Online banking accessibility is no longer a box to be checked for compliance. An estimated 1.4 billion adults worldwide remain unbanked – people without access to basic financial services. Not only is this a social problem, but a huge missed market for FinTech innovators. Accessible banking services can bridge this gap thanks to simple mobile wallets or sophisticated Web3 platforms.

IdeaSoft, being a seasoned FinTech development partner, has helped organizations create inclusive digital banking platforms to tap into this potential. For example, IdeaSoft partnered with Argentina’s BCM (Bolsa de Comercio de Mendoza) to launch a neobank platform for tax payments and everyday banking.

Key Highlights:

- Untapped market. 1.4 billion adults globally don’t have a bank account, representing an enormous potential source of new customers for inclusive fintech services. More effectively serving this segment is projected to release hundreds of billions of dollars in new banking revenue.

- Mobile-first inclusion. The total mobile money transactions worldwide hit $1.68 trillion in 2024 with 2 billion registered accounts – evidence of FinTech penetration in traditionally unbanked communities.

- Business & ESG benefits. Banks that are at the forefront of inclusive digital banking enjoy higher customer retention and align with ESG goals, attracting investor interest.

Ready to bank the unbanked?

Let’s start to discuss the digital accessibility benefit!

Table of contents:

- Why Accessible Digital Banking is a Strategic Advantage

- Fintech Tech Solutions That Enable Inclusion and accessibility

- Real-World Use Case Snapshots from Ideasoft Projects

- Key Barriers to Inclusive Online Banking

- Conclusion

Why Accessible Digital Banking is a Strategic Advantage

Developing FinTech financial inclusion can drive growth by opening up new markets and customer segments not served by mainstream offerings. For first movers, this means faster scale and first-mover advantage in underserved markets. According to the World Economic Forum, fintech innovations that facilitate financial inclusion can drive economic growth and reduce poverty by providing low-cost, accessible products like mobile transfers and microloans. That is, FinTech financial inclusion initiatives yield both social and business value.

Accessible banking is also aligned with Environmental, Social, and Governance (ESG) agendas. Investors are increasingly targeting businesses conducting ethical, inclusive business. A commitment to accessibility and financial inclusion showcases good Social responsibility, making fintech businesses more attractive for investment. Moreover, regulators worldwide are encouraging inclusion – or even mandating it.

For instance, from June 2025, the European Accessibility Act forces digital financial services in the EU to meet accessibility standards. Early adopters who made accessibility standards a priority (e.g., WCAG guidelines) avoided legal risk and positioned themselves as industry leaders.

Finally, an accessible digital banking strategy gives your brand power. Consumers notice when you are serious about inclusivity. Studies show people are more loyal to brands that make services easy to use for everyone. By making banking accessible, you gain reputation, reduce churn, and tap into network effects (as satisfied customers in underserved areas spread the word).

Indeed, some of the best FinTech innovations, like biometric authentication and voice banking, started out as accessibility features and ended up benefiting all users. This is why you definitely need to adopt accessibility standards.

Talk to our team about expanding your fintech product into underserved markets!

Fintech Tech Solutions That Enable Inclusion and Accessibility

FinTech financial inclusion requires selecting the right technology. The following solution areas offer inclusive digital banking in a more complete way. They show you how you can engage with users of any background and ability, without ever compromising your FinTech product’s scalability and innovativeness.

Inclusive UX/UI by Design

Accessible design is the core of digital financial inclusion. Designing for accessibility from the outset ensures that users with disabilities, older users, and those with limited digital skills can employ your service without limitation. This involves following global guidelines like the Web Content Accessibility Guidelines (WCAG), which offer over 50 detailed guidelines to make web and mobile applications perceivable and operable for everyone. It also encompasses employing best practices such as:

- High contrast colors and legible fonts for users with visual impairments

- Text alternatives (alt text) for graphics

- Making the app accessible using screen readers

For example, all interactive items should be labeled correctly so that blind users who navigate using screen reader navigation are aware of what a button performs.

Inclusive UX goes beyond disability access. It encompasses localization and simplicity to aid cultural and linguistic diversity. Such a banking app that is accessible for people with disabilities should offer support for multiple languages and not employ complex jargon, but straightforward words in order not to confuse users from various backgrounds. Dark mode (beneficial to customers with vision fatigue or in low-light environments) and adjustable text sizes are other accessible features.

