DeFi is a fast-growing market that consists of various types of decentralized financial projects. According to DeFiPulse, the total value locked in DeFi is only increasing and already reached $50 billion. So there is no surprise that DeFi has become one of the most popular blockchain trends in the past year. This popularity has led to the emergence of many promising products and even more are under development. In this article, we’ll tell you what DeFi is, what the DeFi ecosystem consists of, and how to get started with DeFi.

Table of contents:

- What is DeFi

- The current DeFi ecosystem

2.1 Decentralized crypto exchanges (DEX)

2.2 Lending/borrowing platforms

2.3 DeFi aggregators

2.4 DeFi payment solutions

2.5 DeFi insurance - How to get started with DeFi

What is DeFi

DeFi (decentralized finance) is a set of specialized services based on smart contracts and decentralized applications (Dapps), which form a decentralized financial ecosystem. This ecosystem provides users with access to a variety of financial services, such as investing, lending, trading, etc. There are a lot of different types of DeFi projects. The best DeFi projects are available to everyone 24 hours a day with no restrictions due to the active development of blockchain technology and the Ethereum platform in particular.

Key advantages of a decentralized financial system (DeFi):

- Accessibility to any user, regardless of geographic location, credit history, and other limitations of the centralized financial system.

- Transparency of all blockchain transactions. All smart contracts are open source, so they can be easily audited.

- Self-custody. Thanks to decentralized features users always keep custody of their assets and control of their personal data.

- Permissionless allows users to interact with applications directly through browser extensions (or wallets) and also provides the ability to create their own applications.

- Interoperability provides amazing opportunities to combine new DeFi applications with existing services. They communicate with each other via universal protocols and developers can combine them to create entirely new products.

The best DeFi apps have a multi-million audience, and the volume of transactions exceeds millions of dollars. According to DeFi Pulse, the dollar value of assets locked into DeFi protocols surpassed $13 billion at the end of 2020, up 2,000% from January. Since the market is young, there is not much competition, so it is easy to enter this market now. It seems like top DeFi projects are going to hit the jackpot this year, as interest in this market is only increasing.

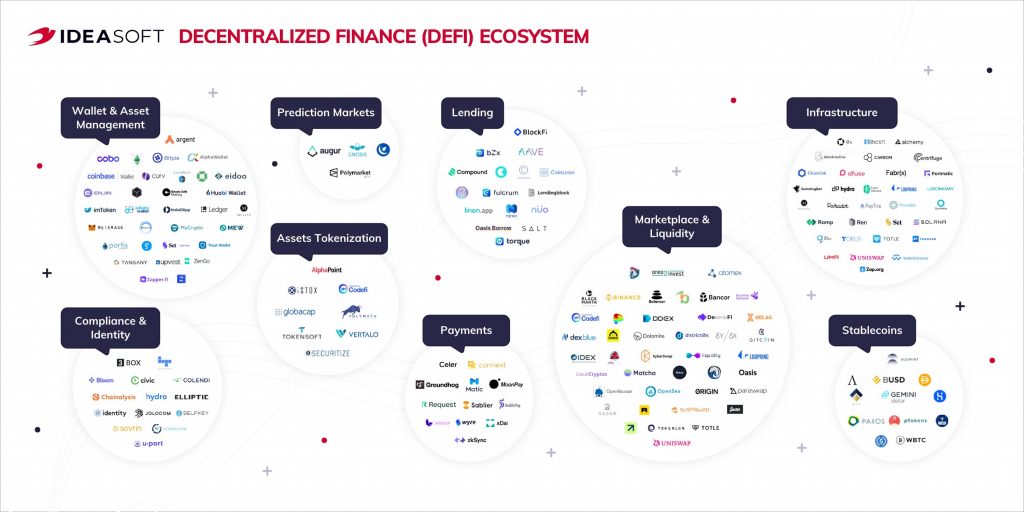

The current DeFi ecosystem

DeFi is on the rise now because it can be a great alternative to traditional financial systems. And if you can create a product that is interesting to the audience, then you can take a good place at the origins of the DeFi market. What are the top DeFi projects? It is difficult to list them all. So we have put together a list of the most popular types of DeFi projects.

Decentralized crypto exchanges (DEX)

A decentralized exchange (DEX) is an exchange that operates on the basis of a distributed ledger. It doesn’t store user funds and personal data on its servers and acts only as a platform for matching bids to buy or sell user assets. Trading on such platforms takes place directly between participants (peer-to-peer) without any financial intermediaries. However, most of the existing exchanges that call themselves decentralized are not completely decentralized: they use their own servers to store trading data, and users keep private keys on their own.

Here is how centralized exchanges work. Centralized exchanges are managed by a specific company or person who is profit-oriented. Exchange managers are responsible for the protection of user data and information about trades, fully control the platform and make decisions that are important for the development of the project. But this is not the case with decentralized platforms. Decentralized crypto exchanges are managed automatically or semi-automatically with the involvement of platform participants in the process of making important decisions. Such platforms provide the technical possibility of direct interaction between the participants and use a distributed ledger (blockchain) to store and process all (or almost all) data.

