From CeFi to DeFi and reinvented ReFi, Web3 has reshaped traditional finance-related activities such as capital investment, profit distribution, and fund transfer. In the field of blockchain, regenerative finance (ReFi) is gradually getting attention on behalf of the blockchain application in the carbon trading market, opening a whole new chapter.

ReFi is not something new, as we at IdeaSoft have already worked with it. We predict a new boom for ReFi projects in 2024. This article will discuss what is ReFi, why ReFi aims for sustainability, and what is the future of regenerative finance.

Does your company actively seeks to contribute positively to the environment and communities while conducting its financial operations?

ReFi promotes the practice of low-carbon actions through blockchain technology and financial reward mechanisms. Through the transparent and resistant characteristics of the blockchain, it regularly rewards those who contribute to green development. Build your own finanial app based on ReFi concept! Contact us and we will help you with the correct requirements for your solution.

Table of Contents:

- Introduction to ReFi: What Is Regenerative Finance?

- Conceptual Framework of Regenerative Finance (ReFi)

- Technological Underpinnings of Regenerative Finance (ReFi)

- How is ReFi Different From DeFi?

- ReFi Case Study: Toucan Protocol

- Future Applications of Regenerative Finance (ReFi)

- Summary

Introduction to ReFi: What Is Regenerative Finance?

Regenerative Finance (ReFi) is a movement based on blockchain technology to encourage people to practice low-carbon and curb or reverse climate change through innovation in financial incentives. Currently, startups, non-profit organizations, investors, venture capital firms, and others have already developed some key infrastructure and applications in Web3. They inject new vitality into sustainable development while actively promoting the construction of a healthier and fairer environmental Web3.

Based on top blockchain development platforms, ReFi combines economic incentives with the current hot topic of sustainable development to bring all industries together to achieve this goal. Blockchain’s distributed network and incentives give it a natural advantage in creating mechanisms, such as smart contracts and NFTs, that can drive the economy toward sustainable development.

Conceptual Framework of Regenerative Finance (ReFi)

This conceptual framework helps to create a more sustainable and just social future in Web3:

- Climate stabilization. ReFi helps stabilize the climate by supporting clean energy and low-carbon lifestyles. It reduces carbon emissions and climate disasters such as forest fires by creating carbon markets to track and allocate resources. This helps reduce the management cost for countries and reduces the impact of climate extremes.

- Establishing social justice. ReFi aims to achieve sustainable development, maintain a balance between people and the environment, and bring about positive cycles. This can be achieved by planting trees to improve the environment, contributing to remote areas, making financial services accessible to lagging countries, etc.

- Increasing financial inclusion. ReFi provides greater financial opportunities and choices to groups that currently do not have access to traditional financial services. This increases financial inclusion, enabling more people to access the financial support necessary to grow their businesses and families.

- Reducing financial risk. ReFi creates more transparent and stable financial markets by utilizing new technologies such as blockchain. This helps to reduce financial risk and make the financial system more robust, thereby protecting investors and financial institutions from unnecessary losses.

So, regenerative finance principles bring much value and impact to society, including stabilizing the climate, establishing social justice, increasing financial inclusion, and reducing financial risk.

Technological Underpinnings of Regenerative Finance (ReFi)

Taking control of the carbon footprint is an important part of sustainability. For ReFi companies, it is not enough to achieve carbon neutrality. They aim to positively impact the climate, i.e., energy savings, emission reductions, and negative carbon emissions by removing greenhouse gases.

In Web3, energy savings and emission reductions can be achieved by choosing energy-efficient alternatives or increasing the percentage of clean energy applications. For example, Ethereum switched from a PoW mechanism to a PoS mechanism, thereby reducing energy consumption by 99.95%.

On the other hand, blockchain can track environmental impacts, improve carbon footprint transparency, and enforce accountability for carbon emissions. “Blockchain+Financial Resources” is not only a technological tool but also a resource to help regenerate the planet.

The innovation of regenerative finance is that financial institutions benefit from renewable energy projects not only on a physical and financial level but also on a social level. Thus, ReFi encompasses multiple dimensions, such as the assetization of renewable energy, the development of accounting measurement standards, and the digitization of carbon assets.

Here are some examples of how blockchain is empowering ReFi to create a sustainable future:

- Gamification. ReFi promotes rewarding participants with work credits, tokens, points, and so on for taking real action to eliminate CO2 emissions.

- Accountability. Blockchain can be used to credibly trace carbon emissions and hold governments, businesses, and NGOs accountable for climate goals.

- Asset digitization. It is possible to use digital twins to transform carbon assets into credible and traceable digital assets, increasing asset liquidity.

- DAO & Community. ReFi leverages the DAO or Web3 community to promote sustainable policy implementation and green business.

