Realizing the potential of RWA tokenization in crypto, the traditional finance giants (such as BlackRock, Fidelity and Hamilton Lane) and many blockchain-based startups (like Securitize, Tzero, etc.) have already got into the game. Moreover, thousands of tech companies are developing powerful DeFi for tokenized RWAs, hoping to become the next “unicorn” solution. However, an exceptional RWA tokenization project for crypto requires a deep understanding of the market, as well as profound knowledge of blockchain development.

Welcome to our guide where we describe how to tokenize real world asset in crypto and the burgeoning realm of DeFi real world assets. As pioneers in this field, our expertise is drawn from real-world experience, as evidenced by our successful fintech and blockchain development cases. Additionally, IdeaSoft experts will review the real-case examples of on-chain RWA solutions to help you better understand its potential for your business and the crypto industry as a whole.

Table of content:

- What is Real-World Asset (RWA) Tokenization?

- What Are the Advantages of Tokenizing Real-World Assets?

- How to Get Started with RWA Tokenization: 5 Key Stages

- RWAs and DeFi

- IdeaSoft successful case study on RWA

- Summary

Want to tokenize an asset? Don’t know where to start?

Learn the basics of RWAs, technology’s advantages and its limitations from our article! Or let’s schedule a call and our team will help you figure it out, and correctly draw up the requirements for your project

Traditional RWAs Limitations

Traditional ownership of real world assets (RWA) is fraught with limitations. These include:

- Illiquidity. RWAs, such as real estate and physical commodities, often lack liquidity. It is difficult to buy or sell them quickly without a significant loss in value.

- Fragmented Markets: Markets for RWAs are fragmented and localized, limiting access and making it harder to find buyers and sellers. This reduces market efficiency.

- Complex Ownership Verification. Establishing and verifying ownership of RWAs requires extensive documentation and potentially lengthy legal processes.

- Limited Accessibility. Investing in RWAs requires significant capital, making them less accessible to small investors.

- Valuation Challenges. Determining the accurate value of RWAs can be complex and subjective, often relying on appraisals and estimations rather than transparent market pricing.

These limitations can hinder the efficiency and accessibility of investing in and managing RWAs. However, through the innovative approach of tokenization, these constraints can be overcome, paving the way for a more accessible and efficient ecosystem.

The market for tokenized assets can grow to as large as $10 trillion in this decade as traditional financial (TradFi) institutions continue to adopt blockchain technology. RWA tokenization is gaining momentum before our eyes.

What is Real-World Asset (RWA) Tokenization?

Real-world asset tokenization is the process of virtualizing real-world (tangible and intangible) assets into digital tokens that can be stored, managed and traded on a blockchain.

The entire concept of RWA tokenization is based on creating a blockchain-based digital investment solution for subjects that have value or a relevant physical existence. So far, the tokenization of real-world assets has been applied across many industries, covering real estate, vehicles, collectibles, fine art, noble metals, securities, stocks and bonds, etc. That said, no matter if you want to sell $100 million worth of Van Gogh’s “Starry Night” or buy the “shares” of an iconic Barbie’s Malibu DreamHouse – tokenized RWAs, will make it possible.

To understand how RWA tokenization works, let’s take the example of real estate. Traditionally, if someone wants to invest in real estate, they would need to buy a property outright or invest in a real estate investment trust (REIT). However, with the concept of tokenization, the ownership of the property is represented by digital tokens on a blockchain. Investors can then purchase and trade these tokens, allowing for fractional ownership of the property and increased liquidity. That is how tokenization is putting real-world assets on blockchains.

What Are the Advantages of Tokenizing Real-World Assets?

As we already know, the tokenization process allows the virtualization of the RWA ownership or legal rights in a crypto environment. But what are the real benefits of real-world asset tokenization?

From the business standpoint, the main gains of a solution built on real-world assets and blockchain include:

- Faster and more flexible asset trading and exchange, which are not tailored to the “9 to 5” business shifts;

- Increased liquidity, which means larger profits;

- A larger pool of clients and investors due to the lower entry barrier;

- Improved system security and trustability;

- Enhanced business competitiveness.

