In today’s tech landscape, the journey doesn’t end with launching a product; it’s just the beginning. As a tech provider deeply invested in our clients’ success, we’ve witnessed a shift in priorities. Many of our longstanding Web3 partners now grapple with the challenge of retaining users and enhancing their experience in an increasingly competitive arena.

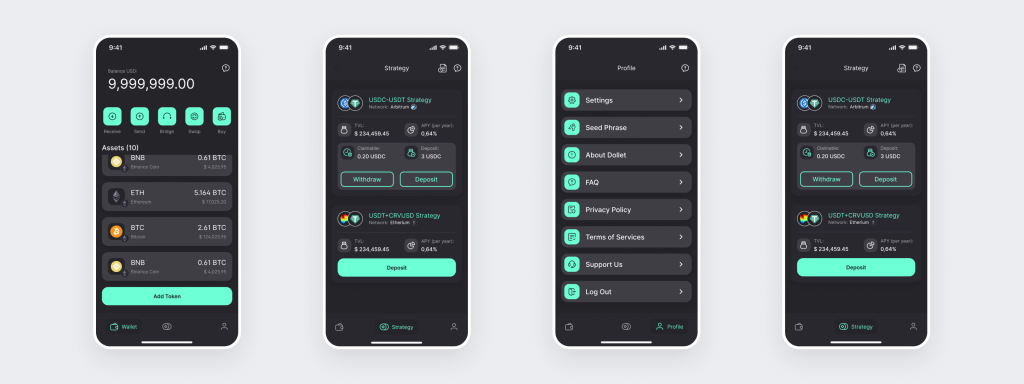

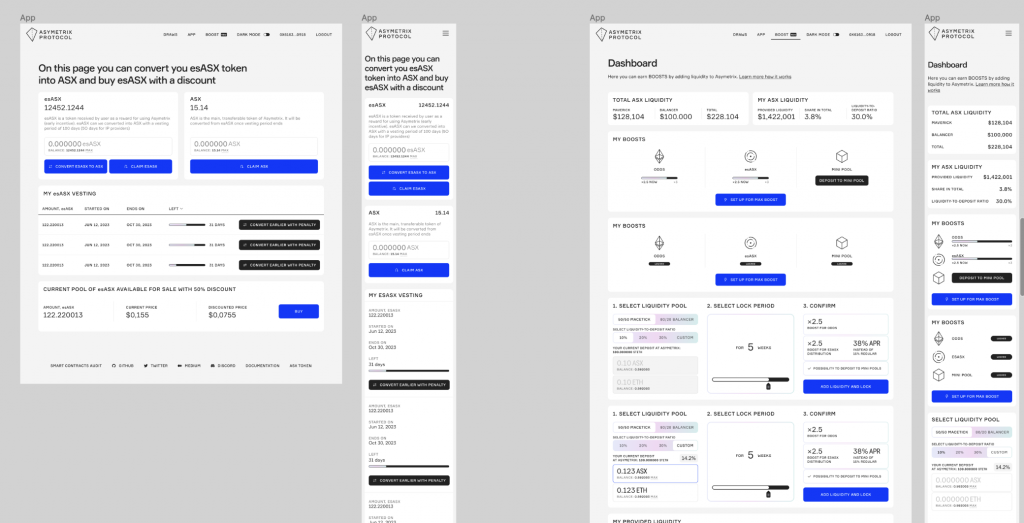

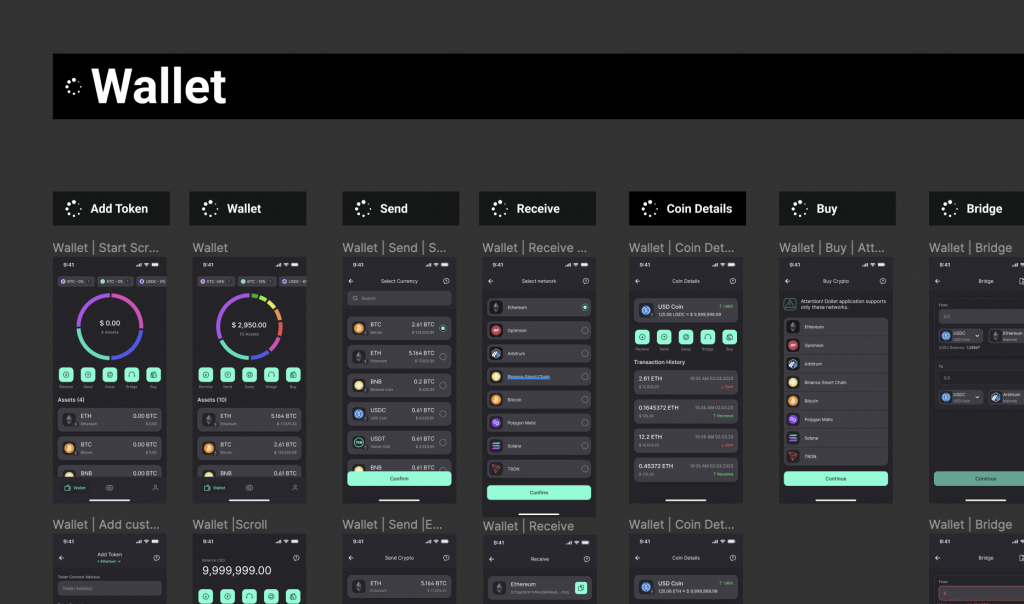

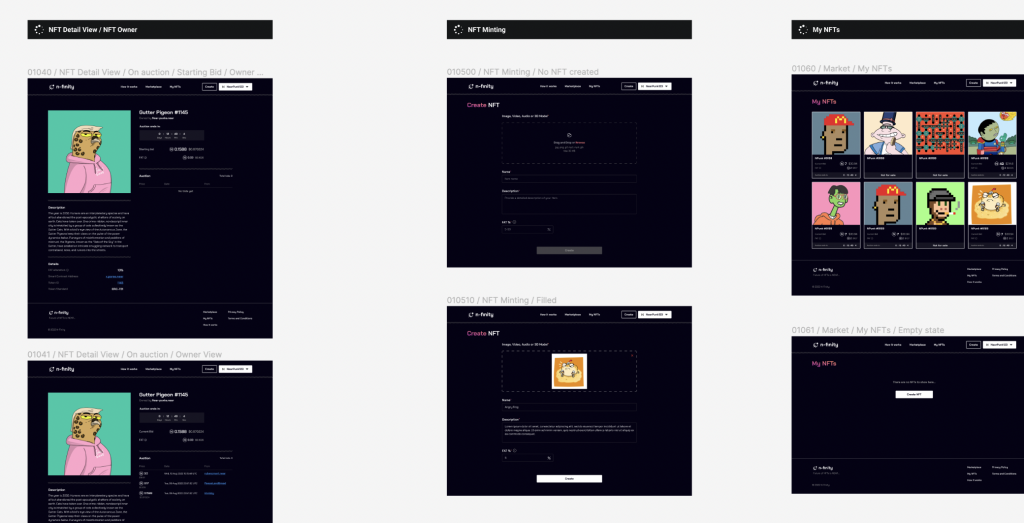

Take niches like crypto wallets or DeFi platforms, for example. These are saturated markets where standing out is crucial. It’s not just about offering a product. For our IdeaSoft team, developing UI/UX for crypto wallet is about waging a battle for user attention and loyalty. One way to achieve this is by leveraging the power of bento UI, a flexible and user-friendly interface design system that enhances the overall user experience.

Recognizing this paradigm shift, we’re pioneering a new approach: crafting UX-optimized pages that transcend traditional platforms. By focusing on enhancing user experience to improve conversion, we empower our clients to thrive in relentless competition.

Backed by a seasoned design team with years of experience, including specialists immersed in Web3 UX for over 7 years, we bring unparalleled expertise to every project. It’s not just about creating websites. It’s about shaping digital experiences that captivate and convert.

Our article will discuss how to increase user engagement with UX and top UX design tips to improve website conversions.

UX and CX are the top priorities for web3 and fintech platforms in 2024! Why?

