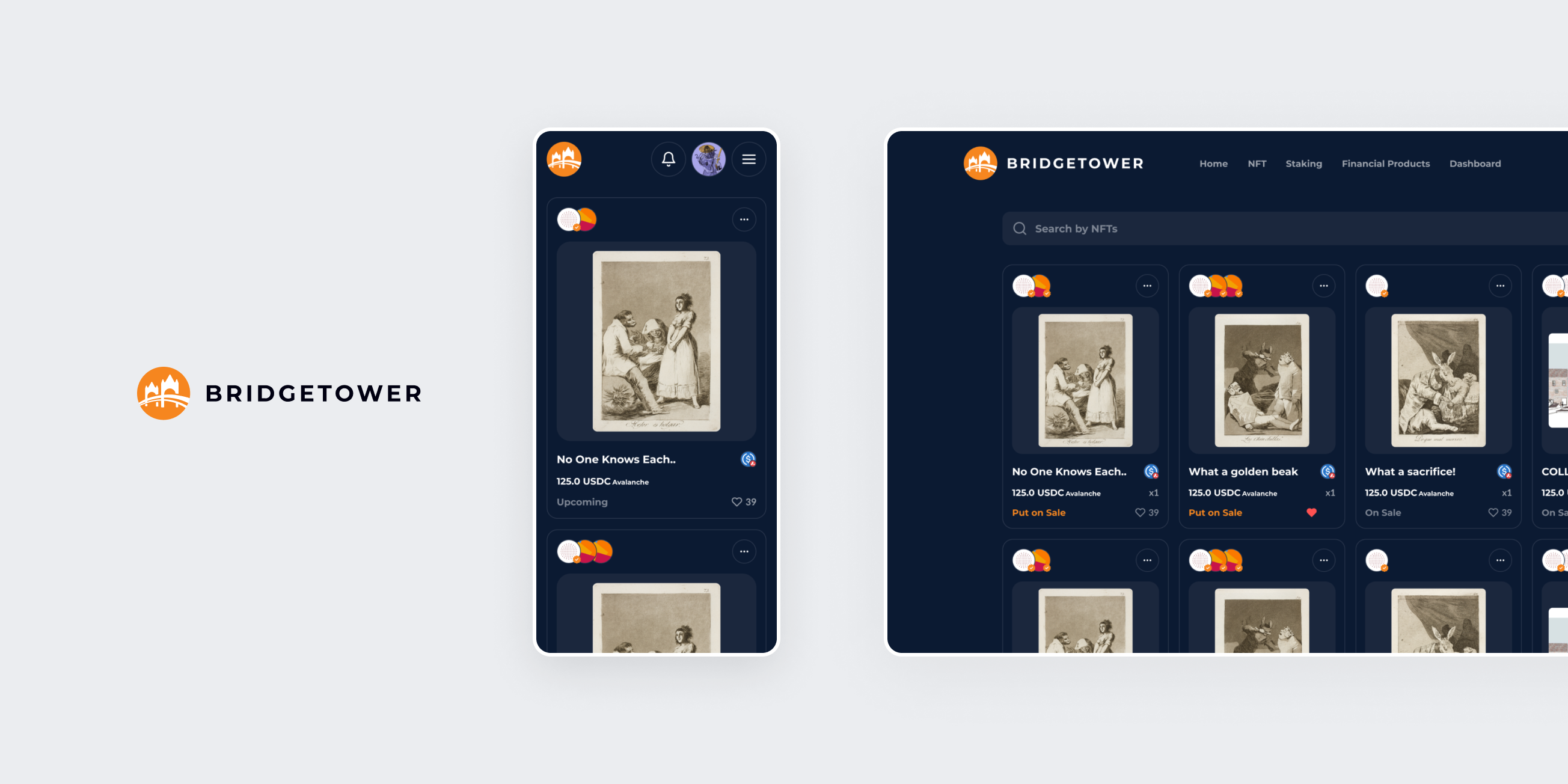

Global Marketplace Development for BridgeTower

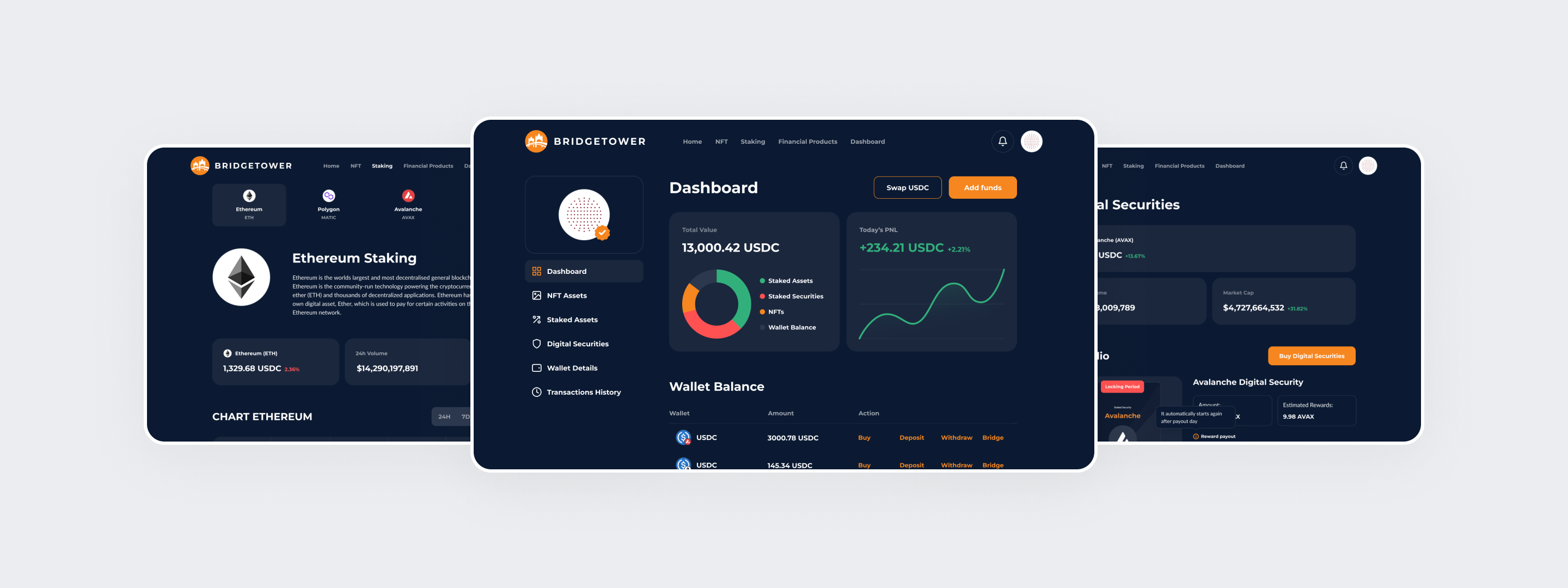

IdeaSoft has helped develop technology for the BridgeTower Market featuring KYC/KYB, anti-money laundering (AML) by MasterCard, wallet whitelisting, proof-of-reserves, custodial services, fiat-to-crypto on and off ramping capabilities. The BridgeTower Market seamlessly integrates numerous best-in-class technologies to provide compliant jurisdiction and diverse solutions.

In addition, the BridgeTower platform has its own NFT marketplace, staking, and security tokens that are still under development and will include other features.

Learn more about our Blockchain Development Services