It’s a big task to build a decentralized exchange, especially in the times when changes come thick and fast in the crypto space. In 2025, it’s more competitive than ever, and user expectations are higher nowadays.

The common pain points for many developers looking to build their maiden DEX solutions or optimize an existing one revolve around ease of use versus robust functionality, ensuring liquidity, and addressing the challenge of a clean UX. If your DEX does not address these pain points, it will not survive long in the increasingly crowded market. Fast and secure DEX solutions for reliable trading are a must.

Need a reliable tech provider?

Contact us to start building your own successful DeFi project!

This article isn’t about how DEXs work. If you’re reading this, you already know. Let’s talk instead about why some fly while others barely get off the runway.

Table of contents:

- Why Uniswap V4 is the Best Choice for Most DEX Development Purposes

- Top 5 Features To Compete With Uniswap V4

- How to Overcome Challenges with IdeaSoft

- Tech Stack Recommended & Other Security Measures

- Summary

Why Uniswap V4 is the Best Choice for Most DEX Development Purposes

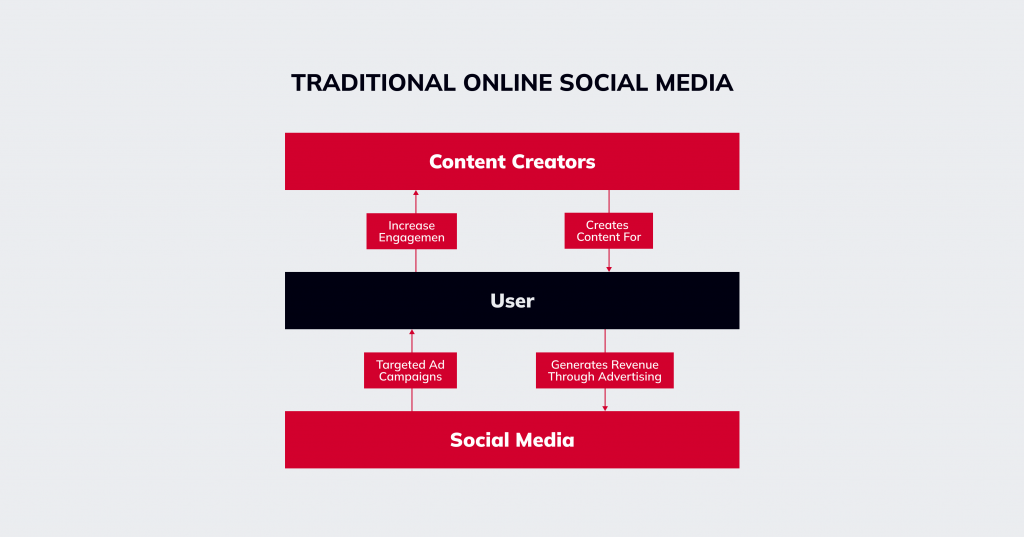

Automated Market Makers (AMMs) have revolutionized the decentralized finance (DeFi) ecosystem. They eliminate the need for traditional order books by allowing users to trade directly from their wallets. They make the process seamless and decentralized. AMMs have become crucial for liquidity provision in DeFi, enabling continuous trading and bringing innovation to the financial landscape.

AMMs facilitate trading by using smart contracts to create liquidity pools. These pools are funded by users who earn fees from trades executed within them. This system democratizes market making, providing opportunities for anyone to contribute liquidity and earn rewards. AMM-based DEX development offers benefits like reduced slippage, enhanced liquidity, and the ability to trade a wide range of assets without the need for a central authority.

DEX AMM Features with Uniswap V4

Let’s discuss Uniswap v4 opportunities:

- Custom liquidity pool structures. One of the standout features of Uniswap V4 is the ability to create custom liquidity pools. These pools allow for unique configurations that can better meet specific trading needs. Custom liquidity pools can optimize liquidity provision by focusing on particular price ranges or asset pairs, thus maximizing returns for liquidity providers.

- Advanced fee mechanisms. Uniswap V4 introduces advanced fee mechanisms that offer more flexibility than previous versions. These mechanisms allow for dynamic fee adjustments based on market conditions. By customizing fees, liquidity providers can optimize their earnings and ensure the trading environment remains competitive and fair.

