The coronavirus pandemic has changed all areas of our lives, and industries were forced to respond to the new needs of society. Many of these needs are related to payments and other banking services. Banking is one of the fundamental areas that affects all the others. Therefore, whatever industry you work with, you should be aware of the top banking technology trends. In this article, we have compiled the main banking tendencies for 2025.

Table of contents:

- Banking market outlook

- The rise of neobanks

- Mobile banking experience

- Contactless payments

- Artificial Intelligence (AI)

- Open banking

- Blockchain

- Wrapping up

Banking market outlook

According to Deloitte insights, in Q2 2020, the top 100 US banks had provisioned $103.4 billion in net loan losses. COVID-19 pandemic harmed the industry, and it not only stopped the growth of the segment but also had a significant impact on banking technology trends. For example, more banks started to adopt blockchain and artificial intelligence as well as transfer all banking processes online. There are many reasons for this.

First, the COVID-19 pandemic created the conditions of forced and rapid digitalization. People had to stay at home with their smartphones which have become the most reasonable way of using banking services. For many customers, it was the first experience of remote interaction with banks. And they liked it.

Secondly, the COVID-19 pandemic increased people’s confidence in online solutions. During the period of self-isolation, people had enough time to learn mobile banking. Those who didn’t trust online banking were able to discover its benefits and increase their trust in it.

Third, COVID-19 has changed users’ expectations. It became even more important for customers to save 3 major resources: time, effort, and money when getting banking services. And mobile solutions are one of the easiest ways to achieve this. So banks are improving the quality of mobile banking apps as well as expanding their functionality.

So, there is no doubt that the impact of Covid-19 on the banking sector has been enormous. And it has led to the emergence of both new trends in the banking sector and new fintech trends in general, as a result. Let’s take a closer look at the top trends in banking services in 2025.

The rise of neobanks

Neobanks is a new generation of banks that operate completely online. Such banks first appeared in the United Kingdom and then spread all over the world. Basically, neobank is a digital bank, which is only available to customers in a mobile app or on a computer. The main sources of neobanks revenue are transaction fees, subscriptions to premium accounts, and commissions from third-party services.

Unlike traditional banks, neobanks:

- Do not have branches.

- Can work without a banking license (not in all states).

- Work on new technological platforms.

- Optimized for mobile device processes.

Advantages of neobanking for clients:

- Favorable terms of service due to lower costs.

- Transparent terms, no extra hidden fees.

- More flexible underwriting policy.

- Automatic analysis of cash flows.

- Access anywhere and anytime.

The neobank model is convenient for users and profitable for the banks themselves. They have many advantages over traditional banks. What’s more, in the context of constant digitalization, neobanks are becoming indispensable financial assistants. According to Statista, in March 2021 the six app-only digital banks had almost 40 million IOS and Android app downloads combined. The future of neobanks looks promising, so there is no wonder that they are part of banking technology trends.

Mobile banking experience

Today, a mobile device is literally the financial gateway to the world. That’s why banks are abandoning traditional structures and investing more in financial technology to offer personalized interfaces, improved security, and a wider range of services. With mobile banking, people can log into accounts from their phones and access banking services anywhere and anytime. One of the biggest advantages of mobile banking is that it is available 24/7. And since fintech companies and modern banks are using artificial intelligence extensively, banking apps could provide many more services in the future.

Easy access is one of the biggest benefits of mobile banking. People can make almost any financial transaction from their mobile banking app. So if they are on the go and want to transfer cash from one account to another, they don’t have to find a branch or wait until they get home. Therefore, mobile banking solutions are one of the main ways to meet the needs of modern users.

According to Juniper Research, the total number of online and mobile banking users has reached 3.6 billion by 2024. Also, experts predict that mobile payments will grow at a compound annual growth rate of 29.0% between 2020 and 2027, expecting to reach $8.94 trillion by 2027.

