You want to build a DEX but don’t know who to trust the development with. Making the wrong choice can cost you precious time and money and compromise the security of your platform.

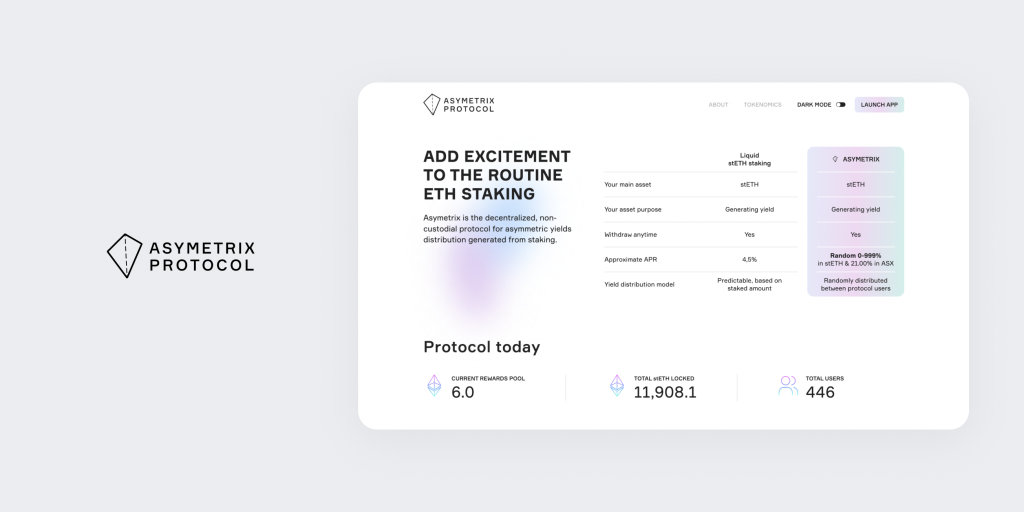

IdeaSoft specializes in secure and scalable decentralized exchange (DEX) development, assisting blockchain startups, fintech businesses, and financial institutions in launching successful DEX platforms with confidence. Our software developers have successful histories of producing secure, high-performance solutions, including the highly secure and easy-to-use platforms developed for Versara and Asymetrix Protocol.

Highlights:

- Long-standing experience with blockchain in smart contracts and liquidity integration

- Successful track record for DEX projects

- Strict adherence to security and regulatory compliance

- Transparency in pricing and project management

- After-launch support for continuous improvement

In this article, we discuss how to choose a DEX development company. We also cover key points to pay attention to when choosing DEX developers, an essential DEX development stages checklist, and common pitfalls with how IdeaSoft circumvents them. At the end, you will find in-depth FAQs addressing cost, timelines, blockchain choices, and white-label vs. custom solutions.

Unsure who to trust with your DEX development?

Let’s talk and plan it right!

Table of contents:

- Key Things to Remember While Choosing a DEX Development Partner

- DEX Development Process Checklist

- Common Pitfalls When Choosing a DEX Provider (and How IdeaSoft Avoids Them)

- Conclusion

Key Things to Remember While Choosing a DEX Development Partner

Decentralized Exchanges (DEX) are extremely dissimilar from centralized exchanges (CEX) as they operate without intermediaries. DEXs allow peer-to-peer transactions. This way, they provide:

- More security

- More independence for users

- Less risk of centralized manipulation

- Less risk of downtime

Users possess full ownership of their assets, thus making DEXs extremely immune to hacking attacks and regulatory shutdowns. For a detailed roadmap on how to build cryptocurrency exchanges, see our in-depth guide: How to Build a Cryptocurrency Exchange Platform.

When evaluating potential DEX development providers, the following comprehensive criteria should be applied. They will help you understand how to choose a decentralized exchange development company.

Experience in DEX Development

Proven experience in decentralized exchange development is crucial. Seasoned providers fully understand complex technical matters such as:

- Smart contract logic

- Liquidity processes such as Automated Market Makers (AMMs)

- Integration into decentralized finance (DeFi) ecosystems

For example, IdeaSoft successfully developed platforms such as Securitize and Biteeu. We demonstrated high-performance DEX solution capabilities to the extent of thousands of transactions per second.

Learn more about IdeaSoft projects in our comprehensive case studies.

