With over two decades of presence in the market, digital tokens has become an essential component of blockchain solutions. Similar to coupons, casino chips or company stocks, they act as a cash substitute and represent a specific amount of digital resources you can own, transfer or redeem.

Alongside commonly known NFTs and payment tokens you’re certainly aware of the other trending assets, such as utility tokens and security tokens. So, in this article, the dedicated IdeaSoft experts will explain the difference between these digital tokens and their functions in the ever-changing crypto market. Also, you will find out whether utility or security token is the right solution to meet your business goals.

Are you looking for digital token integration experts? Contact us right away to discuss how to successfully implement utility and security tokens into your business!

Table of content:

- Digital Tokens: Market Outlook & Benefits

- Security Tokens: Definition & Specifications

- Utility Tokens: Meaning & Specifications

- Utility vs. Security Token Comparison: A Quick Overview

- What’s Common Between Security and Utility Tokens?

- The Key Differences Between Utility and Security Tokens

- Which Token Type Is Better for Your Blockchain Project?

- Summary

Digital Tokens: Market Outlook & Benefits

As of September 2023, the global cryptocurrency market cap has reached $1.034 trillion, which is over a 150% increase compared to September 2020 (CoinMarketCap). And, the rising trends for asset tokenization, DeFi, web 3.0 and cross-chain solutions are expected to become the main growth factors for the market’s success.

Despite the decades of presence on the market, digital tokens become truly popular only in recent years. Today, you can use digital tokens to buy real-world assets, pay university tuition and hotel accommodations, make investments and create crypto exchange solutions.

The cross-industry adoption of digital tokenization brings a whole bunch of benefits from a business standpoint. Digital tokens allow for seamless, efficient, and secure transactions while remaining highly accessible, unlocking substantial liquidity from illiquid assets.

Depending on the technical characteristics, use purposes and value for the particular crypto project, companies can choose from a wide range of token types. So, let’s now review the key highlights of utility and security tokens to identify which one can fully meet your business goals and needs.

Security Tokens: Definition & Specifications

A security token is a digital representation of real-world asset ownership, such as the company’s equity or bonds, real estate or other tokenized tangible or intangible objects that have been verified on the blockchain. Typically, it is directly related to the company’s value and growth, providing the owners with dividends, voting rights and other benefits. That is why, security tokens are often viewed as investments.

It’s also important to admit that the tokens are viewed as securities only when they meet the strict conditions of the SEC (the Howey test). This confirms that the transactions under the security tokens are qualified as an “investment contract” and would therefore be subject to U.S. securities laws.

However, it’s not the only type that has gained huge recognition in today’s security token landscape. Utility tokens are another asset class that is currently trending and has been also applied across a wide range of projects. So, to determine which – security or utility token – can better align with your project requirements and needs, let’s now review the specifications of the latter one.

Utility Tokens: Meaning & Specifications

Unlike the other types of tokens, a utility token is much more than just a payment solution for blockchain. It enables owners to access the services, features and offerings on a decentralized platform, acting as a lifeblood for a specific blockchain network. Utility tokens are an essential tool for nearly any blockchain ecosystem, which is more focused on user engagement and decision-making rather than asset ownership.

Once issued by a company, utility tokens perform the role of digital coupons, that can be redeemed in the future for discounted fees or provide access to a product features or service. It’s also important to say, that utility tokens are not used for investment purposes, as they’re relatively underregulated and can avoid federal laws governing securities.

An excellent example of digital utility tokens is Ether (ETH), which are aimed to enhance smart contract execution and improve the on-platform transactions within the Ethereum network.

Basically, these are the most important aspects of the utility vs. security token overview, that will help you to understand their usage specifications and identify the right solution for your project.

