Over the last few years, APIs have become extremely popular software components across different niches. The finance and banking industry is not an exception. Today, more and more companies and organizations apply fintech APIs to maximize the functionality of their software and competitiveness, as well as to make them more efficient and attractive from a user’s perspective.

In this article, IdeaSoft development professionals will point out the actual value of fintech APIs, covering their use cases, advantages, and development specifications. As a business owner, you’ll be able to identify the efficiency of APIs for your projects and come up with the right strategy for implementation.

Table of Contents:

- How Are APIs Used in Fintech?

- What Types of Fintech APIs should you Use in Your Application?

- What Are the Advantages of Fintech API Solutions?

- How to Strategically Implement Banking APIs for Fintech: 6 Simple Steps

- Summary

How Are APIs Used in Fintech&Banking?

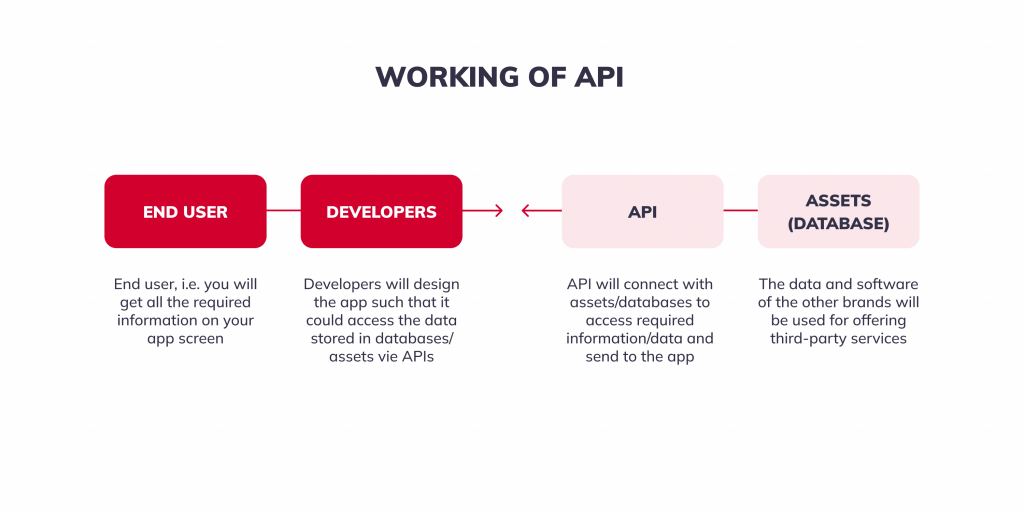

As you already know, APIs (application programming interfaces) perform as a so-called intermediary between the application and server assets (database). Its ensuring their smooth connection and the efficient performance of all the components. With each API having its specific set of functionalities, CTOs choose the most relevant to their fintech solution. After the implementation of the API, the banking software can provide the functionality, and the API can work as anticipated.

In the financial and banking industries, these components are used to improve the interaction between third parties and online banking systems. For example, an independent payment or financial service provider can access the required data about particular users through their bank accounts. Integrating a powerful API solution greatly helps with regulation compliance, which is an essential part of basically any project within this field. Also, APIs can help third-party companies build their products around banking services or integrate those directly into the product to enhance their functionality and improve competition.

In practice, they are usually presented in one or several aspects:

- Connecting consumers, businesses and financial institutions to facilitate the client experience and automate the essential procedures in the financial and banking sphere (such as, for instance, account authentication, analytics, payment processing and even some loyalty programs).

- Increasing the number of digital services provided to clients, which benefits both the revenue of the company and the customer experience. For instance, a common example of this type of software is banking customer apps, which offer credit score updates, mortgage tools and other services provided with in-built APIs.

- Ensuring direct access to banking data and building add-on functionality (personal investment recommendations, spending trackers, etc), which is usually implemented into the app with Banking as a Service (BaaS) APIs.

- Improving the efficiency of related business processes with a particular set of API tools. For example, fintech APIs can boost employee productivity and automate repeated processes (in accounting, as an option), thus helping your business save time and resources.

- Enabling digital services with financial and investment data in real-time, which significantly improves business efficiency, as well as product usability.

As you can see, fintech APIs have quite an extensive scope of use. They’re mostly integrated into core banking, plug-and-play products, cards, wallets and transfers, acquiring systems and so much more. If well-designed and functional, they can significantly increase the performance and functionality of banking software, helping your product stand out.

What Types of Fintech APIs integrations should you Use in Your Application?

Whether you decide to implement a third-party fintech API or opt for a custom API development for your business, it’s essential to identify what type of solution you actually need. For this reason, let’s now review the basic types of software models which are exceptionally popular in the fintech niche.

Financial Data Aggregators and Providers

These APIs enable third-party apps to access financial data such as bank accounts and balances, payments and transaction-related information and so on. Within that segment, there are two types of APIs offered:

- Bank-specific APIs: These have rich functionality and improved security but typically have limited transactional data capacities as they only access information stored within their institution.

- Data aggregators: These can access information from different banks but their security and stability may concede to prior options.

Implementing a reliable fintech API solution can become an additional security layer for your application. Because of this, it’s important to ensure the selected API solution works smoothly and is regularly updated. A great alternative to off-the-shelf software is custom fintech API development.

Designed specifically for your business needs, this solution can improve app security and cover all the vital functions and features, thus making your fintech application efficient and competitive.

