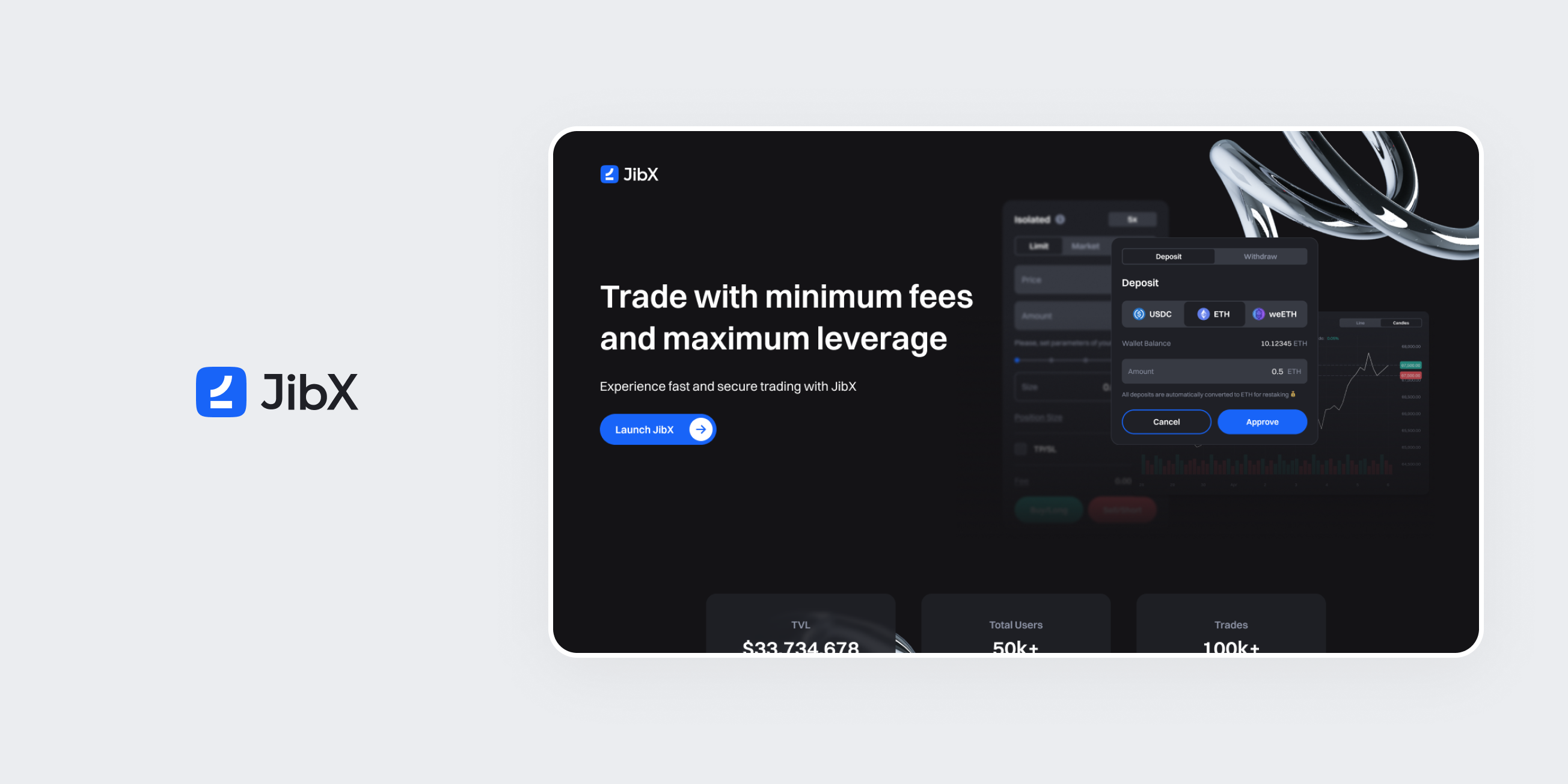

Web3 Decentralized Derivatives Trading Platform for JibX

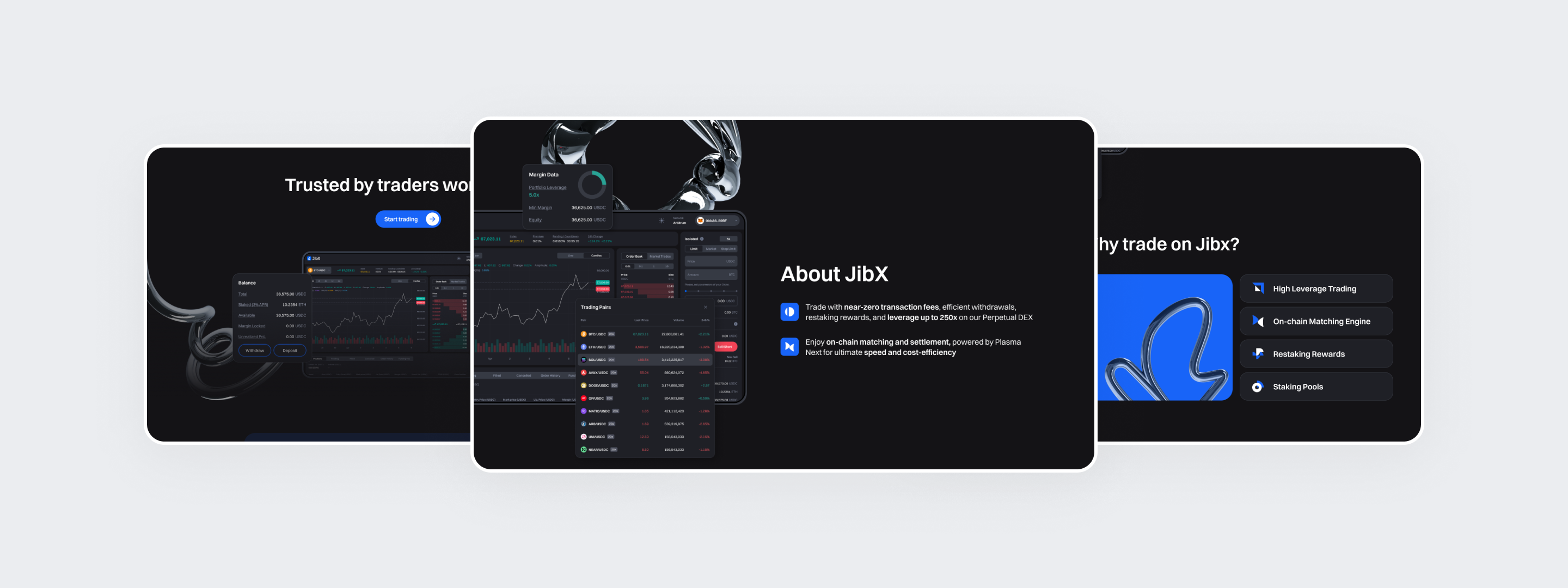

A Swiss-based Web3 firm sought to disrupt the decentralized trading landscape with the launch of an exceptionally fast derivatives exchange tailored for advanced crypto traders. Focusing on perpetuals and advanced risk instruments, the exchange aspired to provide an institutional-grade trading experience fully on-chain.

IdeaSoft was commissioned to develop the platform from scratch: a scalable, secure, and intuitive DEX with a custom matching engine, settlement layer, cross-chain support via LayerZero, and a trading UI designed for real-time decision-making. The ultimate deliverable was a full functional MVP that established the groundwork for the client’s future expansion in the DeFi space.