In DeFi, protocols and traders suffer from fragmentation across dozens of decentralized exchanges. They face issues such as contract risk, price slippage, and capital inefficiency. As a new DeFi platform creator, it is mission-critical to address this fragmentation: users need seamless and secure access to the best-of-breed liquidity.

This guidebook is for DeFi founders, product teams, and investors thinking about how DEX aggregators address these problems. You’ll learn how aggregation removes capital inefficiency, reduces contract risk, and optimizes user experience.

We at IdeaSoft specialize in creating and deploying secure, scalable, custom DEX aggregators for your business or protocol model. For example, we developed a decentralized insurance platform for BridgeMutual. Continue reading to discover how best DEX aggregators work, key design implications, and why it is essential to collaborate with the correct development team.

Considering building a feature-rich DEX?

Contact our experts!

Table of Contents:

- What Are DEX Aggregators?

- Top 6 DEX Aggregators: Features and Benefits

- How to Choose the Right DEX Aggregator for Your Business?

- Key Types & Features of DEX Aggregators

- Technical Considerations When Integrating DEX Aggregators into Existing Platforms

- Conclusion

What Are DEX Aggregators?

DEX aggregators are specifically crafted platforms that interact with multiple decentralized exchanges simultaneously. Instead of requiring users to manually inspect prices and liquidity on each DEX, they present a unified interface that rationally routes trades to achieve the best outcomes.

What Problems Do Aggregators Address?

Liquidity in DeFi is fragmented across dozens of chains and DEXs. This fragmentation results in:

- Thin liquidity on certain trading pairs;

- Widely spread prices;

- Increased slippage;

- Risk of costly or failed transactions.

Need a vivid example? Alice must swap 50 ETH for USDC. In the absence of an aggregator, she manually checks Uniswap, SushiSwap, and Balancer prices, each with dissimilar rates and liquidity. She might get a poor rate or suffer slippage on one exchange.

Alice sets her trade once using a DEX aggregator. The aggregator’s intelligent routing algorithm splits her order automatically: 20 ETH on Uniswap, 15 on SushiSwap, 15 on Balancer, each at the best price. She receives the optimal blended rate with the least slippage, all in a single transaction.

How Do They Work?

DEX aggregators use smart contracts and APIs to:

- Query real-time prices and liquidity across connected DEXs;

- Calculate optimal trade routes to minimize price impact and costs;

- Split and send orders to multiple sources in one transaction;

- Return the results to the user in real-time via a single interface.

Smart contracts ensure trustless execution: users always have control over their funds until settlement, reducing counterparty risk.

Benefit for DeFi Projects

For DeFi product teams and founders, adding aggregator logic offers intuitive benefits:

- Better prices. Optimized execution across multiple liquidity sources automatically;

- Less slippage. Splitting orders prevents large price movements on liquid pools;

- Lower gas charges. Transactions as individuals cut out costly, redundant on-chain interactions;

- Improved user experience. Frictionless trading enables user retention and higher volumes;

- Competitive advantage. Stand out with the best rates and silky UX.

By solving issues of fragmentation and inefficiency, aggregators on decentralized exchanges have become a fundamental building block for any DeFi trading platform.

Top 6 DEX Aggregators: Features and Benefits

The best DEX aggregator list features several prominent platforms, each bringing unique advantages to the DeFi ecosystem. Understanding their distinctive features and capabilities helps businesses make informed decisions about integration and partnership opportunities.

