In the dynamic world of Web3, a start-up finds itself in the chase to scale up as quickly as the increasing user demand can put up with. However, scaling up that fast can cut corners if security measures are not pursued as diligently. Hence, building a successful Web3 company needs just the right amount of protection, especially since the security risks evolve hand-in-hand with the dynamic evolution of user expectations.

At IdeaSoft, we believe in crafting scalable solutions that correspond with the demands of fast-growing ecosystems for Web3. Our partnership with Hypernative, the leading Web3 security company offering real-time threat monitoring and automated response solutions, strengthens our ability to scale flexibly and securely. As we work on constructing adaptable infrastructures for fast growth, Hypernative contributes the necessary security input that keeps the guard up at all times for startups.

Working together, our ambition is to help Web3 founders scale securely, with confidence in both their business goals and the strength of their security protocols.

Building a Scalable Foundation for Web3 Startups

In Web3, every startup finds itself in a peculiar bind of growth and security. In that sense, we at IdeaSoft believe success should, therefore, be about embracing both these objectives equally. We are committed to developing solutions that are scalable but equally secure.

Clearly Defined Business Objectives to Start Off

These are the most important preludes to developing any technological solution. They serve as guidelines while building the security and scalability strategies that will, over time, be quite necessary as the startup grows.

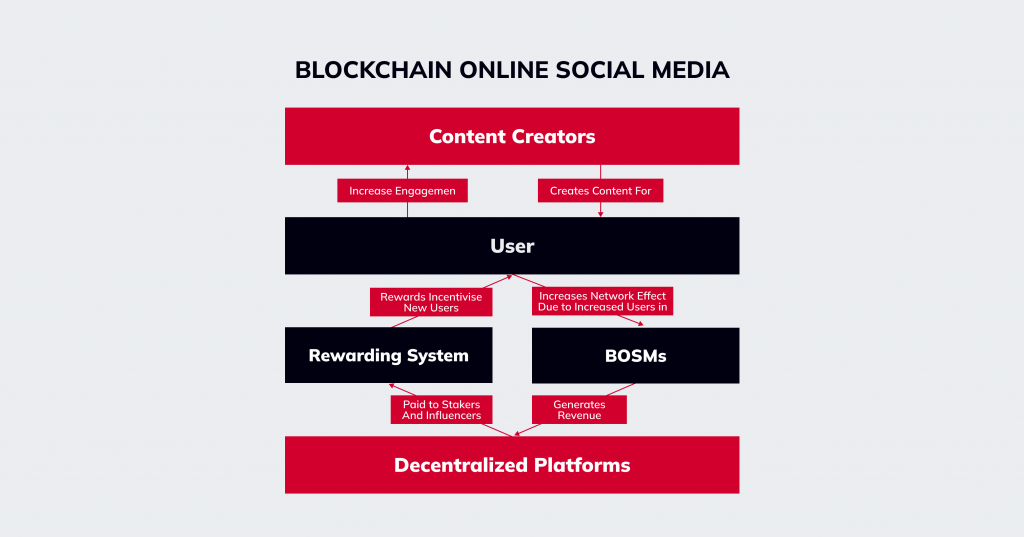

For example, a Web3 startup focused on DeFi could set the goal of onboarding 10,000 users within the first six months. Your goal drives everything, from how to architect the infrastructure to how to implement the security requirements. In that case, setting up for high-volume users would transform into a focus on high transaction throughput and ensuring that higher traffic volumes are not affecting the security of the platform.

Creating Scalable Solutions

In this case, the scalable solution will be one whose infrastructure can adapt to support exponential growth without losing performance and functionality. What this usually means for Web3 is a solution that can handle sudden spikes in users, data, and transactions without breaking a sweat.

For example, think of a blockchain-based gaming startup that records some in-game assets and then suddenly experiences an influx of users. The system should seamlessly scale out for such situations and avoid slowdowns or crashes.

At IdeaSoft, we take pride in devising solutions that consider flexibility and longevity. Through modular architectures, we give startups the ability to iteratively adapt or scale their platforms so that organic growth or sudden spikes in use can be accommodated with ease.

These architectures also let us integrate security layers that evolve with the product and create a more sustainable growth model. This ensures that the underlying infrastructure stays strong, responsive, and secure regardless of scale or pace.