In addition to the above applications, blockchain can enable some things traditional tools cannot do. For example, the contribution of traditional joint ventures is measured chiefly only by the percentage of equity investment, which does not reflect the true picture of the operation of the partnership.

The contribution of a joint venture should include the business opportunities that each partner has brought to the joint venture once the business has started operating, as well as the value that has been driven in the alliance.

In a ReFi crypto eco-alliance built on blockchain, with a good incentive design and governance structure, it is possible to measure the contribution of these more meaningful metrics to create a more productive form of cooperation or alliance model.

Regenerative finance functions more as a framework for engaging in social activities. From my perspective, this is unlikely to reshape the market but presents an opportunity for enthusiasts to leverage this functionality. While it introduces a novel approach to incentivizing social participation, its transformative impact on the broader financial landscape remains to be determined. The concept’s significance may lie in affording enthusiasts a platform to harness its functionalities rather than fundamentally altering market dynamics.

Herman Stohniiev, CTO at IdeaSoft

How is ReFi Different From DeFi?

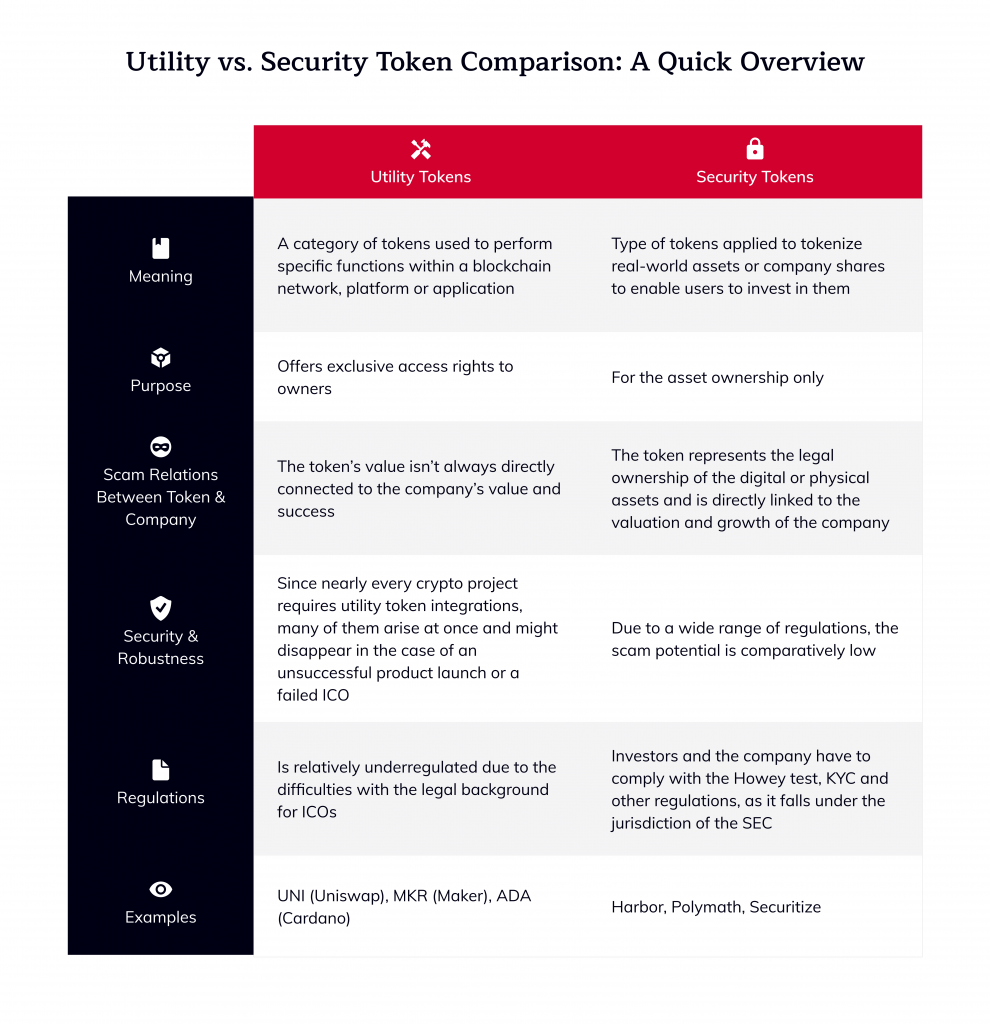

DeFi platform development is often confused with ReFi platform development. Here is a brief comparison of ReFi vs DeFi.

As the threat of climate change intensifies year by year, it is even more vital for enterprises to shoulder their social responsibility. More and more financial institutions are facing pressure not only in terms of investment but also in terms of the social and environmental impact of their investment policies.

An alliance that brings together the resources of communities, investors, and financial institutions can not only make more all-encompassing investments worldwide but also form a large infrastructure portfolio that enables comprehensive investments and quick processing methods.