Here is a feature comparison of the top DEX aggregators.

| Feature | 1inch | Velora | Matcha | Cowswap | OpenOcean | Kyberswap |

| Supported Networks | Ethereum, BSC, Polygon, Arbitrum, Optimism, Avalanche | Ethereum, BSC, Polygon, Avalanche | Ethereum, BSC, Polygon, Optimism | Ethereum, Gnosis | Ethereum, BSC, Polygon, Solana, Avalanche | Ethereum, BSC, Polygon, Avalanche, Arbitrum |

| Key Technology | Pathfinder Algorithm | Multi-Path Engine | 0x RFQ System | CoW Protocol | Cross-Platform Routing | Dynamic Market Maker |

| Liquidity Sources | 250+ | 100+ | 70+ | DEX + CoW | DEX + CEX | 100+ |

| Gas Optimization | Chi Gas Token | Built-in Optimizer | 0x Protocol | Gasless Trading | Cross-Platform | Elastic Pools |

| API Access | Professional API | Full API Suite | Developer API | REST API | Universal API | Professional API |

| Unique Features | Limit Orders, Farming | Post-Settlement Checks | Professional Analytics | MEV Protection | CEX Integration | Amplified Pools |

| Target Users | Professional Traders | Developers & Enterprises | Institutional Traders | Retail Users | Cross-Platform Traders | Professional Traders |

1inch

Ideal user type:

- Professional traders;

- High-volume DeFi projects;

- Institutional desks.

Features:

- Pathfinder algorithm for smart order splitting;

- Chi Gas Token for gas fee optimization;

- Limit order and farming protocols;

- Multi-chain support (Ethereum, BSC, Polygon, Arbitrum, Optimism, Avalanche);

- 250+ liquidity sources.

A DeFi wallet like Trust Wallet has 1inch’s API integrated to allow users to swap tokens at the best prices within the app without the need to leave the wallet. Such integration improves user retention through best-execution trading natively.

Why 1inch? If your task is to offer professional-grade execution with high liquidity and advanced gas savings to high-frequency traders, 1inch offers one of the most battle-hardened infrastructures.

Velora

Ideal user type:

- Developers;

- FinTech companies;

- Enterprise-class DeFi platforms.

Features:

- Multi-Path routing engine with slippage protection;

- Full-fledged, modular API kit for custom integrations;

- Embedded gas optimization;

- Supports Ethereum, BSC, Polygon, Avalanche;

- 100+ liquidity sources.

Ledger, the hardware wallet company, uses Paraswap’s API to allow users to safely swap tokens from their devices. This fact shows it is a secure middleware integration for security-oriented platforms.

Why use Paraswap? Best suited for technical teams that need a robust, flexible API to add custom swap functionality to wallets, fintech apps, or DeFi protocols with full control over routing logic.

Matcha

Ideal user type:

- Institutional traders;

- Analytical trading desks;

- High-end DeFi apps.

Features:

- RFQ system for direct market-maker price;

- Higher-end trading analytics and charts;

- Professional-level UX;

- 0x Protocol backbone;

- Supports Ethereum, BSC, Polygon, Optimism;

- 70+ sources of liquidity.

Matcha’s RFQ system can be integrated into a DeFi analytics platform to give users not only swaps but the ability to request institutional quotes. It is an ideal solution for high-value trades that need quoted prices.

Why choose Matcha? For professional-grade platforms that need tight spreads, direct market maker quotes, and higher-end analytics.

Cowswap

Ideal user type:

- Ethical DeFi apps;

- Retail traders;

- Cost-conscious dApps.

Features:

- Coincidence of Wants (CoW) Protocol for batch auctions;

- MEV front-running protection;

- Gasless trading experience;

- Ethereum and Gnosis support.

A DAO focused on communities can incorporate Cowswap to offer gasless, MEV-protected, equitable trading for its members. This way, it can lessen entry barriers for small-scale traders.

Why choose Cowswap? It is ideal for projects that prioritize user protection against MEV attacks, equitable pricing of trades, and a smooth experience for retail audiences with smaller wallets.

OpenOcean

Ideal user type:

- Cross-chain traders;

- Arbitrageurs;

- CEX+DEX strategies;

- Multi-chain dApps.

Features:

- Both DEX and CEX liquidity together;

- Cross-platform routing engine;

- Ethereum, BSC, Polygon, Solana, and Avalanche supported;

- CEX integration for arbitrage opportunities;

- 100+ liquidity sources.