As our partners and lasting clients navigate the ever-evolving landscape, the focus shifts to retaining users and elevating their journey within a fiercely competitive environment. Meeting this challenge demands unconventional strategies and a commitment to continuous enhancement of the customer experience within your application. Our design team has over 7 years of expetise in web3 niche and knows how to tackle these demands head-on, ensuring that your platform remains engaging and compelling amidst the intensifying competition.

Table of contents:

- Understanding UX and Its Impact on dApp Users

- 12 Key Principles of UX Design for Conversion Optimisation

- 3 Practical UX Design Tips for Boosting Website Conversions

- How to Measure the Impact of UX on Conversion Rate

- Summary

Understanding UX and Its Impact on dApp Users

UX design is the process of developing products (websites, apps, programs) that are useful, easy to use, and pleasant to interact with. In other words, it is the design of systems that should lead the user from the starting point to the endpoint by the shortest route and without difficulty.

UX design means the intersection of programming, design, and testing. The scope of work may vary depending on the specifics of the Web3 solution, but they often include the following:

- User research

- Character creation

- Developing wireframes and interactive prototypes

- Design testing

Conversion optimization with dapp development, UX must advocate for users and put their needs at the center of all design and development efforts.

12 Key Principles of UX Design for Conversion Optimisation

Drawing from the expertise of our Senior UI/UX designer, Anastasiia Lisova, let’s delve into the 12 key principles of Web3 product UX:

- Text contrast for accessibility. Ensuring optimal text contrast is not just about aesthetics but also about accessibility. Anastasiia utilizes tools like A11y Color Contrast Checker to guarantee readability for all users. At the same time, the main text size should be at least 16px for desktop and 14px for mobile screens.

- Minimalism in design. Every element on the screen should serve a purpose. Eliminate unnecessary distractions to avoid clutter. By keeping the interface clean, users can focus on what truly matters, enhancing their overall experience.

- Familiar patterns for seamless interaction. Leverage existing user patterns to reduce cognitive load. Users can effortlessly navigate through the Web3 interface by incorporating familiar design elements, leading to higher engagement and conversion rates.

- Strategic color usage. Limit the color palette to one accent color for primary actions and one secondary color. Avoid using pure black (#00000) and opt for shades to maintain visual harmony. This not only enhances aesthetics but also guides users towards key interactions.

- Deliberate button design. Design destructive buttons such as cancel, exit, or delete with caution. Require users to click on them deliberately to prevent accidental actions. Incorporate additional confirmation prompts before executing destructive actions to prioritize user control and safety.

- Typography for clarity. Choose simple and concise fonts like Nunito Sans, DM Sans, Inter, or Source Sans for the main text. Clarity in typography enhances readability, ensuring that users can effortlessly consume content.

- Error handling with guidance. When errors occur, provide users with actionable solutions rather than just displaying generic error messages. Offer clear guidance on how to rectify the issue, fostering a sense of empowerment and reducing user frustration.

- Multi-sensory information design. Avoid relying solely on color to convey information, as it excludes users with color blindness. Incorporate alternative cues, such as icons or textual indicators, to ensure inclusivity and accessibility for all users.

- Spacing for visual hierarchy. Maintain adequate spacing between elements to prevent clutter and enhance visual hierarchy. Well-defined spacing creates breathing room, improving overall readability and comprehension.

- Feedback through loading states. Implement loading states to signify system responsiveness, especially for actions with delayed responses. Visual feedback assures users that their interactions are acknowledged, enhancing their sense of control and understanding.

- Consistency in iconography. Maintain uniformity in iconography by using the same line thickness across all icons. Consistency fosters familiarity, making it easier for users to interpret and interact with interface elements.

- Progress indicators for guidance. Incorporate progress bars for actions that involve multiple steps. Progress indicators offer users transparency regarding their current position in the process, reducing ambiguity and improving task completion rates.

In contrast, such approaches as thin fonts, large headers at the top of the page, low text contrast, auto-scrolling, and carousel slider on the home page may become the great disadvantage for your platform or dApp UX.