At the same time, the RWA tokenization can benefit asset owners, investors and traders by providing:

- Greater accessibility, as the only things needed to trade RWA tokens are the Internet connection and a digital wallet;

- Allowing for lower fees and commissions, that only involve the minimal gas fees to instantly transfer the RWA tokens;

- Reducing risks for assets sharing or trading due to the secure and transparent RWAs trading environment;

- Facilitating asset exchange, storage and management within a decentralized system;

- The direct trading mechanism involves only a seller and a buyer, and removes any other intermediaries (financial institutions or banks, appraisers, notaries, or any other related authority).

Therefore, the numerous benefits of real-world asset tokenization have proven the value and long-term prospectiveness of this technology in the crypto landscape.

Got lost in tech details?

Let us help you figure it out, and correctly draw up the requirements for your project

Successful Use Cases of Real-World Asset Tokenization

Learning the existing examples of RWA tokenization is an excellent chance to get some helpful insights and inspiration ideas for your future product. That is why, our blockchain experts at IdeaSoft reviewed the projects that gained huge popularity in the real-world assets and DeFi niche.

Fractionalized Real Estate Ownership

One of the earliest use cases of real-world asset tokenization enabled making real estate assets liquid and selling theirits ownership through blockchain-based tokens. The best-known example is the $18 million deal of Elevated Returns, a New York-based asset management firm.

Tokenized Artworks

By tokenizing the ownership of particular artwork prints, these can be offered for sale and, once redeemed – the physical piece can be delivered to the given address. As an option, the token’s ownership can be fractionalized and shared between multiple holders. For example, this is already offered by TheArtToken (TAT), which offers tokens that represent fractional ownership of Contemporary and Post War Art. The physical originals of these artworks are stored in a warehouse secured by the Swiss government.

Intellectual Property (IP) Tokenization

This technology helps to tokenize the IP ownership rights: patents, copyrights, design patterns, logos, trademarks, and trade secrets. According to the American Bar Association, the take-it-or-leave-it nature of tokenized rights can increase the market for IP rights, mainly by providing a legal, transparent, and secure trading landscape. Additionally, owners can advertise their IP broadly without the concern of experiencing expensive marketing or legal costs for unqualified purchasers. The examples of IP tokenization are commonly applied in the NFT trading landscape, where certain IP rights are attached to particular NFTs. For instance, a prominent example of this concept is OpenSea, the largest decentralized NFT marketplace.

Carbon Credits

Real-world asset tokenization can enhance the carbon credits market by increasing transparency, liquidity, and efficiency. Tokenizing carbon credits on a blockchain ensures immutable records and real-time traceability, preventing double-counting and fraud. This process reduces the need for intermediaries, cuts transaction costs, and speeds up settlement times with the use of smart contracts.

Additionally, tokenization allows fractional ownership, making carbon credits more accessible to smaller investors and enabling 24/7 trading on global digital platforms. For example, Verra issues verified carbon offsets and is exploring blockchain integration for enhanced transparency.

Supply Chain Management

Tokenizing assets on a blockchain enables real-time tracking of goods from origin to destination. This reduces fraud, errors, and delays by ensuring all parties have access to the same, verified information.

Furthermore, tokenization allows for the automation of supply chain processes through smart contracts. These contracts can trigger payments, reorder supplies, and update inventory automatically when predefined conditions are met. This reduces administrative overhead, speeds up operations, and improves coordination among suppliers, manufacturers, and retailers, leading to a more resilient and responsive supply chain.

A great example here is IBM Food Trust. It is a blockchain-based platform that tracks food across the supply chain, enhancing visibility and food safety.

Having learned the real-case products based on real-world assets and blockchain, our team was ready to implement the authentic RWA solution for one of our clients – Securitize.

How to Get Started with RWA Tokenization: 5 Key Stages

To come up with a powerful and competitive solution for RWA virtualization, understanding the core tokenization stages is of the essence. Dr. Xu, a Lecturer in Real Estate at The University of Manchester has identified five core stages to tokenize an asset, which play a critical role in digital tokens infrastructure development.