A trading bot can use OpenOcean’s API to find and execute arbitrage opportunities between centralized exchanges and DEXs.

Why choose OpenOcean? It is best for platforms that wish to offer seamless cross-chain and cross-platform trading. It gives traders access to both CEX and DEX liquidity in one place.

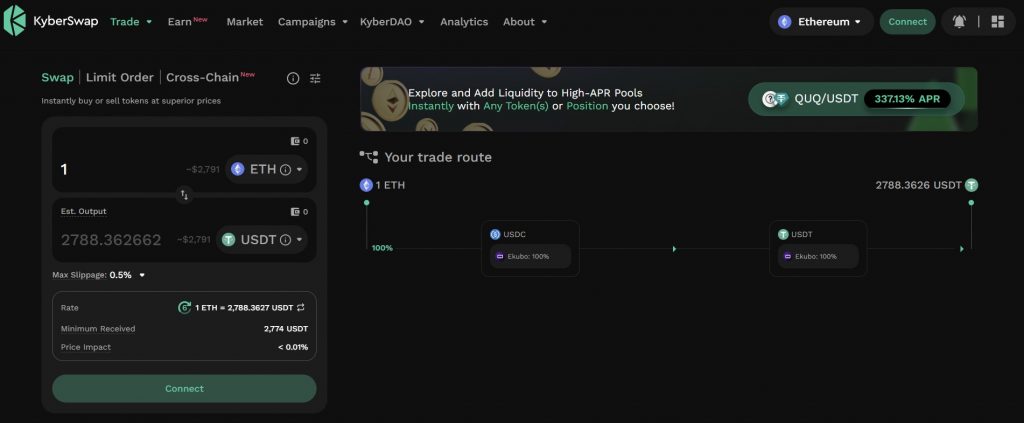

Kyberswap

Ideal user type:

- Institutional desks;

- Liquidity providers;

- Professional DeFi platforms.

Features:

- Dynamic Market Maker (DMM) protocol for maximum capital efficiency;

- Elastic Pools with improved liquidity zones;

- Advanced analytics for liquidity providers;

- Professional API access;

- Supports Ethereum, BSC, Polygon, Avalanche, Arbitrum.

A DeFi yield aggregator can integrate Kyberswap to send user deposits into the most efficient pools. This way, it maximizes the yield strategy with improved liquidity provisioning.

Why Kyberswap? It is optimally built for teams with a focus on capital efficiency, professional trading interfaces, and advanced liquidity management for institution-quality DeFi platforms.

Need a trusted partner for blockchain development?

Our DEX Development Services can bring your vision to life!

How to Choose the Right DEX Aggregator for Your Business?

Making the correct aggregator selection requires balancing users’ requirements, technical specifications, and strategic goals. Use this step-by-step guide to make an informed choice.

Step 1: Identify Your User Type and Use Cases

Start by clearly delineating your target users and the main problems you need to solve:

- Retail traders. Favor simplicity, intuitive UX, low gas costs, and MEV (front-running) protection. A new user DeFi wallet application may welcome Cowswap’s gasless trading and MEV protection.

- Professional traders. Focus on top-tier routing algorithms, analytics platforms, and institutional-grade liquidity. A professional trader dashboard may use 1inch or Matcha to access deep liquidity and RFQ quotes.

- Institutions and enterprises. Look for customizable APIs, high-compliance support, and good SLAs. An OTC fintech institutionally-targeted platform will find Velora’s enterprise-level modular API and specialized support appealing.

Define your personas and what they care about.

Step 2: Assess Trading Volume and Frequency

Different aggregators excel in different volume profiles:

- High-Volume / High-Frequency. Choose aggregators that have shown intelligent routing (1inch’s Pathfinder, Paraswap’s Multi-Path) and gas optimization capabilities. These save money on large orders and high-frequency trading.