Balancing Security with Goals of Scaling

Scaling for Web3 startups isn’t just about how to handle an increasingly large group of users, but how to handle such users while keeping the standards of security high. Security should be embedded by design into the growth strategy right from day one rather than being an afterthought. Negligence here leads to vulnerabilities that scale with the platform, putting the company and its users at risk.

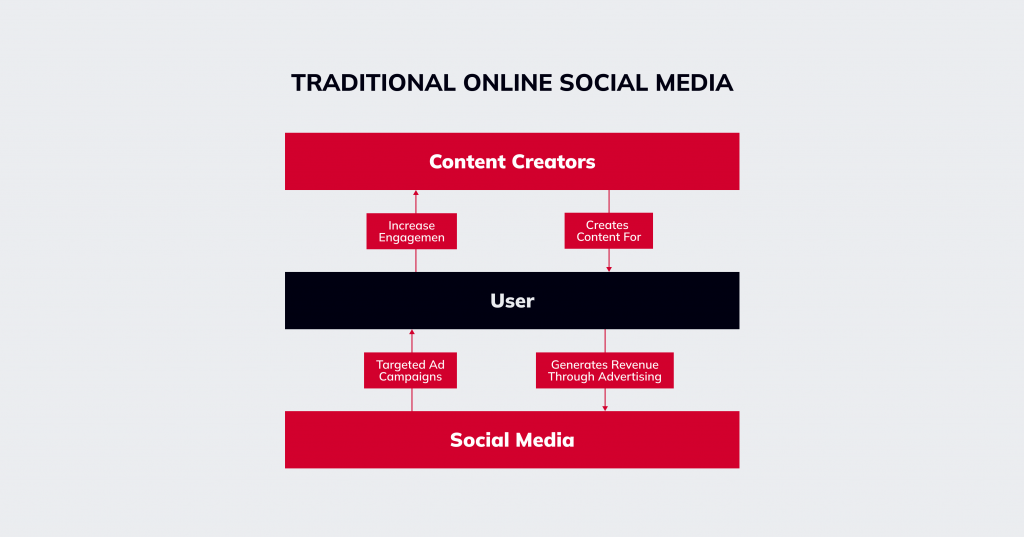

Consider a social media network on Web3. It might be designed with the user-centric approach in mind, considering privacy and decentralization for its users. The larger the user base, the higher the possibility of a security breach – say, unauthorized access to their data or breaching any account.

Here, at every step of scaling up, planning is crucial in terms of security, too. An increase in the number of users brings with it a corresponding scaling up of safety measures.

A strong growth strategy, therefore, should consider these issues early on. Integrating security protocols and adaptable infrastructures from day one ensures that the foundation for a Web3 startup is solid, reducing risks in the longer term. Safeguarding user data engenders trust, too – the most valuable weapon in the competitive world of Web3.

Securing Your Startup as You Scale

Security becomes all the more important as startups reach their scaling milestones. Most early-stage companies find themselves at a vulnerable stage, as they move only by growth and scale, assuming security would be retrofitted. In Web3, security needs to grow with the business, where operations are decentralized and smart contracts are run.

Testing Tools

End-to-end security begins in the development stage. There are a number of security testing tools and solutions that can help with identifying common vulnerabilities, ensuring code consistency and standards, and automated detection of logical errors:

- Olympix offers pre-audit tools for use by developers during the coding process that can significantly optimize the use of paid audit time.

- Mythril and Slither are static analysis tools for smart contracts written in the Solidity coding language and are used early in the development cycle to ensure that vulnerabilities are detected and corrected before moving on to more resource-intensive security processes like formal verification or external auditing.

- OpenZeppelin provides security-optimized templates, pre-audited libraries, and secure coding standards;

- Pwned Nomore and others provide automated bug-hunting services for blockchain developers and integrate into the development workflow to identify vulnerabilities in smart contracts and blockchain protocols.