Utility vs. Security Token Comparison: A Quick Overview

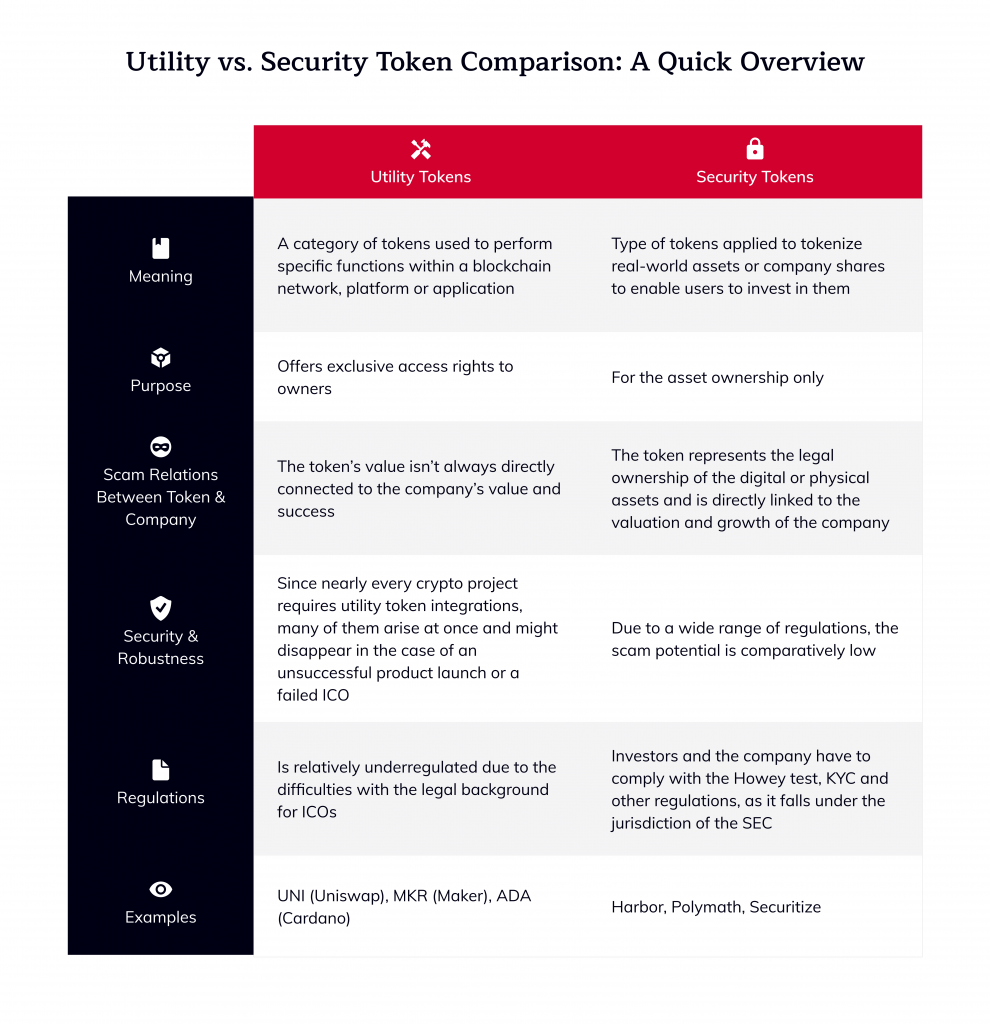

As previously described, security tokens typically represent ownership or assets with intrinsic value and are often subject to regulatory oversight. In contrast, utility tokens are primarily designed to provide access to specific products or services within a blockchain platform, offering functionality rather than ownership.

Let’s now review their main differences to enhance our understanding of this technology.

What’s Common Between Security and Utility Tokens?

Before we start diving into the differences between a utility token and a security token, let’s briefly review the interception areas they feature. This can help you to better understand their role in blockchain development, as well as the perspectives they offer upon the integration.

- Digital Nature: Both security and utility tokens relate to digital assets, represented by cryptographic codes on a blockchain.

- Blockchain-Based: They are built on blockchain technology, which ensures transparency, immutability, and security of transactions.

- Peer-to-Peer Transfers: Both types of tokens can be transferred without the need for intermediaries.

- Programmability: Both utility and security tokens can have programmable features, thanks to smart contracts, enabling automated actions when certain conditions are met.

- Potential for Liquidity: While security tokens are typically associated with ownership in an underlying asset (like equity in a company), they can be traded on platforms that facilitate secondary market trading. Similarly, utility tokens can often be bought, sold, and traded on exchanges.