- Low-Volume / Infrequent Trades. Look for aggregators prioritizing user experience and transaction simplicity over optimization complexity.

- Batch Transactions. If your product batches multiple user orders, batch auction system aggregators (like Cowswap) will reduce fees and slippage.

Estimate daily trading volume and peak load to match the aggregator’s ability.

Step 3: Evaluate Technical Requirements and Integration Complexity

Consider asking yourself:

- Do you need highly customizable APIs to embed swaps deeply into your product pipelines?

- Are SDKs, REST APIs, or GraphQL endpoints available, and are they integrated with your development stack?

- Does the aggregator have good docs, developer support, and sandbox environments?

- Will you need custom routing logic or custom transaction flows?

For example, if you’re building a DeFi yield aggregator requiring complex order routing, Paraswap’s or Kyberswap’s APIs may be better suited than simpler consumer-focused aggregators.

Step 4: Consider Supported Networks and Future Scalability

Ensure the aggregator can cover your present and planned network strategy:

- Ethereum-only Projects/ Most aggregators support Ethereum, but gas costs can be high.

- Multi-Chain Roadmaps. Choose aggregators with consistent support across Polygon, BSC, Solana, Arbitrum, and other L2s.

- Cross-Platform Trading. If you want to supply CEX liquidity, OpenOcean offers CEX+DEX aggregation.

Sketch a map of networks you will support within the next 6–12 months and reduce aggregators accordingly.

Step 5: Consider Cost Efficiency and Economic Impact

Cost structure and gas handling will destroy or salvage the user experience:

- Gas Optimization. Look for features like Chi Gas Token (1inch) or gasless execution (Cowswap).

- Fee Structure. Evaluate aggregator fees per trade and any hidden fees (e.g., protocol fees, rebate schemes).

- Slippage Reduction. Some aggregators are more effective at minimizing price impact for large trades.

Test transactions to see how each aggregator affects true user cost.

Key Types & Features of DEX Aggregators

| Core Feature | Key Benefits | Technical Foundation |

| Liquidity Integration | Enhanced trading depth and better pricing | Smart contracts and standardized APIs |

| Routing Intelligence | Optimal execution and cost efficiency | Advanced algorithms and MEV protection |

| Cross-Chain Capability | Access to multiple blockchain ecosystems | Bridge protocols and unified settlement |

We also recommend you read our DEX (IDO) development guide.

Single-Chain DEX Aggregators

Single-chain aggregators represent the foundation of the ecosystem, focusing exclusively on optimizing trades within specific blockchain networks. These platforms excel at providing deep liquidity and minimal gas costs through specialized infrastructure. Their focused approach enables enhanced execution speed and efficiency. They are particularly valuable for high-volume trading within popular networks like Ethereum or BNB Chain.

Examples:

- 1inch (Ethereum-first approach) combines over 250 liquidity sources with its Pathfinder algorithm;

- Velora is a middleware-focused integration for Ethereum apps needing advanced routing and customizable APIs.

A DeFi wallet like Argent integrates 1inch’s Ethereum aggregation to offer users best-in-class single-chain swaps without leaving the wallet app.

Multi-Chain DEX Aggregators

Multi-chain aggregators have emerged as a more sophisticated solution, bridging the gap between different blockchain ecosystems. These platforms integrate cross-chain functionality to provide unified trading experiences across multiple networks.

Through advanced bridging protocols and unified interfaces, they enable traders to access liquidity pools across various chains seamlessly. Though this convenience often comes with additional complexity in terms of security and execution.

Examples:

- OpenOcean aggregates liquidity across Ethereum, BSC, Polygon, Solana, and more, including both DEX and CEX liquidity;

- Kyberswap offers Dynamic Market Maker (DMM) pools across chains like Polygon, Avalanche, and BSC.

OpenOcean integrated with Solana DEXs enables Ethereum-based users to access Solana liquidity via bridging, supporting cross-chain arbitrage strategies for advanced traders and bots.