Anastasiia Lisova, Senior UI/UX Designer at IdeaSoft

Use these UX design hacks to improve website conversions. They have helped our team build dozens of Web3 products that drive the best user journey for our clients.

3 Practical UX Design Tips for Boosting Website Conversions

Here are 3 practical tips to improve conversion rate with UX design.

Use a clear CTA button

A call to action (CTA) is a button used on a website to motivate users to take a specific action. The most common and effective CTAs are: “Download a trial”, “Sign up for updates”, “Download an app”, “Book a consultation”, and many others.

Using a clear and attractive call to action button improves the user’s interaction with the website. This attribute should be located on every page of the website. Statistics confirm that resources with clear CTAs have higher conversion rates.

Besides, having clear wording for such a call to action significantly improves the overall user interaction. But do not forget, the button will work only if it is located in a prominent place on the page and attracts his or her attention with its design and content. Therefore, creating a new website or redesigning the current site, take into account the following points:

- Varying the color of the CTA plays a significant role in its effectiveness. Use colors for this button that contrast with the color scheme of the entire web page.

- Orient the text of the CTA to specific actions. Avoid using passive verbs. The text should be subtle and unobtrusive but active enough to encourage the user to perform the proposed action.

- Content of the CTA should be as concise as possible – no more than 5 words.

Thus, in website UX design, a clear and visible call to action is a prerequisite for effective interaction between the site and the user. If you need a reliable UX/UI partner, we at IdeaSoft know how to design Web3 app as well as have experience in redesigning UX for conversion optimization.

Eliminate your 404 errors

If, as a result of the search, the visitor gets an error (in most cases, it is a 404 error), he or she simply goes to another site in search of a faster service. In other words, you lose a potential user. How to avoid this:

- First, find out for which queries 404 errors are displayed and fix them as soon as possible.

- Instead of letting your site go to the standard “Error 404: page cannot be displayed” page, customize error messages so that users find them friendly and attractive.

- Use engaging images and create a pleasant background on the error page to reduce annoyance and smooth out the user’s inconvenience.

- Try to take advantage of this situation. Based on your website’s specifics, offer the visitor the option to go to the main page, use the search function, read the promotions, or just entertain him or her.

Unfortunately, it is almost impossible to completely eliminate error messages. Still, you can turn this drawback in your favor, and timely identification and elimination of such defects will bring your resource site to the ideal UX.

Use authentic images

Authentic design is about creating something unique to your brand, avoiding replication or imitation of competitors. It’s crucial that your design not only reflects your brand’s unique selling proposition (USP) but also resonates with your target audience. This approach requires a foundation in thorough user research and understanding of your audience.

By aligning your design with your USP and audience preferences, it becomes a powerful tool in attracting and engaging customers from the very first click. This strategic approach ensures that your design acts as a compelling call-to-action, enticing visitors and driving website conversions.

How to Measure the Impact of UX on Conversion Rate

IdeaSoft design team recommends to use a structured approach to measure the impact of UX on conversion rate:

- Analytics tools. Utilize analytics tools like Google Analytics, Hotjar, or Mixpanel to track user behavior on your platform or dApp. Pay attention to metrics such as page views, time on page, and user flow to identify areas of improvement.

- A/B testing. Implement A/B tests to compare different versions of your UX design to improve website conversions. Test variations in layout, color schemes, call-to-action (CTA) placement, and other design elements.

- Heatmaps. Use heatmapping tools like Plerdy to visualize where users click, scroll, or hover on your website. Heatmaps provide valuable insights into user engagement and can highlight areas for UX optimization.

- Benchmarking. Compare your conversion rate and UX metrics against industry benchmarks or competitors. This provides context and helps set realistic goals for improvement.

- Iterative improvement. Continuously iterate on your UX design based on the insights gathered from the above methods. Monitor how these changes impact conversion rate over time and adjust your strategy accordingly.

Summary

Remember, the key lies in continuous testing, analysis, and adaptation to ensure that the website evolves alongside user needs and preferences. With these UX conversion optimisation tips in mind, you can create seamless digital experiences that drive higher conversions and foster lasting customer satisfaction and loyalty.