- Regulatory Considerations: Both types of tokens may be subject to regulatory considerations, but security tokens are more likely to be classified as securities and thus subject to stricter regulations.

Along with the commonalities of each, let’s explore the unique features that make security and utility tokens stand out.

The Key Differences Between Utility and Security Tokens

To find out the best-matching technology for your project, it’s always important to check the strong sides and potential drawbacks of each option available. IdeaSoft specialists have created a simple and straightforward comparison of security token vs. utility token, that will help you make the right choice.

Security Tokens

Main Advantages of Security Tokens:

- Fundamental Values. Security tokens provide fundamental values such as profit shares, voting rights, legal security and so much more, which makes them an attractive solution for a wide range of projects.

- Regulation Compliance. From the regulatory standpoint, security tokens are better than utility as the prior ones have to pass the strict conditions of the SEC (The Howey Test).

- Recovery Property. Security tokens feature recovery protocols, ensuring the safety of the issued assets.

- Straightforward Integration. Simple integration of these tokens allows their smooth integration into different markets and networks.

Potential Drawbacks of Security Tokens:

- Challenging Compliance Process. Meeting regulatory requirements, such as conducting audits and filing reports, can be complex, time-consuming, and expensive.

- Market Volatility. Depending on the underlying asset, security token values can still be subject to market fluctuations, similar to traditional securities.

Utility Tokens

Main Advantages of Utility Tokens:

- Enhanced Functionality. Utility tokens can enable process automation through smart contracts, thus contributing to the platform’s efficiency and profitability.

- Better Flexibility. They can be designed for a wide range of purposes, from accessing products, services or features to participating in voting or governance mechanisms.

- Boost the Platform Usage. Utility tokens allow businesses to improve the platform’s usability, helping users to easily access the required services or products.

- Broader Audiences. These tokens can also attract a wide user base, including those interested in using the platform’s services rather than strictly for investment purposes.

Potential Drawbacks of Utility Tokens:

- Limited Investment Potential. Unlike security tokens, utility tokens do not provide direct ownership or profit-sharing rights, which makes them less attractive to certain investors.

- Potential Regulatory Uncertainty. The regulatory frameworks for the utility tokens are in the early stages of development, which can cause significant challenges in the regulatory area.

The detailed comparison of utility token vs security token plays a key role in evaluating their potential value from a business standpoint. Now, you’re fully ready to choose the best digital token that aligns with your project requirements and goals!

Which Token Type Is Better for Your Blockchain Project?

Having explored the specifications of each token, you’re all set to find out what solution – utility tokens vs security tokens – can better correspond to your project needs. At IdeaSoft, our dedicated blockchain developers have proven expertise with crypto technologies in fintech, blockchain, B2B and B2G, and many other industries. Regardless of the product’s complexity and arising challenges, we’ll provide a professional assistance in building a robust and secure solution for your business.

So, if your primary goal is to provide access to specific services, products, or functionalities within your platform or ecosystem – consider the utility token application. Typically, they help products to facilitate transactions, provide accessibility, and enable better user engagement within a network.

However, if you want to represent ownership in an underlying asset, such as equity in a company, profit-sharing, or debt – choosing the security tokens will be a better fit. They’ll provide investors with the potential for returns, as the token’s value is estimated based on the company’s valuation.

To succeed in digital token integration, evaluating the project specifications, business goals and consumer needs must be the top priority for your business. Our dedicated experts at IdeaSoft always conduct comprehensive product research and market analysis, helping to identify which token, utility or security, will align with the company’s goals and technical specifications of your crypto solution.

Summary

Though each of these tokens is widely applied in blockchain, the use and purpose of utility and security tokens are completely different. So, before investing in its integration, businesses should make a detailed utility/security token comparison to understand which will better serve their goals and needs. While security tokens work best for fundraising and investments, utility tokens can unlock access to special services, products, or other related assets. ERC 404 tokens provide an innovative approach for specific use cases within this ecosystem.

With cross-industry experience and deep expertise in blockchain, we help our clients to identify, develop and implement the most efficient solutions, technologies and innovations in their crypto projects.