Specialized DEX Aggregators

The ecosystem has further evolved to include specialized aggregators designed for specific trading requirements. MEV-resistant platforms protect trades from front-running and sandwich attacks, while gas-optimized solutions cater to high-frequency trading operations.

Institutional-grade aggregators incorporate advanced features such as customizable routing algorithms and improved security measures to meet the demanding needs of professional trading firms.

Examples:

- Cowswap uses the Coincidence of Wants (CoW) Protocol for batch auctions, protecting users from front-running and enabling gasless trades;

- Matcha has an RFQ system powered by 0x Protocol for direct market-maker quotes and institutional pricing.

A DAO with a large retail user base can integrate Cowswap to offer gasless swaps. This way, it protects users from MEV attacks while lowering transaction barriers for cost-sensitive traders.

Want to ensure liquidity is a core strength of your DEX?

Check out the Essential Features for DEX or let us make a quick audit for you!

Technical Considerations When Integrating DEX Aggregators into Existing Platforms

Technical roadmap for integration:

- Determine what user actions will trigger aggregator calls (e.g., in-app swaps, yield strategies, arbitrage bots);

- Select if you need a single-chain, multi-chain, or cross-chain facility;

- Verify supported API endpoints (REST, GraphQL, WebSocket);

- Ensure the aggregator’s API is compatible with your programming frameworks and languages;

- Verify rate limits, throttling, and reliability warranties;

- Audit the smart contracts of the aggregator for security and audit trail;

- Define contract interactions in your dApp design;

- Enforce robust user approval patterns for contract interactions;

- Discover if cross-chain swaps include third-party bridge integrations;

- Evaluate messaging protocols (e.g., Wormhole, LayerZero);

- Design collaborative settlement and reconciliation protocols for cross-chain trades;

- Design user-friendly swap interfaces;

- Display real-time price, estimated slippage, and fees;

- Offer clear transaction confirmations and transaction history;

- Cache price feeds and route proposals for planning purposes;

- Avoid excessive backend calls to avoid unnecessary aggregator API hits;

- Design server infrastructure to be scalable enough to handle maximum transaction rate.

Best practices our IdeaSoft team recommends you implement:

- Choose well-doc’d aggregators. Opt for services that have well-established, well-documented dev docs and SDKs.

- Audit your own code paths. Even with aggregator contracts audited, take caution not to create vulnerabilities in your integration.

- Implement slippage and gas controls. Make it possible for users to manage slippage tolerance and review estimated gas fees.

- Use rate-limited and cached queries. Avoid API abuse fees and reduce latency by caching price feeds.

- Test in staging environments. Use aggregator testnets or sandbox to test integration safely before mainnet deployment.

- Monitor transactions and failures. Monitor swaps end-to-end, log failures, and have alerts for greater-than-normal failure rates.

When integrating 1inch, wallets like Trust Wallet incorporated straight swap flows, user-accessible slippage controls, and routing information caching to reduce API load while maintaining a responsive UI.

Conclusion

The DEX aggregators list continues to evolve rapidly, with emerging trends pointing toward:

- improved cross-chain functionality;

- Advanced MEV protection mechanisms;

- Layer 2 scaling solutions;

- AI-powered routing optimization;

- Improved institutional integration options.

For businesses entering the DeFi space, DEX aggregators represent not just a technological solution but a strategic necessity. The ability to provide users with optimal trading conditions while maintaining efficiency and security has become a key differentiator in the competitive DeFi landscape.

As a leading DeFi DEX aggregator development company, IdeaSoft has years of experience in creating cutting-edge decentralized exchange solutions. Prioritizing security, performance, and user-centric interfaces above all, IdeaSoft helps businesses navigate DeFi space. How? Through customized aggregator platforms that meet the industry’s highest expectations! Turn to our DeFi DEX aggregator development company for effective collaboration!