1. Identify a real-world asset

The first stage implies choosing the asset that will be represented in tokens. Basically, that covers any type of tangible or intangible RWAs that have value.

2. Establish the RWA ownership

Next, it’s important to verify the ownership of the selected asset, ensuring it is properly registered, licensed and compliant with the legal requirements and regulations. As a rule, this is handled by auditors, lawyers, notaries and other professionals with the relevant expertise.

3. Build a smart contract solution

At this stage, the dedicated development team builds a smart contract that defines and governs the RWA tokenization conditions. This covers the number of tokens, their value, as well as the rights and obligations of the token owners.

4. Issue the token

Once the smart contract is created, the RWA tokens are issued on a blockchain-powered network, where they can be purchased in exchange for stablecoins or fiat currency.

5. Manage and trade the token

Being issued on-chain, the rwa crypto tokens can be then traded and managed on secondary markets, such as decentralized exchanges, money markets and other financial services within the DeFi ecosystem.

No matter if it’s tokenized real-world assets, or fractionalized ownership on the assets available through tokenization, or even ownership rights on the physical assets represented in tokens – the RWA tokenization will be always represented by these essential stages.

Real World Assets and DeFi

The RWAs are tangible or intangible assets existing in the physical world with inherent value. On the other hand, DeFi represents a novel financial system built on blockchain technology, offering various financial services without traditional intermediaries like banks. DeFi’s relevance in the modern financial landscape lies in its ability to provide accessible, transparent, and inclusive financial services to anyone with an internet connection, regardless of their geographic location or socio-economic status.

Global asset tokenization and integration of tokenized RWAs into DeFi platforms involves representing ownership of these assets through digital tokens on a blockchain and allows for real world assets DeFi. These tokens can then be traded, lent, or used as collateral within DeFi protocols. For instance, a tokenized real estate property can be used as collateral for borrowing funds in a decentralized lending platform, or investors can provide liquidity to a decentralized exchange by staking tokenized commodities.

The inclusion of RWAs in DeFi systems offers several benefits:

- Increased liquidity: Tokenization of RWAs unlocks previously illiquid assets, allowing for fractional ownership and facilitating trading on decentralized exchanges, thus enhancing liquidity.

- Diversification: DeFi users gain access to a broader range of investment opportunities by incorporating tokenized RWAs into their portfolios, potentially reducing overall risk; also it fosters the market for creation of new rwa crypto projects;

- Lower entry barriers: Fractional ownership of RWAs through tokenization reduces the minimum investment threshold, enabling more individuals to participate in traditionally exclusive asset classes.

What is the Future of RWA Tokenization?

Real-world asset tokenization opens up a wide range of cross-industry opportunities, converting nearly anything around us into digital forms.

Andrii Lazorenko, Co-Founder and CEO of IdeaSoft

No matter if it’s an artwork, real estate, oil supply contract or even the intellectual property – it can be stored, managed and validated through the protocols within blockchain network.

By creating a transparent and secure system to tokenize real-world assets, companies can expand their market presence to the global level, adopt the new technologies and enhance their funding. RWA tokenization makes direct investments accessible among larger audiences and enlarges the liquidity pool through a wide range of digitalized RWA tokens.

According to Binance’s July 2023 RWA market research, the tokenized asset market is estimated to reach $16 trillion by 2030, which is a significant increase from $310 billion as of 2022. Real estate, bonds, money, gold, art, collectibles and equities have the biggest perspectives for on-chain asset tokenization through blockchain and traditional asset fractionalization (usually represented by exchange-traded funds, real estate investment funds, etc).

Finally, with RWA tokenization becoming more mature and widespread, governments and local authorities will adopt regulatory and legislation background for these digital projects. As a result, in the upcoming two to three years, we’re likely to witness a notable breakthrough in tokenization solutions for real-world assets.