Payment APIs

A payment API (also known as a payment gateway API or a payment processing API) is responsible for integrating one payment solution with another existing application. Basically, these can connect a business to a particular payment system, allowing it to accept payment from customers faster and in fewer clicks. As a result, business owners will see notable improvements in conversion rates and increased revenues.

Some of the most essential points to consider for an efficient payment API solution include clear documentation and maintenance guidelines, excellent usability and functionality, robust security and omnichannel capabilities (so the user can choose from multiple payment methods that are available).

KYC and RegTech Solutions

Another essential aspect to be covered in fintech applications is Know Your Customer (KYC). This is responsible for the verification procedure in nearly all of its forms. It allows financial institutions to ensure anti-corruption and anti-money laundering (AML) compliances, as well as timely identify financial fraudsters and verify that individuals are acting legally.

A similar process is done with the Regulatory Technology (RegTech) solution, which helps leverage the resources devoted to a particular functionality of regulatory compliance elsewhere. Typically, it involves big data, blockchain, AI and machine learning solutions. This reduces financial risk while increasing the regulatory compliance and security of your app.

Authentication and Authorization Tools

The fintech and banking industries remain a lucrative target for thousands of cybercriminals. With over 2,500 cyber incidents reported in 2021, the number of third-party attacks and system penetrations continues to increase tremendously within this field.

However, security APIs can significantly improve the resistance to vulnerabilities of an app. In the fintech sector, authentication and authorization API solutions are among the most used APIs. Once integrated, these allow native solutions to be used: Apple’s Face ID and Touch ID, Android Biometric Library or alternatives. Similarly, you can set up multi-factor authentication (MFA), ensuring each and every part of your fintech app is well-protected.

Investment Broker APIs

These APIs mainly facilitate the development process yet provide off-the-shelf algorithms, robots, and other useful tools designed specifically for trading in the markets. Basically, broker APIs perform the same tasks as human experts. They buy and sell assets on the user’s behalf.

The services offered by broker APIs usually differ, covering generic trading options to niche-specific ones (such as crypto exchanges, for instance). From a business point of view, they allow you to pick the API with the most relevant services to maximize the performance of an app at a reasonable cost.

What Are the Advantages of Fintech API Solutions and Integration?

The right API solution will benefit both the business for owners and users alike. Now, let’s briefly review the potential advantages of API implementation for fintech apps:

- Improved Cost Efficiency. The API architecture specifics help save development and maintenance costs, which is exceptionally important for long-term fintech solutions. Built from individual components, such software has impressive development speed, easy debugging and updating, yet will not likely disrupt operations.

- Simplified, Faster Feature Rollout. Instead of spending significant resources on building each module individually, business owners can take advantage of off-the-shelf solutions. What is more, API tools allow access to limited features and solutions, such as licensed services or those which require durable and expensive compliance.

- Enhanced Compliance Process. APIs work exceptionally well to meet strict regulations, such as DPA, GDPR, PSD2 and others. Additionally, a majority of these are based on KYC and RegTech models, thus making the compliance processes more secure and resource-efficient.

- Better User Experience. The use of fintech-based APIs benefits customers in many aspects, such as software cost, extensive tools for improved performance, increased security and privacy, and many more. Without any doubt, the more satisfied your end users are, the higher ROI you’ll have as a result.

- Outstanding Product Competitiveness. Rich feature sets, smooth performance and maximized security of your fintech app will help your app stand out among the competition.

As you can see, getting a functional API today is a must for a majority of financial and banking projects. Having discovered their potential value, let’s now move to the most interesting part – fintech API implementation!

How to Strategically Implement APIs for Fintech Project: 6 Simple Steps

The process of API implementation requires a lot of engineering work, vast expertise and detailed planning. At IdeaSoft, we have divided the strategy of API implementation into the following stages:

- Identify your business objectives. This allows you to focus on the right service domain, ensuring its step-by-step improvement with minimal risks and reasonable resource management.

- Find the development expertise that matches best. An experienced team of developers can provide professional support across all stages of API development and implementation.

- Prioritize the expected outcomes. Evaluate the goals you want to reach with the particular fintech API (i.e. geographical expansion, increased client base, improved competitiveness, increased revenues, etc)

- Conduct a data audit. At this stage, it’s essential to determine which data is available (for internal and external use) and how it can be utilized with APIs.

- Plan an efficient development strategy for each of the APIs. Another point where the right development crew is surely a must. The team can modify the architecture of the software, check compliance legislation, choose the right tech stack and conduct other preparations for fast and efficient creation and implementation of an API.

- Launch the API development. This phase is focused on building and implementing an API according to the pre-planned strategy. A professional team of developers will cooperate and participate in accessing, building and maintaining the solution, as well as handling the documentation, troubleshooting and even some marketing materials if you want a publicly accessible API.

- Test the final results and consider further maintenance. Upon the delivery of the project, developers will provide recommendations on how to maximize the performance of the API, implement updates, and leverage all available functions to make the most of your banking software solution.

As you can see, there are a lot of things to consider when it comes to fintech API implementation. However, with an experienced crew of specialists, you’ll surely succeed!

Summary

Embedding fintech APIs is an excellent opportunity to upgrade your application and improve your business performance. This approach can enhance the competitiveness of a product, drive more customers, increase revenue and make your banking software become more competitive in the market.

If you are considering the implementation of a fintech API into your project, hiring a professional team is a must. At IdeaSoft, we have years of experience working with different fintech software and have implemented the most efficient solutions into each of the projects we have taken on. Regardless of the complexity of the project, you’ll be offered a custom API implementation strategy that perfectly matches your business goals and needs. Explore what development opportunities you can gain with API solutions by contacting our team immediately!