Contactless payments

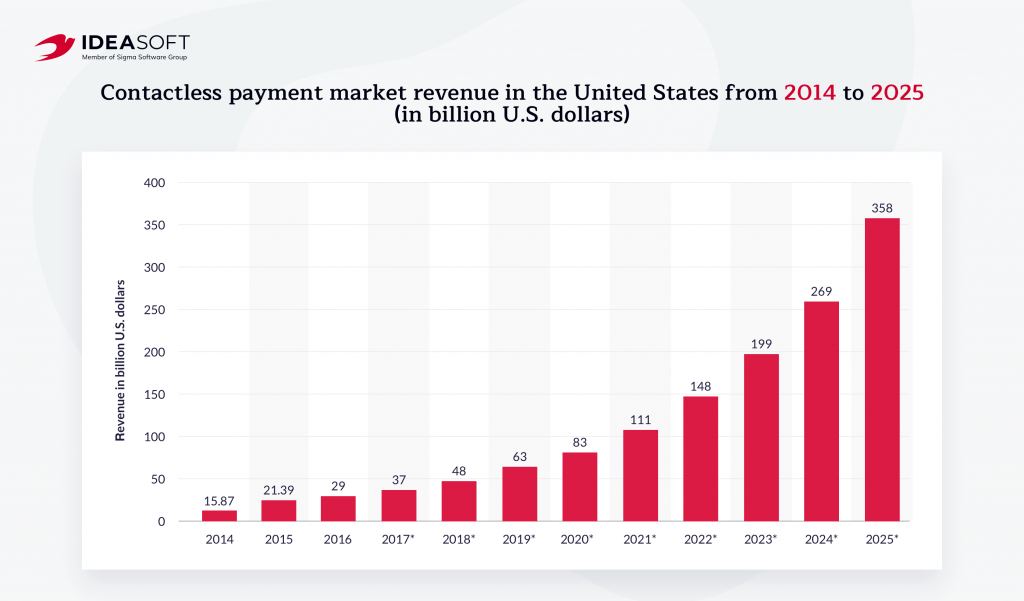

Statistics show that consumers around the world are switching to contactless payment methods. Back in 2018, the number of contactless payments globally increased by 72% to 70 billion transactions, accounting for 15% of total card payments. This figure had significantly increased in 2020 because of the COVID-19 pandemic. According to Statista, contactless payment market revenue in the United States is expected to reach $358 billion by 2025.

The pandemic has put the spotlight on contactless payment as a flexible payment option that allows quick and secure payments. For example, in countries such as the UK and Australia, where contactless payments are used in public transport fare systems, they account for a significant share of card payments. Also, QR codes are popular means of contactless payments in Europe and Latin America.

Small stores are interested in QR-code payments because of the opportunity not to install a terminal and not to pay for its maintenance. Also, QR codes are of interest to small entrepreneurs who currently accept only cash: beauty salons, hostels, flower stores, repair shops, etc. Forecasts show that contactless payments will be part of banking technology trends for a long time.

Artificial Intelligence (AI)

Banks are becoming conglomerates of huge volumes of information and now we see the manifestation of rather tough competition in the banking segment. Adopting artificial intelligence is one of the most effective ways to improve service delivery and stand out from the competition. According to the OpenText survey, most banks (80%) are highly aware of the potential benefits presented by AI and machine learning. Banks need an effective tool that will allow them to reduce costs and increase profits. Therefore, artificial intelligence, processing huge amounts of information is in the focus of financial institutions.

In today’s world, banks own not only the money but also a huge amount of data on all of their customer’s income and expenses. When payments moved online and stores learned to give detailed information about the purchases, banks learned everything about consumer habits. For example, what flavor of ice cream he or she prefers and in which store. And what to do with this information, keep it useless, or use it for additional services? Obviously, the second option is more profitable.

At this point, banks come to the need to implement AI. Only artificial intelligence can process such volumes of information. Based on its algorithms banks will soon be able to launch a whole set of new services. This way banking application is gradually transforming from a fairly narrow-functional service into a full-fledged universal assistant for all occasions, which takes into account the tastes and interests of the client.

