One of the most widely used ways of investing in DeFi is yield farming. It is useful both for users who earn rewards and for DeFi platforms that maintain their liquidity. Not surprisingly, many people are interested in DeFi yield farming platform development. This article will tell you what you need for successful yield farming development and how to prepare if you decide to set up a DeFi yield farming protocol.

Table of contents:

- What is yield farming and how does it work?

- What is the difference between yield farm, liquidity mining, and staking?

- DeFi yield farming platform development:

3.1 Types of yield farming

3.2 The process of DeFi yield farming platform development - IdeaSoft expertise

What is yield farming and how does it work?

Yield Farming is a new way for cryptocurrency owners to earn passive income. If you have tokens, you can lend them on DeFi-platforms and get even more tokens back. So how do so-called “yield farmers” make money?

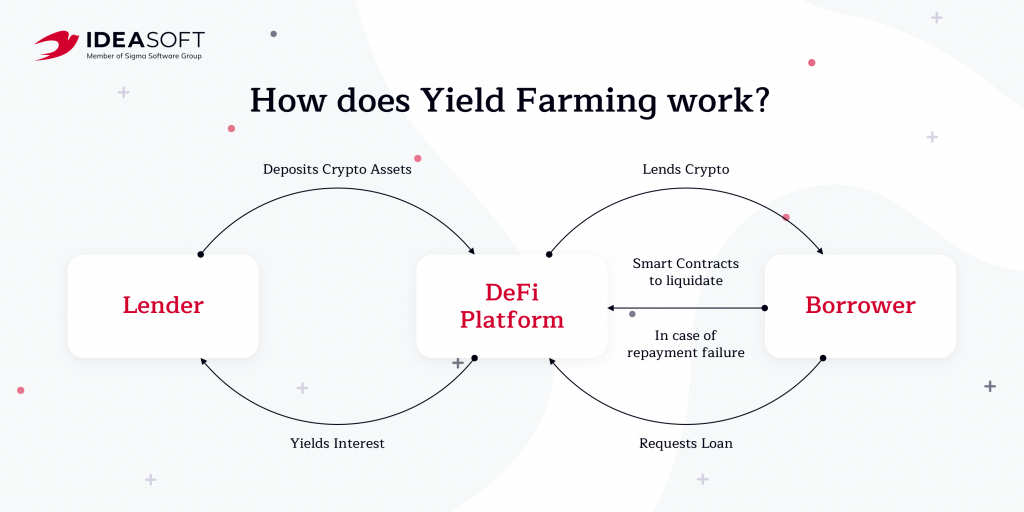

Any DeFi-platform where “farmers” can earn must get as many tokens as possible to ensure their quick exchange, i.e. high liquidity. To do this, cryptocurrency owners or “farmers” place their funds on the exchange and freeze them, thus forming a liquidity pool. A pool is a collection of funds locked in a smart contract. Token holders become liquidity providers, for which they receive a commission in the form of tokens. The process that is described below is yield farming.

With yield farming, liquidity providers provide a way to exchange funds that allows other users to borrow and sell. For this, they pay a commission to the exchange or platform, from which the “farmers” are remunerated. All tokens are placed on the exchange using smart contracts.

Yield farming can bring much more profit than investing in a deposit. However, there are some risks associated with the high volatility of the cryptocurrencies themselves. There is also the risk that a smart contract may contain an error that could lead to a loss of not only profits but also of all investments. That’s why when developing a DeFi product you shouldn’t forget about smart contract audits.

Yield farming is often confused with staking and liquidity mining. So let`s discuss the differences between staking and yield farming as well as liquidity mining.

What is the difference between yield farm, liquidity mining, and staking?

Staking is the process by which blockchains based on the Proof-of-Stake (PoS) algorithm work. Stakers are users who self-configure a node and join a PoS network to support the blockchain’s operation as a node validator. The main purpose of staking is not only to ensure the liquidity of the platform but also to ensure the security of the blockchain network. The more users bet, the more decentralized the blockchain is, and therefore it’s harder to attack. However, when it comes to DeFi staking, yield farming can be considered one of its varieties.