Formal Verification

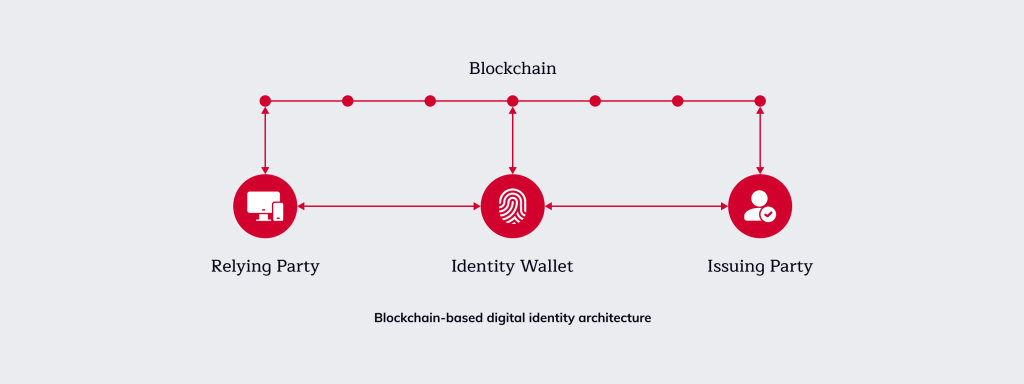

Formal verification uses mathematical and logical techniques to rigorously prove that a system behaves as expected. Developers specify certain properties or invariants (e.g., “funds cannot be transferred without proper authorization”) and formally verify that these properties always hold true within the code. Tools like Certora and K Framework by Runtime Verification check that the code meets these specifications under all possible inputs and execution paths.

Audits

Auditing is a manual or semi-automated process conducted by security experts who review the code to identify potential vulnerabilities and logical errors. Audits typically involve both static analysis (code review, using tools to check for common vulnerabilities) and dynamic testing (simulating various conditions to observe behavior). CertiK, Quantstamp, Trail of Bits, and Hacken are among the most popular audit providers.

Bug Bounties

Bug bounties incentivize ethical hackers and developers to find and report vulnerabilities in a protocol, platform, or application. Bounties play a critical role in maintaining security by leveraging the collective expertise of the developer community. Immunefi, HackerOne, and Code4rena are among the most popular bounty platforms.

Real-Time Monitoring

While audits and bounties are necessary, they alone are not enough. Last year, Web3 projects spent $1B on audits and still lost $2B to hacks, most despite having multiple audits. The real battle begins after the audited smart contracts go live, and that’s where monitoring solutions come into play.

When choosing a monitoring provider, projects should consider these key performance metrics:

- Breadth of coverage: it’s a multichain world and a monitoring solution must cover not only the chains you are building on now, but also networks you might expand to in the future or where your users may bridge your tokens;

- Detection volume and accuracy: detecting most of the hacks is just half the battle, doing it with the least number of false alerts is the other;

- Advanced warning: contrary to popular belief, it is possible to detect hacks before they do damage, but correctly identifying the target of an exploit with enough time to react is what separates a great detection solution from a merely functional one;

- Automated response: the ability to easily create automated triggers can be the difference between a scare and catastrophic loss.

- Proven track record: the radical transparency of blockchain data means that barriers to entry are low, so look for signs of real customer traction.

Hypernative is the leading real-time monitoring and automated response solution in Web3 security. The platform continuously monitors over 45 chains, a list that includes the vast majority of EVM blockchains and L2, including Linea, Mode, Flare, and Astar, as well as Solana, Bitcoin, Cardano, Stellar, Stacks, THORChain, and Tron.

Hypernative’s Web3 security system detected 99.5% of hacks last year with less than 0.001% false positive rate, performance unmatched in the industry. About 98% of the hacks were detected more than 2 minutes before the first transaction.

That combination of high-accuracy and an actionable window of opportunity is the sweet spot for automated actions. The Hypernative Web3 security platform’s automated agents are no-code, user-defined proprietary logic that lets projects set up automated onchain actions including pausing contracts, changing protocol parameters, moving funds to cold storage, unwinding positions, and more.

Now, over 150 leading Web3 projects are using the solution from our partner Hypernative to secure $100B worth funds, a list that includes Balancer, Blockdaemon, Chainalysis, Chainlink, Circle, Consensys, Ethena, Etherfi, Galaxy, Linea, Quantstamp, Solana, Starknet, and Uniswap. The system has helped save over $500M of funds to date.

Summary

Security is not an end state, but a process. And as Web3 enters its mass adoption stage, it is no longer optional. To onboard the next billion users, the industry must make use of all of Web2’s best practices as well as invent and adopt tools and solutions unique to Web3.