliance is crucial, the most significant factor for DeFi’s success within traditional banking lies elsewhere. The most important thing is that the user experience of DeFi must be understood by people. Only when DeFi solutions are intuitive and accessible to the everyday user will we see widespread adoption.

Today, DeFi platforms, while powerful, are often difficult for the average user to navigate. Many concepts are barriers to entry for those unfamiliar with the crypto world. We mean:

- Gas fees

- Private key management

- Multi-chain wallets

- Swapping

- Stacking

- Bridges

To get improved banking with DeFi, these complexities must be abstracted away. The ideal future is one where users don’t even realize they’re interacting with a DeFi system. They simply experience a seamless, intuitive banking product.

Think of account abstraction and chain abstraction as examples. We envision a future where users have wallets they access using their face or fingerprint instead of complicated seed phrases. Where transactions happen seamlessly, and users pay gas fees not in ETH, but in the same currency they’re using for their transaction.

This level of simplicity is the key to making DeFi accessible to the masses. Banks, which are well-versed in delivering user-friendly products, can develop this kind of seamless interface for DeFi.

IdeaSoft has a professional design team dedicated to clients` products success. Our design projects are published on our official Behance page. All of them are made with the latest UI/UX trends of 2024 in mind.

How IdeaSoft Can Support Your Bank Growth

While most of the world’s banks look toward new frontiers, many are looking at DeFi as a value addition to their service offerings and internal operations. A few of the most popular ones are asset tokenization, private or public CBDC development and DeFi integration into banks’ lending & borrowing processes.

Let’s examine solutions banks consider:

- Central Bank Digital Currencies (CBDC). Central banks around the world are in the pilot phase of digital currencies, upgrading financial transactions and making them secure. Digital forms of national currencies powered by blockchain technology will enable instant, low-cost payments with more transparency and simplify cross-border settlements. In turn, banks adopting CBDCs will make it much easier for themselves to cope with a rapidly transforming digital economy.

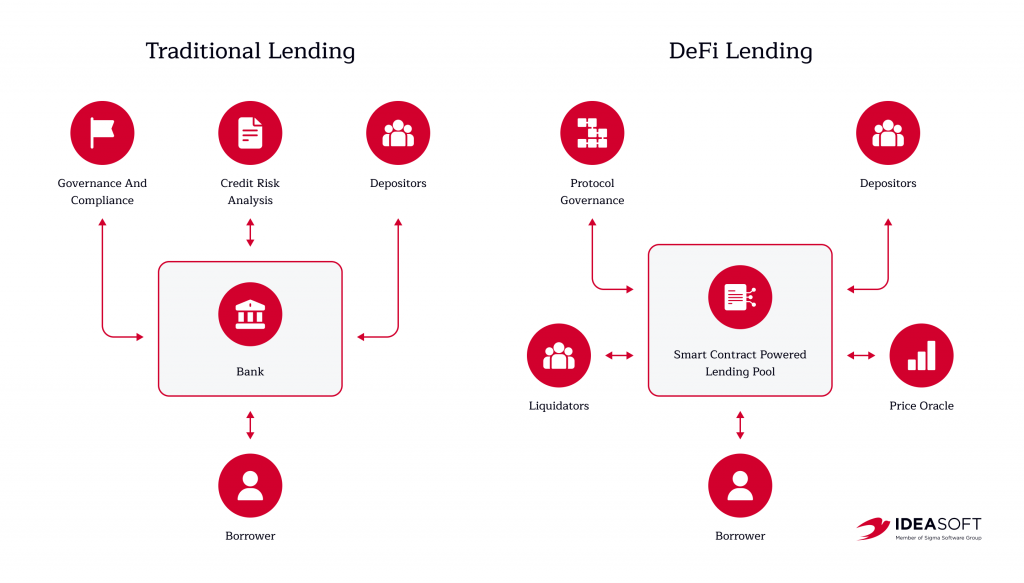

- DeFi lending and borrowing protocols. Large financial institutions have begun to implement DeFi-influenced lending platforms. Such platforms offer a host of benefits for banks, including the capacity to provide more flexible loan products, reduction of risks because of collateralized lending models, and automation of key processes with smart contracts. Decentralized lending is also in demand by customers for more transparency and self-control over their financial decisions.

- Tokenization of traditional assets. Major banks are exploring tokenization, which is an on-blockchain way of digitally representing ownership of assets. This enhances the liquidity of relatively illiquid assets, say real estate or fine art, and allows them to be more easily and securely tradable on a digital platform.

We are proud to share that recently, our team has started cooperation with Credit Agricole, one of the largest banking groups in Europe. This cooperation is an exciting step toward the direction of digital financial futures. As a blockchain vendor, our role will assist Credit Agricole with innovations and adapt to new market demands by using cutting-edge blockchain solutions.

Future Predictions for Traditional Banking and DeFi

This will be a process of integration that will not happen overnight, and the trend is already in this direction. Banks are watching the space closely now, with some making their first moves. For instance, some financial institutions have been studying exactly how they can use stablecoins to settle transactions with far greater efficiency. Decentralized finance banking benefits have been actively examined worldwide.

Full-scale adoption, however, requires many factors to fall in place. Compliance, regulation, and AML have to be appropriately addressed. The banks will require some time to understand the complete risk profile of the DeFi platforms and get their internal systems tuned for that. Most importantly, the user experience of DeFi in traditional banking needs to come to a level that is practically indistinguishable from traditional banking products.

The industry is moving towards this. In the next few years, we expect to see banks offering DeFi solutions as part of their regular product lines. The key will be to create simple, compliant, and user-friendly products that appeal to both crypto enthusiasts and the average consumer alike.

Conclusion

As we have discussed, Millennials and Gen Z seek financial solutions that are faster, more transparent, and technologically modern. What they think about decentralized finance speaks volumes, and traditional banks can’t afford to turn a blind eye to it.

That would mean that, with the incorporation of DeFi advantages for banking, financial institutions can offer state-of-the-art services by meeting the expectations of a new digital generation and retaining all the features that make them trustworthy and regulated.

Challenges for DeFi in banking industry exist, but so do opportunities. And our FinTech software development services can help you overcome it! Contact us through the form below.