Moreover, recent researches says that no matter which “state” of market we would experience, the tokenization of real world assets will gain potential. Thus, according to digital asset manager 21.co, the market potential for tokenized assets could range from $3.5 trillion in a “bear case” scenario to a staggering $10 trillion in a “bull case” scenario.

Talk To An Expert

Let us help you with tech details & requirements for your project!

RWAs Development Case Studies

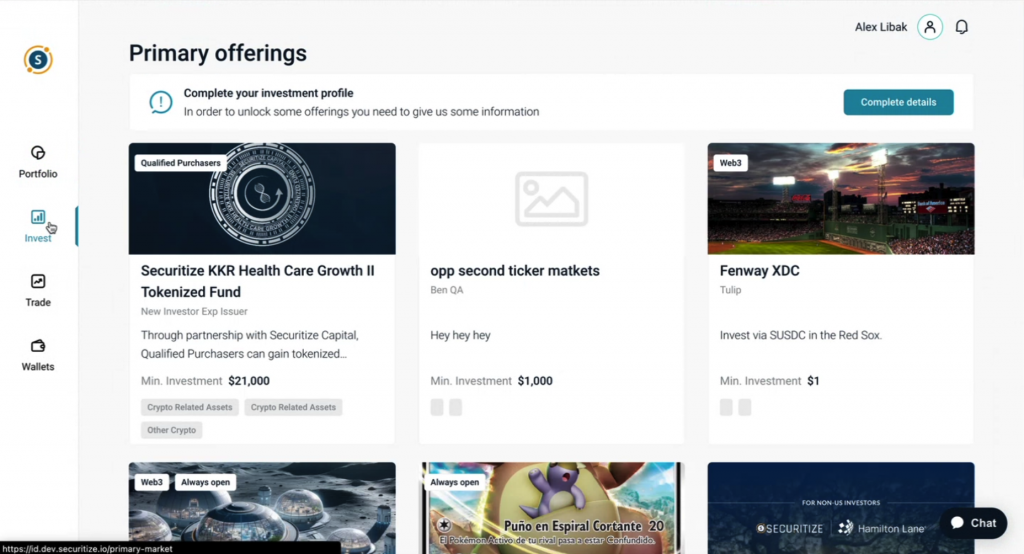

Securitize is one of our best case studies showcasing one of our examples of real world asset crypto projects, tokenizing real world stocks and bonds with the help of blockchain technology.

Securitize provides a comprehensive technology solution for issuers of digital securities, facilitating compliant trading on public blockchains and multiple exchanges. Our platform, developed by the IdeaSoft team, incorporates key features such as investor onboarding, credit card processing, investor dashboard for lifecycle management, optional 2FA for investors, document signing, KYC/AML accreditation qualification, and fund and payout capabilities in both fiat and crypto currencies. We also offer support for multiple blockchains and provide an issuer admin console for seamless management.

One of our standout innovations is the Digital Securities Protocol (DS Protocol), which enables compliant trading of tokens on secondary marketplaces such as Alternative Trading Systems (ATS) in the U.S. and various other global securities exchanges and marketplaces.

Summary

Real-world asset tokenization is a powerful solution that can revolutionize the concept of asset ownership, making it more accessible, affordable and secure. Powered by blockchain, tokenized RWAs can enhance liquidity, enable fractional ownership, and create more opportunities for decentralized asset management and digital investments.

Now that you’ve learned the RWA tokenization essentials and its development specifications in crypto, it’s the right time to get into the game with a custom tokenization solution for real-world assets!

With over 250 successful products in our portfolio, IdeaSoft has accumulated years of cross-industry expertise and development experience in DeFi, NFT, blockchain and other tech areas. For each of our clients, we create a custom product development strategy that is tailored to the goals, requirements and needs of their company or enterprise.

Restaking can further enhance the benefits of tokenized assets, providing additional rewards and incentives for stakeholders. Do you need an expert quote on real-world asset tokenization or want to hire a dedicated team for DeFi development? Contact us to discuss how to enhance your business with the RWA tokenization solutions today!