For example, going back to ice cream, a bank might create an app based on purchase history and geolocation. Or another example: the bank gives personal discounts on life and health insurance based on the purchase history of fitness subscriptions. According to analysts at McKinsey, this is what the bank of the future looks like.

But back to today, most large banks have chat-bots and voice-bots in their contact centers. Smart algorithms know how to quickly solve customers’ issues. Some banks went even further in developing the functionality of the voice assistants: they can be used to transfer money or buy shares. The robot is not only able to communicate effectively itself, but also to control the work of employees and analyze how well they build dialogues with clients.

These are not all AI applications in the banking sector. For example, smart algorithms can also predict the likelihood of cyberattacks, and more.

Open banking

Open banking is a system in which banks open up their APIs to third-party service providers to access clients’ financial data and conduct financial transactions on the clients’ behalf. This approach improves the availability of financial services by connecting traditional banks and fintech companies into a single ecosystem. The main principle of open banking is that users independently choose which companies they want to open their data to and this is possible only with their permission.

Data transfer in open banking takes place using APIs, and the client’s consent to the processing of their data is certified using a special token that is valid for a limited time frame. Open banking provides reliable security flow, completely protecting information from unauthorized users.

The number of open banking users worldwide is expected to grow at an average annual rate of nearly 50 percent between 2020 and 2024, reaching 63.8 million users by 2024. Open banking contributes to increased competition in the market and improved offerings for users of financial services. By resorting to this model, banks get an additional way of rapid modernization, while fintech startups will be able to develop faster. Users also receive significant benefits and can easily manage their finances, choose service providers and make better financial decisions.

Blockchain

The rise in popularity of cryptocurrencies has not gone unnoticed by the banking industry. Today, DeFi is some kind of alternative to traditional finance. Most of the existing DeFi protocols are created on the Ethereum blockchain and the number of new applications in decentralized finance is steadily growing.

DeFi consists of blockchain-based services and applications. Decentralized finance opens access to decentralized lending and new investment platforms for a large number of people. Moreover, it allows them to earn passive income from cryptocurrency assets, as well as save on transfer fees, loans, and deposits. Although the decentralized application sector is just developing, the advantages are already quite numerous. The main one is that any user can get a particular financial service, for example, a loan, bypassing the bank. Decentralized lending protocols minimize risk and provide 24/7 access to borrowed funds. This is especially relevant for borrowers from countries with expensive bank loans.

Even apart from DeFi, the growing popularity of blockchain has been keeping this technology in the top banking technology trends for several years. By using blockchain, banks optimize their functionality and reduce risks. For example, some banks have been able to migrate their operational systems and risk controls to innovative cloud-based platforms. Blockchain development isn’t so easy as some people think. So be sure to work with experienced developers.

The main areas affected by blockchain technology are as follows:

- Optimization of financial reporting, driven by improved quality and timeliness of incoming information.

- Reduction of compliance costs due to the transparency and ease of verification of banking transactions.

- Minimization of centralized activity costs due to the implementation of digital identification and limited access to personal information.

- Reducing the cost of operating activities due to the automation of transactions, as well as their control and error analysis.

According to Statista, the application of blockchain technology in the financial sector is expected to reach a market size of approximately 22.5 billion U.S. dollars in 2026.

Wrapping up

Banks are increasingly adopting advanced technologies and working on new digital transformation strategies. The rapid development of fintech and the growing popularity of DeFi platforms are forcing traditional banks to look for new solutions to compete with alternative financial service providers in the market. Top banking technology trends in 2025 include neobanks, mobile banking, artificial intelligence, blockchain, and contactless payments. These solutions improve the user experience, streamline internal banking processes and help achieve efficiency for both parties.

However, banking technology trends may change. Therefore, it is important to work with an expert banking software development team that can help you solve your tasks in the best possible way. IdeaSoft is a first-class software development company that provides European quality services. Our portfolio includes over 250 projects in different domains, including the banking sector. Check out our Fintech software development page or contact us directly to discuss your next project!