Voice assistance is another extremely useful feature. Voice-enabled banking allows customers to do everything via voice commands. For instance, Bank of America’s virtual assistant “Erica” allows users, even blind customers, to balance accounts and send money using voice commands.

Digital Wallets as a Gateway to Inclusion

Mobile money systems and digital wallets are coming forward as a financial inclusion technology in all developing economies. Compared to conventional banking, which in most cases entails a lot of paperwork and the requirement of physical branches, digital wallets can be as simple as an application or even a mere SMS menu on a feature phone. This allows those with no bank account to save, be paid, and borrow. In fact, many have leaped over to mobile finance. There were over 2 billion active mobile money accounts sending daily transactions valued at $4.6 billion in 2024.

These services are available to customers with no bank access but who do possess a phone, which illustrates the power of a mobile-driven strategy for inclusion. One of the key enablers in this sense is designing wallets for operation on low-end phones and lean connectivity. For example, USSD-based mobile wallets (text-menu driven) enable users to make payments on basic feature phones without the internet.

Another lean yet powerful solution is QR-code payment systems. QR codes make it possible for any user of a camera phone to pay cashless without a credit card or even a dedicated wallet application. A merchant may show a static QR code for payment, and a buyer just scans it using their phone to pay through a mobile money app or banking app. It is a cheap method of deploying – no POS devices or cards required.

Biometric authentication is also a wallet feature that supports inclusion: using fingerprint or face recognition can help users with low literacy or those without formal IDs to securely access their accounts. For instance, some services now enable customers to enroll based on a fingerprint scan that connects with a national ID database, simplifying KYC for the unbanked.

Web3 + DeFi for Borderless Financial Access

Web3 + DeFi are top solutions to adopt accessibility standards. DeFi platforms are built on top of public blockchains (like Ethereum, Binance Smart Chain, NEAR, etc.), offering financial services through smart contracts. The promise here is open, transparent, permissionless financial services that are available to the world. To the unbanked and underbanked, it can mean access to savings, loans, investment, and payments, but not necessarily a conventional bank account.

How will Web3 help the unbanked? One example is P2P lending and microlending via blockchain. An emerging country’s subsistence farmer might have no credit record and thus not qualify for a loan from a local bank. Still, with a DeFi lending protocol, the farmer would be able to borrow small sums from a global pool of liquidity, typically off alternative credit ratings or collateral. Smart contracts automatically enforce the loan terms, cutting out costly intermediaries.

Similarly, cross-border payments and remittances are faster and cheaper using cryptocurrencies and stablecoins. Money is received by families from abroad in minutes, with costs lower than traditional remittance providers. For unstable local currency economies or unbanked economies, stablecoins (USD-pegged or other stable asset-pegged cryptocurrencies) provide a secure store of value and exchange medium available from a basic smartphone. CBDC development is also a hot topic.

Planning a wallet or Web3-based fintech app?

Book a free discovery call with our experts!

Real-World Use Case Snapshot from Ideasoft Projects

Nothing proves feasibility as forcefully as success in the real world. Below are two brief vignettes of how IdeaSoft has implemented accessible digital banking solutions – one in a mainstream finance setup and one utilizing Web3 – with outcomes that bear witness to the power of accessibility and innovation.