Security & Compliance Standards

Crypto exchange security features come first, especially in the wake of nearly $1.5 billion stolen from Bybit in 2025. Selecting a partner that focuses on security-first development practices is imperative. We mean:

- Smart contract audits by trusted companies like CertiK or Hacken

- Bug bounty programs

- Strict adherence to AML (Anti-Money Laundering) and KYC (Know Your Customer) standards in crypto

For example, robust KYC integration ensures that platforms are FATF compliant, significantly reducing regulatory risk and improving user trust.

Blockchain & Tech Stack Expertise

The performance of DEX relies on choosing an appropriate blockchain and tech stack. Operators with experience with leading blockchains like Ethereum, BNB Chain, Polygon, or Solana are better suited to offer solutions that are best suited for:

- High scalability

- Low fees

- Speed of transactions

For instance, Solana can handle as many as 65,000 TPS, significantly more than Ethereum’s 15-30 TPS. This is why it is ideal for high-frequency trading applications.

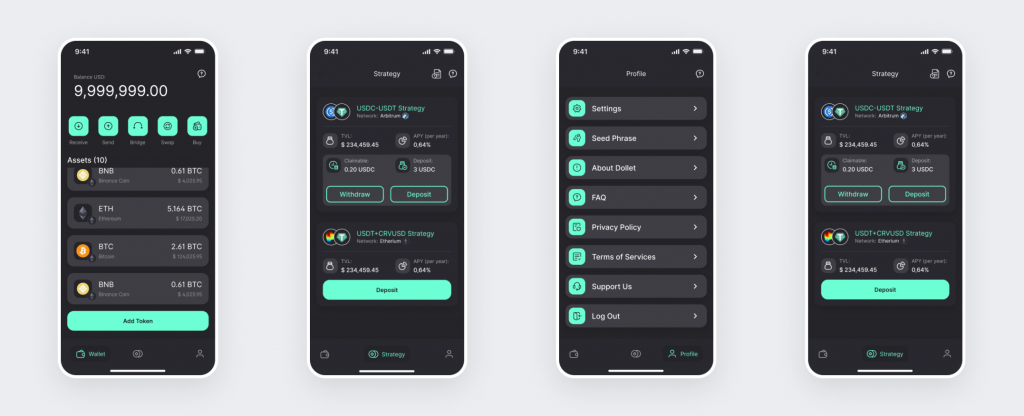

UI/UX Experience

Smooth user experience greatly improves adoption and retention rates. Excellent UI/UX ensures:

- Seamless navigation

- Quick transaction confirmations

- Easy interactions

Top DEX platforms, such as Uniswap and PancakeSwap, focus on simplicity and ease of use. This results in better retention rates and enormous trading volume growth.

IdeaSoft places emphasis on user-centered design. We conduct thorough usability testing to validate that all solutions satisfy user requirements. This results in ongoing engagement and trust.

Post-Launch Support & Maintenance

Careful partner choice combined with strong post-launch support is critical. What this implies:

- Regular security patches

- Continuous optimization of smart contracts

- Rapid adoption of future DeFi features

They keep platforms in contention and secure. According to Gartner, by 2026, 70% of enterprises will have integrated compliance as code into their DevOps toolchains. This helps with reducing risk management and improving lead time by at least 15%..

IdeaSoft provides thorough post-launch maintenance. We resolve probable issues ahead of time, improve features, and increase solutions to keep up with user growth.

Book a consultation for developing your DEX with IdeaSoft today!