- Tailored trading algorithms. These algorithms can be designed to automatically adjust liquidity positions, optimize trading routes, and manage risk more effectively. This level of customization can significantly enhance trading efficiency and profitability.

Each Uniswap version brings significant improvements. Let’s look at the evolution from V3 to V4 and highlight the new AMM features with Uniswap.

| Feature/Improvement | Uniswap V3 | Uniswap V4 |

| Concentrated Liquidity | Liquidity providers can concentrate their funds in specific price ranges. | Further optimized for efficiency and profitability. |

| Customizable Fees | Different fee tiers to suit varying trading pairs. | More flexible fee structure for tailored liquidity provision. |

| Oracle Enhancements | Improved time-weighted average price (TWAP) oracles. | More accurate and reliable oracles for better pricing data. |

| Capital Efficiency | Greater capital efficiency with concentrated liquidity. | Enhanced capital efficiency, reducing costs for liquidity providers. |

| Security Features | Multiple security audits and robust mechanisms. | Advanced security features to protect users’ funds and trades. |

| Protocol Upgrades | Easier upgrades to future versions. | Streamlined upgrade process with backward compatibility. |

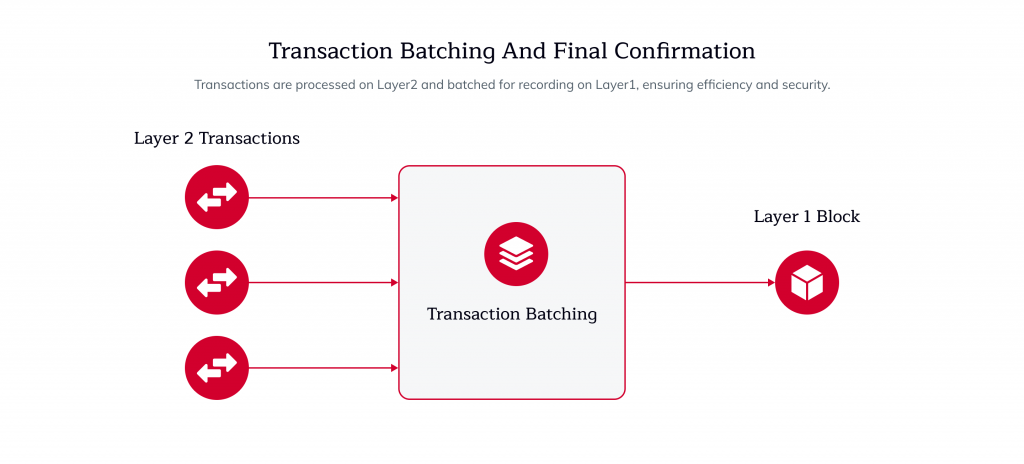

| Layer 2 Integration | Optimized for Ethereum mainnet and layer-2 solutions. | Improved integration with layer-2 solutions for faster and cheaper transactions. |

Enhancements in Uniswap V4

Uniswap V4 takes AMM functionalities to the next level. Here are some of the notable enhancements:

- Improved capital efficiency. Uniswap V4 further optimizes capital efficiency by allowing liquidity providers to allocate their funds even more precisely. This means higher returns on smaller capital investments and reduced risk.

- Dynamic fees. The introduction of a more flexible fee structure in V4 allows liquidity providers to set dynamic fees based on market conditions. This adaptability ensures better profitability and responsiveness to market changes.

- Better Oracle functionality. The improvements in Oracle functionality provide more accurate and reliable pricing data. This enhancement ensures that trades are executed at fair market prices. As a result, the risk of manipulation is reduced while system trust is increased.

- Streamlined upgrades. Upgrading to Uniswap V4 is more straightforward. Backward compatibility ensures that previous versions’ features are retained. This makes it easier for users to adopt the latest version without losing functionality.

- Layer-2 integrations. Uniswap V4 offers improved integration with layer 2 solutions. This integration results in faster transaction times and lower fees.

As you can see, Uniswap V4 represents a significant step forward in the evolution of AMMs.