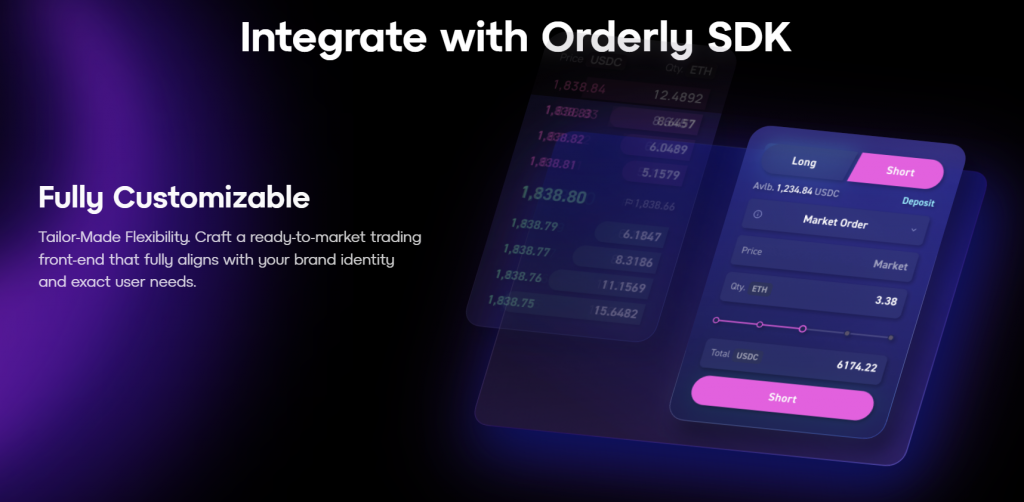

Orderly Network on the NEAR blockchain

IdeaSoft has set the pace in integrating blockchain solutions with affordable FinTech. For instance, we helped develop Orderly Network on the NEAR blockchain – a DeFi system that provides fast, low-cost trading to both everyday users and institutional investors.

Through designing the platform (such as combining off-chain order books with on-chain settlement), the solution achieves low fees and high liquidity. This makes sophisticated financial services accessible to more users without the usual challenges of high gas costs or slippage.

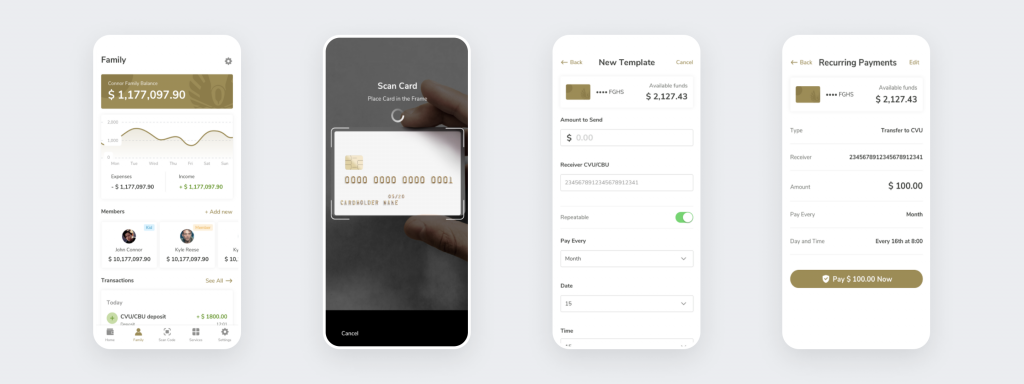

Development of a neobank for BCM (Argentina)

BCM (Bolsa de Comercio de Mendoza), a reputable stock exchange and finance hub in Mendoza, Argentina, needed to renovate its services for greater online banking accessibility. All transactions (tax payment, utility bill, etc.) were cash-based and manual, with limited reach and efficiency.

IdeaSoft developed a robust neobank platform that digitized such activities and put them at users’ fingertips. We implemented an end-to-end solution consolidating municipal tax payments, utility bills, and insurance services into a single web-based banking system.

We also developed mobile apps (iOS and Android) so that people and businesses can utilize accessible banking services remotely from a smartphone. It is a critical feature for expansion in a region where not everybody might easily visit a bank office. The platform had user management with hierarchical access (admin, super-admin roles) and CRM features to allow easy onboarding and support for all users.

The impact of financial inclusion technology was dramatic. BCM customers, many of whom were previously excluded by geography or convenience, could now pay taxes or fees online instantly and safely. Cash transactions disappeared, improving liquidity and transparency for BCM. And since UX was designed to be safe and simple, usage improved quickly across demographics.

See what we’ve built and what we can build for you!

Let’s talk

Key Barriers to Inclusive Online Banking

While the opportunity is vast, scaling inclusive digital banking is far from easy. It’s a challenge to find affordable solutions so we can create a path to overcome them. Here, we outline significant challenges that FinTech operators face in building truly inclusive products.

Technological Barriers (Devices, Connectivity, Literacy)

Standard phones (or no phone) are still widespread. Services based on an assumption of the latest smartphone or a constant data link will leave out these customers. Inclusive services, then, must cater to feature phones (via SMS, USSD, or voice interfaces) and low-end Android phones with low storage.