Examples of decentralized exchanges (DEXs): IDEX, Waves Dex, Bancor Network.

Lending/borrowing platforms

Lending/borrowing platforms are services that provide an opportunity to borrow or lend through a crypto network. Technically, this lending space is similar to a traditional institution that offers financial loans to people and businesses. The only difference is that DeFi does it without intermediaries.

Any blockchain user can transfer coins to a certain lending platform, which will lend crypto to another user at interest. DeFi lending is governed by smart contracts. When a person lends or borrows funds, he or she signs a contract with the other party that specifies all the details, such as repayment period, interest rate, etc. Compared to traditional lending, DeFi offers notable advantages. The most important of them is transparency and simplicity of the process thanks to the absence of third parties. All you need is an account on one of DeFi’s platforms and a crypto wallet.

Examples of lending/borrowing platforms: Compound, MakerDAO, Nuo Network.

DeFi aggregators

According to Messari, about 20% of the total trading volume of non-custodial Ethereum exchanges is generated with the help of the so-called DeFi-aggregators. Such services not only help reduce transaction costs but also simplify user interaction with DeFi services.

A DeFi aggregator is a complex platform that collects and sorts information about different DeFi services. DeFi aggregator is a base of a large amount of information on a specific topic in one place. Thanks to DeFi aggregators, users save their time. In particular, they don’t have to search for data on different sites.

The advantage of such platforms is that there is an opportunity to set up a filtering system. The functionality of the aggregator depends on its focus. For example, platforms like RAY match users with the most profitable DeFi services, helping to maximize the profitability of blocked crypto assets. DEX-aggregators 1inch and DEX.ag enable users to exchange crypto-assets at the most favorable rate with minimal “slippage”.

Examples of DeFi aggregators: 1inch, DEX.ag, Value DeFi.

DeFi payment solutions

DeFi payment solutions create a more open economic system for users and help large financial institutions streamline market infrastructure and better serve wholesale and retail customers. With DeFi solutions, users can securely and directly exchange cryptocurrencies with each other, without intermediaries.

DeFi payments apps and protocols provide better value-added payment solutions, such as cheaper transactions, instant payment apps, and more. Additionally, cross chain DeFi solutions enable seamless transactions across different blockchain networks, enhancing the versatility and reach of DeFi payment systems.

Examples of DeFi payment solutions: Celer Network, Connext Network, Matic Network.

DeFi insurance

Decentralized financing has created a need for new forms of insurance. Large cryptocurrency deposits can be stolen or devalued within minutes. Smart contracts can contain unforeseen errors, making any funds they contain permanently unavailable. These risks require a new insurance system. Players in the decentralized insurance space are providing democratized versions of traditional insurance. The insurance mechanism is simple. Users of an insurance platform provide liquidity to cover damage in the case of an insured event, and they themselves receive interest for providing liquidity.

Most insurance projects on the market today offer a wide range of services, including insurance against hacking of protocols, technical and other errors that may lead to loss of funds, the bankruptcy of a token or stable coin issuer, and many others. When selecting an insurance provider, people pay attention to the territorial coverage, the services offered, the insurance payments, and the list of insured events, as well as the technical and legal features of the project.

Read our recent article on Insurance trends 2021

Examples of DeFi insurance platforms: Nexus Mutial, ETHERISC, VouchForMe.

How to get started with DeFi

If you have decided to develop a DeFi product, you definitely need the help of an experienced development team. Developing decentralized platforms requires good expertise and a deep understanding of blockchain technology. The last year has been a boom for DeFi, but it also showed the vulnerabilities of decentralized finance if you neglect the security and quality of smart contracts. Therefore, to get started with DeFi, discuss your idea with the professionals to find out the best ways to implement it.

Emerging trends like SocialFi, which blend social media with decentralized finance, are also worth considering for innovative financial solutions.

To maximize your project’s potential, consider partnering with experts who can develop cross-chain DeFi platforms, ensuring seamless interoperability and enhanced functionality.

IdeaSoft has been developing different types of blockchain projects for clients all over the world for more than 5 years. During this time we have delivered more than 250 projects including crypto exchanges, blockchain protocols, NFT marketplaces, issuance platforms, trading/auction platforms. Our in-house development team knows what tech stack and architecture to choose for different kinds of projects. The extensive experience of IdeaSoft developers allows us to create products of any complexity, and the business model we work on will help you cover all project tasks within one company, from business analysis and design to programming, testing, and support.

Feel free to share your ideas with the IdeaSoft team. We will do our best to bring them to life in the best way. Contact us to get a free consultation with a technical specialist or a project estimate. And good luck with your DeFi product, you’re on the right way!