Top 5 Features To Compete With Uniswap V4

We have identified the main innovations of Uniswap v4 compared to Uniswap v3. Next, let’s discuss what is a key feature of decentralized exchanges.

Feature 1: Liquidity Management

Of all the key features of a decentralized exchange, arguably the most important feature is liquidity management. Without ample liquidity, users face high slippage, longer transaction execution times, and, overall, a very frustrating trading experience. Through liquidity pools, decentralized exchanges are able to match trades quickly, ensuring that the platform remains usable and attractive for the users.

Competitive rates are merely a starting point for liquidity management in 2024. The top DEXs now employ sophisticated algorithms that rebalance pools, incentivize liquidity providers, and even yield farming solutions to maintain deep liquidity.

Liquidity will make or break your DEX. A well-managed system keeps the trades flowing with as little friction for the user as possible, which in turn keeps them coming back.

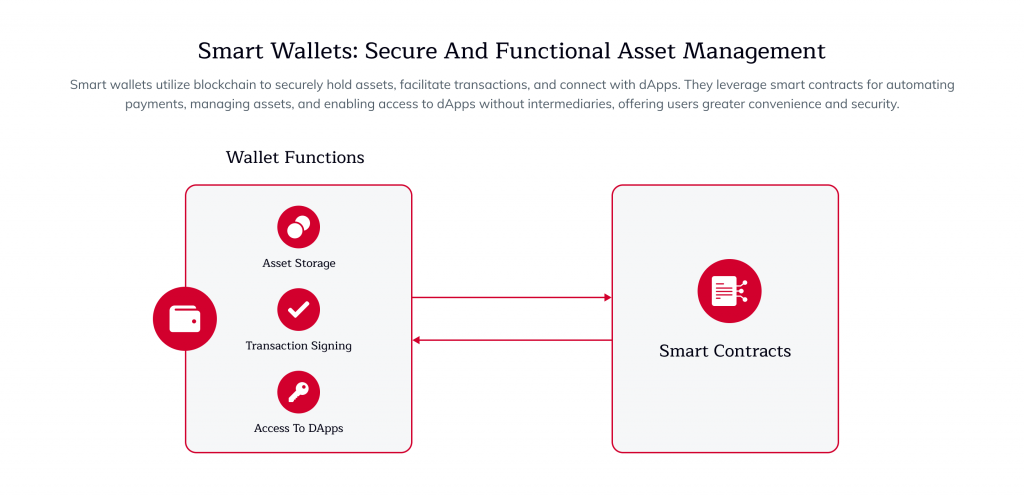

Feature 2: Smart Contracts

DEX is powered by smart contracts. Smart contracts automatically execute a trade without any intermediary. These are called smart because they execute trades based on predetermined rules and play a vital part in the platform’s behavior in a transparent way. In simple words, smart contracts serve as the trust layer between the user and the platform.

For many years, the most damaging cyber attacks have targeted weaknesses in smart contracts, leading to over $6.45 billion in losses. In the first half of 2023 alone, approximately $471.4 million was stolen on chain. Today, strong smart contracts limit that risk and save users as well as liquidity providers from an attack.

The tech stack can differ depending on your developers’ skills and needs. Our IdeaSoft team has experience in blockchain solutions development, and we know what we are talking about. Choose wisely, and you will not face serious challenges during or after development.

Feature 3: Bento Box UI/UX

Among the aspects of designing DEX, UI/UX is among the least discussed. No matter how decent the platform might be from a technological point of view, it’s incapable of evading repulsing users with a confusing interface.