Similarly, remote and impoverished areas may have gaps in coverage and high data costs. Even now in 2025, almost a third of humanity (2.6 billion people) are offline and disconnected from the internet. Such a digital divide means that FinTech applications must be made to function properly in low-bandwidth environments – offline mode, small installation size, and 2G/3G network support can make a huge difference.

Digital literacy is the last barrier here. A very sophisticated app is worthless if people cannot make sense of it. Most unbanked adults have limited experience with formal financial products or advanced apps. In fact, low digital and financial literacy is identified as one of the key barriers to full financial inclusion. These users might be turned off by complex onboarding or jargon. Inclusion-targeted FinTech products must place additional focus on straightforward, intuitive UX (as already noted) and provide in-app assistance, e.g., chatbots or in-app tutorials in the client’s own language.

Poor UX for Vulnerable Users (Accessibility, Simplicity, Support)

Even with the technology implemented, a poor user experience can exclude large parts of humanity. Few banking apps are designed for elderly, disabled, or low-literacy users, resulting in interfaces that are incomprehensible or unworkable for them. For example:

- If on-screen text and icons are too small or of inadequate contrast, visually impaired or tremor-prone people will struggle.

- If an app is not accessible to screen readers or keyboard inputs, blind and motor-disabled people cannot access it.

- If the language is full of financial jargon or is only in English, people with limited education or non-native speakers may give up.

Most in need (e.g., the elderly with pensions or the disabled needing electronic payments) are most likely to be left behind by poor design. To prevent that, FinTech products need to adopt accessibility standards. That means tidy designs, clear labeling and instructions, and elimination of any unnecessary steps in user journeys. A simplified app helps users with cognitive or literacy challenges, it actually benefits everyone by making banking quicker and more intuitive.

Inclusive design features like voice command capability, chatbots, and multi-language support can significantly improve usability. We’ve already mentioned voice assistants: incorporating a voice interface can allow users to perform transactions or get information just by speaking, which helps visually impaired users or those who aren’t comfortable typing.

Multi-lingual interfaces and local vernacular translation are necessary in high-language-density markets – people are far more likely to take up a service in their native language. And for very low-literacy users, symbolic, sound-only, or even totally voice-controlled services (think “dial a number and talk to a bank bot”) might be the answer to online banking accessibility.

Regulatory & Infrastructure Gaps (KYC, Digital IDs, Cash Ecosystems)

Rules and historical infrastructure can be significant barriers to bringing the unbanked into the digital financial system. A prime example is KYC (Know Your Customer) requirements. FinTechs and banks must verify users’ identities in compliance with anti–money laundering (AML) regulations.

The majority of unbanked citizens lack formal proof of identification documents or addresses. As of recent estimates, approximately 850 million people globally lack official ID. This makes traditional KYC procedures a non-starter, and de facto excludes them from obtaining digital services.

Another challenge is the cash-based economy many unbanked people still live in. If all the supporting infrastructure around (employers, merchants, billers) is only in cash, then even if a person has a digital wallet, they will always find themselves converting cash in and out of money, with money and hassle lost. If there is no network of agents or ATMs available to handle cash-in/cash-out, digital solutions will not gain traction.

Finally, policy and education infrastructure must be taken into account. In some countries, legislation simply did not anticipate digital finance. Perhaps there are ambiguous regulations for mobile money, cryptoassets, or agent banking. FinTech providers in emerging economies will also need to engage with policymakers to update legislation and create an enabling environment for innovation (e.g., obtaining e-money licenses or regulatory sandboxes for new business models).

Conclusion

We’ve highlighted how technologies like mobile wallets and DeFi can dramatically extend the reach of financial services. But success isn’t just about tech – it’s about empathy with the end-user. Every extra step removed from onboarding, every UI element made more intuitive, every alternate language or voice feature provided, is an investment in a broader customer base and a better world.

Early adopters of online banking accessibility design and practices often see network effects. By the time others pay attention to the digital accessibility benefit, inclusive products have already won the hearts (and accounts) of millions.

Let’s build a fintech product that works for everyone!

Get in touch with IdeaSoft today