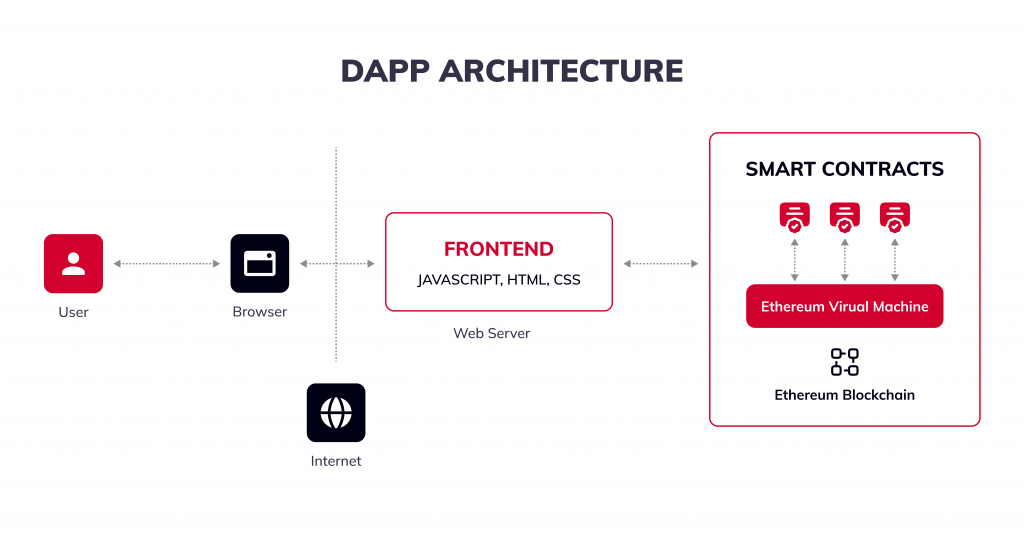

DEX Development Process Checklist

Decentralized exchange software development involves several significant steps. Here is a quick checklist for you:

- Planning & Research. Market research, blockchain platform selection, and regulation analysis.

- Smart Contract Development. Stable, secure, and audited contracts delivering secure and optimal transactions.

- Liquidity Integration. Developing stable liquidity pools and integration with decentralized finance protocols.

- Security Audits & Compliance. Detailed audits and rigorous AML/KYC regulations compliance.

- Testing & Optimization. Comprehensive QA procedures, bug resolving, and performance optimization.

- Deployment & Launch. Seamless deployment on selected blockchain networks, persistent monitoring, and scaling.

Common Pitfalls When Choosing a DEX Provider (and How IdeaSoft Avoids Them)

Choosing the ideal decentralized exchange software development partner is what makes or breaks your project. Below are elaborate explanations of common pitfalls and exactly how IdeaSoft avoids them.

Underestimating Security Requirements

Most companies underestimate the importance of security and, therefore, create risks that lead to severe financial loss. At IdeaSoft, we adopt a security-first approach with full security measures. This includes:

- Multiple smart contract audits by well-known firms like CertiK

- Frequent penetration tests

- Live vulnerability monitoring

Our compliance team ensures full compliance with global AML/KYC regulations to keep your risk of non-compliance minimal.

Choosing Based on Lowest Cost

Selecting solely on the lowest cost has the potential to result in poor quality development, inferior infrastructure, and unscalability. IdeaSoft provides clear, concise proposals detailing how every dollar adds up to robust technology, flawless scalability, and secure architecture. Our approach enables your DEX platform to balance upfront cost with long-term stability and performance so that you are offered excellent value.

No Clear Roadmap

Without a properly defined roadmap, DEX projects stand to:

- Missed crucial deadlines

- Increase expense

- Experience scope creep

IdeaSoft starts every project off by carefully planning every phase, from market research to technical feasibility studies, detailed project timelines, and well-defined milestones. Such deliberate strategic thinking avoids expensive surprises and keeps the development process strongly aligned with your business objectives.

Not Evaluating Communication Culture

Misunderstandings, project delays, and costly revisions are caused by communication breakdowns. Top decentralized exchange developers prize highly cooperative and open communication. They employ specialized project managers to inform clients of specific progress reports regularly. We at IdeaSoft employ good project management tools. They facilitate ongoing, transparent, and proactive communication throughout the entire project life cycle.

Not Checking for Ongoing Support

Post-launch monitoring dilutes the long-term viability and retention of a platform. IdeaSoft values end-to-end long-term support by providing:

- Dedicated personnel for continuous monitoring

- Prompt resolution of issues

- Continuous security patches

- Methodical improvements

Conclusion

Developing a decentralized exchange is a complex and strategically significant undertaking. To succeed, hire DEX development company that understands the intricacies of:

- Blockchain technology

- Regulatory compliance

- Security best practices

- Market dynamics

IdeaSoft offers expertise, transparent project management, rigorous security protocols, and ongoing support tailored to your business objectives.

If you are ready to dive deeper into developing your secure and scalable decentralized exchange, our experts at IdeaSoft are here to provide detailed consultation and help you bring your innovative ideas to fruition.

Ready to launch a secure, scalable DEX?

Let IdeaSoft bring your vision to life!