ReFi Case Study: Toucan Protocol

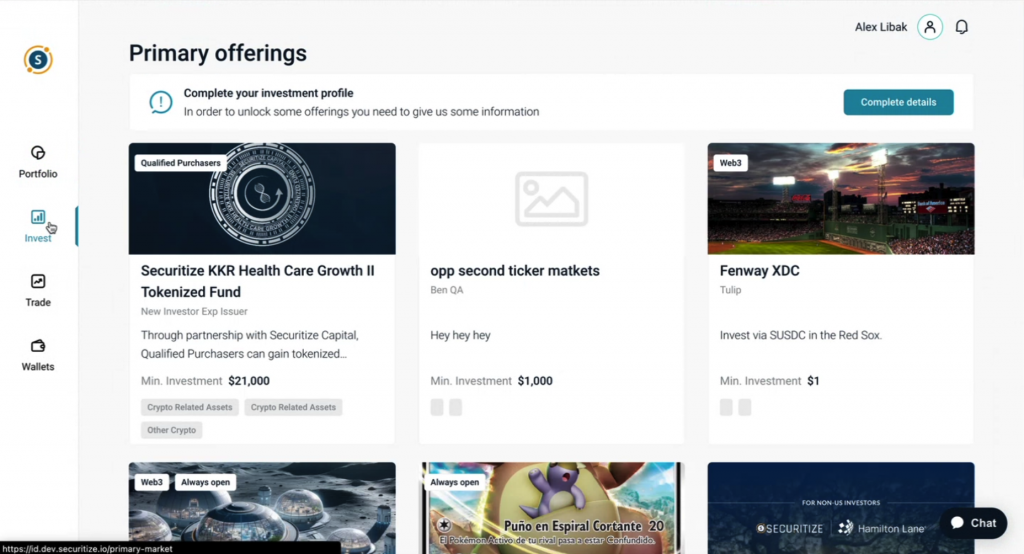

The example of the Toucan Protocol provides a better understanding of how carbon rights are tokenized and solves the price discovery problem. However, the Toucan Protocol still has issues that need to be addressed.

For example, whether carbon credits are actually beneficial to the climate and whether on-chain trading meets real-world international market standards. Both the on-chain and off-chain worlds have their issues to face.

The Toucan Protocol, which converts Verified Carbon Units (VCUs) into a cryptocurrency and a regenerative economy based on the DeFi model, consists of 3 main elements.

Element 1: Toucan Carbon Bridge

The Toucan Carbon Bridge enables users to store carbon credits as NFTs on the blockchain. Advantages include complete transparency and divisibility, and the destruction of carbon tokens on the chain is equivalent to the cancellation of carbon credits, which prevents double-counting. The NFT can be split into fungible toucan carbon tokens to facilitate transactions.

Element 2: Toucan Carbon Token (TCO2)

Since Toucan Carbon Token still retains the original properties of NFT (origin registration, yearly score, etc.), it causes the problem of illiquidity. It is also a major pain point in the real-world carbon rights market, hence the emergence of Toucan Carbon Pool.

Element 3: Toucan Carbon Pool

It is needed for product differentiation per project. The Toucan Carbon Pool solves the problem of price liquidity in the carbon market by taking carbon tokens (TCO2 tokens) from multiple projects and pooling them into a more liquid carbon index token. It can be traded on a decentralized exchange.

Need more tech details?

Contact our team to get more information about the ReFi concept and how it can help your project to contribute.

Future Applications of Regenerative Finance (ReFi)

ReFi could encourage the development of innovative financing models, such as green bonds and impact investing, specifically tailored for sustainable infrastructure. These financial instruments can attract capital from investors seeking both financial returns and positive environmental impact.