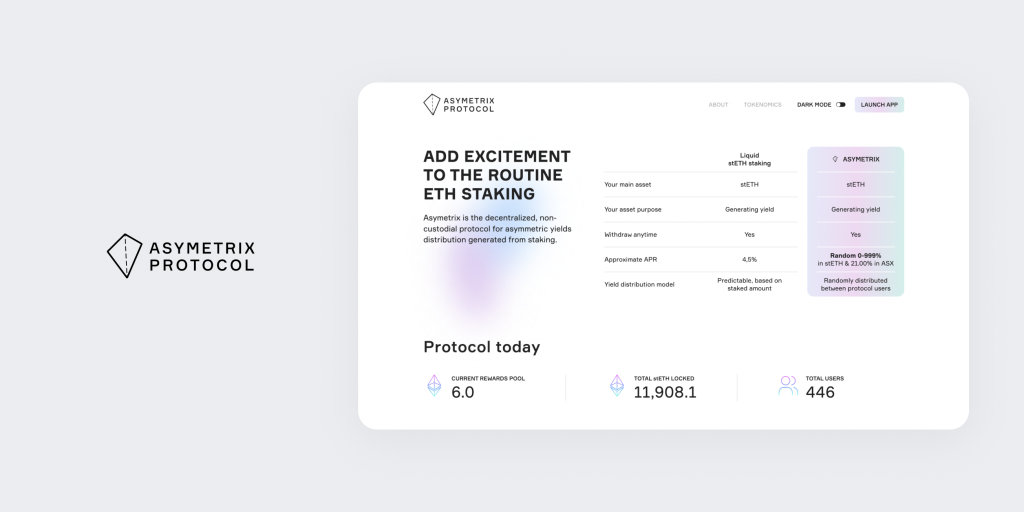

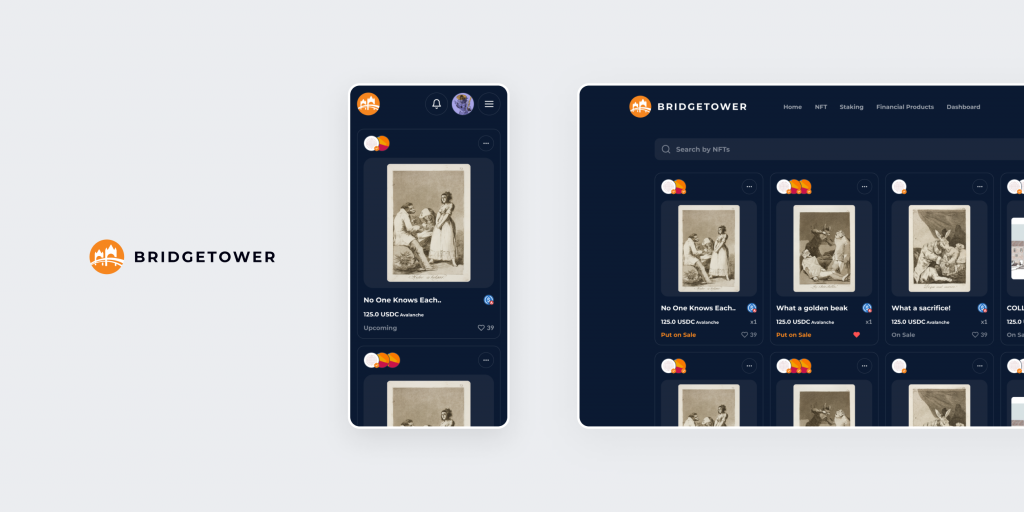

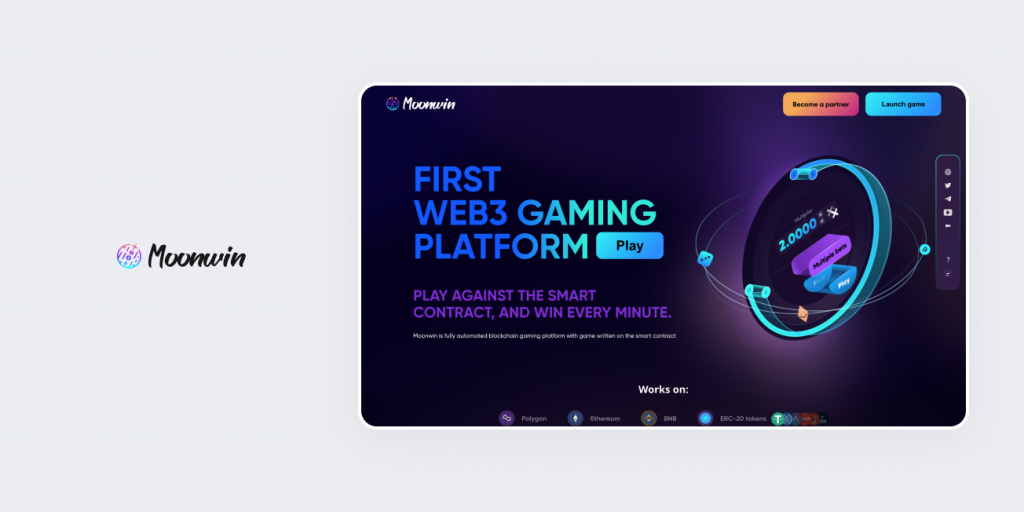

Bento Box UI/UX is about minimalism in a modular approach to providing users with as clean and intuitive experience as possible, concealing a far more complex entity in the background. However, you are free to use any other UI/UX trends in DEX development.

A well-thought-out user interface increases user engagement and retention. It should be painless for any user to navigate the platform and become a liquidity provider, trader, or staker. At the same time, businesses should consider the DEX development price, as custom UI/UX design can significantly impact overall costs while enhancing user adoption.

Remember that a well-designed UI enhances UX and encourages more users to engage with your platform. This is especially relevant for custom DEX development.

We’re always setting the bar high by putting the user experience front and center when developing DEXs. The more minimalistic yet elegant the design, the less friction there is. This increases user satisfaction and retention rate.

Herman Stohniiev, CTO and co-founder of IdeaSoft

Feature 4: KYC/AML Processes

KYC and AML processes are key enablers that support the long-term survivability of your DEX in these times of rising regulations. These steps keep your platform safe from fraudulent activities and help meet regulatory standards so that your platform can continue to function in most jurisdictions.

Don’t you know the difference between KYC vs KYT? While KYC confirms that the users are verified, AML attends to the monitoring and reporting of suspicious activities. These processes might be tedious. However, they do build trust and ward off legal risks to the platform.

Feature 5: Privacy Policies

The best policy would include transparency in collecting, processing, and storing methods of data. Key sections to include in a privacy policy:

- Data collection methods. Clearly explain what user data you collect and for what purposes.

- User consent. Make users aware of the information gathered from them and request their consent in case of need.

- Third-party services data. Mention whether the data are shared with any third-party service.

- Data security. Describe how security incidents involving user data are prevented.

Nowadays – following all new crypto market regulations coming into force, each DEX needs a solid privacy policy. It will protect your users and ensure that you comply with global regulations and data protection policies, like GDPR.

How to Overcome Challenges with IdeaSoft

With years of experience in AMM development, our team has refined and perfected the technology to address common pitfalls like impermanent loss, slippage, and smart contract vulnerabilities. As one of our greater achievements, we should underline the development of Orderly.Network – an infrastructural layer for DEXes within the NEAR blockchain ecosystem.

It’s a powerful NEAR-based solution with enterprise-grade liquidity and an order-matching engine on the board. This ecosystem has generated over $240 million in total trading volume and has great development potential in the DEX industry.

Our custom AMM solutions are designed to navigate the complexities of the crypto market, ensuring stable, efficient, and secure trading environments. By understanding and tackling the challenges inherent in AMM systems, IdeaSoft helps clients bypass potential pitfalls, allowing for a smoother, more reliable trading experience. Feel free to hire custom AMM features developers at IdeaSoft!

Speak with our team to turn your DeFi idea into a profitable reality!

Let us help you figure everything out, and correctly draw up the requirements for your project