Liquidity mining is a mechanism that helps maintain balance in the market. DEX rewards users who contribute their assets to a common pool of liquidity which increases the liquidity of the exchange. In some ways, it is similar to yield farming, but with more processes going on. In most cases, liquidity mining is popular among liquidity providers who funnel their funds into different liquidity pools.

It’s clear that the lines between these types of yield farming platforms are very thin. Their goal is to earn interest by providing assets to different protocols and platforms.

DeFi yield farming platform development

There are different platforms and protocols on the market that allow users to generate passive income from their crypto assets. Moreover, they have different yield farming strategies and features. The complexity and speed of yield farming development depend on the number of features. So before getting into the details of the development process let’s first take a look at some examples of yield farming platforms.

Types of yield farming

These are 3 of the most famous yield farming platforms: Compound, MakerDAO, and Aave. Let`s talk about them.

- Compound is an algorithmic loan and lending platform. Any user with an Ethereum wallet can lend their funds to Compound’s liquidity pool and start receiving income instantly after a deposit. Rates are algorithmically calculated based on the supply/demand ratio.

- MakerDAO is a decentralized lending platform that supports the issuing of DAI tokens on bail ETH, BAT, USDC, WBTC. DAI is a stablecoin whose exchange rate is pegged 1:1 to the U.S. dollar. Yield farmers often use issued DAI to implement their investing strategies.

- Aave is a decentralized loan and credit protocol that is very actively used by yield farmers. The lending party (liquidity providers) receives aToken’s in return for their funds. These tokens immediately start generating income when issued.

Decentralized finance, and in particular yield farming protocols, are a breakthrough in finance, cryptocurrency economics, and computer science technology. So how is a DeFi yield farming platform developed?

The process of DeFi yield farming platform development

The DeFi yield farming development is similar to creating any other DeFi product. The yield farming development process consists of 5 stages: discovery, design, development, testing, and the launching phases. Now let`s discuss them in more detail.

- The discovery phase helps define the goals and objectives of the project, makes a list of features and selects a technology stack for its implementation. Business analysts work with the client in this phase to help build a bridge between the business part of the project and the technical solution. We advise you not skip this stage, as it allows you to reduce the risks of the project, optimize the budget, and speed up the time to market.

- The design phase is no less important than any other phase. One of the main drawbacks of DeFi products often is a poorly designed user interface. It is better to enlist the support of experienced designers who can help you not only to create an attractive interface, but also to find the best ways to present the benefits of your platform.

- The development phase starts after you have an idea of exactly how your platform should work, what mechanisms of rewarding users should be used, and what features should be implemented. The foundation of any DeFi product is self-executing smart contracts. Creating such contracts requires deep blockchain expertise because they must work as intended and also be devoid of vulnerabilities. DeFi protocols are one of the favorite targets for hacker attacks, so you should take the security of your smart contracts seriously.

- Testing and launching are inseparable processes. Before launch, it is mandatory to check your product for bugs. DeFi testing should include not only functionality and usability testing but also security testing. One of the best practices is to audit smart contracts before releasing the protocol to the market. Smart contract auditing is a process that scrutinizes a piece of code to identify bugs, vulnerabilities, and risks. It is often conducted before the code is deployed and used on the main network because then it is no longer subject to change.

This is how the DeFi yield farming development process works. If you are looking for a DeFi yield farming development company, you are in the right place. Our experienced development team can help you develop an innovative DeFi project.

IdeaSoft expertise

The DeFi sector has been getting more and more attention lately. After Compound gave away COMP management tokens and some of their holders claimed annual returns of 100%, the community became obsessed with DeFi yield farming. That’s why it’s better than ever to think about your yield farming development.

IdeaSoft has been providing blockchain development services for more than 5 years. The in-house development team has extensive expertise in building crypto exchanges, crypto wallets, DeFi aggregators, lending/borrowing protocols, staking and yield farming platforms, and more. IdeaSoft has repeatedly been named among the TOP blockchain development companies according to Techreviewer, Upvotes, DesignRush and Clutch. Feel free to contact us to discuss your next project.