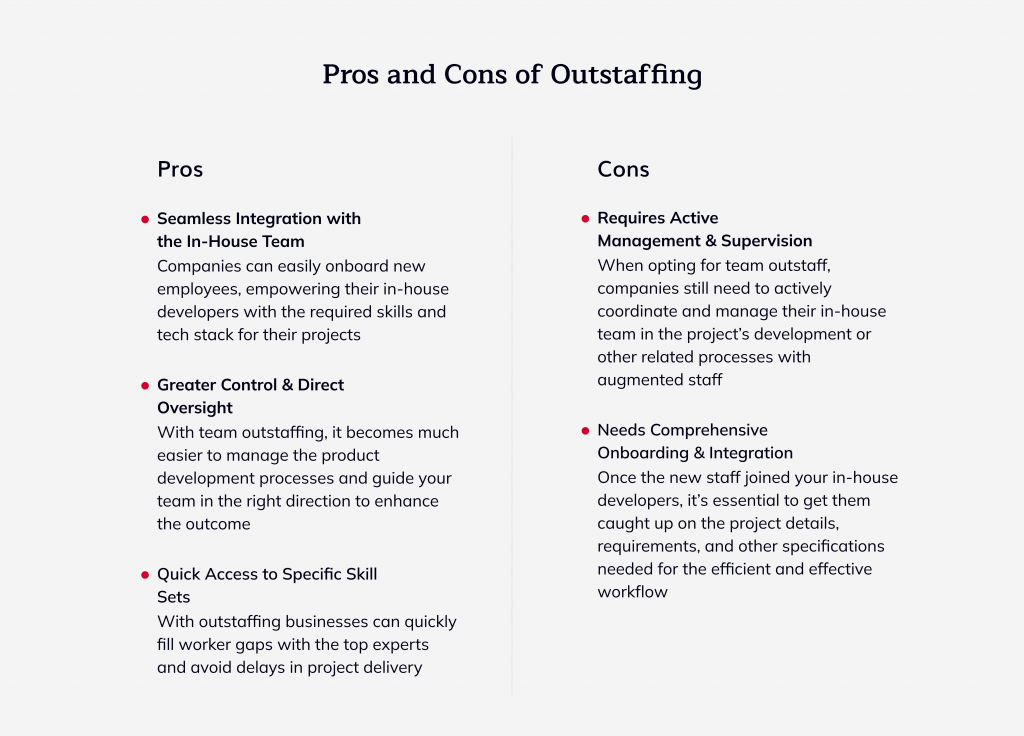

By aligning financial incentives with sustainability goals, ReFi has the potential to accelerate the transition to a more sustainable and resilient Web3 infrastructure globally. Leveraging outstaffing for Web3 development can empower organizations to build cutting-edge ReFi solutions by accessing skilled developers specialized in blockchain and sustainability-focused projects.

Regenerative finance in crypto can empower local communities through decentralized financial solutions. This involves shifting financial decision-making and resources closer to the communities that are directly affected by them. Local community banks, credit unions, and microfinance institutions adhering to regenerative finance principles may emerge as key players in providing financial services to underserved populations.

Regenerative finance can also be crucial in funding conservation and restoration efforts and supporting initiatives to protect biodiversity and ecosystem services. Financial institutions incorporating regenerative principles may allocate resources to projects focused on reforestation, habitat preservation, and sustainable land use practices.

So, regenerative finance seamlessly fuses the principles of regenerative economics with the innovation of decentralized finance. This visionary financial ecosystem represents a paradigm shift, aspiring to make financial services and products accessible to all.

The ReFi-driven movement has initiated robust communication channels within its community, and the momentum is surging, propelled by the transformative capabilities of Web3 technology.

Notably, the focus is steadfastly placed on catalyzing sustainable development across diverse sectors through ReFi projects embedded in the Web3 landscape. Brace yourself for the impending takeoff of these groundbreaking initiatives in 2024 as they redefine the future of finance.

Summary

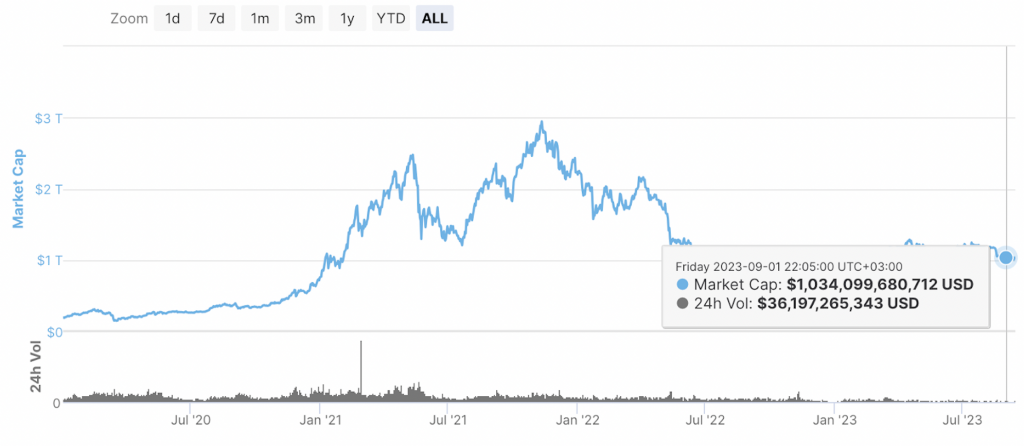

As ReFi heats up in 2023, there is an influx of ReFi projects that aim to engage companies and users in solving many of the world’s problems while using cryptocurrency to label their contributions and economic returns.

At IdeaSoft, we believe that 2024 will be the year that ReFi gains more mainstream attention and adoption, proving that cryptocurrencies can directly impact the real world. ReFi will help shift the crypto narrative from the “scam” to one promoting a more sustainable, low-carbon economy.