Last Thoughts: Tech Stack Recommended & Other Security Measures

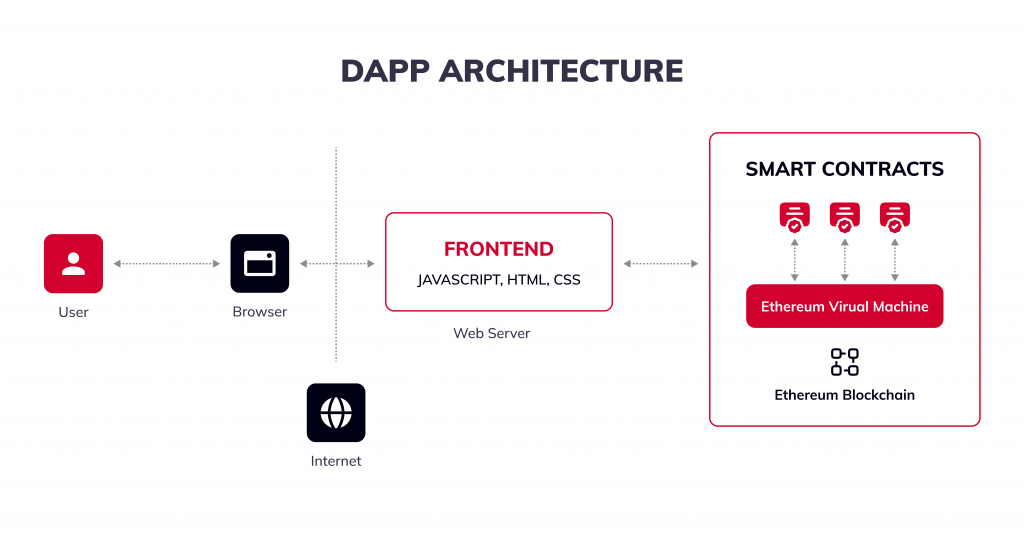

When it comes to building a secure DEX, the selection of the appropriate tech stack and the implementation of security measures play a vital role. In our opinion, one should stick to the proven tech stack: Solidity for smart contracts, Ethereum, or other reputable blockchain networks, while securing oracle solutions with Chainlink.

For robust and scalable decentralized exchanges, many developers rely on Ethereum and Binance for DEX due to their strong ecosystems and flexibility.

Besides that, a serious approach to following the best security practices will make a platform safe and reliable for its users. We have a separate article about top CEX security features. Below is a table outlining key security measures you should implement in DEX.

| Security Measure | Components | |

| Preventive Measures | Regular Security Audits | Conduct third-party audits on smart contracts and platform infrastructure. |

| Code Reviews | Continuous manual and automated code reviews to identify vulnerabilities. | |

| Secure Development Practices | Use secure coding standards and best practices during development. | |

| Encryption | Encrypt sensitive user data, transactions, and private keys. | |

| Detection Measures | Real-Time Monitoring | Implement systems for real-time monitoring of transactions and activity logs. |

| Intrusion Detection Systems (IDS) | Set up IDS to detect unauthorized access or suspicious activities. | |

| Anomaly Detection Algorithms | Use machine learning algorithms to spot unusual patterns in user behavior. | |

| Reactive Measures | Incident Response Plan | Have a predefined plan to address potential security breaches swiftly. |

| Regular Software Updates | Keep all libraries, dependencies, and software components up to date. | |

| Bug Bounty Program | Encourage ethical hackers to report vulnerabilities in exchange for rewards. |

We recommend you order an external audit from our IdeaSoft team. We will provide an unbiased assessment of your code’s security and reliability. Our developers have enormous expertise in AMM, DeFi, DEX, Lending protocols, etc. We have a crypto exchange case study where we showed all the processes.

Summary

Uniswap is an open-source protocol created by Hayden Adams and now controlled by DAO. For the first time, it allowed users to trade assets on the blockchain in general and Ethereum in particular without losing out on the “spreads” that inevitably occurred during the exchange process on the then-existing decentralized exchanges.

Uniswap managed to realize the new mechanism of automatic market maker proposed by theorists. This mechanism is served not by a book of limit orders that require a fee for creation but by a new primitive—token pools that work on the basis of smart contracts and reward users for providing assets to them. Among the essential features of a decentralized exchange, liquidity pools and automated market-making play a crucial role in ensuring seamless and efficient trading. The source of this profitability is trader commissions paid on trades.

During its existence, the protocol has never lost its leading position in decimalized exchanges. It has been deployed on all major networks and is generally a benchmark of the DeFi protocol, as it fully meets the basic requirements of its field.

If you need assistance, we can help you create AMM features with Uniswap v4. You can hire our custom AMM features developers through the IT outstaffing model or outsource your custom AMM development to our professional team. Don’t hesitate to get in touch via the form below.